Introduction

The income tax department has recently revamped its existing website www.incometaxindia.gov.in with some exciting new features which include a user-friendly interface, value-added features and new modules.

Income Tax India website is a comprehensive repository of tax and other related information. Users can access various acts and rules in addition to the Income Tax Act.

As per the department’s press release dated 26th Aug 2023, this new website will educate the taxpayers and enhance the tax compliance.

Read full press release here: CBDT Press release on National Website of Income Tax department

In this article, let’s find out what new features have been introduced.

Features of the Income Tax Website

The Income Tax India website is a comprehensive repository of various resources. In the old website, we could not access certain features with ease. Whereas in the new revamped website, we could see most of the important features on the homepage itself.

Those who want to learn income tax on income, tax-related concepts and all the relevant acts, they can find all this information in one place.

Since it is difficult to discuss all the features here, we will discuss about some of the key features of the website which one should not miss.

They are:

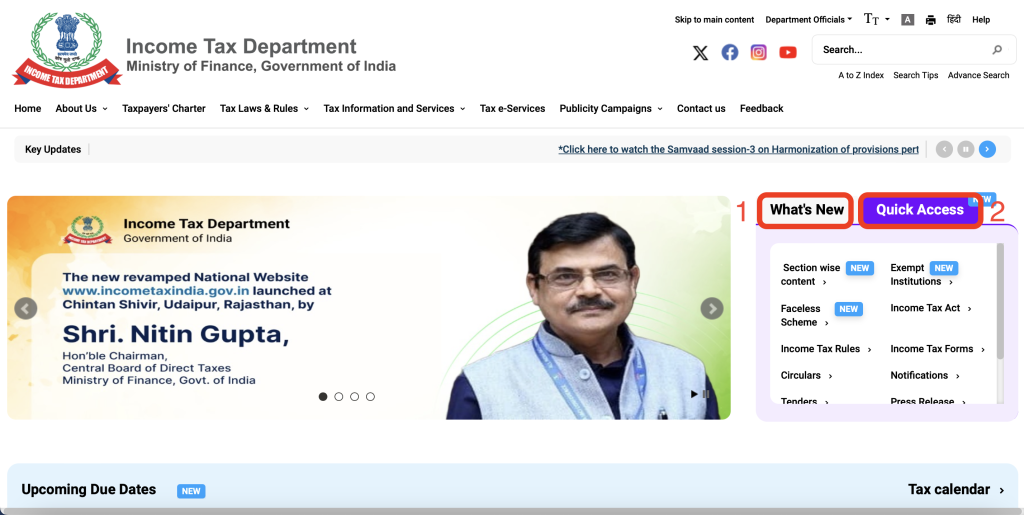

1. On the homepage itself, you will find 2 new tabs which are “What’s new” and “Quick access”. First one gives you all the recent updates released by the income tax department and the latter gives you all the most important links associated with the income tax.

So, under ‘Quick access’ toolbar itself, one can access the income tax act, rules, forms, circulars, notifications, and press releases also.

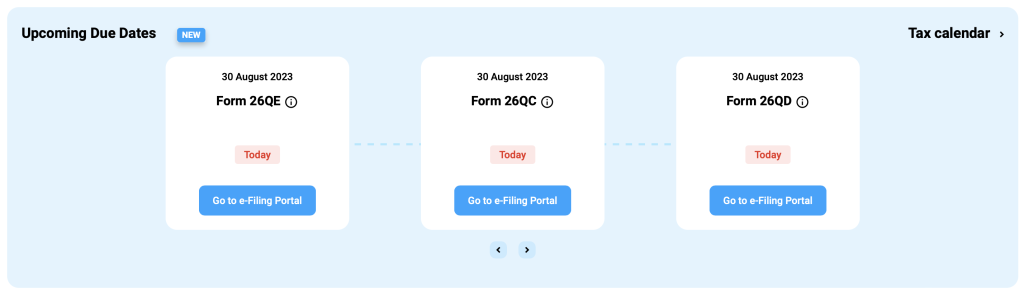

2. And, the next most prominent feature is “Upcoming due dates”. Earlier also this feature was available but now in this revamped website, we can see the form and actual due date and reverse countdown as well. In addition, hyperlink to e-filing website is also given there itself.

