Book Keeping and Accounting: In Accounting, most people use the terms of both bookkeeping and accounting interchangeably. But there are some differences you should observe between the two.

In this article, “8 Top Differences between Bookkeeping and Accounting” will try to clarify the distinction between Bookkeeping and Accounting.

So let’s read till the end to gain complete knowledge about Bookkeeping Vs Accounting.

Let’s get started..!!

Book Keeping and Accounting

Firstly, we will understand about the concept of Bookkeeping.

Book Keeping

Book Keeping is an

- “Art of recording

- business transactions

- in a Set of books“

Book Keeping is

- A set of Primary records.

- It is a routine & repetitive work,

- Continuous activity

- and also a Basis for accounting.

It means, all the business transactions shall be recorded firstly through Bookkeeping only. i.e. Purchase transactions, Sales transactions, Cash expenses, etc. For that, a person will be held responsible to record all these transactions in the books of accounts. The person who maintains all such records will be called a “Bookkeeper”.

A bookkeeper will be responsible for keeping all business records or only a limited segment like Maintaining the creditor’s position of the departmental store.

The bookkeeping work is done manually by maintaining a proper set of books till computerization. But nowadays, it is taken over by the computers using different accounting software.

I hope you are clear about what is book keeping.

Then, let me clarify, which transactions are to be recorded in the books of accounts?

A 35-year-old Husband bought jewelry of Rs.50,000 for his wife Geetha..?

A Father paid Tuition fees of Rs.10,000 to his son…?

Shall I record these transactions in the books of accounts?

Wait wait…!!

As per the Accounting norms,

- Only business transactions expressed in terms of money & also

- Transactions have a Transfer of economic value from one person to another.

Those transactions are only recorded in the books of accounts.

The above 2 transactions are even though made in terms of money but they are of personal nature. While recording the transactions in the books of accounts, only business transactions are to be recorded. Read the below example to better understand this topic of bookkeeping and accounting.

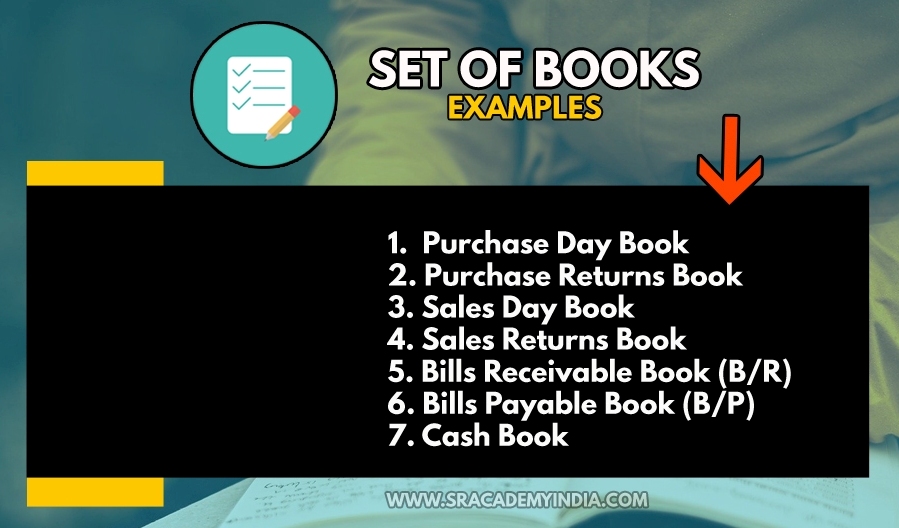

Examples of Book Keeping:

- Mrs.Lakshmi purchased goods of Rs.10,000/- for business from Mr. Chinna and paid in cash.

1st Impact:

Here, the goods purchased is a business transaction and it is to be recorded in a Purchase Day Book and

2nd Impact:

Mrs.Lakshmi paid the amount in Cash of Rs.10,000/- which is to be recorded in the Cashbook.

The above transaction is in terms of money and is a business transaction that includes the transfer of economic value (I.e. either Money or Money’ worth) from one person to another.

What kind of benefits we can get if we maintain proper bookkeeping?

Is bookkeeping is required?

Yes…!!!

Why?

The main idea behind maintaining book-keeping is

- To show the correct position regarding each head of Income & Expenditure.

For example, A departmental store in Visakhapatnam may purchase goods on credit as well as on a cash basis. When the goods are bought from the supplier Mr. Suryam on credit, a record must be maintained with regard to the person to whom money is owed. It means we shall maintain Mr. Suryam’s record (i.e. a Creditors a/c) in the books of a department store.

The Proprietor of the business Mr. Reddy may like to Know, from time to time, What amount is due on credit purchases & to Whom (like Mr.Suryam a/c & other creditors).

If the Proper record is not maintained by the departmental store, it is not possible to get details of the transactions with regard to expenses.

At the end of the accounting period, Mr. Reddy, the proprietor wants to know how much profit has earned or loss been incurred during the course of the period i.e., either for a month, quarter or year.

To know all these, a lot of information is needed which can be gathered from the proper record of transactions.

Therefore, in book-keeping, for proper maintenance of books of a/c’s is important & crucial for any business.

Is there any Legal implication in bookkeeping?

Yes..!!

Case 1: In case of

– Sole proprietorship &

– Partnership business

- No Specific legislation regarding maintenance of books of a/c’s & preparation of Financial Statements.

Case 2: In the case of Company

Maintenance of Book-Keeping & preparation of Financial Statements is guided by

- Companies Act,

- Banks & Insurance Companies etc.,

I hope you understand about bookkeeping. So now look at the Accounting.

