You might have heard about these 2 Banking Terms of NEFT & RTGS plenty of times. But you may end up both are almost the same.

But in this article, let me go through the 8 top differences between NEFT and RTGS. At the end of the article, you can also find which is cheaper, faster, and best.

Let’s get started..!!

1. What is difference between NEFT and RTGS?

What is NEFT?

The full form of NEFT is “National Electronic Fund Transfer”. NEFT is one of the modes of Transfer of money from one bank to another bank i.e. Inter-bank transactions, say SBI to ICICI, ICICI to HDFC, etc.,

What is RTGS?

RTGS means “Real Time Gross Settlement”

Using RTGS, one can transfer money from one bank to the same bank of other branches i.e. Intra – bank transactions, say SBI one branch to SBI another Branch.

And also can transfer money from one bank to another bank i.e. Inter-bank transactions i.e. SBI to Union Bank

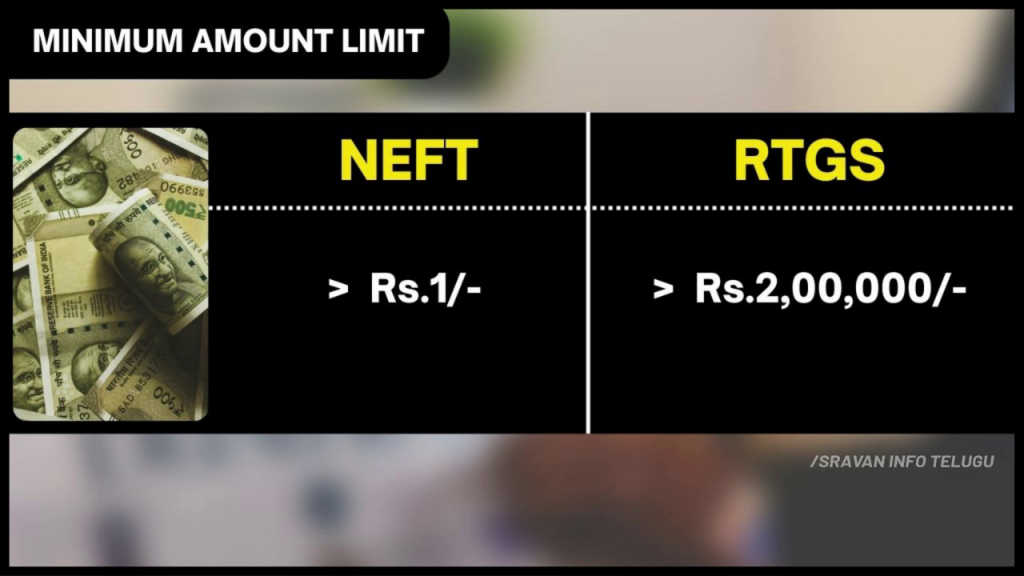

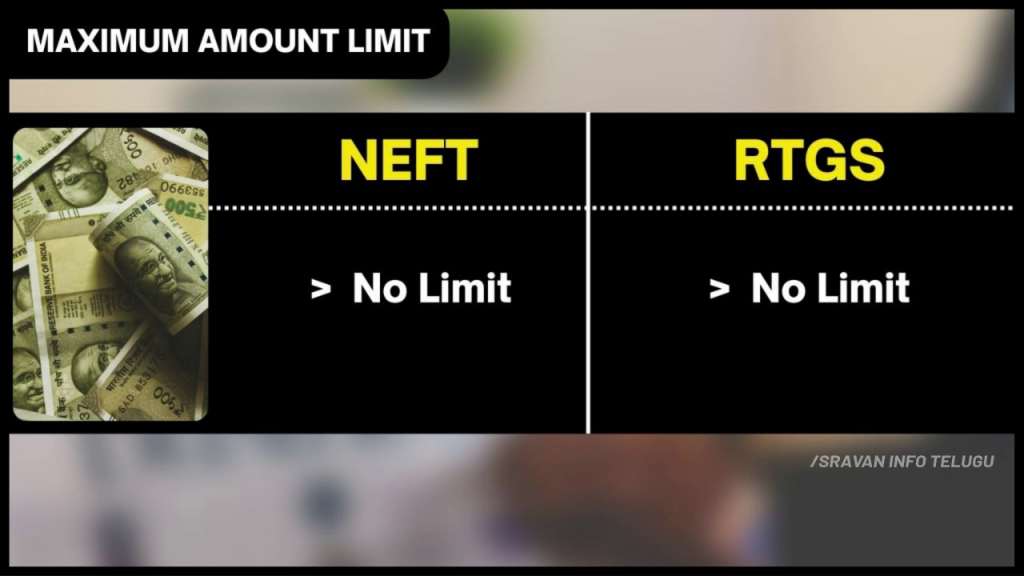

