Cost Audit Applicability in India

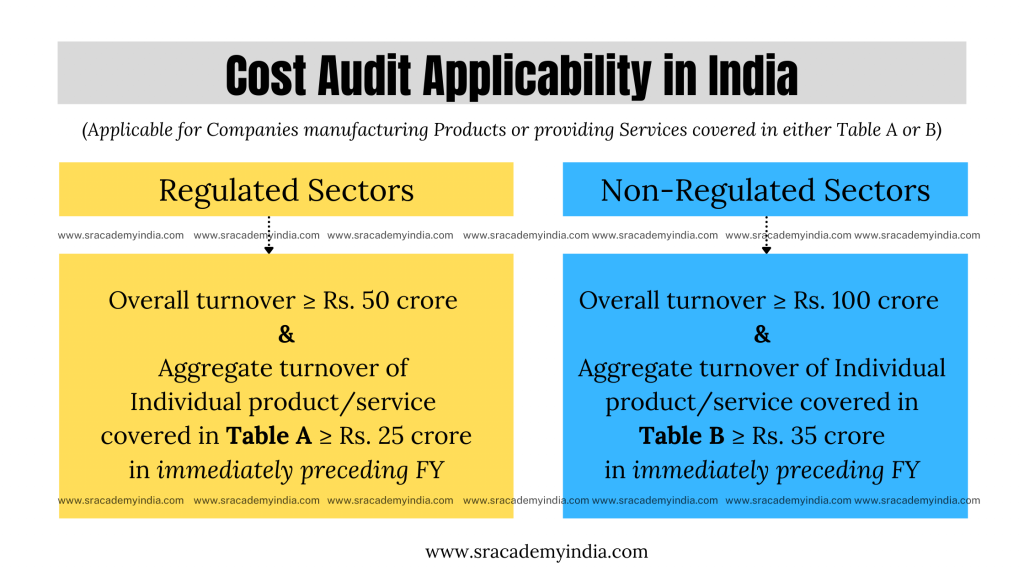

Cost audit is applicable for every company (including a foreign company) which is engaged in production of goods or provision of services specified in either Table-A or Table-B. For this purpose, companies are basically divided into Regulated and Non-regulated sectors.

Cost audit applicability for Regulated Sectors – Cost audit is applicable if overall turnover of the company is Rs. 50 crore or more and aggregate turnover of individual products or services covered in Table-A is Rs. 25 crore or more in the immediately preceding financial year.

Cost audit applicability for Non-Regulated Sectors – Cost audit is applicable if overall turnover of the company is Rs. 100 crore or more and aggregate turnover of individual products or services covered in Table-B is Rs. 35 crore or more in the immediately preceding financial year.

Before we discuss the Cost Audit Applicability in India, let’s understand what is a Cost Audit all about. ?

When you think about the concept of Cost Audit, you will get numerous questions surrounding it, which creates even more confusion.

What is a Cost Audit?

Who all are covered under Cost Audit?

Is it mandatory for all companies? And on and on. . .

In this article, I have tried to cover the various aspects of Cost Audit in a simple manner which will give you a detailed understanding of the topic.

Page Contents

- Meaning of Cost Audit

- Cost Audit Applicability

- Cost Audit Procedure

- Cost Audit is NOT applicable – When?

- Maintenance of Cost Records

Let’s understand the concept in detail. . .

There are many standard definitions assigned to the term “Cost Audit” by various authors.

Though the objective of the Cost Audit is more or less similar, the approach to achieve it differs from person to person as well as from industry to industry.

Moreover, there is significant ambiguity and misconceptions in the industry regarding the applicability of the cost audit. Though a separate Cost Accounting Record Rules were introduced in early 2011, the confusion persists regarding numerous factors which also includes the frequent changes of the cost accounting record rules relating to the applicability of Cost Audit for various products and services.

Meaning of Cost Audit

Cost Audit is the process of independent examination or verification of the cost accounting records of an entity to express opinion thereon.

