How to Identify Capital expenditure

A startup is a trending business in India in 2020. In India, there are many successful startups like Swiggy, Paytm, Ola, Myntra & Flipkart, etc., and the list goes on. But not all startups have the same success. As per the study, 90 percent of the startups in India fail due to a lack of funds within 5 years.

There are many factors that contribute to the success of a business. But the main factor that every CEO of the startup/venture shall understand is the financial needs of the business. Many entrepreneurs fail to maintain a record of inflow and outflow of money in the form of income & expenditure which leads to cash crunch.

Coming to the expenditure perspective, one should understand and able to differentiate what is Revenue expenditure and what is Capital expenditure. Such careful differentiation helps the businesses to identify the essential and wasteful expenditure, thereby to improve the liquidity in the business.

In this article, we are going to discuss on the topic “How to identify Capital expenditure”.

Page Contents

- What is Capital Expenditure

- Rules for Capital expenditure in the accounting

- Who has to identify Capital Expenditure

- Purpose of Identification of Capital Expenditure

- Accounting for Capital expenditure

- Amount limit for CAPEX

- Capitalization as per AS-10

- Capital Expenditure Examples

- Disclosure in Financial statements (P&L and Balance Sheet)

- Capex in Cash flow statement (CFS)

- Depreciation Computation

- Wrong treatment of Capital expenditure as Revenue expenditure

- Whether Replacement also Capex

- GST Impact

- Capital Expenditure of Government

- Capital Expenditure in Railways

- Tax benefits for Salaried employees

- FAQ’S

1. What is Capital Expenditure?

In simple terms, Capital expenditure means money spent by an organization for the Acquisition of newly purchased assets or extending the useful life of the asset. The benefit of expense must be for a period of > 1 accounting period.

Then, what is Capex ? Is there any difference between Capital expenditure and Capex. No, both are the same only.

Capital expenditure is commonly known as “Capital expense” or “CAPEX“.

To understand in brief about the Capital expenditure, you should learn the rules.

2. Rules for Capital expenditure in accounting

To classify the expenditure as Capital expenditure, any of the following rules are to be satisfied.

Any amount

- Which is spent for the purpose of acquiring Long term Asset (i.e. whose Usefulness or Useful Life is at least > 1 Accounting period)

- for Use in the business

- to Earn Profits &

- Not meant for re-sale

Eg:

- Purchase of Land.

- Acquisition of Industrial Plant & Machinery.

- Purchase of Car for Manager.

- Construction of Buildings, Roads, Flyovers, Dams etc.,

[Or]

Any amount which is incurred for the purpose of acquiring services like Copy rights, Trade marks, Licensing & Software etc.,

[Or]

Any expenditure which is incurred for the improvement of assets also considered as a “Capital expenditure”.

For instance, A commercial complex has 5 floors. The owner of the building plans to build 1 more floor. The construction of Building of 1 more floor is an improvement of assets. Therefore, it shall be treated as a Capital Expenditure.

[Or]

Any expenditure which Increases the earning capacity or Useful life for the business.

For example, M/s Alpha ltd acquired a building of Rs.10,00,000 in 2000 having a useful life of 20 years. In the year 2020, Rs.5,00,000 was incurred towards major Repair charges for the building . Due to which the life of the building increased by 5 more years. Therefore, Rs.5,00,000 shall be treated as a Capital Expenditure.

The salaried person or business person, who shall identify the Capital expenditure? Is identification of expenditure is necessary or not.

3. Who has to identify Capital Expenditure (i.e. Salaried or Business People?)

Capital expenditure is to be identified by the following persons only. i.e.

- Sole Proprietors,

- Partners,

- Association of Persons (AOP),

- Society,

- Companies etc.,

whether the motive of the business is either profit oriented or not.

In case of Individuals i.e Salaried are not required or not mandatory to identify the Capital expenditure. But there are some tax benefits are available in case of specific assets for the salaried. Read the complete article to know about this.

Also one should know which items in P&L and Balance sheet gets affected or changed due to capital expenditure.

4. Why Capital Expenditure is to be identified

Capital expenditure is to be identified due to it’s financial impact. That means, the effect of the expenditure in the Statement of Profit and Loss account and Balance sheet.

Capital expenditure has no impact on profit of the organization either directly or indirectly. But it has two impacts in Balance Sheet.

- The Value of the Asset will be increased &

- Bank balance will be decreased due to payment to the supplier.

From the above it is clear that there is an impact only on the Balance sheet items of Asset and Bank balance. Since the asset value is increased and Bank balance will be decreased. So Balance sheet Tallies. Here the asset may either be Tangible assets or Intangible assets. But the impact is same.

