If you want to make a fund transfer through NEFT, we have seen it in the previous article. In case, if you make a fund transfer much faster and quicker than NEFT in Banking, then, RTGS is one of the best options, you should gonna try.

In this article, I am going to cover 11 points about RTGS to understand it completely.

Let’s get started..!!

1. RTGS Meaning

If you want to transfer money from one bank to another bank in Real-time, then, you use need to use RTGS.

RTGS is one of the Quickest and Fastest modes of money transfer electronically on a Gross settlement basis.

Simply, through RTGS, You can make a fund transfer from SBI to another bank account holder of ICICI Bank, Union Bank of India etc.,

2. RTGS Full form

RTGS stands for “Real Time Gross Settlement”.

It is a system where there is continuous and real-time settlement of fund transfers, individually on a transaction-by-transaction basis (without netting).

‘Real Time’ means Processing of instructions at the time they are received;

‘Gross Settlement’ means that the settlement of funds transfer instructions occurs individually.

3. RTGS Minimum & Maximum Limits

RTGS is self is meant for Large-value transactions only.

The minimum amount to be remitted through RTGS is ? 2,00,000/- with no upper or maximum ceiling.

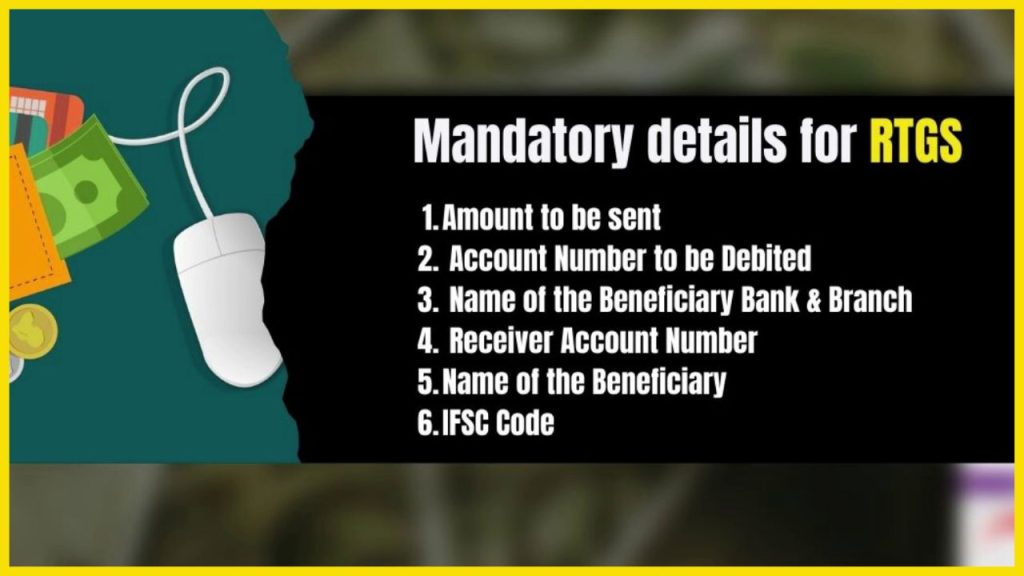

4. Mandatory Details for RTGS

For the sender of the RTGS or the remitting customer has to furnish the following information to a bank for initiating RTGS remittance.

5. RTGS Timings

As per the guidelines of the Reserve Bank of India (RBI) dated 14th Dec 2020, the RTGS can be made 24 x 7 x 365

6. RTGS Charges

For Outward Transactions

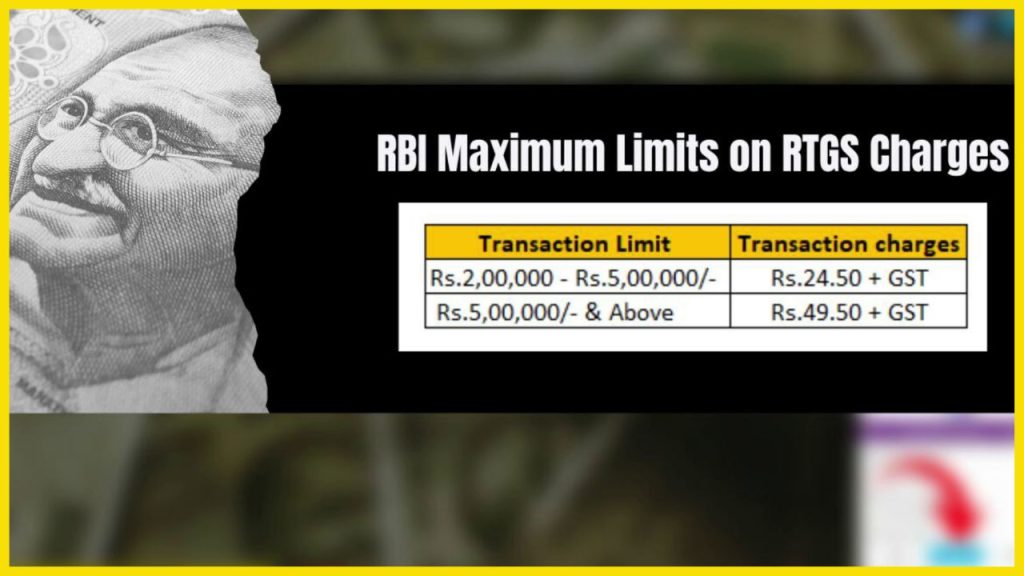

The Reserve Bank of India (RBI) set the maximum limits for the sender as follows.

