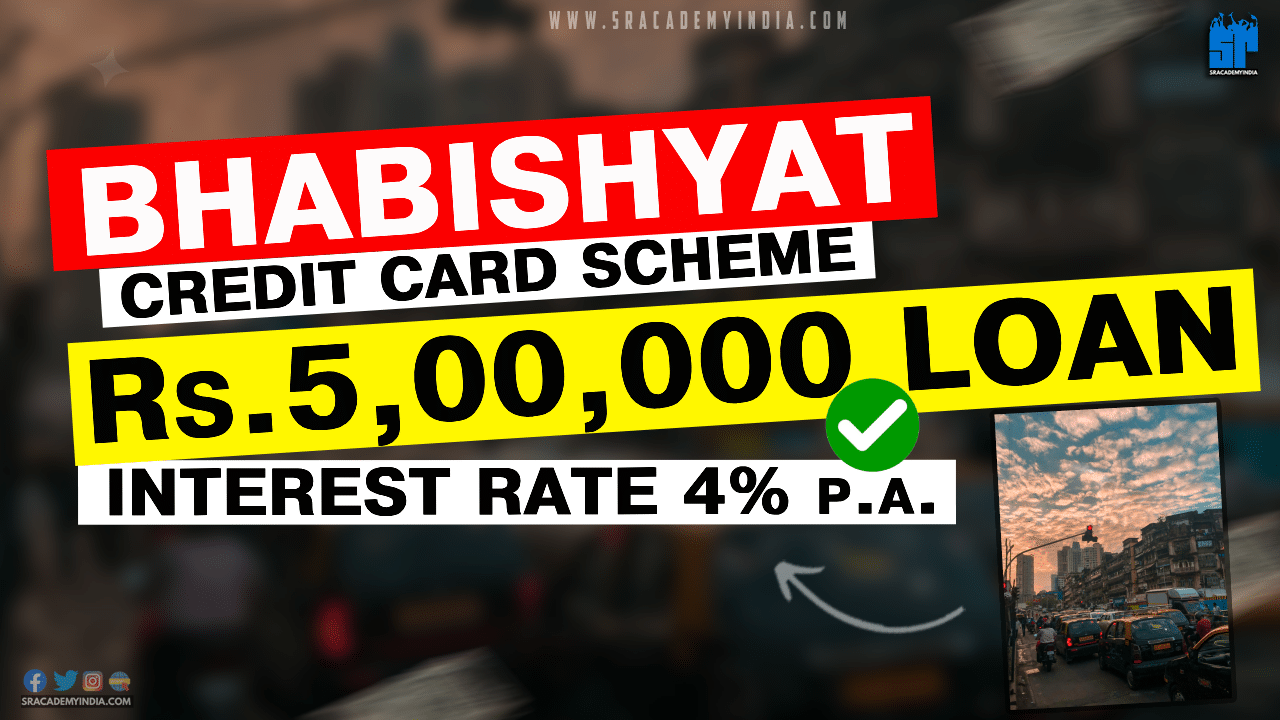

Bhabishyat Credit Card

Introduction

“The Way to get started is to quit talking and begin doing”

– Walt Disney

Everyone wants to start their own business but 90% of people never start due to lack of Money.

Am I Right..!

When you are younger, you might have also thought of starting your own business. But as far as the Indian traditional mindsets, you might have been settled with your 9-5 job.

I Don’t know about you..!

But I’m one of them..!!

