SBI Titan Credit Card

The State Bank of India recently launched a new credit card in association with Titan brand. i.e. SBI Titan Credit card. It is a premium credit card that comes with 7.50% cash back.

This SBI Credit card offers cashback on Purchases. You can earn cashback up to 5% cashback on Mia, Caratlane & Zoya. If you spend on Tanishq by using this credit card, you can earn 3% value back in form of Gift Vouchers.

This SBI Titan credit is not Free. You should pay Annual fees to avail it. But this can be waived off by meeting minimum spending requirements.

Without a further ado let’s see What are the Features or Benefits this Credit card is offering? And I also share my Genuine opinion on this Credit card by discussing about its Drawbacks as well.

Let’s get Started..!!

SBI Titan Credit Card Overview

| Credit Card Type | Cashback |

| Joining Fees | Rs.2,999/- (One-time) |

| Renewal Fees | Rs.2,999/- per annum |

| Best for | Titan brand shoppers |

What Benefits you get from SBI Titan Credit Card ?

When it comes to SBI Titan credit card, this card comes with Black and light blue colour combination. You can see the Titan Logo on top left side of the card. Along with that logo of the Contactless card feature appears on the left middle of the card. i.e. Near-field Communication (NFC) support.

On top right side of the card, you can see SBI card log and at the right bottom of the card, you can see type of Credit card network i.e. Visa.

Let me go through Top benefits offering by this Credit Card [Incl. My Analysis]

SBI Titan Credit Card Benefits:

1. Welcome benefits

Coming to Welcome benefits, the State Bank of India (SBI) has tied up with Titan Company. You can use this Welcome offer against almost 8 brands.

To avail this feature on this credit card, you have to pay the Joining fee of Rs.2,999/- excluding GST. With GST, you should pay Rs.3,539/-

On paying this Joining fees, the State Bank of India (SBI) will offer you 12,000 reward points.

These reward points will be credited to your credit card within 60 days of taking this credit card. You can use these 12,000 reward points to redeem your Titan vouchers.

2. Exclusive Titan Instore Benefits

As far as the second benefit is concerned, this is for the Titan in store benefit.

If you purchase anything from Titan’s stores, then, you will be offered with 7.5% cash back.

Which brands will comes under Titans stores?

If you use this SBI Titan Credit Card and spend at Titan, Taneira, Titan Eye+, Helios, Fastrack, Skinn, Irth & Sonata stores, they will offer you 7.5% cashback.

If you use this SBI Titan credit card in Caratlane, Mia, Zoya store, then, you will get 5% cash back on the value of your purchase.

If you use this SBI Titan credit card in Tanishq store and buy Gold and diamond jewellery, then, you will get 3% value back on the value of your purchase.

The value of this cash back will be reflected in your credit card statement within 5 working days from the time it is generated.

My Analysis

Simply, you will get 7.50% cashback & 5% cash back on your purchases at Titan stores & Titan Jewellery on a total of 11 brands & the Cashback earned on it, will be reflected on your credit card statement.

Whereas, for your spends at Tanishq Jewellery store, you will get 3% value back for the items you bought. And the value back will be provided in the form of a Gift voucher.

That’s the difference between Cash back and Value back here.

| Category | Benefit | Applicable Brands | Total Brands |

| Titan Other Brands | 7.5% cashback | World of Titan, Taneira, Titan Eye+, Helios, Fastrack, Skinn, Irth, Sonata | 8 |

| Titan Jewellery | 5% cashback | Caratlane, Mia, Zoya | 3 |

| Titan Tanishq | 3% worth Gift Voucher | Tanishq | 1 |

3. Cashback Limit – How much ?

What Is the Maximum Limit of Cash back you will get?

Let’s check now.

Usually, the Credit card companies offers major cashbacks on your monthly spends only. But this SBI Titan Credit Card offers Cashback on your Quarterly spends. Therefore, there is a good chance of getting more in the form of cash back on the purchases made by the customer.

7.50% Cashback

Under 7.50% category of cashback, if you shop at 8 brands like World of Titan, Taneira, Titan Eye+, Helios, Fastrack, Skinn, Irth & Sonata, then, you will get cash back up to Rs.10,000 per Quarter.

i.e. The Maximum Cashback that can be earned on under this category is capped at Rs.10,000/- per quarter.

To earn Maximum cashback on this SBI Titan credit card, your Maximum spends per Quarter should be Rs.133,333/-

5% Cashback

Under 5% category of cashback, if you shop at brands like Mia/Caratlane/Zoya, you will get cash back up to Rs.10,000 per Quarter.

i.e. The Maximum Cashback that can be earned on under this category is capped at Rs.10,000/- per quarter.

