Top 10 Objective of Financial Accounting

Today the youngsters are more enthusiastic to become entrepreneurs.

Even Flipkart, Uber, Paytm, Swiggy, etc have started their operations in the same way.

As you know that the books of accounts for such a big enterprises also will be prepared by the Finance & Accounts department staff like Accountants, Managers or Accounting experts.

But the question is Why do we prepare accounts and What is the necessity of preparing the books of accounts ? i.e. “ Objectives of Financial accounting”.

As quoted by William Howard Taft

“We are all dependent upon the Investment of Capital“

Can you imagine a business without Capital…!!!!

No..!!

It may be a small boutique (or) Departmental store (or) an Aluminum industry,

the Capital is the Key source for any business.

It will be provided by the proprietor himself from two sources

1. From the available Cash balance or

2. Through Bank loan or Mortgage etc.

The Capital contribution for different enterprises will be different which is mentioned below.

In case of Sole Proprietorship, the capital will be contributed by the Sole Proprietor/ Owner of the business.

For the Partnership, by the Partners.

In case of Companies, the Capital will be contributed by the “Shareholders/ Stakeholders“.

As the capital is investing by the shareholders, the business needs to provide financial information to the shareholders which is the main objective of accounting. Therefore, businesses need to prepare books of account for the following purposes which are also call it as “Objectives of Financial Accounting“

In this article, we are going to discuss on the topic “Top 10 Objectives of Financial accounting” and check the table of contents i.e. Basket of Mangoes

Basket of Mangoes

- Track & Record Expenses and Incomes to Ascertain Profit or Loss

- Know the Success of Racing Horse

- Check your belly

- Identify your Kattappa

- Know What it Owes

- Be like Kamal Hasan’s INDIAN

- To assess the progress of the business

- To disclose Information

- For Assessment of Tax Liability

- For Decision Making

What are objectives of accounting?

1. Track & Record Expenses and Incomes

A business enterprise shall identify and maintain a proper record of all the (financial) transactions in a systematic manner. Based on the volume of the transactions (& ease with the different software packages) they use different accounting softwares like Tally, Quick Books, etc. for recording expenses, incomes etc.

These transactions will be recorded through Journals and Posted in Ledgers. For each and every type of Expense and Income, a separate Ledger will be prepared.

In Case of Expenses

The following ledgers will be created to identify how much expenditure is incurred during a period. The period may be either a Month or Quarter or Annual basis.

Salaries A/c – In case of monthly payments to employees

Wages A/c – In case of daily wages to Labour, Workers and Contract labour

Electricity – In case of Electricity charges of Factory/Company etc.

When a company has a Bank account in SBI, all the transactions of the bank (Cash withdrawals, Cash Deposits,Bank Charges etc) for each and every month are to be recorded from 1st to 31st of every month by preparing Bank Book.

In case of small Cash transactions, a Petty cash register is also maintained for the day-to-day conduct of the business.

In Case of Incomes,

The following ledgers will be created to identify how much income is received during a period.

Sales A/c – In case of Goods sold to customers

Services A/c – In case of Rendering of Services like Professional fees

Rental Income – In case of Rent income received from out letting space or any other income etc.,

2. Know the Success of Racing Horse

What is the motive of any business..?

Of course earning Profits.

Every business motto is to finally identify whether their horse will win or lose.

How an enterprise can ascertain Profit or Loss..!!

To ascertain whether the business made Profit / Loss, can be ascertained by preparing the Statement of Profit and Loss account.i.e. simply, P&L a/c.

In case of Companies who maintain the books of accounts on Accrual basis of Accounting shall also record all expenses including outstanding expenses like Outstanding Rent and Accrued Incomes like Accrued Interest on the Debit side of P&L a/c and all incomes including Accrued Incomes like Accrued fees, Rent etc on Credit side of P&L a/c.

Then only a business enterprise can ascertain the amount of Profit / Loss made by preparing the Profit and Loss a/c through their Ledgers.

3. Check your belly

Yes, Check your belly.

In case of Non-Trading Concerns like Charitable Trust, Societies, Charitable Hospitals whose objective is to help society or group of persons in large but not the profit. It is non-commercial only. Such organizations required to ascertain their Surplus or Deficit only not the Profit or Loss.

So, check your belly whether it has a surplus or deficit of stomach. The Surplus or Deficit can be ascertained by preparing the Income & Expenditure Account instead of Statement of Profit and Loss account.

4. Identify your Kattappa

Kattappa is one of the key strength of the kingdom of Bahubali.