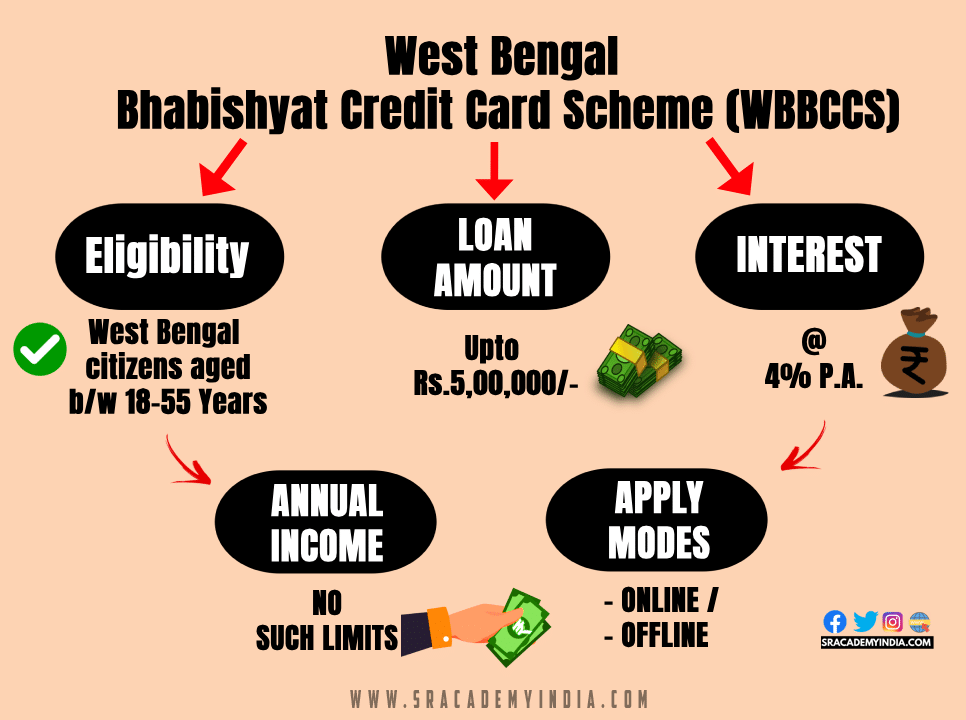

If you are a West Bengal resident and seeking a convenient and affordable credit solution for your business, then, you can consider a West Bengal Bhabishyat Credit Card Scheme (WBBCCS).

The West Bengal Government launched this scheme under the Department of MSME&T on 1st April 2023 for a term of 5 years with the target coverage of 2 Lakh Youth in a year.

This Bhabishyat Credit Card scheme is designed with a motive to bridge the financial gap for Low-income individuals allowing them to start their businesses. This Bhabishyat Credit Card scheme was announced by the West Bengal Chief Minister Mamata Banerjee Garu during the Budget presentation.

Let’s see the Features of this scheme,

To whom this scheme is beneficial?

Who is eligible for a Bhabishyat credit card?

And also about, the Bhabishyat Credit Card interest rate?

Let’s get started..!!

The Bhabishyat Credit Card scheme applies only to the West Bengal citizens of both Rural and Urban People.

I reside in the state of West Bengal only.

May I know, Who is Eligible for a Bhabishyat credit card?

Eligibility of the Bhabishyat Credit Card Scheme

1. Indian nationals who have resided in the state of West Bengal for the past 10 years.

2. West Bengal State citizens who are working as a

– Motor Transport Workers

– Building and Other Construction Workers

aged between 18-55 years are eligible for this scheme.

(It is amended as per the Notification dated Aug 11, 2023, of Notification No. 3474/MSMET-18011(11)/5/2023)

3. But it is to be noted that only one person in a family is eligible for this Bhabishyat credit card.

Here, Family means both Husband and Wife.

What benefits the West Bengal residents can get from this Bhabishyat credit card scheme?

Benefits of the West Bengal Bhabishyat Credit Card Scheme

The top benefits offered by this scheme are as follows.

