Scapia Credit Card

Introduction

Nowadays co-branded credit cards become trending.

Co-branded credit cards will be launched in a collaboration of a Banking company with another company or brand. They mutually collaborate to launch a New credit card that combines the major benefits of both entities, to attract new customers.

This strategic alliance leverages the strengths of both entities.

A few examples of Co-branded credit cards are

1. SBI Titan credit card (combination of SBI Bank + Titan brand)

2. HDFC Swiggy credit card (combination of HDFC Bank + Swiggy company)

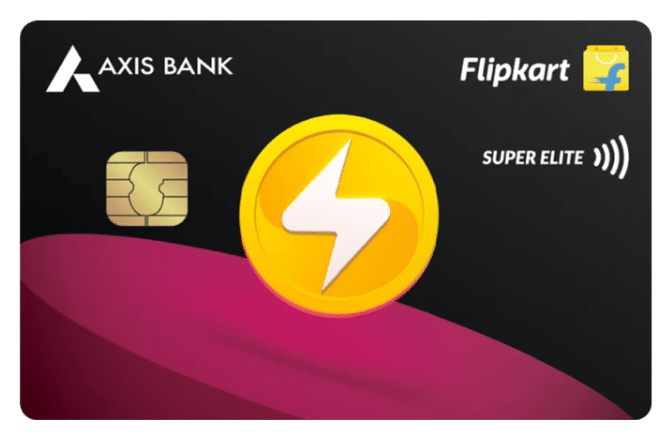

3. Axis Flipkart Credit card etc (combination of Axis Bank + Flipkart Shopping brand)

In the same way, in this article, we are discussing a Lifetime Free Co-branded credit card i.e. Federal Bank Scapia Credit Card.

Federal Bank is India’s one of Private sector bank and started its operations in the year 1931. This bank was earlier named “Travancore Federal Bank” and headquartered in Kochi, Kerala with 1500+ branches all over India. (As per Wikipedia source)

However, Scapia Technology Private Limited is a Bangalore-based Private Limited company incorporated in the year 2022 with a motive to enhance the Travel experience for individual Domestic and International users.

This mutually collaborated Federal Scapia Credit Card is a Virtual Credit card and that can be activated immediately. However, this credit cardholder will also get the Physical Scapia Credit card within 2-5 days.

Let’s check out the top features and benefits offered by this credit card.

Scapia Credit Card Overview

| Particulars | Description |

|---|---|

| Credit Card Type | Reward Points, Cashback |

| Joining Fees | Nil |

| Renewal Fees | Nil |

| Best for | Travel Lovers |

Coming to the Scapia Credit Card, it is designed especially for Travel lovers. And it looks in a vertical stylish format with an Orange, Black, and White combination.

On the Top left-hand side of this credit card, you can see the “Federal Bank Logo”. On the bottom of it, you can see, you can see the “Contactless logo” symbol which supports Near-Field communication (NFC) technology.

In the middle of this card, you can see the Cardholder’s name along with an animated Travel person picture carrying a Backpack and a Trolley bag.

You can see the “Scapia Logo” on the top right-hand side.

Looking at the bottom of this credit card, you can see the “Type of Credit card network” as “Visa” along with the Chip card beside it.

Now, Let’s crack this vertical credit card features and benefits.

What Benefits do you get from Scapia Credit Card?

Scapia Credit Card Benefits:

