Sec 194N – TDS on cash withdrawal – An easy understanding

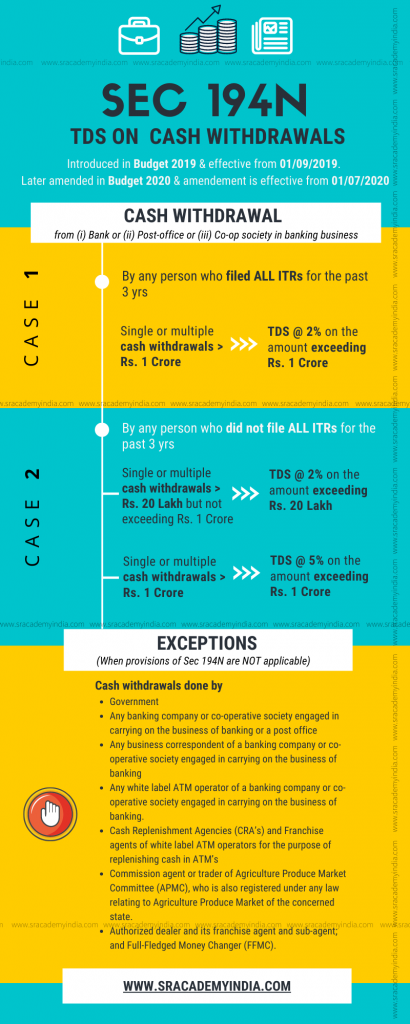

Government in the Union Budget 2019 has introduced a new provision sec 194N which deals with TDS on cash withdrawals to discourage the cash transactions and move towards cash less economy.

Though initially it was applicable from 1st September 2019, it was later amended in the Union Budget 2020 and revised provision is effective from 1st July 2020.

When it was first introduced, threshold limit for applicability was Rs. 1 crore for all persons. But after it was amended in the Budget 2020, two different rates and threshold limits were specified for the filers and non-filers of income tax return.

Accordingly, when cash withdrawals are done by any person from an account or accounts maintained with either a bank or post office or co-operative society engaged in banking business in excess of Rs. 20,00,000 (for non-filers of income tax return) or Rs. 1 crore (for filers of income tax return) during the previous year are covered under sec 194N and hence attracts TDS at either 2% or 5% of the amount in excess of the threshold limit.

Does your cash withdrawals from Bank or Post Office attract TDS?

Before discussing it, let’s have the basic understanding of the provision i.e. TDS on cash withdrawals under sec 194N of Income Tax Act, 1961.

Table of Contents

- Applicability of TDS on cash withdrawals

- Threshold limit and Rate

- Effective date

- Point of Taxation

- Who will deduct TDS

- Non-applicability

Applicability of TDS on cash withdrawals

It is applicable when any person who withdraws cash either from a bank or post office or co-operative society engaged in banking business in excess of threshold limit (discussed in the later part of the article) during the previous year.

Hence, all categories of persons are covered except those are specifically excluded from the purview of the section (exceptions are discussed in the last part of this article).

If you want to know more about TDS, read our Detailed guide on TDS

Threshold limit and Rate

Initially when it was introduced, there was a uniform threshold limit for all persons i.e. Rs. 1 crore. But as per the amended provision, different threshold limits are specified for filers and Non-filers of income tax return.

| Category of Person | Threshold limit | Rate of TDS |

|---|---|---|

| Filer of ITR | Exceeds Rs. 1 crore | 2% |

| Non-Filer of ITR | Exceeds Rs. 20 lakh but does not exceed Rs. 1 crore | 2% |

| Exceeds Rs. 1 crore | 5% |

Effective Date

Originally it was effective from 1st September, 2019. However, it was later amended in the Union Budget 2020. Hence, the amended provisions of sec 194N are applicable from 1st July, 2020.

Point of Taxation

At the time of payment by the payer to the payee.

Who will deduct TDS

TDS has to be deducted by the payer (i.e. Bank or Post office or Co-operative society engaged in banking business) at the time of cash withdrawal by the payee (i.e. any person)

Non-applicability

In the following cases, provisions of sec 194N are not applicable.

- Government

- Any banking company or co-operative society engaged in carrying on the business of banking or a post office

- Any business correspondent of a banking company or co-operative society engaged in carrying on the business of banking

- Any white label ATM operator of a banking company or co-operative society engaged in carrying on the business of banking.

- Cash Replenishment Agencies (CRA’s) and Franchise agents of white label ATM operators for the purpose of replenishing cash in ATM’s

- Commission agent or trader of Agriculture Produce Market Committee (APMC), who is also registered under any law relating to Agriculture Produce Market of the concerned state.

- Authorized dealer and its franchise agent and sub-agent; and Full-Fledged Money Changer (FFMC).

The required mechanism for implementation of this new provision is also enabled for Banks & Post offices w.e.f. 1st July, 2020. Through which payer (i.e. Bank or Post office) can verify the applicability of TDS on cash withdrawals with the help of PAN of the recipient.

If you look at the impact on cash withdrawals, for regular filers of income tax return (i.e. who has filed ITR’s for the past 3 years), they can utilize the upper cash withdrawal limit of Rs. 1 crore and will have a lesser impact on their withdrawals. On the other hand, for non-filers of income tax return (i.e. who did not filed at least one year ITR out of the past 3 years), impact due to this provision will be higher as the upper cash withdrawal limit is only Rs. 20 lakh.

Though the intention for introduction of this new provision is to curb the black money, there are lot of ambiguities in the practical application of the provision which needs to be addressed by the Government. As we are still in the initial stages, let’s hope the Government will take suitable initiatives for its effective implementation.

Read our Detailed guide on applicability of Sec 194N (Coming Soon)

Also read: Practical understanding and application of Sec 194N (Coming Soon)

Liked the content!

Pls do share.

Not happy with the content!

Pls comment your suggestions to improve it.