2. Minimum & Maximum Transaction Limit

NEFT

In the case of NEFT transfers, the Reserve Bank of India (RBI) has not set any Minimum transaction limits, so, you can transfer money from even Rs.1/ onwards.

The Minimum and Maximum NEFT Transfer limits of SBI are as follows

Minimum amount – Rs.1/-

Maximum amount – No Limit

RTGS

Whereas, In the case of RTGS fund transfer, the Minimum transaction amount is Rs.2,00,000/-

The Minimum and Maximum RTGS Transfer limits of SBI are as follows

Minimum amount – Rs.2,00,000/-

Maximum amount – No Limit

If you want to transfer money from one bank to another bank between Rs.1/- to Rs.2,00,000/-, then you need to use NEFT mode.

3. Charges

The charges for NEFT & RTGS will be changed from one bank to another.

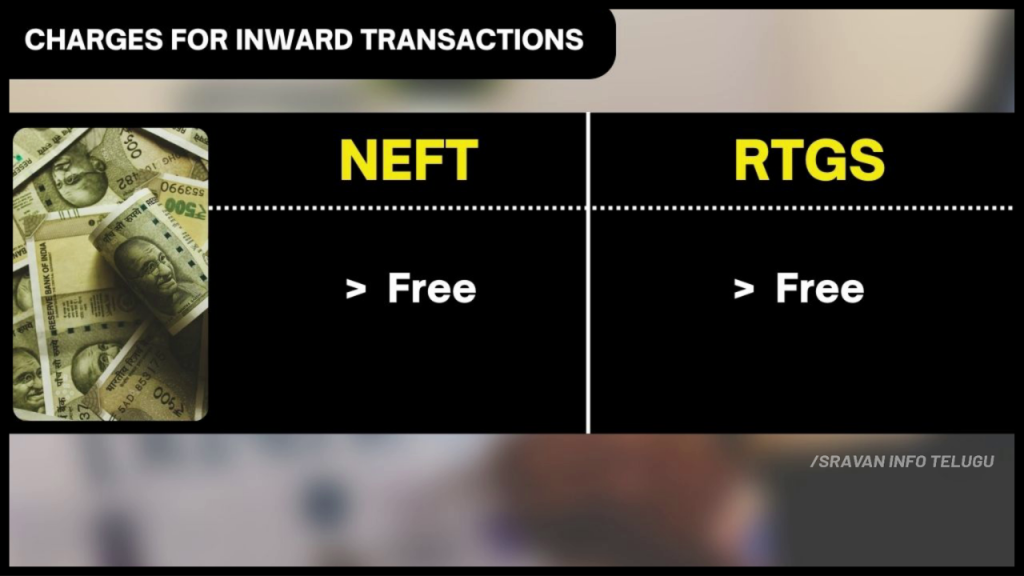

For Inward Online transactions

In case any amount is received in your Bank account either through NEFT or RTGS, for such an amount, No charges will be levied. It’s completely Free.