Cost accounting records include cost statements, cost records and other related information on which cost auditor relies to express his opinion.

As per the definition given by Chartered Institute of Management Accountants, London (CIMA), cost audit is the verification of the correctness of cost accounts and of the adherence to the cost accounting plan.

To put it simply, Cost Audit mainly focuses on two aspects.

- Accuracy – To ensure that the cost statements and reports prepared on the basis of cost accounting records are accurate

- Adherence – To check whether the cost accounting records are complying with cost accounting principles, procedures, and objectives.

Cost Audit Applicability in India

Sec 148 of Companies Act, 2013 contains the provisions relating to the cost audit. Accordingly, every company (i.e. including a foreign company) engaged in the production of specified goods or providing specified services should get their cost accounting records audited by a Cost Accountant in practice.

For this purpose, coverage is broadly divided into Regulated sectors and non-regulated sectors.

Regulated sectors

Companies engaged in the products or services specified in the Table-A are liable for cost audit, if during the immediately preceding financial year

- Overall turnover from all of its products or services – Rs. 50 crore or more and

- Aggregate turnover of individual products or services which are covered in Table-A – Rs. 25 crore or more

Non-Regulated sectors

Companies engaged in the products or services specified in the Table-B are liable for cost audit, if during the immediately preceding financial year

- Overall turnover from all its products or services – Rs. 100 crore or more and

- Aggregate turnover of individual products or services which are covered in Table-B – Rs. 35 crore or more

If any company is covered under cost audit, it shall appoint a practicing cost accountant as the cost auditor and the procedure for such appointment is as follows:

Cost Audit Procedure

Appointment of Cost Auditor

Every company covered under Cost Audit shall appoint the cost auditor within 180 days from the commencement of every financial year. For which, the written consent of such auditor has to be obtained prior to such appointment.

For instance, the Cost Auditor appointment for FY 2021-22 has to be done within 180 days from 1st April 2021 i.e. before 27th September 2021.

Intimation to the Central Government

Upon appointment of the cost auditor, the company shall inform such appointment to the Central Government electronically through the Form CRA-2 within

- 30 days from the Board meeting in which such appointment is made or

- 180 days from the commencement of financial year whichever is earlier

Submission of Audit Report

After completion of the audit, Cost Auditor has to furnish the signed Cost Audit Report along with the reservations or observations in the Form CRA-3 to the Board of Directors of the company within 180 days from the closure of the relevant financial year.

In turn, the company shall send such Cost Audit report to the Central Government in Form CRA-4, within 30 days from the date of receipt of the audit report from the Cost Auditor.

Cost Audit is NOT applicable – When?

The following companies are NOT covered under cost audit.

- Revenue from exports (i.e. in Foreign exchange) is more than 75% of total revenue

- Unit located in Special Economic Zone (SEZ)

- Unit engaged in the generation of electricity for captive consumption through Captive Generating Plant.

Recommended: A Complete guide on TDS for simple understanding

Maintenance of cost records

Companies engaged in the manufacture of goods or provision of services specified in either Table A or Table B shall maintain the cost records as per sec 148(1) of the Companies Act, 2013, if their aggregate turnover from all its products or services is Rs. 35 crore or more during the immediately preceding financial year.

Format

Companies covered under these rules (i.e. Companies (Cost Records & Audit) Rules, 2014) shall maintain the cost records in Form CRA-1.

Purpose

Cost records shall be maintained

- To facilitate the calculation of per-unit cost of production or cost of operations or cost of sales and margin for each of its products or services on a periodical basis and

- To control various operations and costs to achieve optimum economies in the utilization of resources

Cost records includes books of accounts relating to material, labour and other items of cost-related directly or indirectly with the production of goods or provision of service.

Though the industry is familiar with the concept of Cost Audit, migration from company-specific audits to industry-specific audits took longer time than expected to settle down and still a lot of awareness has to be created across the industries to understand the benefits that can be derived from cost audit, apart from the statutory compliance.

Please do share if you like it. And, also give your feedback/suggestions to improve the content in the comments.