TDS (Tax Deduction at Source) – A Complete guide

“Tax Deduction at Source” in general terminology called as TDS, which means deduction of tax at the point where initially the income is generated.

For instance, your annual salary is Rs. 3,60,000 and imagine you don’t have any tax-saving investments, then ideally your employer shall deduct tax from your gross salary before paying it to you. Let us assume your employer deducted Rs. 10,000 as tax from your salary, which will be called as TDS (i.e. Tax Deduction at Source) on your salary income of Rs. 3,60,000.

Let’s understand what is Tax Deduction at Source and procedures relating to TDS in detail:

Introduction – TDS

Generally, under the Income Tax Act, income earned in the previous year will be taxable in the assessment year and there are certain exceptions to it.

At the time of filing the income tax return(ITR), assessee has to arrive at the total income earned in the previous financial year (i.e. Previous year) and pay tax on it, which is called “Self-assessmentâ€.

In the above mechanism, tax remittance by the assessee will take place only in the next year. In addition, the accuracy with which the tax liability will be determined depends on the awareness of the assessee about the tax provisions.

Hence, the concept of TDS or Tax Deduction at Source has been introduced to reduce the gap between the assessment of income & tax payment. It also aims at the regular flow of funds to the government and efficient collection of taxes at the source of the income.

Under TDS mechanism, responsibility for deduction of tax at source lies with the payer. Depending on the nature of payment and the amount payable, the payer has to identify the rate of TDS and amount to be deducted.

Upon deduction, tax will be paid directly to the Government by the payer on behalf of the payee and TDS certificate to this effect will be issued for claiming the tax credit by the deductor to the deductee.

Process of TDS mechanism

Broadly the entire TDS process can be classified as follows:

- Identifying coverage of payment under TDS mechanism

- Rate at which TDS has to be deducted (If covered)

- Remittance of TDS to the Govt.

- Filing of TDS Return

- Furnishing the TDS certificate to the deductee

- Consequences for default

Payments covered under TDS

Currently, TDS provisions are applicable to the various payments like salary, interest, commission, brokerage, work charges, professional fees and royalty, etc.​

Depending on the nature of payment, IT Act specified exemption limits for each category. If such limit exceeds, TDS is applicable at the corresponding rates.