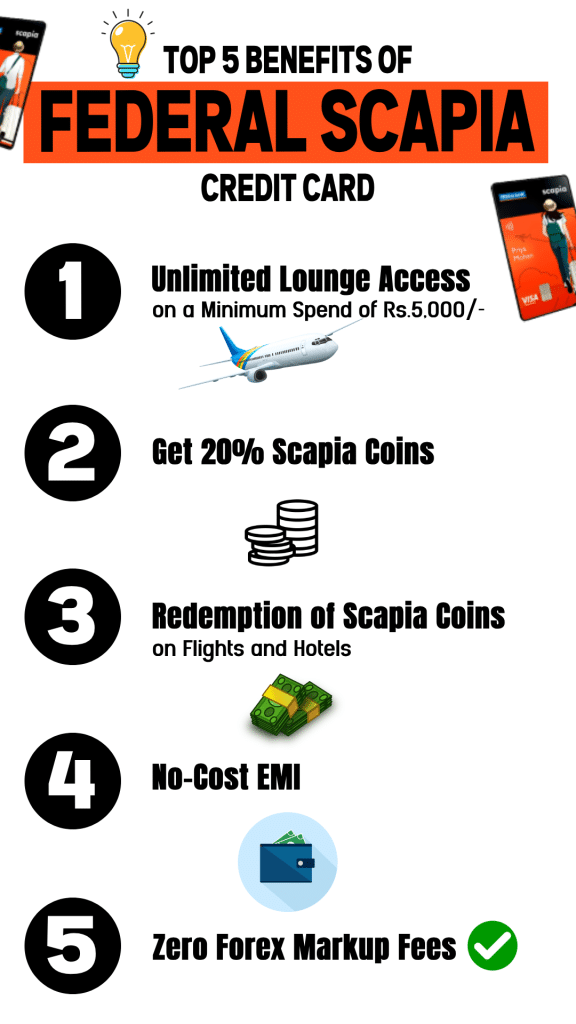

Let me go through the Top 5 benefits offered by this Scapia Credit Card [Incl. My Analysis]