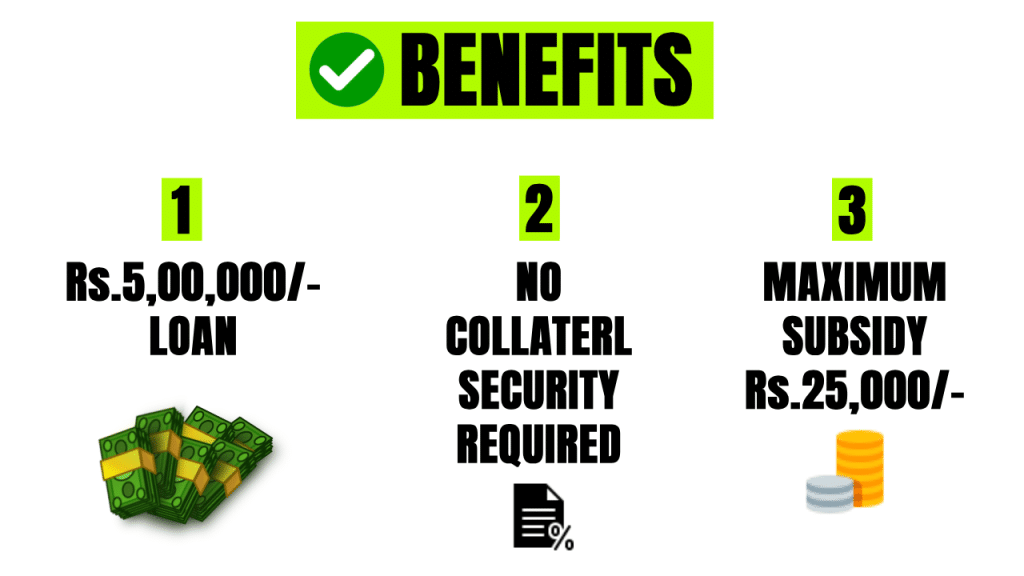

1. The beneficiaries will receive Rs.5 Lakh rupees as a Project Cost Grant.

2. You can also get this Loan without providing any collateral security. Here, the West Bengal Government will act as a Guarantor.

3. Each eligible beneficiary is entitled to get a Maximum Subsidy of Rs.25,000 rupees. i.e. up to 10% Subsidy on Margin Money

What is meant by Margin Money?

Let me tell you an Example..!

If you want to take a Home Loan, then, the Borrower must contribute a percentage of the Purchase price from their own funds, it is known as Margin Money.

Whereas, coming to the Bhabishyat Credit Card Scheme, the Margin money will be provided, by the State government of West Bengal as a Subsidy i.e.Rs.25,000 or 10% of the Project Cost whichever is lower, will be provided as a Margin money.