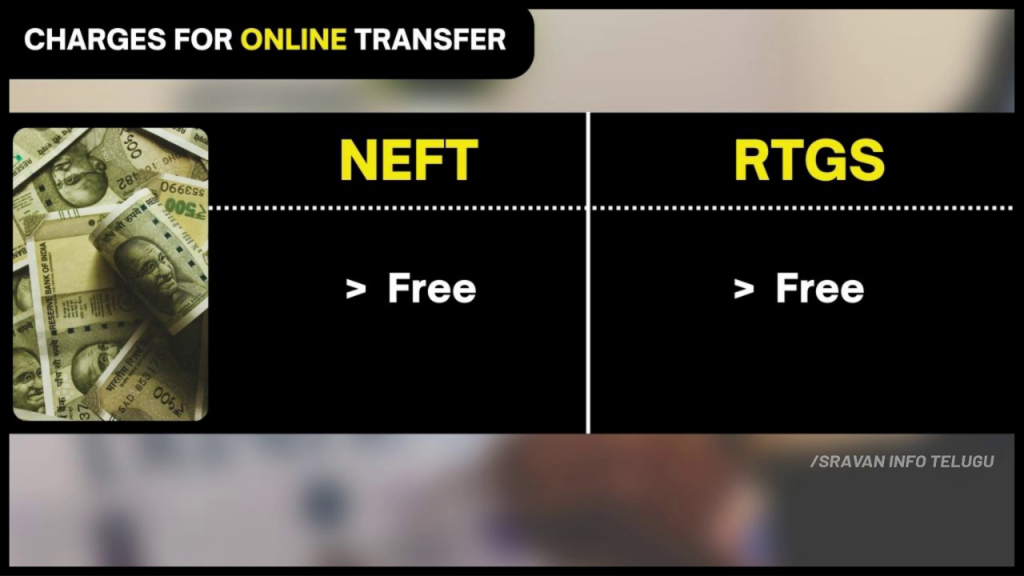

Charges for Outward Online Transactions

NEFT

From 1st Jan 2020 as per the guidelines of the Reserve Bank of India (RBI), customers who initiates NEFT transaction Online, there will be no charges.

RTGS

From 1st Jan 2019 as per the guidelines of the Reserve Bank of India (RBI), customers who initiates RTGS transaction Online also, there will be no charges.

Note: If you want to transfer money either through NEFT or RTGS, it’s better to opt for it Online as it is completely free. No charges will be levied.

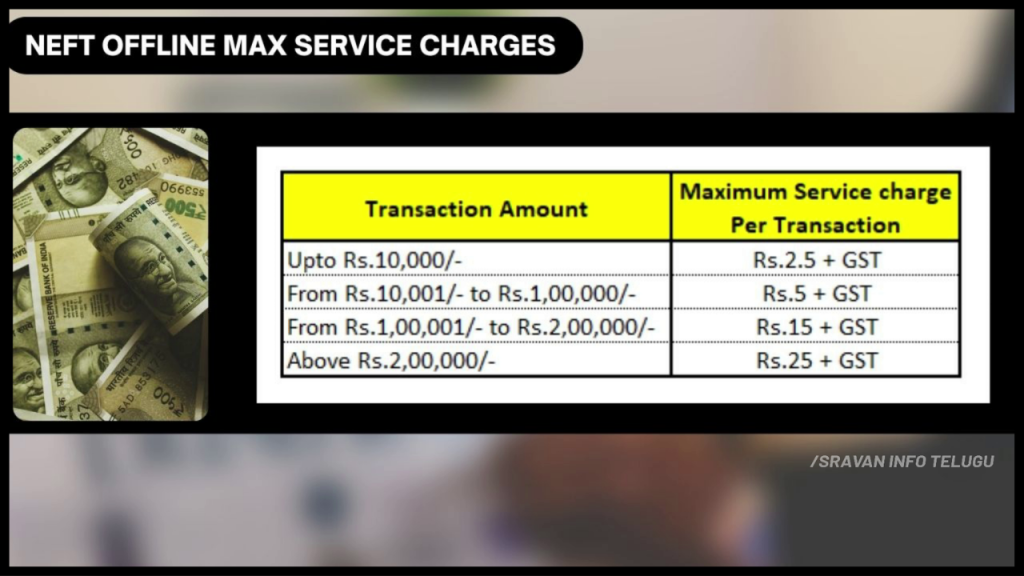

Charges for NEFT Outward Offline Transactions

In case you transfer money by filling out a form at the bank and initiating the fund transfer through NEFT, then how much will be charged?

The below limits are prescribed by the Reserve Bank of India. These are the maximum amount a bank can charge from the customer on Offline NEFT transaction is as follows.