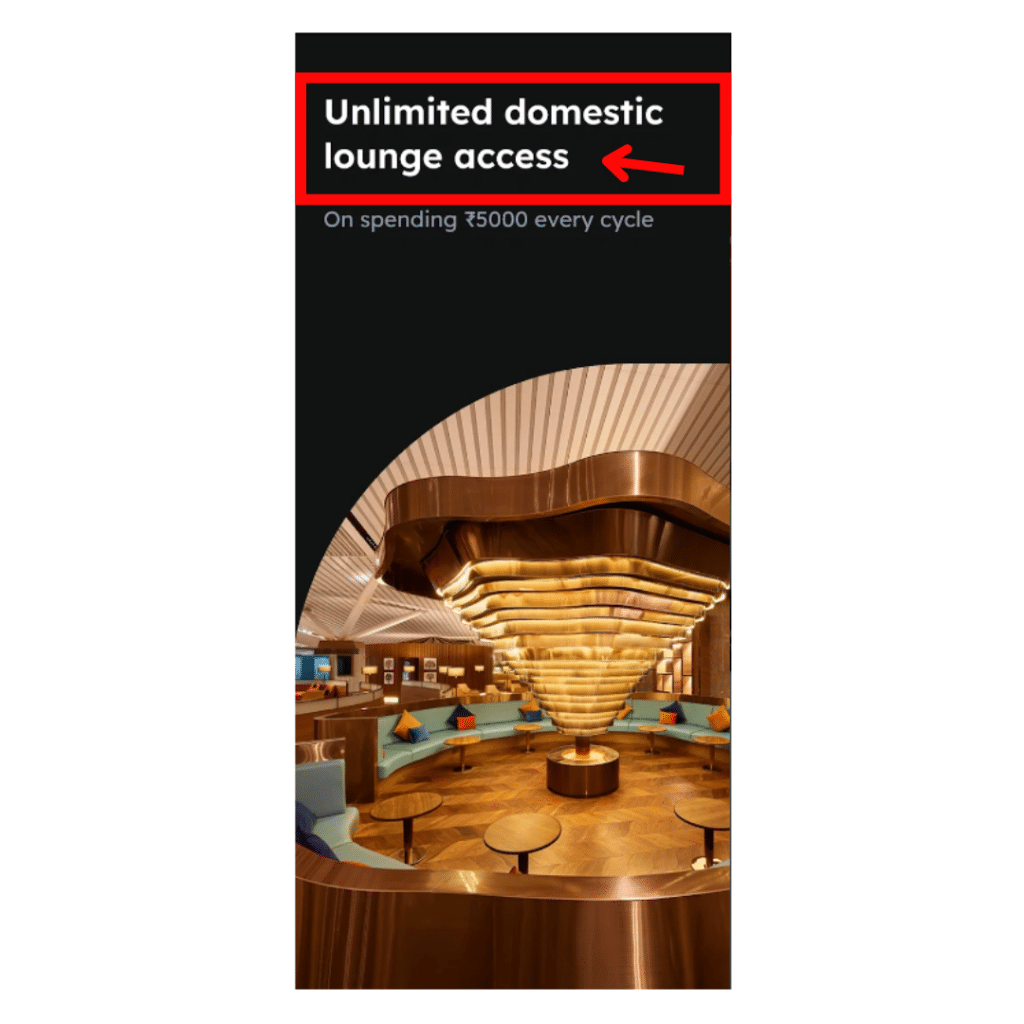

1. Unlimited Domestic Lounge access

Do you fly across India regularly..!!

Either for Business or Personal purpose.!

Then, you must have this Federal Bank Scapia Credit card to enjoy Unlimited Domestic Airport Lounge access on a Minimum spend of Rs.5,000 in a billing cycle. This facility can be availed in more than 60 domestic airports in India.

Airport Lounge access is a benefit provided to Debit and Credit cardholders to enjoy a comfortable waiting period in the Airport terminals.

Usually, the Airport Lounge access includes

– Free Food,

– Free Wifi,

– Showers

– Complimentary refreshments,

– Newspapers,

– Charging stations,

– Spa etc.,

The above-mentioned services may differ by type of the cardholder.

Moreover, to avail of this feature regularly on this credit card, the card should be active every month. You can check the List of participating Domestic Airport Lounges provided by Scapia credit card here.

My Analysis

I truly liked this Unlimited Lounge feature.

The reason is that even the major and top-rated credit card companies also do not offer Unlimited Domestic Airport Lounge access facility to their customers even though they spend Rs.1,00,000 on their credit cards.

Therefore, offering this facility for a minimum spend of Rs.5,000 spends is a good deal for frequent travelers.

2. Scapia Coins – Upto 20%

Scapia Points are nothing but Reward Points.

10% Scapia Coins on Online or Offline spends:

If you spend either Online or Offline by using this Scapia Federal Credit card, then, you can earn 10% Scapia Coins. However, You can earn scapia points on any regular spending of any category.

For Example,

If you spend Rs.1,000/- Online, you can earn 10 Scapia Coins (i.e. Rs.1,000 x 10%)

20% Scapia Coins on Travel Spends:

– If you are a regular traveler then you can earn 20% Scapia Coins. For that, this cardholder should make travel bookings through the Scapia app.

For Example,

If you spend Rs.1,000/- on your Travel bookings, you can earn 20 Scapia Coins (i.e. Rs.1,000 x 20%)

Worth of Scapia Coins

What is the worth of 1 Scapia Coin?

As per Federal Bank website, 5 Scapia Coins is equal to Rs.1/- rupee worth.

My Analysis

If you earn 10 Scapia Coins is equal to Rs.2/- rupees

If you earn 20 Scapia Coins is equal to Rs.4/- rupees.

To earn Rs.100/- worth through Scapia coins, you should earn 500 Scapia coins.

To earn 500 Scapia Points Online / Offline, you should spend Rs.5,000/- on your Scapia credit card. However, to earn 500 Scapia Points on Travel bookings, you should spend Rs.2,500/- on your credit card.

| On a Minimum Spend | Type of Spend | You will get | Worth of Scapia Points in Rs. |

|---|---|---|---|

| Rs.500/- | Online / Offline | 50 Scapia Points | Rs.5/- |

| Rs.1,000/- | Online / Offline | 100 Scapia Points | Rs.20/- |

| Rs.1,000/- | Travel | 200 Scapia Points | Rs.40/- |

| Rs.25,000/- | Travel | 5,000 Scapia Points | Rs.1,000/- |

| Rs.50,000/- | Online / Offline | 5,000 Scapia Points | Rs.1,000/- |

Zero Reward Points:

The Scapia Credit cardholder will earn No reward points for the below transactions

1. Cash withdrawals,

2. EMI transactions,

3. Money transfers,

4. Digital wallet loadings and

5. Rental payments

6. For Transactions less than Rs.20

7. International Transactions

8. Education-related fees

9. Crypto transactions

10. Gift cards & Scapia Credit card bill payment

3. Redemption of Scapia Coins on Flights and Hotels

The Minimum spend to earn Scapia points on this credit card is Rs.20 rupees & above.

