Kotak Rupay Credit Card

Introduction

In the dynamic era of finance, the importance of credit cards emerging as a convenient and secure payment method is undeniable. Amidst a wide variety of choices, the Kotak Rupay Indian Oil Credit card is one such choice for individuals who are seeking a comprehensive and rewarding Credit solution along with a special offer of 60 Liters of Free petrol from Indian Oil Corporation Limited (IOCL).

The Kotak Indian Oil Credit Card is a Cobranded credit card, launched in collaboration with Kotak Mahindra Bank with Indian Oil Corporation Limited (IOCL).

Co-branded credit cards will be launched in a collaboration of a Banking company with another company or brand. They mutually collaborate to launch a New credit card that combines the major benefits of both entities, to attract new customers.

Let’s see about 2 companies in short.

Kotak Mahindra Bank Limited is a BSE and NSE-listed Indian Public Banking company headquartered in Mumbai, India, and started its operations in the year 1985 with over 1,00,000+ employees. (Source: Wikipedia)

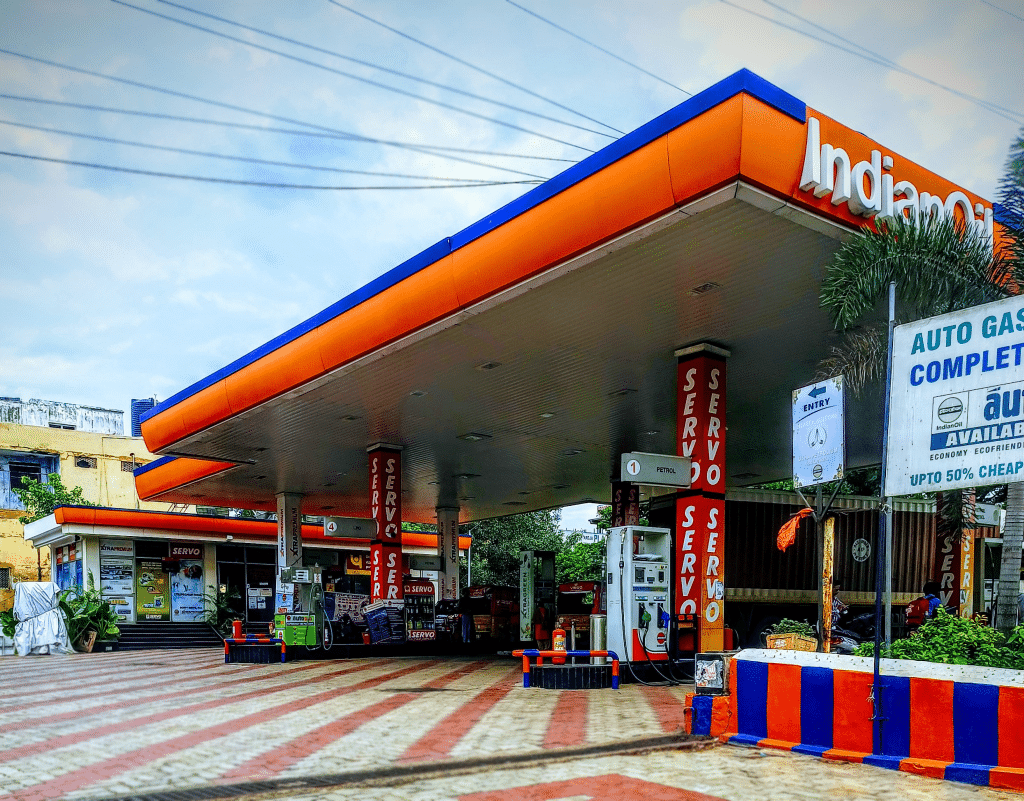

However, Indian Oil Corporation Limited (IOCL) is a Public sector undertaking and a New Delhi-based Oil and Gas company founded in the year 1959 with over 30,000+ employees. (Source: Wikipedia)

This strategic alliance leverages the strengths of both entities.