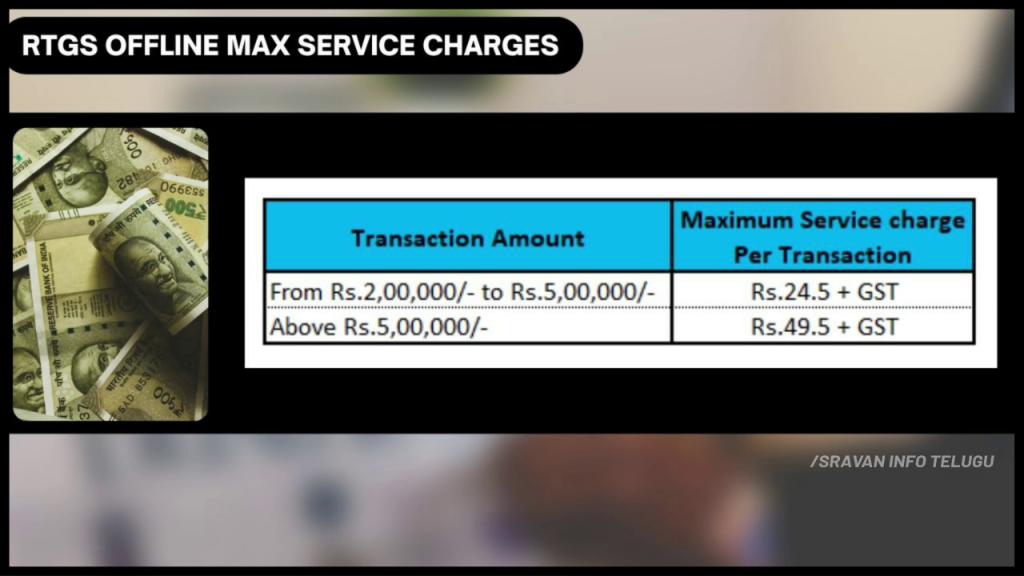

Charges for RTGS Outward Offline Transactions

The below limits are prescribed by the Reserve Bank of India. These are the maximum amount a bank can charge on your Offline RTGS transaction.

Click on the below link to Watch it in Telugu

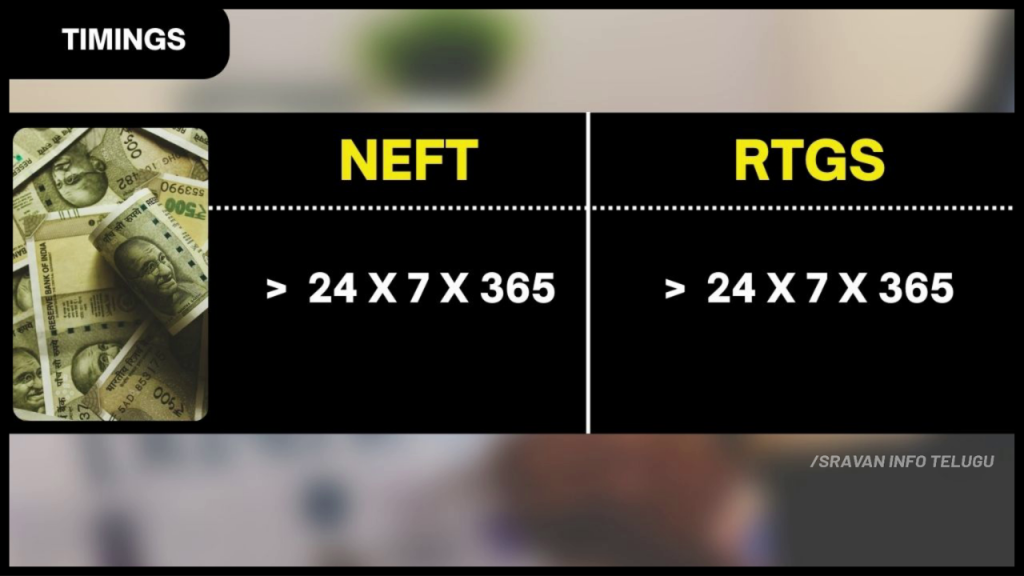

4. Timings

When an NEFT or RTGS transaction can be initiated.! Is there any time to initiate both.

There are no specific time slots for both NEFT & RTGS transfers. Therefore, customers can initiate online 24 x 7 or 365 days.

For online mode, you can use either Mobile Banking or Internet Banking.