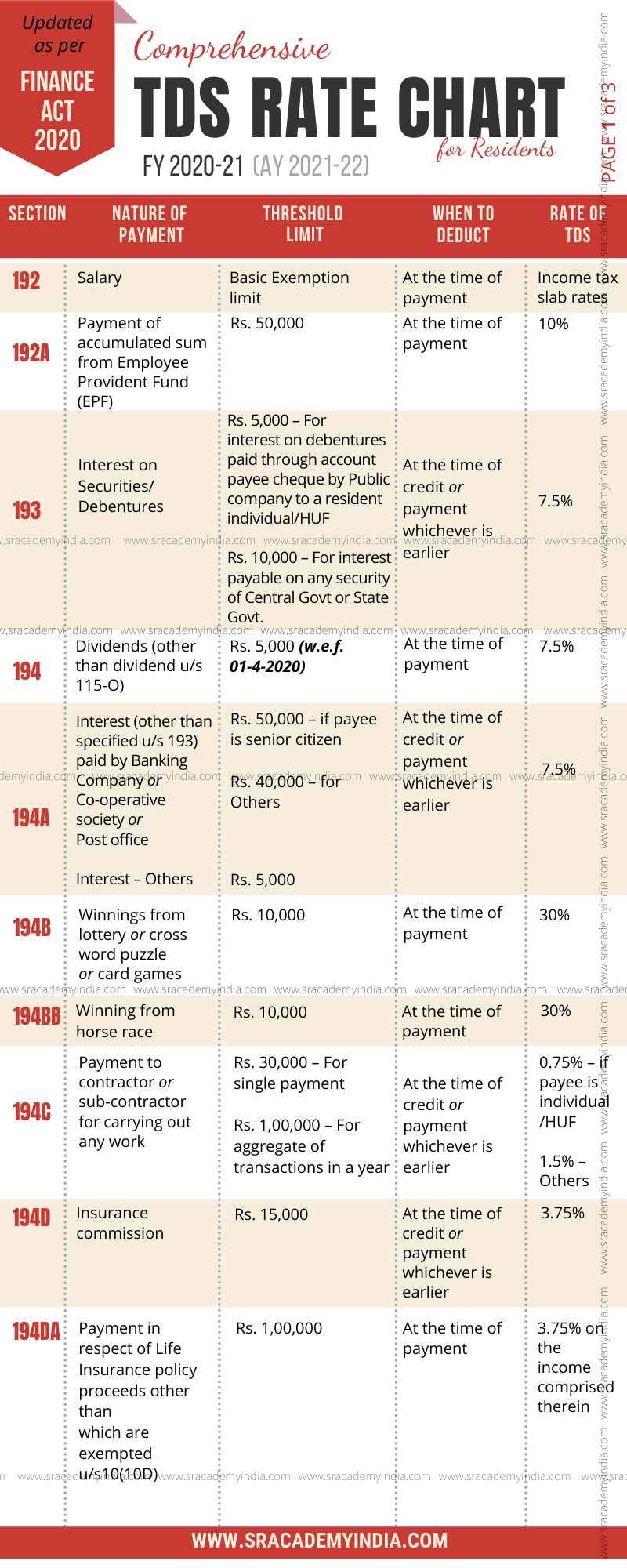

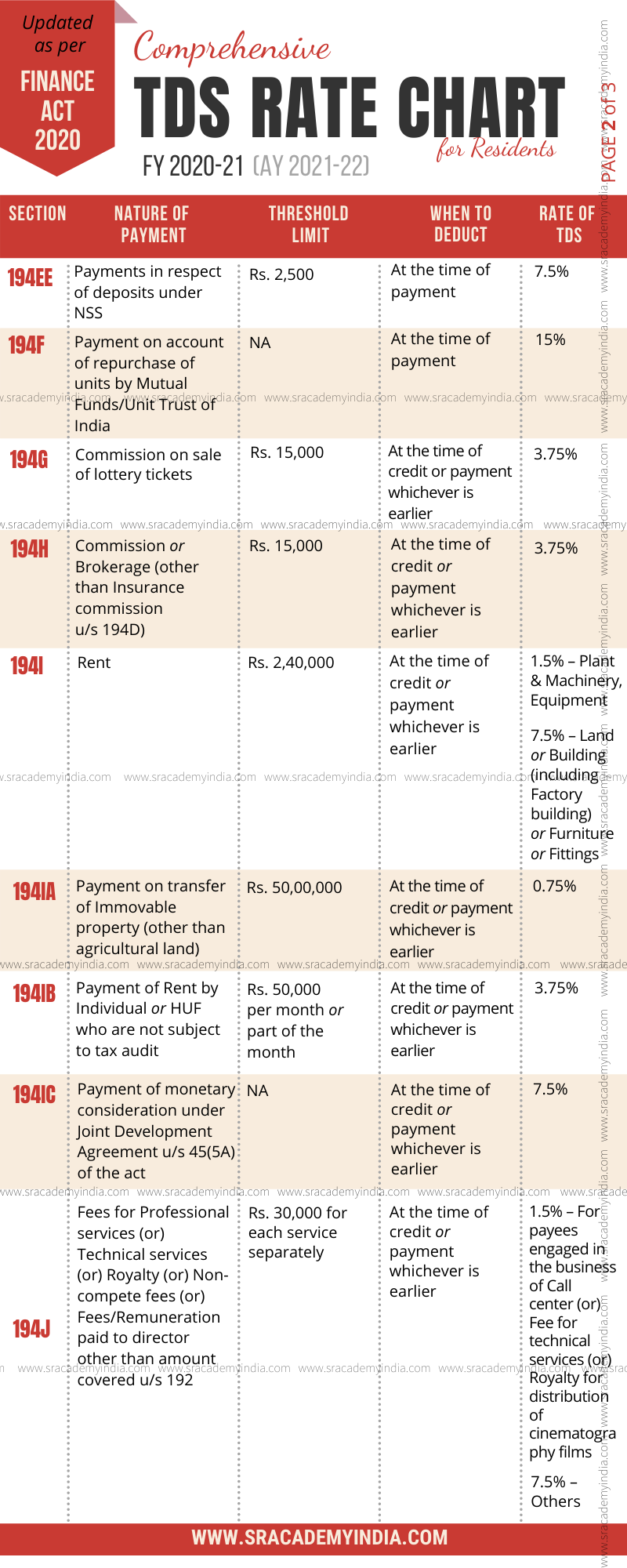

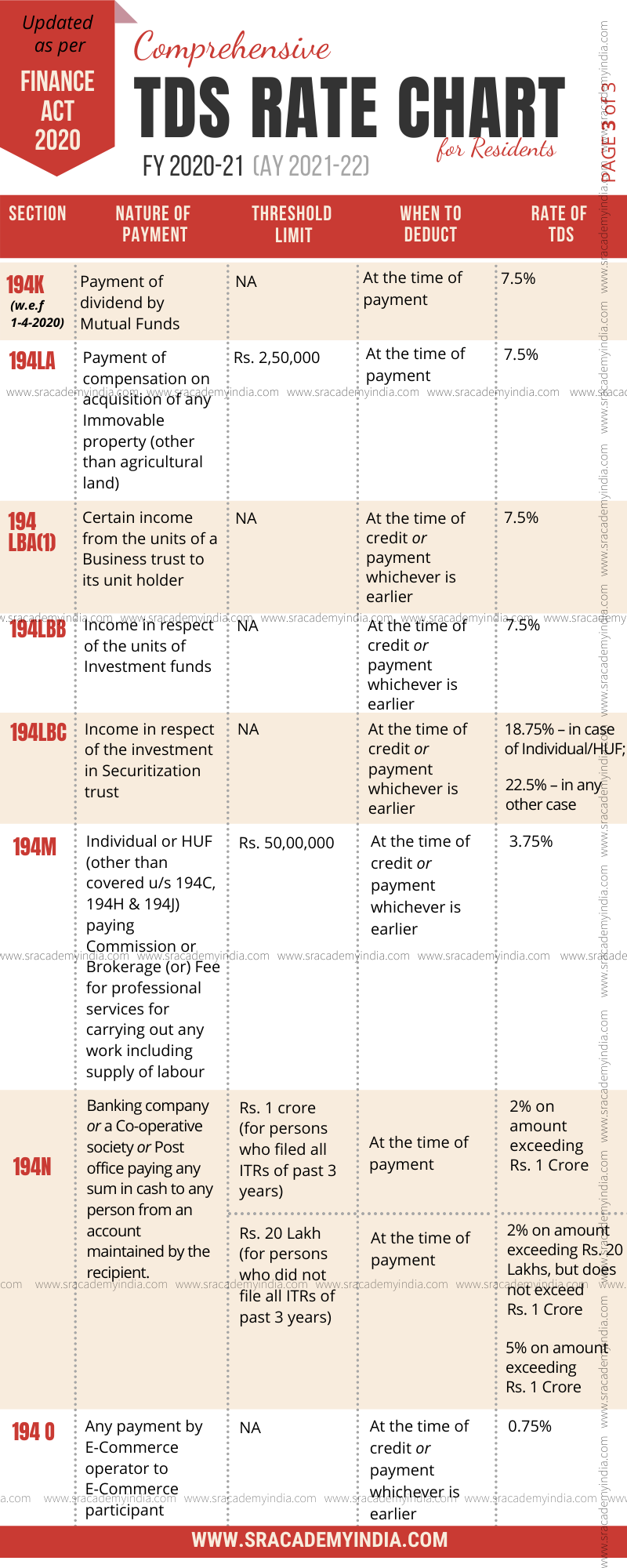

Rates at which TDS is to be deducted

Except for TDS on salary, all other payments are liable to TDS at a fixed rate depending on the nature of payment.

Given below are the TDS rates for various payments: (Updated as per Finance Act, 2020)

Higher rate when applicable?

If PAN of the recipient is not furnished then deductor shall deduct the tax at higher of the following rates as per Section 206AA:

a) at the rate specified in the relevant provision of this Act; or

b) at the rate or rates in force; or

c) at the rate of 20%.

However, if any payee is located in a notified jurisdictional area and amount is subject to TDS, the tax shall be deducted in accordance with at the highest of the following rates:​

​​a) at the rate or rates in force;

b) at the rate specified in the relevant provisions of this Act;

c) at the rate of 30%

Remittance of TDS

​​Tax deducted shall be deposited to the credit of Central Govt and TAN number has to be quoted by the deductor in such remittance form in addition to the other basic details.

Due dates for remittances differ between Govt and Non-govt deductors. The same are given below for quick reference:

In case deductor is an office of the Government

a) Where tax is paid without production of an income-tax challan – On the same day when tax is deducted

b) Where tax is paid accompanied by an income-tax challan – On or before 7 days from the end of the month in which the deduction is made or income-tax is due under Section 192(1A)

In case of any other deductor

a) Where the amount is credited or paid in the month of March – On or before 30th day of April

b) In any other case – On or before 7 days from the end of the month in which the deduction is made or income-tax is due under Section 192(1A)

Exception: The above mentioned time limits are not applicable for payments made u/s 194IA, 194IB & 194M. In these cases, TDS shall be paid to the credit of the Central Government within a period of 30 days from the end of the month in which the deduction is made.