A few examples of Co-branded credit cards are

1. SBI Titan credit card (combination of SBI Bank + Titan brand)

2. HDFC Swiggy credit card (combination of HDFC Bank + Swiggy company)

3. Axis Flipkart Credit card etc (combination of Axis Bank + Flipkart Shopping brand)

In this post, let’s check out the top features and benefits offered by this credit card along with a detailed analysis of each feature.

Kotak Indian Oil Credit Card Overview

| Particulars | Description |

|---|---|

| Credit Card Type | Reward Points & Cashback |

| Joining Fees | Rs.449 + GST |

| Renewal Fees | Rs.449 + GST |

| Best for | Fuel Spenders |

Coming to the Kotak Indian Oil Credit Card, this card is designed especially for Indian Oil fuel lovers. And it looks in a horizontal format with a Pink, Blue, and White combination.

On the Top left-hand side of this Credit card, you can see the “Kotak Bank Logo”.

On the bottom of it, you can see the Chip card symbol, and on the right beside it, you can see the “Contactless logo” symbol which supports Near-Field communication (NFC) technology.

At the bottom left side of this card, you can see the Cardholder’s Name.

On the top right side of this credit card, you can see the “Indian Oil Logo” and at the right bottom of this credit card, you can see the “Type of Credit card network” as “Rupay Platinum”

Now, Let’s crack this vertical credit card features and benefits.

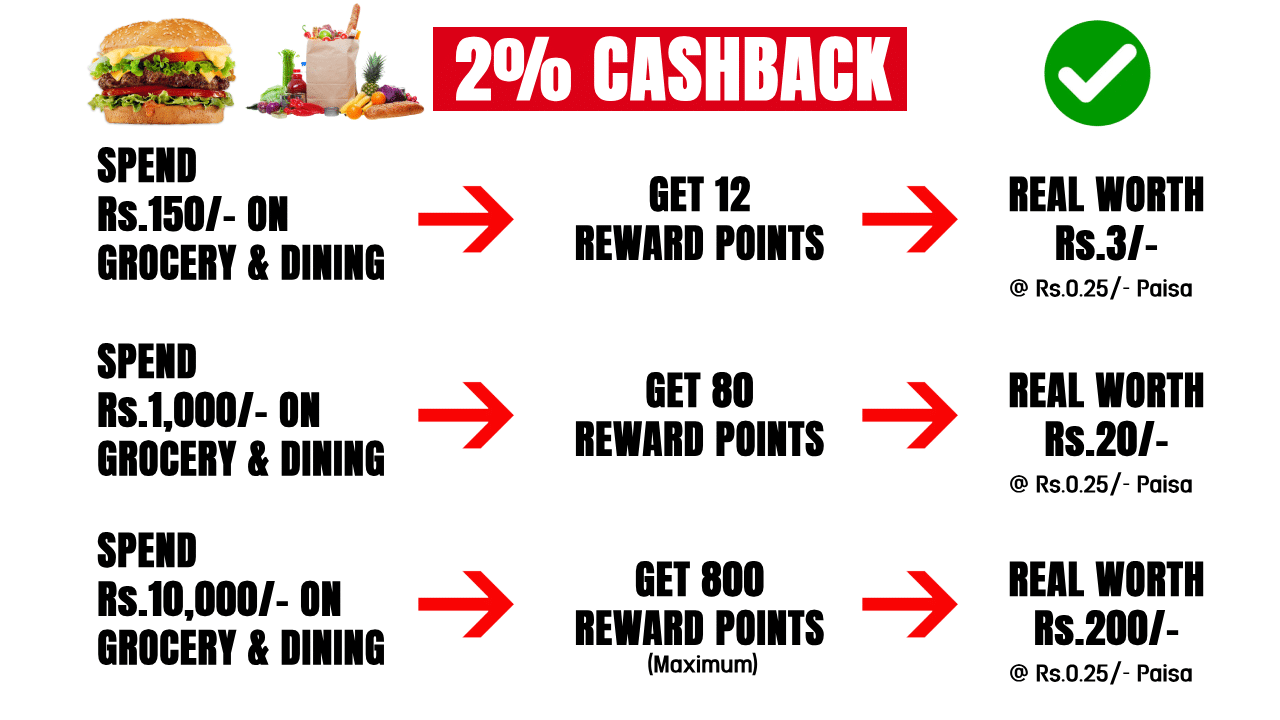

IOCL Kotak Credit Card Benefits

What Benefits do you get from Kotak Indian Oil Credit Card?