To earn Maximum cashback on this SBI Titan credit card, your Maximum spends per Quarter should be Rs.2,00,000/-

3% Value back

Under 5% category of Value back, if you do shopping at Tanishq, they provide up to 3% value back, so, you will get a value of Gift voucher of up to Rs.25,000 per quarter i.e. for every 3 months.

The Maximum Cashback that can be earned on under this category is capped at Rs.25,000/- per Quarter.

To earn Maximum Value back on this SBI Titan credit card, your Maximum spends per Quarter should be Rs.8,33,333/-

This Gift voucher comes with a validity for a period of 1 year only from the date of issue.

This voucher cannot be encashed by you.

Even if there is any unused balance after the validity time, it will not be refunded.

| Category | Benefit | Applicable Brands | Maximum Benefit |

| Titan Other Brands | 7.5% cashback | World of Titan, Taneira, Titan Eye+, Helios, Fastrack, Skinn, Irth, Sonata | Rs.10,000 per Quarter |

| Titan Jewellery | 5% cashback | Caratlane, Mia, Zoya | Rs.10,000 per Quarter |

| Titan Tanishq | 3% worth Gift Voucher | Tanishq | Rs.25,000/- per Quarter |

What is the difference between Cash back and Value back?

Under Cashback, a certain percentage of amount on your total spends will be credited to your credit card statement i.e. Cash back.

In case of Value back, the Gift vouchers will be provided on a certain percentage of value on the spends you make. When you pay at at Titan stores, you can use these Gift vouchers to reduce a small amount of money on your total bill. i.e Value back.

4. Contactless card feature

Cashback SBI Credit Card comes with Contactless technology. In India, you can make payment using this credit card at the Point of Sale (POS) Machine for a Maximum Payment Rs.5,000/- per transaction without entering the PIN number.

If you want to make a payment of more than Rs.5,000/-, then, this card holder should input the Credit card PIN number to complete the payment.

5. Lounge Benefits

SBI Titan Credit card Domestic Lounge access

This SBI Titan card comes with Domestic and International Lounge facility.

The card holder can get 8 Domestic Lounge access in a year. The Maximum lounge benefit access is capped to 2 access per quarter lounge access.

SBI Titan Credit card International Lounge access

The card holder can get 4 complimentary International Airport Lounges in an year. The Maximum lounge benefit access is capped to 2 access per quarter lounge access.

To avail this Complementary lounge benefit, you need to swipe your SBI Titan Credit card at the lounge.

SBI Titan Credit card Priority pass

SBI Priority pass is a membership program which allows the travellers to access to airport lounges across the world on enrolment without worrying of Airlines or Flight class.

| Lounge Type | Maximum Per Quarter | Maximum Per Year |

| Domestic | 2 Domestic Lounge access | 8 Domestic Lounge access |

| International | 2 International Airport Lounges | 4 Complimentary International Airport Lounges |

6. Exclusive Milestone Benefits

If you use this SBI Titan credit card and spend an amount of more than Rs.3,00,000/- annually, then, you do not need to pay the yearly renewal fees of Rs.2,999+GST.

The additional Milestone benefits are provided in 2 categories.

1. If you spend more than Rs.5,00,000 in a year by using this credit card, then, you will be provided with a Gift voucher worth Rs.5,000/-. This voucher can be used in Titan related stores.

2. Also, if you use this SBI Titan credit card and spend more than Rs.10,00,000/-, then, you will be provided with a Gift voucher worth Rs.10,000/-

It means, you will get 1% of your annual spends as a exclusive milestone benefits.

Please consider this benefit, it it helps you.

| Yearly spends | Gift Voucher |

| More than Rs.5,00,000 | Rs.5,000/- |

| More than Rs.10,00,000 | Rs.10,000/- |

7. Reward Points on other Spends

If you spend on anything else using this credit card, i.e. either Offline / Online, on a shopping apps like Flipkart, Amazon or through any other online spends, then, you will get 6 reward points for every Rs.100 spent.

1 reward point is worth 0.25/- paisa and these reward points do not expire.

If you do Rupay credit card transaction in Titan stores through your UPI, you will get 6 reward points on every Rs.100 rupee spent.

No Reward Points

If you have uploaded money in to the wallet, spent on property rental space, activities and shared activities, you will not get any reward points.

The Cashback is not allowed on the below transactions.