Also read full article on “TDS payment due dates”

TDS Return filing

Every person responsible for deduction of tax, after remittance of such tax, shall furnish quarterly statements either in paper form or electronically with digital signature or electronically along with Form 27A.

Form to be used for filing TDS statements

Quarterly TDS statements shall be furnished in the following forms:-

Form 24Q – Statement of deduction of tax from salary under section 192.

Form 26Q – Statement of deduction of tax under section 193 to 196D in any other case.

Form 27Q – Statement of deduction of tax under section 193 to 196D, where deductee is a non-resident (not being a company) or a foreign company or resident but not ordinarily resident.

Form 26QB – challan-cum-statement for tax deducted under section 194-IA

Form 26QC – challan-cum-statement for tax deducted under section 194-IB

Form 26QD – challan-cum-statement for tax deducted under section 194M

Form 26B – claim for refund for excess TDS/TCS paid

Due date for filing of TDS statements (Both for Government and other Deductor)

| For Quarter Ending with | Due date |

| 30th June | 31st July of the financial year |

| 30th September | 31st October of the financial year |

| 31st December | 31st January of the financial year |

| 31st March | 31st May of the financial year immediately following the financial year in which deduction is made |

Exception: Above mentioned time limit is applicable for Form-24Q, 26Q & 27Q only. The due date for filing of Form 26QB, 26QC & 26QD is within a period of 30 days from the end of the month in which the deduction is made.

Keypoint: Any sum deducted u/s 194IA, 194IB & 194M shall be paid to the credit of the Central Government within a period of 30 days from the end of the month in which the deduction is made and shall be accompanied by a challan-cum-statement in Form No. 26QB, Form No. 26QC & Form No. 26QD respectively.

Furnishing of TDS certificate to the payee

Any person after remitting the TDS & filing of TDS return as mentioned above, shall issue the following forms to the deductee.

Form 16 – TDS on salaries – Periodicity is annually – Shall be issued before 15th day of June of the financial year immediately following the financial year in which the income was paid and tax deducted.

Form 16A – TDS on all other payments other than salaries – Periodicity is quarterly – within 15 days from the due date of filing the TDS return

Form 16B – TDS on sale of property (sec 194IA) – Within 15 days from the due date of filing the TDS return u/s 194IA (i.e. Form 26QB)

Form 16C – TDS on Rent (sec 194IB) – Within 15 days from the due date of filing the TDS return u/s 194IB (i.e. Form 26QC)

Form 16D – TDS on payments by Individual/HUF (sec 194M) – Within 15 days from the due date of filing the TDS return u/s 194IB (i.e. Form 26QD) Updated

Consequences for default

Default can be either due to default in payment of TDS or due to delayed filing of return.

Default in payment of TDS

A deductor would face the following consequences if he fails to deduct TDS or after deducting the same fails to deposit it to the credit of Central Government’s account:

1. Disallowance: Any sum (other than salary) payable outside India or to a non-resident will be disallowed u/s 40(a)(i).

Similarly, any sum payable to a resident would attract 30% disallowance as per section 40(a)(ia).

2. Interest: Interest will be levied u/s 201 and deductor is liable to pay simple interest as follows:

(i) at one per cent for every month or part of a month on the amount of such tax from the date on which such tax was deductible to the date on which such tax is deducted; and

(ii) at one and one-half per cent for every month or part of a month on the amount of such tax from the date on which such tax was deducted to the date on which such tax is actually paid.

3. Penalty: Penalty of an amount equal to tax not deducted shall be imposed under section 271C. Also, Penalty u/s 221 may be imposed by the AO if assessee is in default or deemed to be in default up to the max of tax in arrears.

4. Prosecution: Assessee-in-default shall be punishable with rigorous imprisonment for a term which shall not be less than three months but which may extend to seven years and with fine under section 276B.

Delayed filing of TDS return

1. Interest: A late fee of Rs. 200 per day during which such default continues may be imposed. However, the maximum amount is restricted to the extent of TDS/TCS. (Sec 234E)

2. Penalty: In addition to the fee u/s 234E, if any person fails to furnish TDS return or furnishes incorrect information in the return, penalty between Rs. 10,000 to Rs. 1,00,000 may be imposed by the Assessing Officer. (Sec 271H)

1 thought on “TDS (Tax Deduction at Source) – 6 step process Complete guide for easy understanding”