For offline mode, you need to visit the bank branch and a physical form is to be filled out to initiate either NEFT or RTGS. It is to be noted that you must visit during banking hours only.

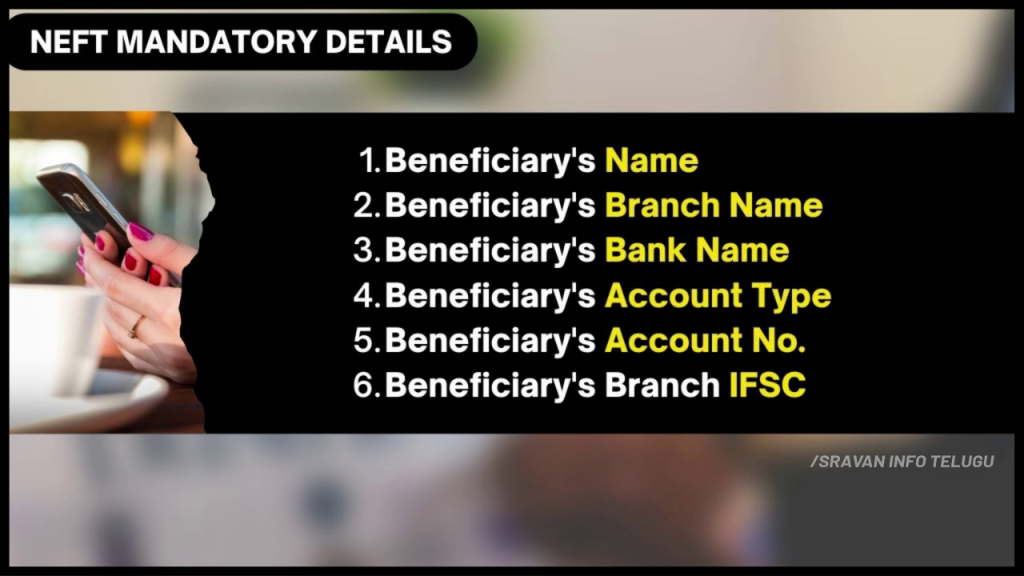

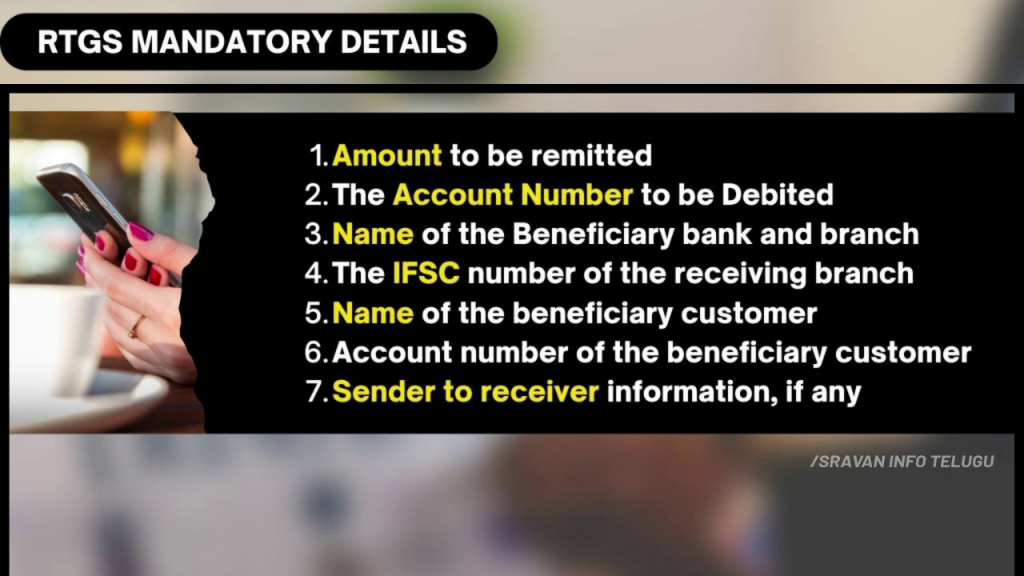

5. Mandatory details

To initiate an NEFT transaction, the below-mentioned details are required

To initiate an RTGS transaction, the below-mentioned details are required.