– If you convert Credit card Balances into EMI

– Cash advances,

– Convert transactions into EMI through Flexi pay,

– E-wallet loading transactions,

– Merchant EMI,

– Disputed transactions,

– Finance Charges.

8. Fuel Surcharge Waiver

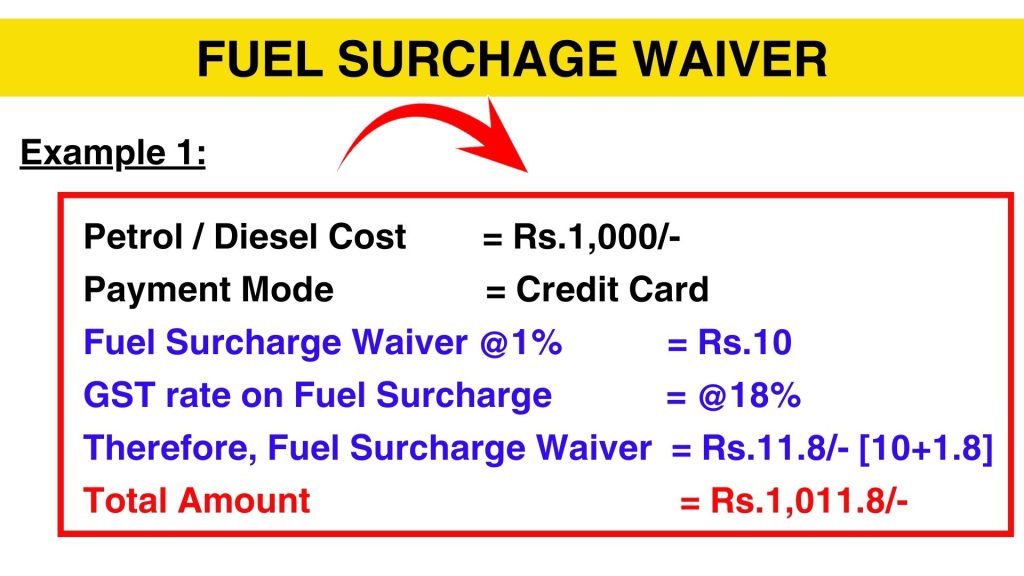

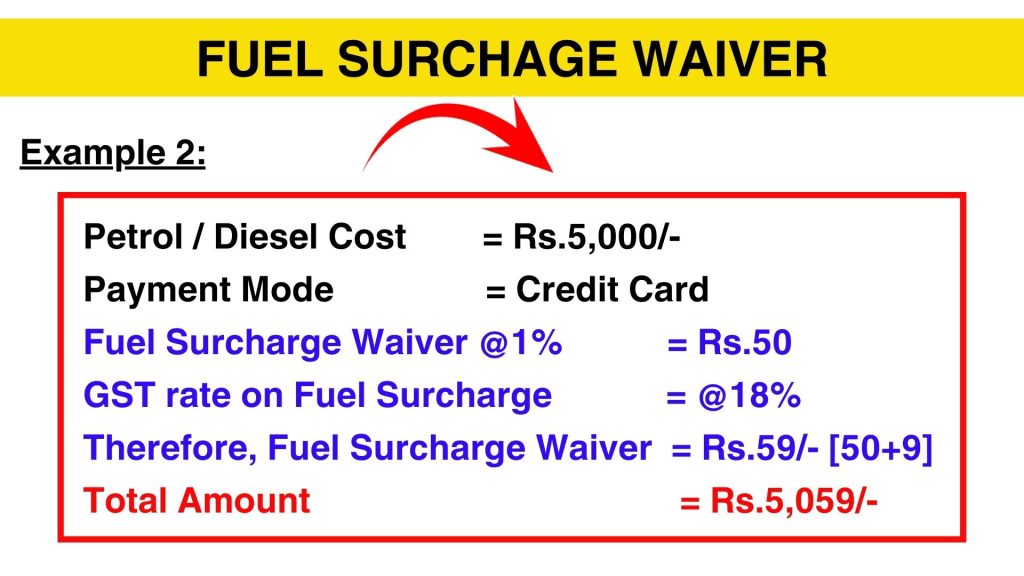

By using this Credit Card If you spend on Petrol/Diesel between Rs.500-Rs.3,000/- across all Petrol pumps, then, normally a Fuel Surcharge will be charged. It may be around 1-3% of your Fuel Cost.

