Budget 2023 has made numerous changes in the New Income Tax Regime which will be effective from FY 2023-24 i.e. from 1.4.2023.

In this article, let’s understand about these changes in detail. Instead, if you want to know completely about the New Tax Regime (after incorporating the changes in Budget 2023), you may pls refer here for full article: All about New Income Tax Regime (as per Budget 2023)

Here is the list of changes:

- AOP, BOI and AJP (other than Co-operative society) are now eligible to opt for New scheme

- Basic Exemption Limit is revised to Rs. 3 lakh from the existing limit of Rs. 2.5 lakh

- Slab rates are revised

- Rebate limit u/s 87A is enhanced to Rs. 7 lakh from the existing limit of Rs. 5 lakh

- Standard deduction, Family Pension deduction and contribution to Agniveer Corpus Fund can now be claimed

- New Tax scheme becomes the DEFAULT option

- Surcharge rate capped at 25% instead of existing 37%

Let’s elaborate in detail.

1. Not only for Individuals & HUF

Till now only Individuals and HUF can opt for new tax regime if they wish to do so. But from FY 23-24 onwards, this scheme is also available for AOP, BOI and AJP (but NOT applicable for Co-op societies).

2. Exemption Limit revised to 3 Lakh

Upto FY 22-23, basic exemption limit was Rs. 2.5 lakh which is now revised to Rs. 3 lakh. So you need not pay any tax if your total income is upto Rs. 3 lakh. But do remember this is applies ONLY if you opt for New tax regime.

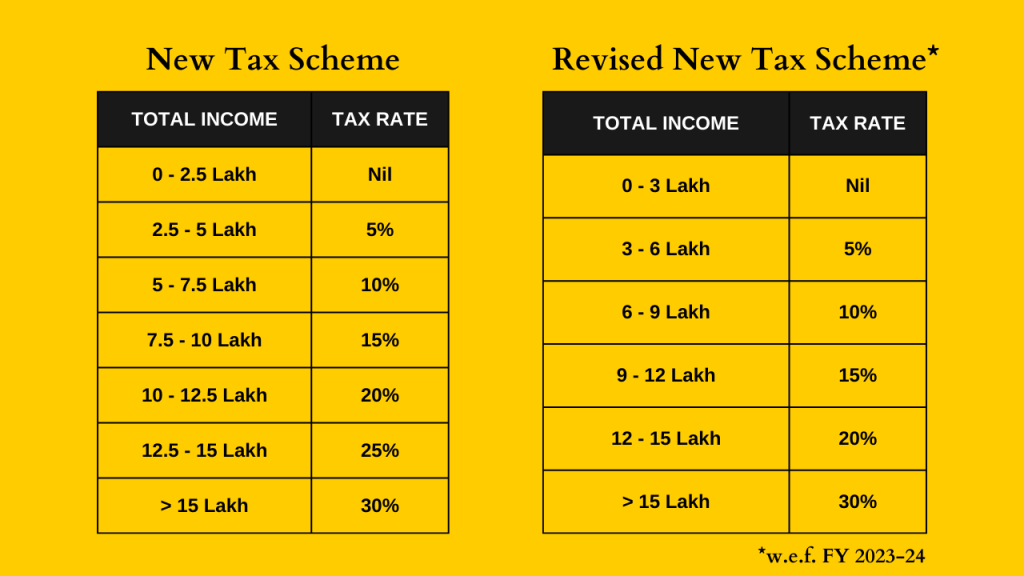

3. Revision in Slab Rates

Structure of slab rates are also slightly changed. Earlier, for every 2.5 lakh Income increment tax rate increment was 5%. Now, that Income increment was revised to 3 lakh and tax rate increment was same as earlier but 25% slab has been done away with.

Following is the comparative rates prior to and after the Budget 2023:

4. Enhanced Rebate Limit

Rebate under sec 87A is available only if

(i) your total income does not exceed Rs. 5 lakh and

(ii) you are Resident Individual.

This limit is equal both under the Old and New tax regimes. But if you opt for new tax regime from FY 23-24, you are eligible for enhanced limit of Rs. 7 lakh.

So, if your income is upto Rs. 7 lakh your tax liability would be ZERO. In case of employees and pensioners, since the standard deduction of Rs. 50,000 is also available, they need not pay any tax upto Rs. 7.5 lakh.

And, hence for the employees who doesn’t want to invest at all, New Tax scheme would be the better option.

5. More deductions

From FY 23-24 onwards, New scheme also allows tax payers to claim the following deductions in addition to the existing deductions like Sec 80CCD(2) & 80JJFF etc.

- Standard deduction of Rs. 50,000

- Family pension deduction upto Rs. 15,000

- Contribution to Agniveer Corpus Fund (80CCH)

6. New Scheme becomes DEFAULT option

Since the new scheme becomes the DEFAULT option from FY 23-24, if you want to opt for old tax scheme you need to choose it specifically. Otherwise, your tax saving investments will not considered for TDS and hence it will result in higher deduction of TDS.

7. Cap in Surcharge Rate

If you opt for New scheme, highest surcharge applicable would be 25% instead of 37%. So even after crossing income of Rs. 2 crore, now the applicable surcharge would be 25%.

Pls do remember, surcharge is applicable only if total income is more than Rs. 50 lakh.

These are the changes in New tax regime in this Budget. If you are opting for New tax regime from FY 23-24, make sure to remember these changes while computing your tax liability.

Hope you have enjoyed the article, thank you for your time.