Customers who earn Scpia points will be credited to the Scapia Federal Credit Card account. It is also to be observed that there are no redemption charges for the redemption of accumulated Scapia points

Usually, credit card companies charge Rs.99/- per redemption of accumulated points. But you can avoid those charges on it.

You can use these Scapia Coins on the Scapia app for Flight and Hotel bookings through Scapia app.

Validity

What is the validity of Scapia Points?

The Scapia Points come with a Lifetime validity. i.e. These Scapia Points will never expire.

In case you have not used your Scapia credit card for more than 365 days, then, all the accrued Scapia points will be nullified. Therefore, you cannot redeem it.

My Analysis

Scapia Points are nothing but Reward Points. Just a name change. I see Reward Points offered on Credit cards as Peanuts only.

The reason behind that is you cannot get any worthy benefit for the Scapia points you accumulated. Simply, you will get nominal benefits for your spending.

4. Zero Forex Markup Fees

If you travel abroad and make any International transactions, then, you will be charged with Zero Markup fees on the transaction value.

Who is Eligible for Scapia Credit Card?

Scapia Credit Card Eligibility

To get eligible for this Federal Bank Scapia Credit card, please check the below conditions.

1. Age:

Minimum Age – 23 years old

Maximum Age – 60 years old

2. Annual Income:

For Salaried

– The applicant of this card must have a Minimum monthly Income of Rs.18,000 are eligible to apply for this card.

For Non-Salaried

– The applicant of this card must have an Annual Income of Rs.4,00,000 as per the Income Tax return (ITR) are eligible to apply for this card.

3. Credit Score:

The Minimum credit score to get this credit card is 720.

How to Apply for a Scapia Federal Credit Card?

Scapia Credit Card Apply Online:

If you want this Scapia Credit Card, then, You can apply here.

Scapia Credit Card Charges

If you are applying for this Scapia credit card then looking at the benefits won’t help you, my dear friends. You should look at the charges as well.

The overview of the Top charges of the Scapia Credit Card is as follows.

| S.No. | Particulars | Description |

|---|---|---|

| 1 | Joining fees | Nil |

| 2 | Renewal fees | Nil |

| 3 | Foreign currency Markup | Nil |

| 4 | Reward Redemption Fee | Nil |

| 5 | Cash advance charges | 2.5% or Rs.500/- w.e.h |

| 6 | Interest charges | @3.49% p.m ; @ 41.88% p.a. |

| 7 | Late payment charges | Rs.0 – Rs.1,000/- |

| 8 | Over-the-limit charges | 2.5% or Rs.500/- w.e.h |

1. No Joining fees

If you want to use this Scapia Credit Card, then, you will be offered Zero Joining fees. i.e. Free for the first year.

2. No Renewal fees

If you want to continue using this Scapia Credit Card from the second year onwards also, you are not liable to pay any Renewal fees. i.e. No Renewal Fee.

3. Cash advance charges / Cash Withdrawal charges

You can Withdraw Money using this Federal Scapia Credit card but Don’t withdraw cash from any credit card. If you withdraw money by using this Federal Scapia Credit card, a Transaction fee will be levied on all such Cash Withdrawals at ATMs. Such transaction fees would be billed to the Cardholder in the next statement.

A transaction fee of 2.5% or Rs.500/- whichever is higher will be charged.

It is my sincere and humble request for all the Credit Card users that Whatever the Credit card you use, you Please don’t make any Cash Withdrawals by using your Credit Card. Consider this as my Personal request.

A Small request to all

If you have an urgent cash requirement / Cash crunch, then I suggest you take a Personal Loan or Gold Loan.

Those are much better options.