Note: Capital Expenditure has no impact on profit in the Statement of Profit and Loss account (i.e P&L A/c).

5. How to record Capital expenditure in the books

Due to Capital expenditure a new asset is either purchased or the life of the asset or future benefit will be increased. Hence, the expenditure incurred should be added to the cost of the asset. It is called as “Capitalization.”

Now, its Entry time. i.e Accounting for Capital expenditure.

While preparing the books of accounts, the accounting treatment for Capital expenditure is as follows as per the Golden rules of Accounting.

Also Read:

| Particulars | Type of Account |

| Capital Expenditure (or) Asset A/c Dr | [Real Account] |

| To Bank A/c | [Real Account] |

Now, one should understand the proper impact of the above entry in the financial Statement.

- X Ltd purchased Plant & Machinery of Rs.10,00,000

| Particulars | Dr (Rs.) | Cr (Rs.) |

| Plant & Machinery A/c | 10,00,000 | |

| To Bank A/c | 10,00,000 |

As the amount is huge, the above purchase of asset is a Capital expenditure.

No..!!!

6. Amount limit for CAPEX:

M/s Aaron enterprises incurred Rs.12,00,000 for Safety and Security of the building to Manpower supplier contractor. It is revenue expenditure only.

Why? Here, even though the amount of expenditure is huge. These charges dont increase the life of the building due to safety and security charges. Therefore, It is a Revenue expenditure only.

Is there any amount limit to classify it as a Capital expenditure?

No..!! There is no amount limit to specifically call it as Capital expenditure. Based on the above rules only, we shall decide. Normally, people feel that if the amount of expenditure is huge it is capital expenditure. Whether the amount is huge or not depends on the organization financial structure. It is different from case to case. It is case specific only.

Look at the another example. Rs.15,000 incurred for Transportation charges for bringing the Machinery from Hyderabad City to Factory located at remote area. It is a Capital expenditure. Even though the amount of expenditure is small, it satisfies the rule of capex and also as per AS-10.

7. Capitalization as per AS-10

Which items are to be capitalized as per As 10 ? For that, firstly you should understand what is Cost as per AS-10.

As per AS-10 Property Plant and Equipment issued by Institute of Chartered Accountants of India (ICAI), the Cost includes

- Purchase price,

- Import duties,

- Non refundable purchase taxes and

- any costs directly attributable to bringing the asset the present location and condition.

Examples of Directly attributable cost include:

- Cost of Site preparation

- Initial delivery and Handling costs

- Installation and assembly costs etc.,

As Accounting Standard-10 deals with Property, Plant and Equipment. It means whenever any item of expenditure incurred related to Property, Plant and Equipment, then respective provisions of AS-10 will apply. Therefore, while capitalizing the expenditure one should also comply with the respective accounting standards.

8. Capital Expenditure Examples

Let’s discuss the below Capital Expenditure examples for better understanding of, How to Identify Capital Expenditure.

Example # 1

- M/s Visakha Ltd, Andhra Pradesh purchased an Equipment of Rs.5,00,00 within state for production purpose having a useful life of 10 years. GST @18% is applicable.

Firstly, Purchase of equipment is of acquiring Long term Asset. The equipment has a useful life of 5 years. It means the Equipment has useful life of more than 1 accounting period and using for the purpose of business and to earn profit by using it for production purpose and not meant for resale.

As it satisfies all the conditions, so it is a Capital expenditure. The Journal entry for the transaction is as follows.

Journal Entry:

| Particulars | Dr (Rs.) | Cr (Rs.) |

| Equipment a/c Dr | 5,00,000 | |

| Input CGST a/c Dr | 45,000 | |

| Input SGST a/c Dr | 45,000 | |

| To SBI Bank a/c | 5,90,000 | |

| (Being Equipment of Rs.5,00,000 purchased with GST @18% within state.) |

Example # 2

- M/s Speed ltd is a Second hand cars show room Purchased a BMW car of Rs.15,00,000 from outside the state for re-sale purpose having useful life of 10 years. GST applicable @18%

It is not a Capital expenditure.

Firstly, Purchase of a BMW Car by M/s Speed Ltd is an expenditure which is not incurred for the purpose of acquiring Long term Asset as it bought only for re-sale purpose and not for the production purpose. Even though it has useful life of 10 years and to earn the profit but it is not a Capital expenditure as it is not satisfied all the above conditions. Therefore, It is a Revenue expenditure.

The journal entry for the above transaction is as follows.