Bhabishyat Credit Card Interest rate

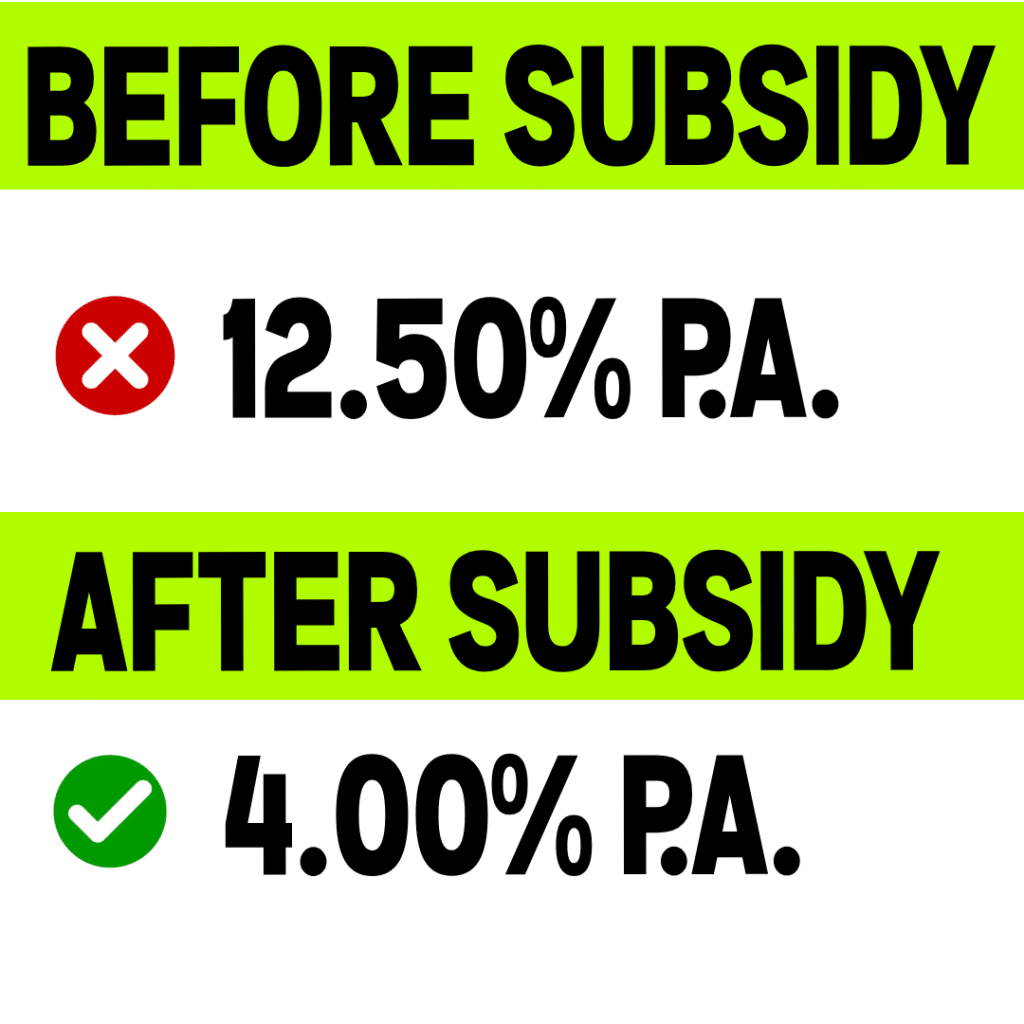

The West Bengal government sets a Ceiling limit of 12.50% p.a.

It is the current interest rate charged by the State Bank of India (SBI) for MSE loans of up to Rs.5 Lakh rupees.

However, the Maximum Interest subsidy under this scheme for borrowers with “Standard” Loan accounts is 8.50% p.a. which results in an Interest rate burden of 4.00% p.a. for the borrowers.

The Project Cost after approval will be reduced by the Government Subsidy. The remaining amount will carry a government-subsidized interest rate of 4% per year, which should be borne by the borrower.

The Bank Loan will have 100% coverage jointly by the Government

– 85% will be covered by the CGTMSE

– 15%- By West Bengal Government.

Here, CGTMSE refers to the Credit Guarantee Trust Fund for MSE

Besides, Is there any Annual Income bar applicable to get this Loan?

Bhabishyat Credit Card Scheme Annual Income Rule

There is no bar on the Annual Income. West Bengal citizens of any income level can apply for this scheme. But you should be aware of applicable categories of businesses to get this loan more easily.

Applicability of Bhabishyat Credit Card Scheme

1. The Bhabishyat Credit Card Scheme West Bengal provides Financial assistance to

– Micro Enterprise

- Investment: Less than Rs 1 crore

- Turnover: Less than Rs 5 crore

– Small Enterprises:

- Investment: Less than Rs 10 crore

- Turnover: Up to Rs 50 crore

– Medium Enterprises:

- Investment: Less than Rs 50 crore

- Turnover: Up to Rs 250 crore

Who are engaged in various sectors including

-Manufacturing

– Services

– Trading

– Agriculture i.e. Diary, Poultry, Fish, Piggery

Both the New and Existing MSMEs can apply for Term Loans, Working Capital Loans, or Composite loans under this scheme.

2. New businesses are also eligible for this Bhabishyat Credit Card Scheme. However, they are eligible for Additional Capital support for the Machinery or Tools or for Expansion only after 2 years of their Business Operations.

3. Additionally, all the Applicants who have earlier submitted applications under the Karmasathi Prakalpa Program but were not approved by Apr 1st, 2023 will be transformed automatically to this Bhabishyat Credit Card Scheme.