In a Personal Loan, every month you pay the Principal amount + Interest as an EMI. The rate of interest for Personal Loans usually ranges from 15-20% p.a. on the higher side in most cases.

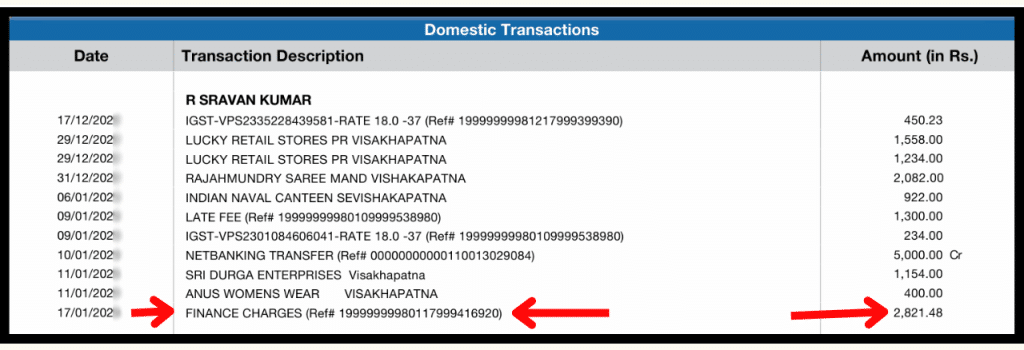

Apply Now4. Interest charges / Finance Charges?

Do you know how much interest you will be charged on this Credit Card?

You must know it, boss.!

For Example,

You have used this Scapia Credit Card and bought all the stuff you need.

But you don’t have enough money to pay the Credit Card Outstanding amount.

Then, the Federal bank will charge you interest @3.49% per month. It means the Annual interest the bank will charge is almost up to 41.88% per annum.

These finance charges won’t be stopped until you pay off your Credit Card’s outstanding balance in Full.

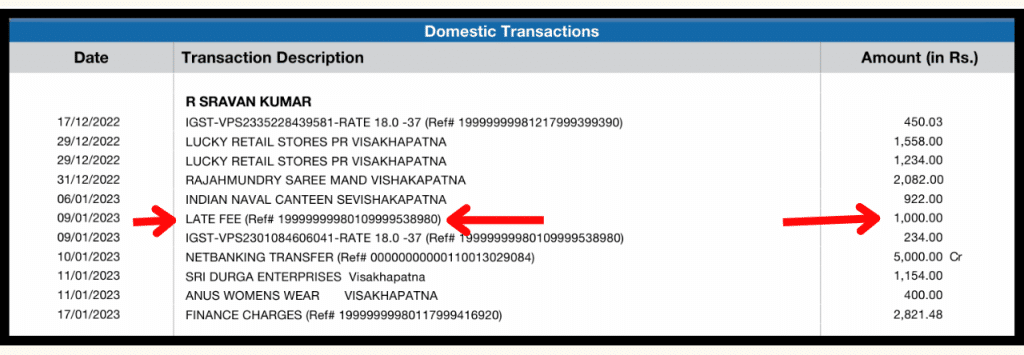

5. Late payment charges

Apart from Interest charges, if you delay paying this Federal Bank Scapia Credit card Outstanding by 1 day, you will have to pay Penalty Charges on top of your Credit card Outstanding.

Generally, the Late payment charges range from a Minimum of Zero rupees to a Maximum of Rs. 1,000/- depending on your Credit card outstanding.

If your credit card outstanding balance is more than Rs.100/-, then you will attract Late payment charges.

| Credit Card Outstanding Balance is | Late payment charges |

|---|---|

| Less than Rs.100 | Nil |

| Between Rs.101-Rs.500 | Rs.100/- |

| Between Rs.501-Rs.5,000 | Rs.500/- |

| Between Rs.5,001-Rs.10,000 | Rs.600/- |

| Between Rs.10,001-Rs.25,000 | Rs.750/- |

| Between Rs.25,001-Rs.50,000 | Rs.950/- |

| Greater than Rs.50,000 | Rs.1,000/- |

So if you use a credit card you have to be very organized and should deal with Credit card timelines properly.