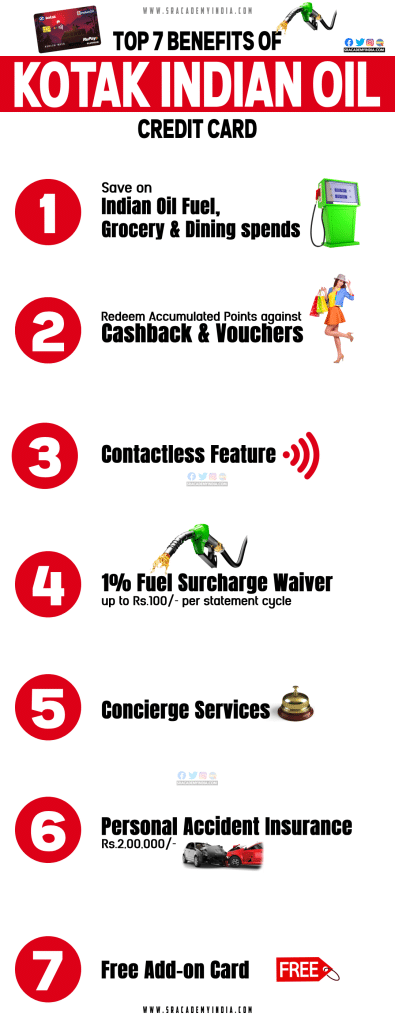

Let me go through the Top 7 benefits offered by Indian Oil Corporation Limited (IOCL) Kotak Rupay Credit Card [Incl. My Analysis]

1. Reward Points

5% Save on Indian Oil Fuel spends

With the Kotak Indian Oil Credit Card, the Cardholder can Save 4% as Reward Points on Indian Oil Fuel Spends.

However, the Credit cardholder can earn 24 Reward Points for every INR 150 spent. The Maximum Reward Points per statement cycle capped at 1200.

For Example,

If you spend Rs.1,000/- on India Oil Fuel, then, you can earn 160 Reward Points (i.e. Rs.1,000 x 24/150)

In case, you want to earn a Maximum of 1200 Reward points in a statement cycle, then, you must spend at least Rs.7,500 on Indian Oil Fuel.