Journal Entry:

| Particulars | Dr (Rs.) | Cr (Rs.) |

| Purchases a/c Dr | 15,00,000 | |

| Input IGST a/c Dr | 2,70,000 | |

| To SBI Bank a/c | 17,70,00 | |

| (Being Second hand car purchased of Rs.15,00,000 from outside state.) |

9. Disclosure in Financial Statements

In Profit &Loss a/c:

No direct impact on Profit and Loss a/c.

In Balance Sheet:

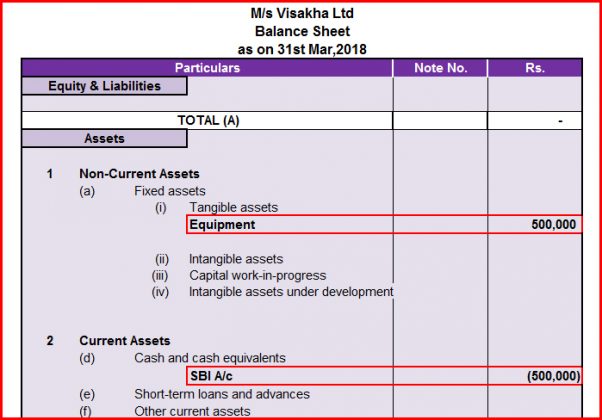

As mentioned in the Point no.4 of the above as per Example #1, the value of “Equipment” i.e Asset will be increased by Rs.5,00,000 is shown in Balance sheet under Non-Current assets— > Tangible assets —> Equipment.

Whereas, the value of “SBI A/c” i.e. Bank balance is decreased by Rs.5,00,000 is shown in Balance sheet under Current assets —> Cash and Cash Equivalents assets —> SBI A/c. It is shown as Negative balance only due to purchase, the bank balance will be reduced.

The The impact of Capital expenditure in Balance sheet will be as follows:

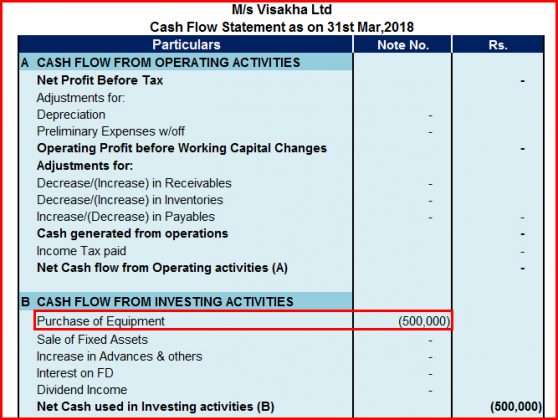

10. Capex in Cash flow statement (CFS)

Acquisition or Improvement of an asset shall be shown under “Investing activity” in Cash flow statement as per AS-3 Cash Flow Statements (Screen Shot). As per the above Example # 1, Purchase of equipment will be shown under “Investing activity” as a negative balance.

Why it has to show as a negative balance ?

Logic: Due to purchase of Equipment there is an outflow of cash. Outflow of cash means it is an expenditure. Therefore, Purchase of equipment is to be show as a negative balance only.

11. Depreciation Computation

As per the GST provisions, an enterprise can claim either Depreciation or Input tax credit (ITC) on the value of asset purchased. Both Depreciation & ITC cannot be claimed. Coming to the computation of Depreciation there are 2 cases.

Case 1: When Depreciation can be claimed?

As per the GST provisions, If the enterprise is not claiming ITC then Depreciation can be computed on the total value of the asset purchased including the Input GST part. As per Example #1, in case of M/s Visakha Ltd bought the equipment of Rs.5,00,000 which is the value of the asset excluding the Input GST of Rs.90,000 (i.e. Input CGST Rs.45,000 + Input SGST Rs.45,000). Therefore, M/s Visakha Ltd can claim depreciation on the total value of asset i.e., Rs.5,90,000.

Case 2: When depreciation cannot be claimed ?

An enterprise cannot claim the Depreciation when it takes ITC. As per Example #1, in case of M/s Visakha Ltd which bought the equipment of Rs.5,00,000 which is the value of the asset excluding the Input GST of Rs.90,000 (i.e. Input CGST Rs.45,000 + Input SGST Rs.45,000). Therefore, M/s Visakha Ltd can claim depreciation only on the value of Rs.5,00,000 only.

12. Wrong treatment of Capital expenditure

In case the Capital expenditure is wrongly treated as Revenue expenditure, it means instead of increasing the asset value the amount has been charged / debited to Profit and Loss account. In such a case, the first impact will be on Profit i.e. Reduction of profit.

Due to Wrong identification of the expenditure, the following are the implications:

- Non Creation of Asset in Balance Sheet.