6. Over the Limit charges

If you spend more than the available limit on the credit card, that means you have overused your Credit card. In such a case, you will be charged with “Over The Limit charges”.

The more you spend than your Credit Card limit, the more you will be charged.

If you overused this Scapia Credit card than the given limit, then, you will be charged @2.50% on the overdrawn amount, or the Minimum amount Rs.500/- rupees, whichever is higher will be charged.

Scapia Credit Card Review

Coming to my opinion on this credit card, the Federal Scapia Credit card is designed especially for Travel lovers, who travel across flights within India. The card users can avail Unlimited Airport Lounge facility which is a true benefit to the card holders.

In case you make any International transactions by using this Credit card, then, you will be charged Zero Makrup fees could be helpful to Online international spenders.

Coming to the Reward Points, the Federal Bank should include Rental Payments and Educational payments under the Reward Program benefits, which adds a nominal benefit to the customer.

However, this Federal Scapia Credit card is an Entry-level credit card with minimal benefits only.

If you are looking for a Credit card with Lifetime Free, then, I will recommend this credit card. In case, you don’t travel much, you can skip this credit card without any further doubts.

In case, if you are looking for a Credit card with Fuel benefits then, you can check the below-mentioned credit card from IDFC First Bank.

Frequently Asked Questions

1. What is Scapia Credit Card?

Scapia Credit Card is a Co-branded Credit card launched by Federal Bank and Scapia Technology Private Limited to tailor to the needs of frequent travelers and regular shoppers. This credit card offers rewards in the form of Scapia points up to 10% on Online and Offline spending & 20% on travel bookings along with Top benefits of Unlimited Domestic Lounge access, No cost EMI, etc.,

2. Is Scapia Credit Card Rupay Card?

The Scapia Credit Card is not a Rupay Credit Card. But at present, it offers a Visa Card network to its customers.

3. Is Scapia Credit Card Virtual Card Only?

The co-branded Scapia Credit Card is a Virtual Credit card that can be activated immediately. However, the cardholder will also get a Physical Scapia Credit card within 2-5 days. This Credit card is designed especially for Travel lovers and offers Unlimited Domestic Lounge access, No-cost EMI, and a lot more benefits for an entry-level user.

4. Can I Link Phonepe in Scapia Credit Card?

As a Scapia Credit card is a Visa Credit Card, the cardholder can link to their PhonePe.

5. Is Scapia Credit Card has Lounge access?

The Federal Scapia Credit card offers Unlimited Domestic Airport Lounge access on a Minimum spend of Rs.5,000 in a billing cycle. This facility can be availed in more than 60 airports in India. However, to avail of this feature regularly on this credit card, the card should be active every month.

6. Scapia Credit card Interest rate for EMI Transactions?

If you convert any purchases made through Scapia Credit into EMI, then, an interest rate of @16% will be applicable for tenures of 3, 6, 9, 12, 15, 18, 21

and 24 months tenure.

7. Is the Scapia credit card contactless card?

The Scapia credit card comes with Contactless technology.

In India, you can make payment using this credit card at the Point of Sale (POS) Machine for a Maximum Payment of Rs.5,000/- per transaction without entering the PIN.

If you want to make a payment of more than Rs.5,000/-, then, this card holder should input the Credit card PIN to complete the payment.

8. Can I Withdraw Cash by using this Virtual Credit Card?

By using a Virtual Credit card you cannot withdraw money. However, when you get this Physical Scapia credit card, then you can withdraw cash.

9. Does the Scapia Credit Card has Fuel Surcharge Waiver?

The Federal Bank Scapia Credit card does not offer a Fuel Surcharge Waiver. This cardholder does not even earn any Scapia Coins on Fuel transactions as well.

10. Scapia Reward Points Non applicability?

The Scapia Credit cardholder will earn zero reward points for transactions of Cash withdrawals, EMI transactions, Money transfers, Digital wallet loadings, Rental payments, Transactions less than Rs.20, International Transactions, Education-related fees, Crypto transactions

Gift cards & Scapia Credit card bill payment.

Thanks for your time, my dear readers 🙂