Are you appearing for a job Interview for the position of Accounts Payable?

If Yes, we have provided a few of the questions you might encounter during job interviews.

In this article, we delve into some common “Top 17 Accounts Payable questions for Interview” that are often asked by interviewers during Job interviews.

I hereby confirm you that the Answers to the questions in this article are not one-liners. The answers may be long to understand the concept clearly.

We are quite sure that these “Top 17 Accounts Payable Questions for Interview” will definitely boost your confidence to face the interview.

Let’s get started, my dear folks..!

1. What do you understand by Account Payable? Explain it with an example

When a business has purchased goods from suppliers or received any services from the Service providers, then, the buyer of the goods/ the receiver of the service will be under an obligation to pay the Supplier / for the Service provider.

Simply, the Buyer of the goods / Service recipient will be under an obligation to make payment to suppliers. From the viewpoint of the buyer, it is an Outstanding amount, therefore it is Payable only. The cumulative of all these kinds of payables to different suppliers by the Buyer will be called “Accounts Payable”

Example

Suppose, M/s Amritha Farms Pvt Limited purchased Honey bottles worth Rs.10 Lakhs from the farmers on a Credit basis. Here, M/s Amritha Farms Pvt Limited is a Buyer and the Farmers are Suppliers of Honey. As M/s Amritha Farms Pvt Limited (i.e. Buyer) bought honey, they are under an obligation to pay Rs.10 Lakhs to the Farmers (i.e.Suppliers).

Also, M/s Amritha Fams Pvt Limited purchased Packing Jars worth Rs.50,000/- from Krshina Supplies on a Credit basis. In this case, M/s Amritha Fams Pvt Limited is a Buyer and Krishna Supplies is the Supplier / Seller of the Jars.

The cumulative of all these suppliers ( Farmers + Krishna Suppliers etc.) will be called “Accounts Payable” in the books of M/s Amritha Fams Pvt Limited.

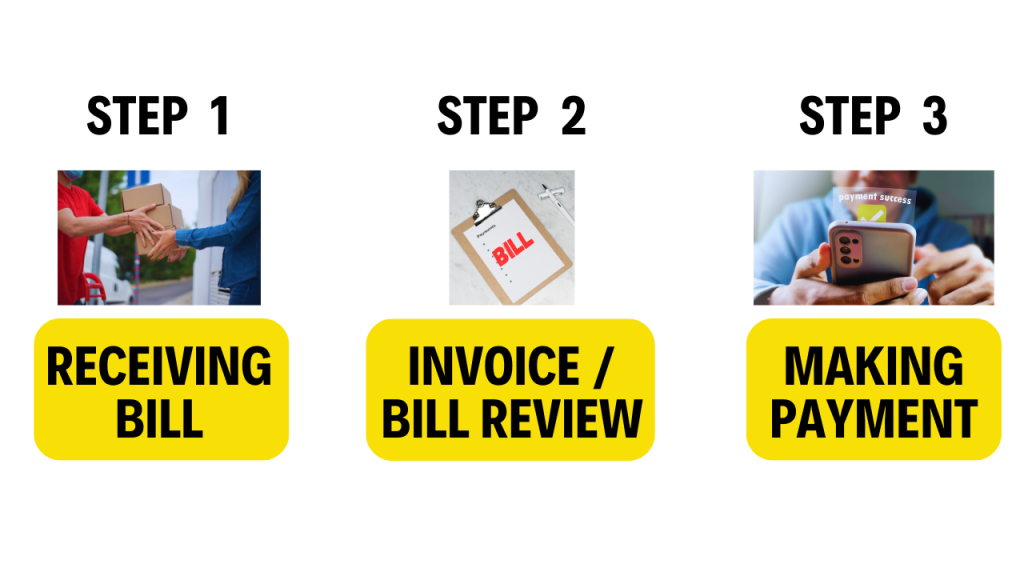

2. What Is the Accounts Payable Process?

A business needs Raw Materials. Those raw Materials will be supplied by the Suppliers.

Receiving Bill:

Whenever the seller of the goods supplies to the buyer, it will b along with be supplied along with the Sales Invoice.

The Sales Invoice is an Original document that contains information of – the Purchase order Number (PO),

– Invoice number / Invoice ID,

– Invoice Date, Quantity supplied,

– Rate, Amount,

– GST,

– Discounts if any,

– Net Amount Payable, Supply Instructions, Terms and Conditions, etc.,

Invoice / Bill Review:

Once goods are supplied, the Buyer will receive it.

After receipt of goods, the Invoice will be reviewed and will prepare Goods Receipt Note (GRN) by the Store department based on the Purchase Order (PO).

The GRN is a document that acknowledges the delivery of goods to a customer by a supplier. A GRN is a record of confirmation that the goods has received by the buyer.

The Store’s department will confirm the Quantity of Material received, the Condition of the goods, and supplied Vendor details, etc.

Then, the Stores department will inform about the receipt and accuracy of supplied goods as per the PO to the Purchase departments and the same will be approved by it after due cross-check on their part.

Making Payment:

Once the Purchase department approves the Invoice, then, the Accounts department will check the authorizations of the Purchase and also will verify that the Store department made entry into the Stores by checking the Store Entry stamp on the back side of the invoice and will finally complete the payment to the supplier as per the terms of Purchase Order (PO).

3. What are the documents required to verify an Invoice?

To verify an Invoice, one should check the 2 reports

1. Goods Received Note (GRN) from Stores dept

2. Approved Purchase Order

4. What is a Purchase order and When it will be issued?

A purchase Order is an official and commercial source document that will be issued by the Buyer to the Seller for placing an order to supply the goods.