Identify your strength. One of the important objects of accounting is to know the financial position/ strength of the business. i.e. to assess what the business owns. A business enterprise is required to acquire certain assets for the day-to-day activities/conduct of the business.

For example, 2 Acres of Land is acquired by an Aqua company and Constructed a building thereon. Here, both Land and Building are assets to the organization. To manufacture goods, Machinery is also required. Whereas an MD of the company who bought a Car for an official purpose from the available funds of the company which is also an asset.

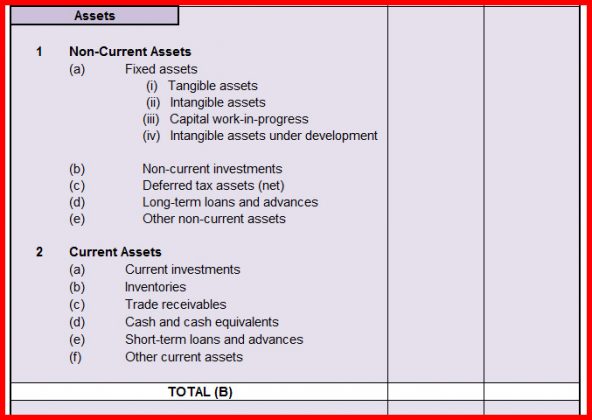

The following are also will be considered as an Asset only for the organization.

Manufacture of goods i.e. Inventory

Sale of goods on a credit basis. i.e. Debtors

Cash proceeds from sale of goods i.e. Cash & Bank balance

Note: Here, the assets mean both Non-Current assets and Current assets.

All such assets shall be disclosed under the “Assets” side of “Balance Sheet”.

Also Read: 18 Key points about Capital expenditure

5. Know What it Owes

In case an enterprise has no Cash reserves (or) General reserves (or) any other specific reserve to acquire any asset, then, how come they acquire.

Obviously. Borrow i.e a Loan from Bank

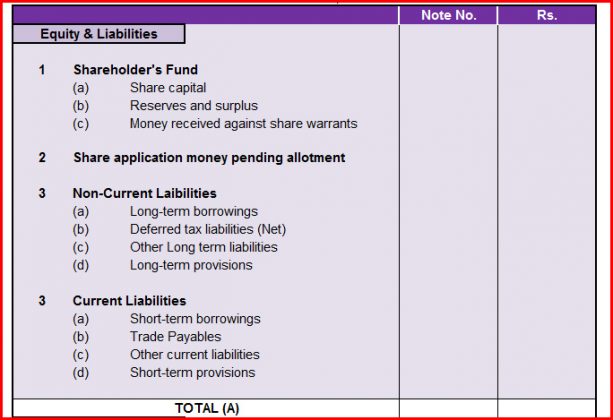

Then, an organization is obliged to disclose the

– Amount of loan taken,

– No.of EMI’s paid &

– Balance loan outstanding at the end of the financial year.

That is called what the business owes.

The following are also will be considered as a liability only for the organization.

Purchase of goods on a credit basis. i.e. Trade Creditors.

Financial accounting shall always disclose nature of liability of an organization based on Generally Accepted Accounting Principles (GAAP) whether it is either Long-term or Short-term. All such liabilities shall be disclosed under the “Liabilities” side of the “Balance Sheet“.

6. Be like Kamal Hasan’s INDIAN

Kamal hasan’s long back released movie has shown the character of Old Kamal Hasan’s as a Rule follower. Even though his method of following rule is not correct, but we will take the good from him as a Rule follower.

Whenever a business organization gets registered it shall comply with certain compliances.

In short to understand the same, in case an organization is registered as a Company under the Companies Act, 2013. Then, such organization shall follow the rules & regulations of Companies act,2013 like Issue of Shares, Allotment of Shares, Appointment of an auditors etc.,

Whether only a single act is to be followed?

Or is it sufficient to follow a single act as per registration of the business?

No.

| When? | Which Act? |

| When the Factory is incorporated | Factories Act |

| When labour is engaged | Payment of Minimum of Wages act |

| When the No. of employees exceeds 10 | ESI Act |

| When the No. of employees exceeds 20 | PF Act |

| For Payment of Income Tax | Income Tax Act,1961 |

| For Payment of GST | GST Act |

| For Filing of Annual Report | Companies Act,2013 |

So, Be like Kamal hasan’s Indian and follow the rules in a legal manner.

7. To assess the progress of the business

An Owner of the enterprise always has concern on profit of the organization. But one cannot wait till the end of the Financial Year. Micro, Small, Medium enterprises may not assess their Profit/Loss on regular basis.

