Budget 2023 has revised the rebate limit in sec 87A under new tax regime to Rs. 7 lakh from the existing limit of Rs. 5 Lakh. So, if your total income is up to Rs. 7 lakh in FY 23-24, then you need not pay any tax.

But, for those taxpayers who is having income marginally beyond the 7 lakh limit they are unable to claim this rebate and hence they are bound to pay more tax.

So to benefit this section of people, Finance Act 2023 has made an amendment in sec 87A to provide marginal relief benefit to small taxpayers whose total income is marginally above Rs. 7 Lakh in FY 2023-24.

Let’s dive in.

Applicable for whom

It is applicable only to Resident Individuals who opts for new tax regime. So whoever opts for old regime cannot avail this benefit.

And do remember, this benefit can be availed from FY 2023-24 onwards.

Marginal Relief calculation

Step1: Calculate tax liability on Total Income (before adding HEC @4%)

Step2: Compute the income in excess of Rs. 7 Lakh

Step3: Step1 – Step2

Amount derived under step3 will be the marginal relief benefit u/s 87A. Deduct this benefit from step1, then add HEC@4% to arrive at your final tax liability.

Here total income = Gross Total Income less Chapter VIA deductions less Standard Deduction

Practical Understanding

Let’s understand it better with the help of following example:

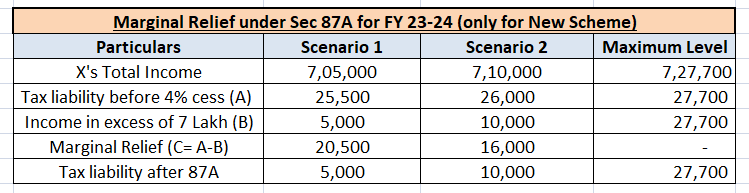

Scenario1: Since X’s total income is more than 7 Lakh, he is not eligible to claim sec 87A rebate. Thus, his tax liability would be Rs. 25,500 (before adding HEC@4%). For a marginal income increment of Rs. 5,000 beyond Rs. 7 Lakh, his tax liability is Rs. 25,500 which is much higher. So here comes the marginal relief benefit.

After claiming the marginal relief, X’s tax liability would be Rs. 5,000 (before adding HEC@4%). Hence X saved Rs. 20,500 in the form of marginal relief.

Same goes with scenario2 as well. For a marginal income increment of Rs. 10,000, X need to pay Rs. 26,000 as tax liability (before adding HEC@4%). But after claiming marginal relief benefit u/s 87A, his total liability would be Rs. 10,000 (before adding HEC @4%).

And do remember, you can claim this benefit upto an income level of Rs. 7,27,700 only. Beyond this limit, marginal relief benefit won’t be available.

Conclusion

So if you opted for new tax regime and your income is marginally above Rs. 7 lakh, then this marginal relief definitely helps you to save some tax.

Hope you enjoyed this article, please comment for any doubts/queries. Thank you for your time.