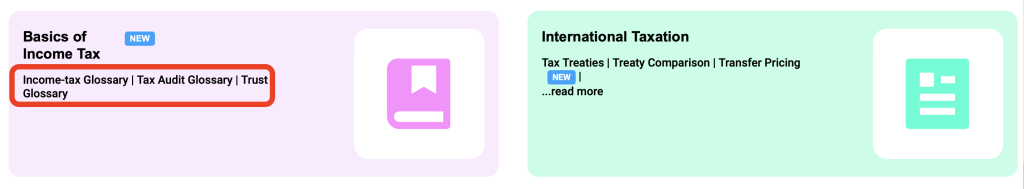

3. If you are struggling to understand the complex income tax jargons, income tax glossary feature will certainly help to the layman in understanding the correct meaning of the terms frequently used in Income Tax Act.

4. If you scroll down further on the homepage, you can see the “Taxpayer services” and “FAQ”. First one gives you the most important links associated with the income tax related services and the latter provides FAQ’s on income tax-related concepts to enhance in-depth understanding of the concept.

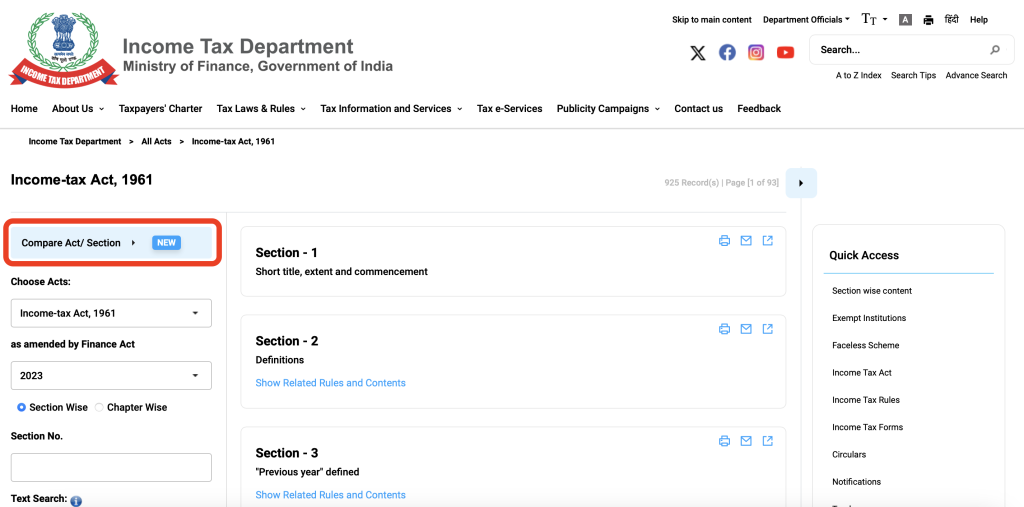

5. Also, The new website allows users to compare different acts, sections, and rules which makes it easy for the user to compare the different acts in a same page itself.

6. Another great feature of the new website is mobile responsive layout. Since most of the users access the site on mobile, this feature will certainly enhance the user-experience.

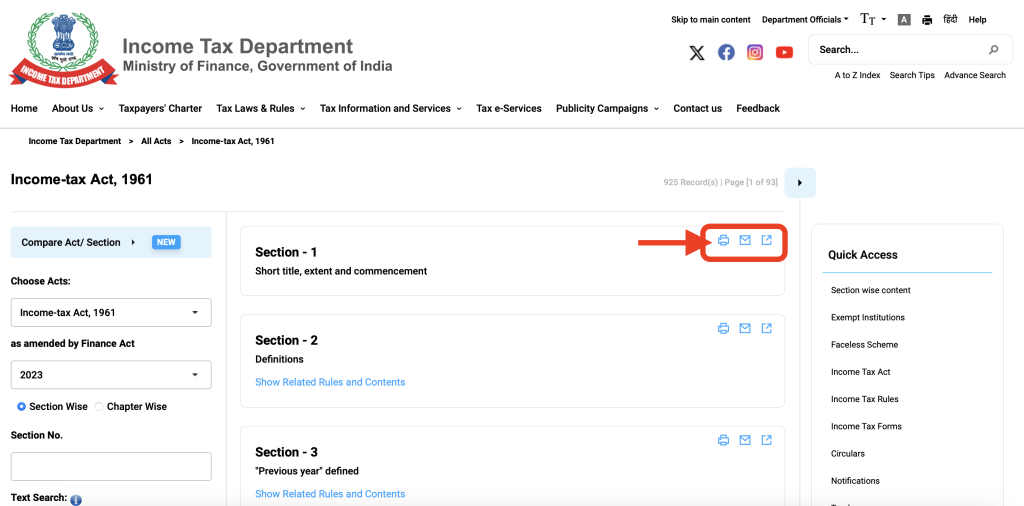

7. Now, one can print any section or rule of any of the acts without even opening the complete section or rule as the print feature is provided next to the rule/section itself.