Whereas, in case of large organizations like TCS, Wipro, Infosys, Mind tree etc will announce their Profit/Loss position on Quarterly basis (Which can be seen in Daily news papers)

As per the Economic Times report, The Q4 results of Infosys for the FY 2019-20 is reported Rs.4,321 crores profit as compared with the same quarter of Q4 in the last financial year of FY 2018-19 with Rs.4,074 crores profit. IT means the profit raises to 6%.

Large organizations will normally make a comparison of financials with one quarter of a financial year with the same quarter of previous year only. The logic behind that is a comparison of financials will be done accurately.

8. To disclose Information

What information is required to disclose to stakeholders?

Whether the Patent’s right information about a Drug?

No..!!

Financial information only but not to all the persons. To understand the same in detail, read the complete article.

9. For Assessment of Tax Liability

Based on prepared financials, an auditor will give an opinion on the financial statements of the business. Such an opinion will be called as a “Audit Report”. The tax officials will normally assess the tax liability of an organization and assess the amount of tax payable and arrive the actual tax paid by the entity based on audit report only.

In case of difference, the tax official will initially seek the auditor for clarification. If the auditor’s reply is satisfied, then no demand will be raised. Otherwise, the officials will raise a demand notice on the business for further action.

10. For Decision Making

Based on financials, an owner of the business will make a decision like

- For the expansion of business,

- Replacement of Asset,

- To discontinue any product / Line of activity,

- To sell off any old machine etc.,

- For dividend declaration to Shareholders

To whom financials are beneficial

Financial information is normally provided through Financial Statements (FS). As the main objective of the Accounting is to provide Financial Information to the various persons who are engaged with the organization. Financials will be seen by different people in a different manner. Those persons are:

- Lenders – To assess the Repayment capacity of Loan including Principal & Interest.

- Employees – To know the Profitability of the organization.

- Government – Compliance with legal requirements.

- Competitors – Performance of business.

- Owners – To know Profit or Loss, Reduction in expenses & Increase in Income

- Debtors (Customers) – Growth of the business.

If the Objectives not followed

In case, Profit understated (or)

Loss overstated (or)

Even though number of employees of the business exceed 20, doesn’t apply for PF Registration (or)

Wrong computation of Cost of Machinery which is not as per As-10 (or)

Bank loan is not shown in Balance sheet

All the above transactions which are done either intentionally or unintentionally will impact on True & Fair view of accounts which leads to non-compliance with the Objectives of accounting.

If the objectives of the accounting are not followed and books of accounts are not prepared as per the required rules and regulations, the auditor has a right to inform to the management by providing a qualified opinion.

In case an auditor gives a qualified opinion, it means the Financials are not prepared by the management as per the rules. Then, shareholders won’t invest in such business which leads to winding-up of the business.

Benefits to Employees

Most of the employees worried about their ESI & PF share which will be deducted from their salaries. And also whether Employer’s share shall also paid by the management. An enterprise that follows the rules and regulations will deposit your PF & ESI by 15th of every month which is beneficial for timely payment of salaries.

So the employees will also get benefited from timely payments of Salaries, Wages, Bonuses etc.

Benefits to Management

Understanding the financials of a business helps the management in many ways. It includes

- To ascertain the overall profitability of the business. If the business is into multi-product or multi-service operations, it would enable them to understand the product/service specific profitability also.

- Comparison of the actuals with the standards become easy to ensure that the actual results are well within the defined budgets

- To assess the unit performance with the industry performance, to understand the scope for improvement in the various aspects of the business

- Assists in effective decision-making process

- To understand the financial strengths & Weaknesses of the business

FAQ

- Whether Expenses include Outstanding expenses also?

Yes. While tracking of expenses, Outstanding expenses shall also be recorded like Outstanding Salaries, Arrears etc. - Whether Incomes includes Accrued Incomes also?

Yes. While tracking of incomes, Accrued incomes shall also be recorded like Accrued Rent.

As per the above objectives, it is evident that a businessman can never be negligent on the financials of the enterprise simply by saying “I don’t understand financials”. It is the obligation of every businessman to understand the basic objectives of accounting and follow the regulations accordingly. Then only the business will flourish in the long run.

Don’t be the Rule Breaker

Happy Winning 🙂

Please COMMENT which of the above topic you “LIKE”. Also, SHARE the article to your Friends & Family.

Thanks for Reading..!!!

Disclaimer: Every effort has been made to avoid errors or omissions in this material. In spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition. In no event the author or the website shall be liable for any direct, indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information.

Author: ACMA Sravan Kumar R

1 thought on “Top 10 Objectives of Financial Accounting”