6. Processing Time

NEFT

Once you initiated an NEFT transaction, the Minimum processing time is 30 Minutes. NEFT Transactions will be processed every 30 minutes on a batches wise.

RTGS

Whereas the RTGS transaction will not be made in batches, it will be processed on Instruction to Instruction basis individually in Real-time.

7. When amount will be get Credited?

NEFT

As NEFT transactions will be processed in batches form, the initiated NEFT transaction will be get credited to the beneficiary account within 30 Minutes time.

30 Minutes over..! But the Beneficiary did not get the Money..!

What to do..?

As per the suggested guidelines of the Reserve Bank of India, from the time NEFT is initiated, the transaction is to be completed within a Maximum time of 2 hours.

Simply, if any NEFT transaction is not completed in 30 minutes, you have to wait for 2 Hours. So, within a maximum time of 2 hours, your money will be credited into the Beneficiary Bank account in most cases.

For any reason, the NEFT initiated amount is not credited to the Beneficiary bank account within 2 hours, then, the receiver bank or the Beneficiary bank has to return the money to the Sender bank within 2 hours.

RTGS

As the RTGS transactions will be processed on a full day continuously on a real-time basis. It means, whenever the sender initiates the transaction the Beneficiary/receiver will get money immediately.

In case the RTGS money is not credited to the Beneficiary account, then, the bank has to remit the amount to the beneficiary account within a maximum time of 30 minutes. It is the obligation of the Banker to remit back to the sender.

For any reason, if the RTGS-initiated amount is not credited to the Beneficiary bank account, then, the receiver bank or the Beneficiary bank has to return the money to the Sender bank within 1 hour.

8. Which is Cheaper, Faster, and Best

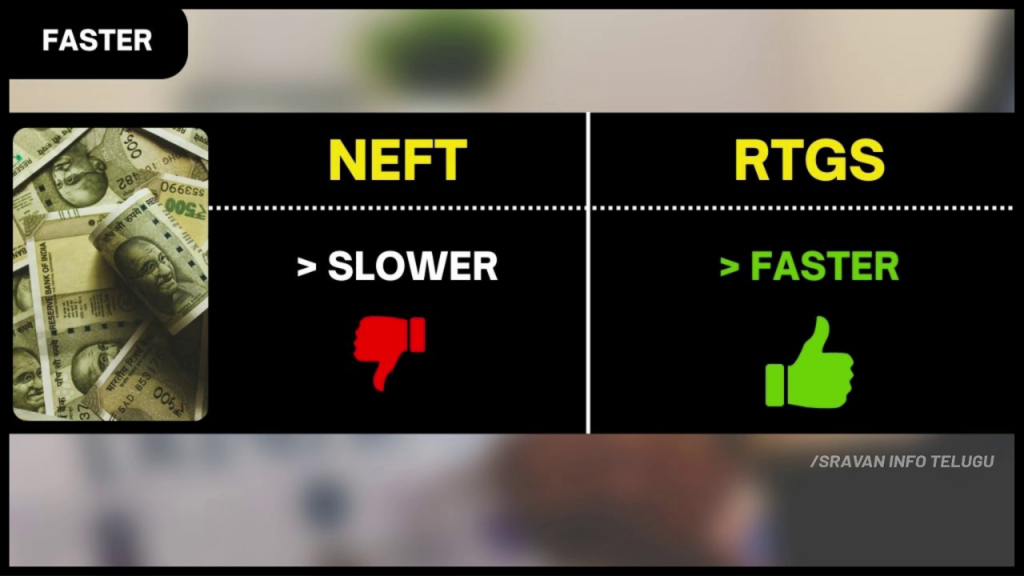

Faster

Amoung NEFT & RTGS, the RTGS is faster only. The reason is RTGS transfers money immediately to the beneficiary bank account on a real-time basis, whereas the NEFT transaction takes 30 minutes of time to complete it.

