In Budget 2023, new income tax regime has undergone some phenomenal changes. From the beginning itself, many were reluctant to opt for new regime as most of the deductions and exemptions are NOT available under this regime.

However, the recent changes made in this Budget 2023 has made this option more lucrative to the tax payers. In this article, let’s completely understand about the New Income Tax Regime, including the changes made in Budget 2023.

Introduction

This scheme was initially introduced in Budget 2020 and effective from 1.4.2020. So from FY 20-21 onwards, one can choose from the either of these options whichever is more beneficial.

Key difference between these schemes are, most of the exemptions and deductions which are available under the Old scheme are NOT available under the New scheme. That could be the main reason why many were reluctant to opt for new regime.

Who can opt?

Up to FY 22-23: ONLY Individuals and HUF can opt

From FY 23-24 onwards: AOP (other than co-op society), BOI & AJP can also opt

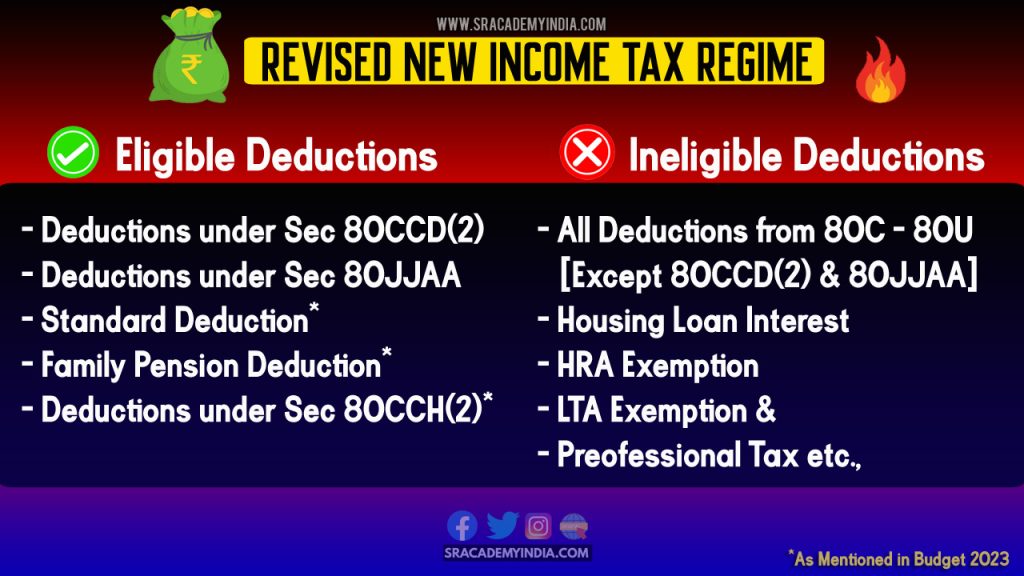

Eligible and Ineligible Deductions

Under the new regime, most of the deductions are NOT available except the following:

Few deductions which you can claim under the new scheme are:

- Sec 80CCD(2) – Employer contribution to NPS

- Sec 80JJAA – Deduction for new employment creation

However under the revised new regime from FY 23-24, tax payers can now claim the following benefits in addition to the above.

- Standard Deductions of Rs. 50,000 [sec 16(ia)]

- Family Pension deduction of Rs. 15,000 [sec 57]

- Contribution to Agniveer Corpus Fund [sec 80CCH]

Here is the comparative chart of Eligible and Ineligible deductions under the Revised new scheme:

Changes in Budget 2023

Here are the list of changes w.e.f 1.4.2023:

- Basic Exemption Limit is revised to Rs. 3 lakh from the existing limit of Rs. 2.5 lakh

- Slab rates are revised (pls refer below)

- Rebate limit u/s 87A is enhanced to Rs. 7 lakh from the existing limit of Rs. 5 lakh

- Standard deduction, Family Pension deduction and contribution to Agniveer Corpus Fund deductions can be claimed

- New scheme becomes the default option

- Highest surcharge rate capped at 25% instead of existing 37%

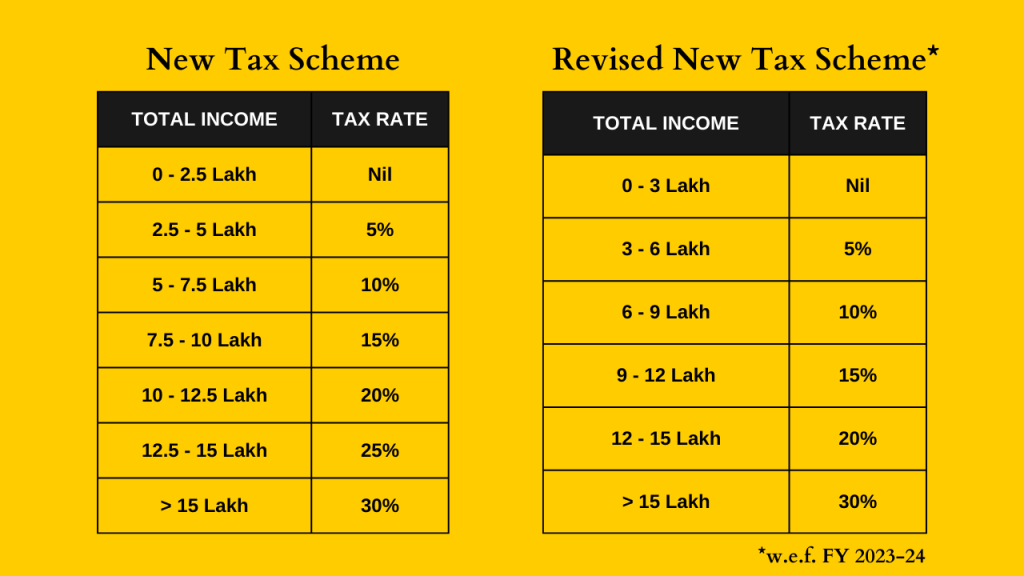

Comparative Slab Rates

Now let’s understand how the slab rates are changed in the Budget 2023.

Up to FY 22-23, basic exemption limit is Rs. 2.5 lakh and for every 2.5 lakh income increment, tax rate increment is 5%. Whereas, under the revised new scheme basic exemption limit was enhanced to Rs. 3 lakh and for each 3 lakh income increment, tax rate increment would be 5% and there will be NO 25% slab rate.

Here is the comparative table:

Is switchover between New and Old scheme possible every year?

Now, the next big question is “Can we shift between these schemes every year?”

As long as your income does not consists of income from either business or profession, you can shift between these two schemes every year. But, if you are having either business or professional income, then once you move out from new regime, only once you can come back in your lifetime.

Conclusion

With the recent changes in Budget 2023, new scheme is certainly more lucrative to the tax payers who are either

(i) reluctant to invest in specified schemes to become eligible for deductions or

(ii) have recently started their careers and doesn’t want to invest at all

But for those who are already covered under old scheme and thinking to choose new scheme, pls do the comparative analysis of the tax liability before opting-in and then choose the right scheme for you.

Hope you have enjoyed the article. In the upcoming articles, we will also discuss which scheme is better for you. Thank you for your time.