In case you paid it through this card, you will be eligible for “Fuel Surcharge Waiver“. Let me clarify you about Fuel Surcharge Waiver with 2 Examples

I really don’t understand why Credit card companies are highlighting Fuel Surcharge Waiver..!! This is not even a Nominal benefit to the Card user because you have to pay it only if you use this Credit card. Normally if you pay it in cash there will be No such Surcharges at all.

Also Read: How I Lost Money by paying Fuel bills with Credit Cards

9. Utility Bill payments

By using this SBI Titan credit card, you can also pay your Electricity, Telephone, Mobile and other utility bills by using the “Easy Bill Pay” facility on your TITAN SBI Card PRIME.

10. Balance Transfer on EMI

The SBI Titan Credit card holder can transfer the outstanding balance of other banks’ credit cards to your Titan SBI Card PRIME, and can avail a lower rate of interest and pay back in EMIs.

SBI Cashback Credit Card Apply

If you want this Cashback SBI Credit Card card, You can apply.

Apply NowSBI Titan Credit Card Charges [Must Read]

Let’s check all the applicable charges for using this SBI Titan Credit Card.

1. Joining Fees

If you want to use this SBI Titan credit card, then, you will have to pay a Joining fees of Rs.2,999 excluding GST. With GST, you should pay Rs.3,539/-

2. Renewal Fees

If you want to use this SBI Titan credit card from the second year onwards, then, you will have to pay a Renewal fees of Rs.2,999/- per year excluding GST. With GST, you should pay Rs.3,539/- per year.

If you are looking for FREE Credit card, without Joining Fees and Renewal fees, then, you can check here.

3. Cash advance charges / Cash Withdrawal charges

If you withdraw money by using this SBI Titan Credit card, a Transaction fee would be levied on all such Cash Withdrawals at Domestic or International ATM’s. Such fees would be billed to the Cardholder in the next statement.

A transaction fee of 2.5% or Rs.500/- whichever is higher will be charged at domestic and international ATMs.

It is my sincere and humble request for all the Credit Card users that Whatever the Credit card you use, you Please don’t make any Cash Withdrawals by using your Credit Card. Consider this as my Personal request.

A Small request to all

You can Withdraw Money using this SBI Titan Credit card but Don’t withdraw cash from any credit card. If you have urgent cash requirement / Cash crunch, then I suggest you to take a Gold Loan or a Personal Loan. Those are much better options.

Because in a Personal Loan, every month you pay Principal amount plus Interest as an EMI. The rate of interest for Personal Loan ranges from 15 to 20% p.a. on a higher note.

Do you know how much Interest you will be charged on Credit Cards ?

As per the SBI Card website, the Rate of interest will be charged is upto 3.25% per month. It means you have to pay up to 42% per annum as a Finance / Interest charges on your Credit Card Outstanding balance.

4. Interest charges / Finance Charges ?

You have used this SBI Titan Credit card and bought all the stuff you need.

But you don’t have enough money to pay the Credit Card Outstanding amount.

Then, the bank will charge you Interest between @3.50% per month. It means, the Annual interest is almost 42% per annum.

These finance charges won’t be stopped until you pay off your Credit Card outstanding balance in Full.

5. Late payment charges

Apart from Interest charges, if you delay paying this SBI Titan Credit card Outstanding by 1 day, you will have to pay Penalty Charges on top of your Credit card Outstanding.

Generally, the Late payment charges ranges from Minimum Rs.400/- rupees to Maximum Rs. 1,300/- depending on your Credit card outstanding. If your credit card outstanding balance is more than Rs.500/- to Rs.50,000/- ,then you will incur the Late payment charges.

So if you use credit card you have to be very organized and should deal with Credit card timelines properly.

6. Over the limit charges

If you spend more than available limit on the credit card. That means you have over used your Credit card. Then, you will be charged with “Over The Limit charges”.

The more you spend than your SBI Titan Credit card limit, the more you will be charged i.e. @2.50% on the overdrawn amount. The Minimum amount will be charged starts from Rs.600/- rupees.

SBI Titan Credit Card Review

If you don’t shop at Titan Watches or Titans stores, then this card is not for you. You please skip it without any second thought.

This card is specially designed for the users who are more interested towards watches or similar things of Titan. To those people, I will recommend this SBI Titan credit card for 100%. Because, you can earn 7.50% cashback if you shop on Titan stores, it’s a real benefit for them.

Also, this credit card don’t have any movie ticket offers.

If you are in the habit of shopping online regularly and want a contactless credit card, then if you think you need an SBI entry level credit card, then you can check SBI Simple credit card from SBI, You can check it now.

Thanks for your time my dear folks 🙂