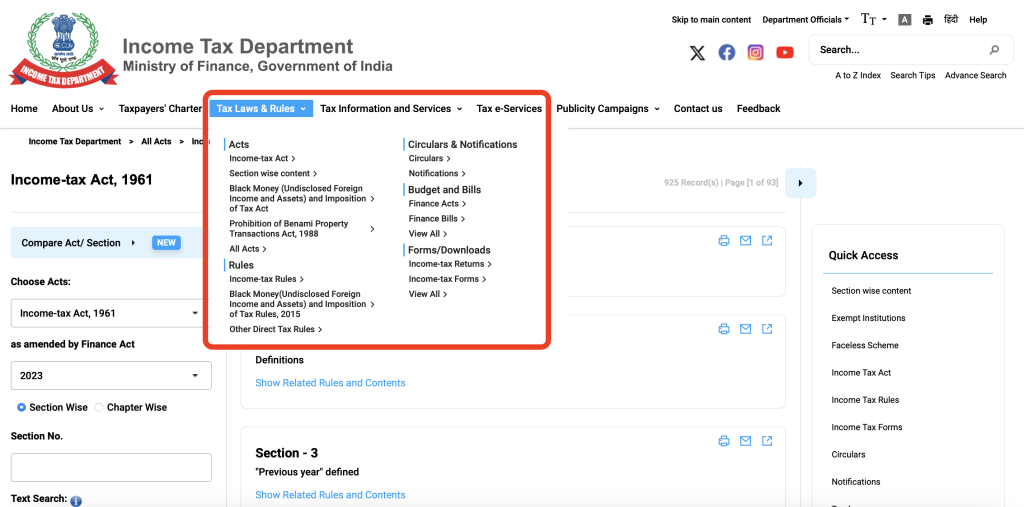

8. Now the website has “Mega menus” for content, with new features and functionalities

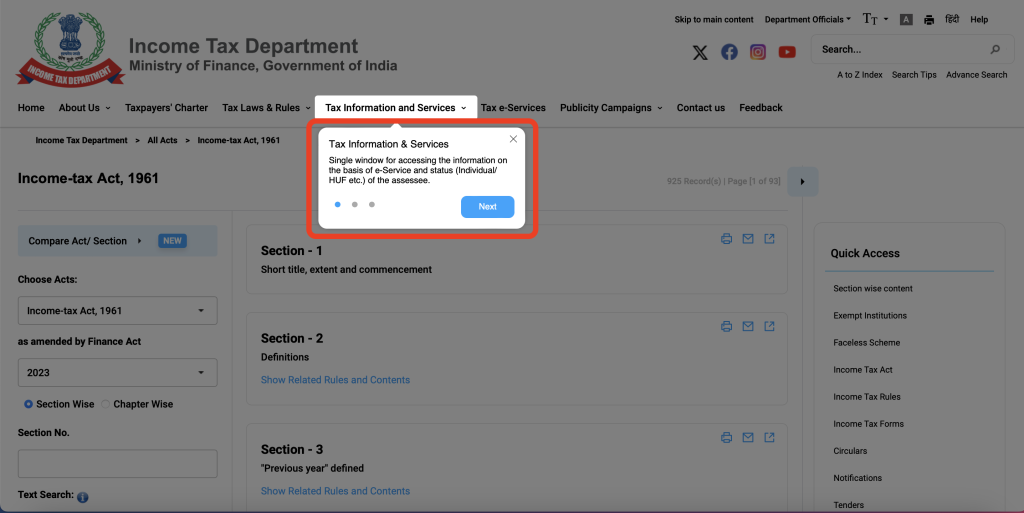

9. To enhance the user convenience to the next level, now new additions in the website are explained through a guided virtual tour and new button indicators.

Conclusion

With all these features and functionality, new Income Tax India website will certainly recreates a new experience to the users. Those who want to learn income tax and income tax related concepts, this website is a gold mine. Go and check this website at your convenience, you will never be disappointed with the content.

If you think we have missed any important feature or functionality of the website worth mentioning, please let us know in the comment section. We will cover the same in our upcoming articles.

Hope you have enjoyed the reading this article. Thank you for your time.