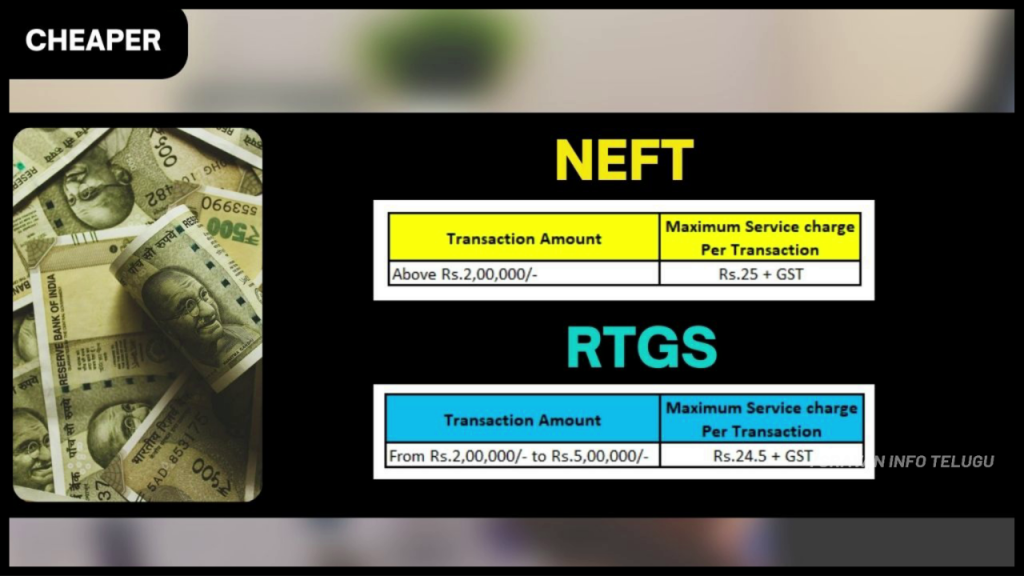

Cheaper

Amoung NEFT & RTGS, which is cheaper?

For this, I am considering RBI Offline charges as a base, as there are no charges for Online transactions for both NEFT & RTGS.

For Rs.2,00,000/- and above

So, by comparing Both it is clear that RTGS is a little cheaper as compared to NEFT.

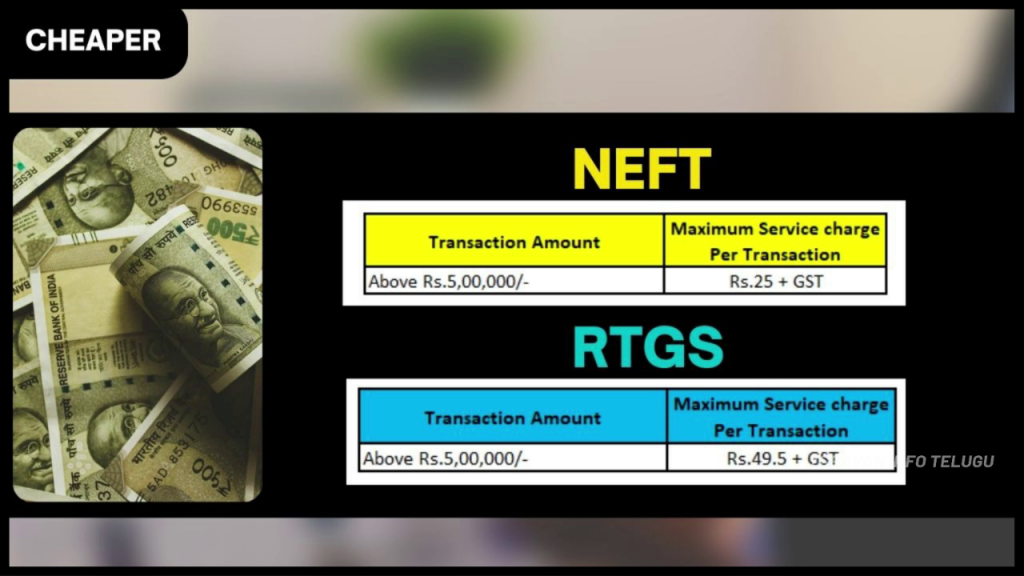

For above Rs.5,00,000/-

So, by comparing the Both it is clear that NEFT is cheaper as compared to RTGS.

Best

To transfer Small and Medium amounts with no urgency, then NEFT is suggestable.

Whereas, to transfer Large amounts on an immediate and urgent basis, then, RTGS is suggestable.

So, between NEFT and RTGS, we cannot compare them as both are designed for user purposes only. Depending on the time and use it will be decided which is best.