“There is a Dark Side to Everything”

-Prince

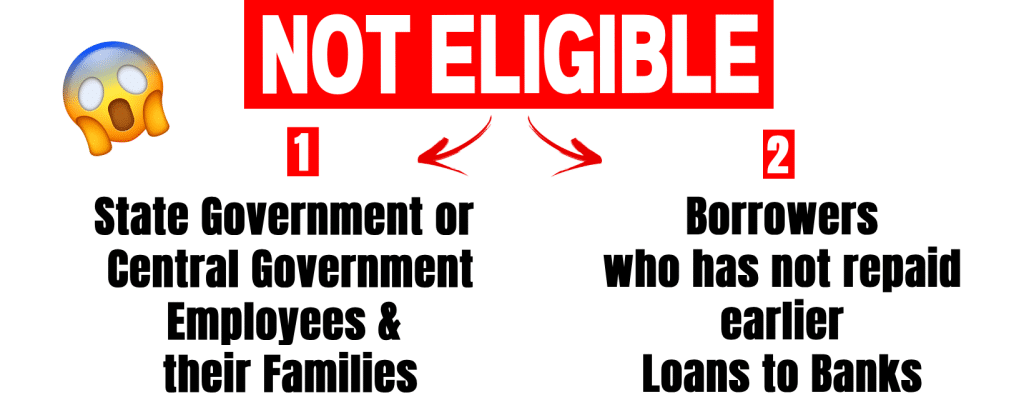

Who is Not Eligible for the Bhabishyat Credit Card Scheme?

The below-mentioned persons are not eligible to avail of a Credit facility under this Scheme.

Let’s see Who?

1. Employees of the

– State Government or

– Central Government /

– Government undertakings including their families

are not eligible for this Scheme.

2. The Borrowers who have failed to repay their loans to any Banks or Financial institutions are also not eligible for this scheme.

What about charges?

Are there any charges applicable to get this card?

Bhabishyat Credit Card Charges

Yes.

The Credit Guarantee Trust Fund for MSEs (CGTMSE) will charge an Additional Guarantee Fee (AGF) as a Share of guarantee coverage.

But it is to be noted that No additional charges will be levied from the AGF as an additional guarantee coverage provided by the state government.

Everything is fine..!

But Who will provide these loans?

Where Can I get this Loan?

This Loan can be availed from any of the below-mentioned Banks or Financial Institutions.

1. All Scheduled Public sector banks. Example: SBI, Bank of Baroda

2. Private Sector banks. Examples: HDFC, ICICI etc.,

3. Regional Rural Banks Example: Andhra Pragathi Grameena Bank

4. Small Finance Banks

5. Cooperative Banks

6. Any Other Lending institute as prescribed.

What Documents may be required for the Banks to apply for this Credit Card scheme?

Bhabishyat Credit Card Documents required

The following documents are required to apply for the West Bengal Bhabishyat Credit Card Scheme.

| S.No. | Document Type |

|---|---|

| 1. | Aadhar card |

| 2. | Bank Account details |

| 3. | Education Qualifications |

| 4. | Detail Project report |

| 5. | Residence proof |

| 6. | Passport size photos |

| 7. | Mobile number |

| 8. | PAN card |

How to Apply for West Bengal Bhabishyat Credit Card?

If you are satisfied with the above eligible conditions, you can apply for this scheme either Online or Offline. Let’s discuss both.

#Method 1: Online Procedure

Bhabishyat Credit Card Online Apply

1. To apply for this Scheme, the applicant must Register online by providing Personal Information.

Apply Now2. After logging into the Portal, you should select the scheme and complete the applications by providing all your details.

3. Now upload all the necessary documents as required

4. Before you submit, Carefully review your application form and submit it

5. After successful submission, the Department of MSME&T will verify your application

6. Once approved you will receive your Bhabishyat credit card.

#Method 2: Offline Procedure

If you want to apply for this Scheme offline, follow the steps below.

1. Visit the Department of MSME&T office physically and obtain an Application form (or) You can also Download the Bhabishyat Credit Card Form PDF from the below link.