- Profit reduction.

- Financial Statements (FS) doesn’t show a True & Fair view.

- Financials doesn’t attract investors.

- Ultimately, Reduction in Capital flow to the business.

13. Whether Replacement also Capex

Case 1: Replacement of Similar asset

When an existing asset is replaced with same capacity & features such expense is to be treated as Revenue expenditure. For example, An old typing machine of Rs.10,000 is replaced with new one with same features is a “Revenue expenditure”

Case 2: Replacement with Superior asset

When an existing asset is replaced with superior capacity, then, such expense is to be treated as Capital expenditure. For example, A manual mask manufacturing machine manufactures 1,000 masks per day of Rs.1,00,000 is replaced with an automated machine of Rs.5,00,000. The existing machine cost of Rs.1,00,000 is to be charged to treated as “Revenue expenditure” and the difference value of Rs.4,00,000 is to be treated as “Capital expenditure” i.e to be Capitalized.

14. GST Impact

Who can avail ITC on Capital Goods:

As per the GST provisions, only registered persons are eligible to take Input tax credit (ITC) on Capital goods.

It means, a person who is registered as a dealer under GST only eligible to claim Input tax credit (ITC). Whereas, Unregistered dealers and Composite dealers are not eligible to take Input tax credit (ITC) on Capital goods.

How much:

100% Input tax credit can be availed by the Purchaser in case the receiver is registered dealer. In such a case, the supplies received shall be normal taxable supplies. Then, GST paid on purchase of item can be taken as Input tax credit.

Purpose:

Input tax Credit (ITC) on Capital goods can be claimed only for business purpose and not for Personal purpose. And also ITC is not allowed in case of Exempted supplies or Supplies for which ITC specifically not available.

Example # 3 Purchased for Business

M/s Bio Tech limited, Delhi is a registered dealer of GST. It purchased a Medicine manufacturing Machinery and paid GST on it. Therefore, M/s Bio Tech limited is eligible to take Input tax credit (ITC) on Medicine Machinery as it is a Capital good.

Example # 4 Purchased for Business but..!!

Mr.Balu purchased a Silo for storage of the Milk for his business at Kakinada. Silo is being used to store the milk in a bulk container and for longer period. Since he is supplying Milk, GST is exempted. So, he cannot claim any GST on the Silo purchased.

Example # 5 Purchased for Personal

Mrs.Priya, a Steel plant employee purchased a Washing Machine of Rs.20,000 plus GST of 3,600. She bought it purely for personal purpose. That means she has not bought it for business purpose. Mrs. Priya is not eligible to claim ITC on GST amount of Rs.3,600.

15. Capital Expenditure in Government

In case of Government, the expenditure is classified in to 2 types.

1. Acquisition or Creation of assets i.e. “Capital expenditure”

2. the other which is not either creation or acquisition of assets i.e. operational expenses which is a “Revenue expenditure”.

The Union government normally announces the budget every year on the first day of the February mainly categorized into two parts. 1. Capital a/c and 2. Revenue a/c.

Capital account contains both Capital receipts & Capital expenditure. It is non-recurring in nature. Similarly, Revenue account contains both Revenue receipts & Revenue expenditure. It is recurring nature.

16. Capital Expenditure in Railways

In case of Indian Railways, the capital expenditure is like

- Purchase /Set up of Train or

- Set up a large solar power facility on railway land new lines,

- Gauge conversion,

- Track formation,

- Additional tracks,

- Bridges, Wagons etc.,

In the financial year 2017-18, the Capex on Contract and Utilities etc amounted to Rs.6,703 Crores as compared to Rs.5,488 Crore in the financial year 2016-17.

(Source: As per Indian Railways Annual Report)

17. Tax benefits for Salaried employees:

In case of an Individual, purchased a house for the first time only can avail the tax benefits. It is as per Section 80EEA of Income tax Act,1961. As per the said section a deduction for interest payment is available upto Rs.1,50,000 only. But the condition is only when the owner or his family resides in the house property by taking the housing loan.

18. FAQ’s

- I bought a Fridge or any other home appliance for domestic purpose, Can claim deduction under Sec 80EEA of Income tax Act.

No. An individual can claim deduction under Section 80EEA of the Income tax only in case of House property only not in others.

- Whether construction of Rs.1 Cr building also Capitalization.

Yes. Not only the acquisition but also construction comes under Capitalization.

Thanks for reading the topic “How to identify Capital expenditure” 🙂

Please comment your E-mail ID to get the PDF in your inbox. Also, share this article to your Friends & Family.

Author: ACMA Sravan Kumar