A Purchase order (PO) mentions the details of items to be supplied by the vendor. It contains the details of the Item Name, Vendor details, Rate, Quantity to be supplied, UOM, Amount and Credit terms, and other conditions of supply.

After the issue of the Purchase Order (PO), only the supplier makes arrangements to supply the goods to the buyer.

The format of Purchase order is as follows

5. Purchase Order vs Invoice: What’s the Difference?

Purchase Order (PO) is an order issued by the Buyer & it is the obligation of the supplier to supply the goods.

Whereas, the Invoice is issued by the Vendor / Seller of the goods as per the PO terms & the Payment will be made by the buyer after due satisfaction of the supplied goods.

6. What do you understand by a Non-PO Invoice?

Non-PO Invoice is nothing but It is an Invoice without any Purchase Order.

Generally, we will order the goods based on the Purchase Orders (POs) but in the case of Non-PO Invoices, no PO will be raised.

Non-PO Invoices will be used for any indirect purchases/services made by the buyer with low value and non-repetitive nature of expenses.

Suppose, Hotel room expenses worth Rs.8,500/- are provided to the Cost auditors for the Cost audit purpose by a Company.

As the above expenditure is a non-repetitive nature and indirect expense, no PO is required to be issued.

Also Read: 18 Must read Accounting Basics Interview questions

7. What is a Cash discount?

A cash discount is a “Discount which will be given by the Dealer to its Customer for the recovery of Bad debts”.

In other terms, a Cash discount can also be defined as a discount that is allowed to encourage prompt payment to clear the customer’s outstanding immediately.

8. What is a Trade discount?

Trade Discount is a “Discount which will be allowed by the Wholesaler or Manufacturer to the Retailer for bulk quantities on a fixed percentage basis”.

The Trade discount will be allowed against a certain quantity of material or on the total Invoice value. The discount computation will be done based on the Invoice Price or List price and Sales will be done on the basis of the Net price. i.e. List price less Trade discount.

9. What do you understand by an Early Payment Discount?

Suppose a Feed Supplier supplied Rs.1,00,000/- worth of Feed Material to M/s Godavari Feeds.

The Invoice date is 01st January. The Credit period allowed by the supplier is 30 Days. i.e. 31st January is the Final due date to make payment.

Early payment discount terms – 5% Discount if the payment is completed within 15 days from the Invoice date.

Here, M/s Godavari Feeds is a Buyer. Its actual liability on feed materials is Rs.1,00,000/-. But as per the Early payment discount terms, the customer receives a discount of 5% if M/s Godavari Feeds clears the payments within 15 days of the Invoice date. i.e. before 16th January

In such a case, the buyer i.e. M/s Godavari Feeds can save Rs.5,000 and will pay the balance amount of Rs.95,000/- to the supplier instead of the Orginal bill amount of Rs.1,00,000/-

Simply, Earlier Payment discounts are Sales discounts that will be offered by the seller on the Total Invoice amount if the buyer pays the Invoice amount within the discounted period.

10. What is the Journal entry for Accounts Payable?

When the business Purchases goods / Merchandise, then the Journal entry in the books of the Buyer will be as follows:

| Particulars | Debit / Credit | Logic |

|---|---|---|

| Purchases a/c Dr | Debit | Increase in Inventory / Purchases |

| To Accounts Payable a/c | Credit | Increase in Liability |

Also read: Golden rules of an Accounting – An easy understanding

11. What is the Journal Entry for Returning Damaged Goods?

In case the received goods are not in satisfactory condition to the buyer, he/she may return them to the supplier. Then the Journal entry will be as follows.

| Particulars | Debit / Credit | Logic |

|---|---|---|

| Accounts Payable a/c Dr | Debit | Decrease in Accounts Payable |

| To Purchase Returns a/c | Credit | Decrease in Purchases |

12. What is the Journal entry for the Purchase of Assets?

When the business Purchases assets on Credit, say, Plant, Equipment, Machinery, Furniture, Tools etc., then the Journal entry in the books of the Buyer will be as follows:

| Particulars | Debit / Credit | Logic |

|---|---|---|

| Asset a/c Dr | Debit | Increase in Assets |

| To Accounts Payable a/c | Credit | Increase in Liability |

13. What is the Journal entry for the Services rendered on Credit?

When the business received any services on Credit, say, Audit Fees, Technical Consultation Fees, Legal Charges, etc., then the Journal entry in the books of the Service receiver / Buyer will be as follows:

Particulars | Debit / Credit | Logic |

|---|---|---|

| Expenses a/c Dr | Debit | Increase in Expenses |

| To Accounts Payable a/c | Credit | Increase in Liability |

14. What is the Payment entry for Accounts Payable ?

When the due date is clear the Purchased goods happens, you should clear the payment on goods / assets purchased and services received will be as follows.

| Particulars | Debit / Credit | Logic |

|---|---|---|

| Accounts Payable a/c Dr | Debit | Decrease in Accounts Payable |

| To Cash / Bank a/c | Credit | Decrease in Asset |

Also Read: B Com Interview Question & Answers [For Freshers]

15. Accounts Payable Asset or Liability?

It should be decided from the viewpoint of the buyer. As the buyer buys the goods from the supplier and the buyer will be obligated to pay the supplier. It is a Liability from the buyer’s point of view.

Therefore, Accounts Payable is a “Liability”.

16. An Accounts Payable ledger account would normally have a Debit or Credit balance?

As the Accounts Payable is a Liability, it should have a “Credit Balance” only.

17. Accounts Payable on a Balance Sheet?

Accounts Payable include Short term debt which is owed to the Supplier by the Buyer. Therefore, It will appear on the Liabilities sider under the “Current Liability” in the Balance Sheet.

Thanks for reading 🙂