Download

2. Complete the form thoroughly and attach all the supporting documents

3. Submit your field application form to the MSME&T district office.

4. Now department officials will review your application and documents

5. Once approved you can collect your credit card from the Department of MSME&T office

I hope this article will help you in finding your best loan and We hope you can be financially independent by starting your own business.

Keep growing on your feet 🙂

Frequently Asked Questions

Still, have Questions, this might help you, my dear friend..!!

1. Bhabishyat Credit Card scheme applicable from which year?

The West Bengal Bhabishyat Credit Card scheme was launched on April 1, 2023, but this scheme was implemented w.e.f Apr 1, 2024, for all the existing loans sanctioned by the Banks.

2. What is the 5 lakh scheme in West Bengal?

The West Bengal Bhabishyat Credit Card Scheme is designed with a motive to bridge the financial gap for Low-income individuals allowing them to start their businesses. Under this scheme, the beneficiaries will receive Rs.5 Lakh rupees as a Project Cost Grant with an effective rate of 4% per annum to the citizens of West Bengal.

3. Bhabishyat Credit Card Scheme Age Criteria?

West Bengal State Government has set an Age Limit for their citizens who are working as Motor Transport Workers and Building and Other Construction Workers must be aged between 18-55 years.

4. What is the interest rate of Bhabishyat credit card in West Bengal?

The West Bengal Government has set a Maximum Interest rate for certain Loans is 12.50% p.a. This rate is currently charged by the State Bank of India (SBI) for Micro and Small enterprises for Loans below Rs.5 Lakhs. However, the Borroers with “Standard” Loan accounts are eligible for a Maximum Interest subsidy of 8.50% p.a. which results in the effective Interest rate for the Borrowers under this scheme is 4% p.a. only.

5. Bhabishyat credit card Status check?

Once you successfully Log into the portal, the Applicant will find the “Details” link in the Dashboard. By clicking on that link, Applicants can access their loan application status after submitting the online application form.

6. Bhabishyat Credit Card Helpline Number?

If the applicant is facing any Techincal Questions or Critical issues encountered while applying, you can contact the

Helpline Mail: helpdesknic.bccs@gmail.com

Helpline Mobile number: 033 2262 2004 between 10 am to 6 pm (on Monday to Friday-Except Holidays)

7. Can a Non-Bengal people apply for a Bhabishyat card?

The Eligibility for the Bhabishyat card is strictly limited to the Permanent residents of West Bengal State only. This scheme helps people to build their own business. Applicants must be Indian Nationals who have resided in West Bengal for a minimum of a decade are qualify for this scheme. Therefore, outside residents of West Bengal are not qualified to apply for this scheme.

8. What is the Maximum amount of Loan under West Bangal Bhabishyat scheme?

The West Bengal residents beneficiaries are eligible for Maximum amount of Rs.5 Lakh rupees as a Project Cost Grant. The applicants can also get this Loan without providing any collateral security. For this loan, the West Bengal Government will act as a Guarantor.

9. Are women entrepreneurs eligible for West Bangal Bhabishyat scheme?

Indian nationals who have resided in the state of West Bengal for the past 10 years and who are working as Motor Transport Workers, Building and Other Construction Workers aged between 18-55 years are eligible for this scheme.

But there is no clear distinction between Men and Women entrepreneurs. Therefore, Women who are interested in starting their footprints as an entrepreneurs can also apply for this scheme.

10. Are Minors eligible for the West Bengal Bhabishyat scheme?

West Bengal citizens who resided in the last decade in that state and citizens who are actively employed in Motor Transport, Building Construction and other related fields aged between 18 to 55 years are eligible for this scheme. Therefore, Minors aged below 18 years are not eligible to apply for this scheme,

11. Is any collateral security required to get this loan?

As the West Bengal Bhabishyat scheme is a unique loan and it does not require any collateral security, as the West Bengal state government itself acts as a guarantor.

Hope you will get this Loan..!

All the Best BusinessMan..!!