It is the maximum amount of charges any bank can levy on the customer for the RTGS Fund transfer.

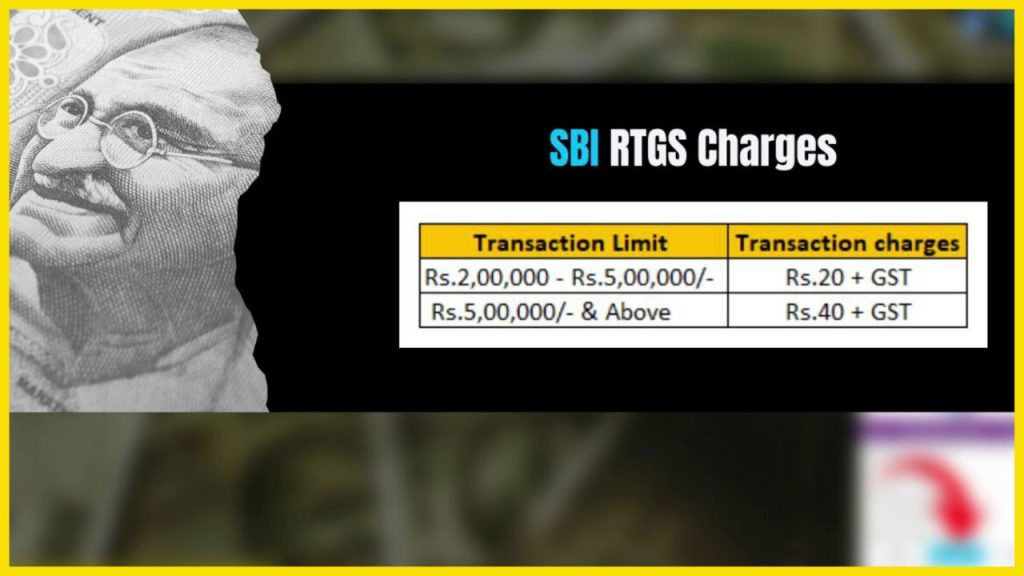

The charges for RTGS remittance in SBI are as follows.

For Inward Transactions

No fees is to be livied. It’s free only for the receiver.

7. RTGS Transfer time

Generally, the RTGS transactions will be processed throughout the day on a transaction-to-transaction basis. Therefore, if you want to transfer a larger amount immediately, then, RTGS is one of the fastest modes of transfer.

Whenever the customer initiates the RTGS transaction, the bankers have to process it on a real-time basis as and when a particular transaction comes and they need to be cleared on an immediate basis.

The maximum time to complete an RTGS transaction is 30 Minutes.

Want to watch it in Telugu

8. Is RTGS Name based or Account Number based?

As the RTGS transactions will be completed on a real-time basis, it is not easy for the bankers to transfer money on a name based.

The main reason is as you know that the PAN name mentioned in the PAN Card may or may match with the Aadhar Name. Therefore, it’s been quite difficult to find a match between the two and to make a money transfer.

So, the banks will process the RTGS transactions based on Account numbers only.

It is to be noted that while initiating RTG or any fund transfer, you need to check the Account number more than twice to check the accuracy of the beneficiary Account details.

9. Money transferred to the Wrong Account number

I mistakenly entered the wrong Beneficiary account number, is there any chance to recover it?

If you have initiated an RTGS transaction by entering the Wrong beneficiary account number, then the onus of responsibility lies on the sender itself.

In this case, the Reserve Bank of India (RBI) guidelines are crystal clear as “RTGS transaction payments made are Final and Irrevocable”

It means, every bank’s RTGS transaction will be recorded in the books of RBI, therefore, as the records are updated on the RBI itself, it’s been almost impossible to recover the money in case you transferred the money to the Wrong account number in case of RTGS.

Therefore, whenever such an issue arises, it is better to reach the Bank or customer care immediately and report your issue. They may find a better solution.

10. RTGS Amount Not credited

In case, the RTGS amount is not credited into the beneficiary account for any reason then the amount will be received by the sender within a maximum time of 1 hour.

11. To whom RTGS is useful

If you want to transfer money immediately of more than Rs.2,00,000/- and such amount is to be immediately get credited into the Beneficiary account, then, RTGS will be useful.

12. How to reach Customer Contact for Delay in or Non-credit of RTGS ?

The remitting customer can reach his /her branch/bank/ if there is an issue of delay or non-credit to beneficary account.

The details of the Customer Facilitation Centre of member banks are also available on the website of RBI at https://www.rbi.org.in/Scripts/bs_viewcontent.aspx?Id=2070.

13. Help Desk /Contact point of RTGS

You may approach the RTGS Help Desk / Contact point of the RBI at

rtgsmumbai@rbi.org.in

14. How to raise a Dispute / Complaint related to an RTGS transaction?

You may approach the grievance redressal cell of your bank with details of the disputed transaction. In case your grievance is not resolved within 30 days, you may make a complaint under “The Reserve Bank-Integrated Ombudsman Scheme (RB-IOS 2021)”.

The RB-IOS 2021 provides a single reference point for customers to file complaints against the RBI regulated entities specified therein.

The RB-IOS, 2021 is available at the following path on the RBI website:

https://rbidocs.rbi.org.in/rdocs/content/pdfs/RBIOS2021_121121.pdf