Financial Accounting:

Accounting is a broader subject as compared to bookkeeping. From the transactions recorded in Book-Keeping, we can able to analyze & interpret the information.

Let’s understand about the Financial Accounting

Financial Accounting is an

- Art of Recording,

- Classifying and

- Summarizing the business transactions

- In a significant manner and

- In terms of money

- the transactions and events

- Which are in part

- At least of the financial character &

- Interpreting the results there of.

What did you understand from the above..!!

For me, I didn’t understand anything from the above definition.

Yes, You are correct.

So let me brief you, my dear learners..!!

Also Read: Top 10 Objectives of Financial Accounting

Identifying & Recording:

The first step in the process of accounting is

- to identify the transactions which will find their place in the books of accounts &

- the transactions having financial impact only to be recorded.

Not all transactions will find a place in the books of accounts. Only business transactions and the transactions which are dealing with money or money’s worth will be recorded.

- If Mr. Rahul agrees to sell goods to Mr.X for Rs.1,00,000, It is just an agreement. So it will not be recorded. It is not a transaction.

Reason: It is just an agreement between Mr.Rahul & Mr.X to sell the goods. There is no transfer of goods from Mr.Rahul and Mr.X has not paid any money on this transaction. When Ms.deepa enter into an agreement for the

supply of goodsfor consideration of Rs.2 Crores and supplied to the customer Ms.Revati.

Reason: It is a business transaction and has a financial impact. So, it is a transaction

Recording is one of the primary functions of accounting. As all business transactions which are of financial character should be supported by basic documents or source documents like

- Purchase Invoice or bill

- Sale bill or invoice

- Bank statement

- Electricity bill etc.,

These transactions shall be recorded in the books of accounts in a book called a “Journal“

Classifying:

After the recording of transactions & events, these shall be transferred to subsidiary books i.e., a “Ledger“.

In the ledger, transactions & events are classified into

- Income

- Expenditure

- Assets

- Liabilities

Also Read: Failed in CA.. Don’t Worry

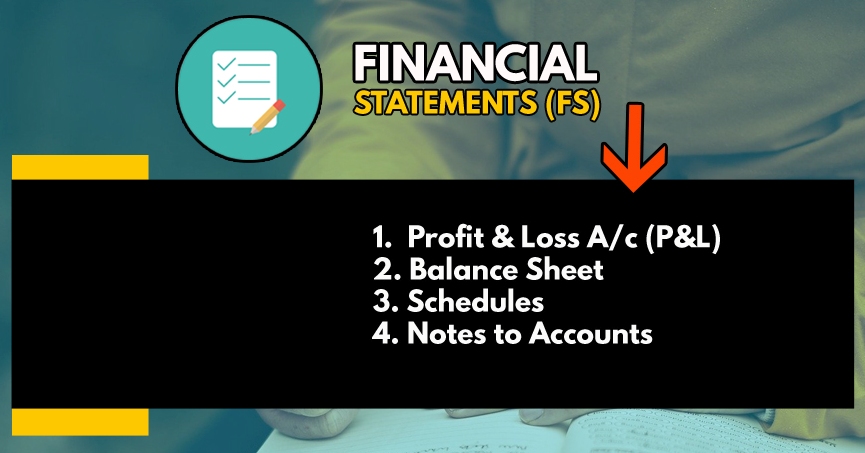

Summarizing:

It includes the preparation of

- Trial Balance [TB]

- Profit and Loss account [PL]

- Balance sheet [BS]

- Cash flow statement [CFS]

- Notes to account

Interpretation:

It is the final function of accounting. In this, the data which has been recorded through Journals, ledgers, etc will be interpreted.

Eg:

If a businessman wants to know total sales during the year (or)

To know whether sales are increased or decreased as compared to previous year etc.,

Now check the Top 8 differences between bookkeeping and accounting

BOOKKEEPING AND ACCOUNTING : 8 Top Differences between Book Keeping & Financial Accounting are as follows:

|

S.No. |

Basis |

Book Keeping |

Financial Accounting |

|

1 |

Meaning | Bookkeeping is a process of Identifying and recording financial transactions. | Financial accounting is the process of classifying, Summarizing, and interpretation of financial transactions. |

|

2 |

Phase |

It is a recording Phase. | It is an accounting Phase that includes summarizing. |

|

3 |

Financial Statements | It doesn’t form part of it. | Financial Statements are prepared on the basis of book-keeping records. |

|

4 |

Management decision | Management decisions can’t be taken with the help of records maintained in Book Keeping. |

Management decisions can take decisions on the basis of these records. |

|

5 |

Financial position | One can’t ascertain the financial position of the business using Book Keeping. |

Financial Position can be ascertained using accounting reports. |

|

6 |

Sub fields | Subfields | There are no sub-fields in bookkeeping. |

|

7 |

Skills | It has sub-fields like – Financial Accounting– Cost accounting – Management accounting etc., |

Accounting requires special skills to prepare, maintain and finalize the books of accounts. |

|

8 |

Interpretation | Bookkeeping does not have an interpretation part. |

Accounting has an interpretation part. |

Please do Share if you like this article, “8 Top Difference between bookkeeping and accounting” . Also, give your valuable Feedback/Suggestions to improve the content in comments. Hit “Like” if you liked the article

Thank you for reading 🙂

Disclaimer: Every effort has been made to avoid errors or omissions in this material. In spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition. In no event the author or the website shall be liable for any direct, indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information.

1 thought on “8 Top Differences between Bookkeeping and Accounting”