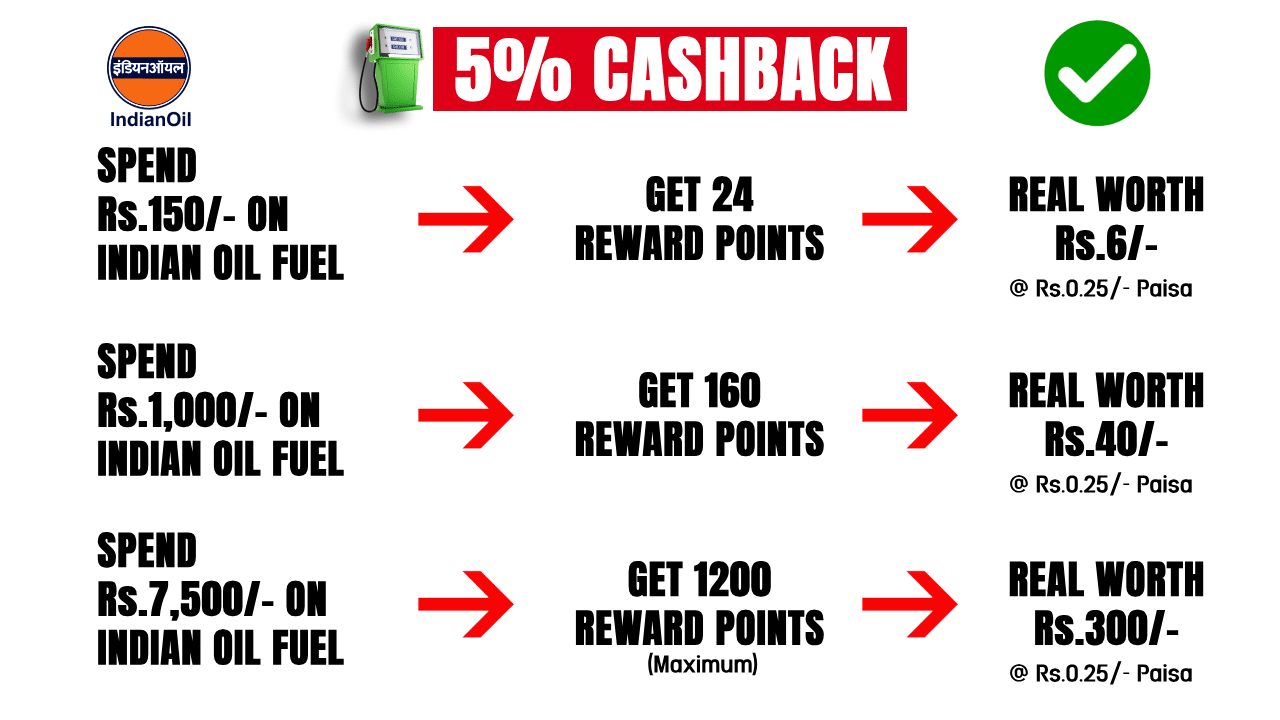

2% Save on Grocery and Dining spends

If you make any spends through this Rupay Credit card, the Cardholder can Save 2% as Reward Points on Grocery and Dining spending.

However, this credit cardholder can earn 12 Reward Points for every INR 150 spent. The Maximum Reward Points per statement cycle capped at 800.

My Analysis

For Example,

If you spend Rs.1,000/- on IGrocery and Dining spends, then, you can earn 80 Reward Points (i.e. Rs.1,000 x 12/150)

In case, you want to earn a Maximum of 800 Reward points in a statement cycle, then, you must spend at least Rs.10,000 on Indian Oil Fuel.

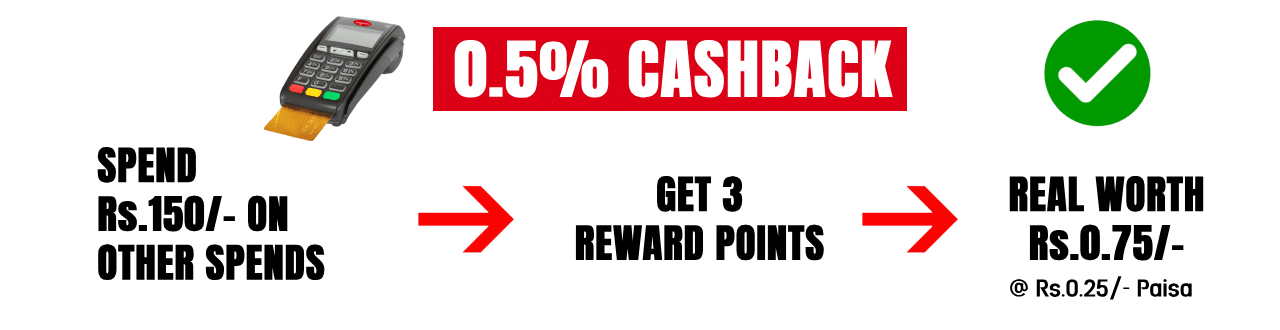

0.5% on all other spends

In case the cardholder spends on any other spends other than Indian Oil Fuel, Grocery, and Dining, then, the cardholder can save 0.5% back as Reward Points. However, this credit cardholder can earn 3 Reward Points for every INR 150 spent.

Let’s discuss how to get 60 Liters of Free Petrol as discussed above

Let me tell you an Easy math.

Simply, If you earn 2000 Reward Points (1200 under 5% category +800 under 2% Category).

Then, 1 Reward Point = Rs.0.25/- paisa.

Therefore, you will get Rs.500/- (i.e. 2000 RP x Rs.0.25/-)

So, you can get 5 Litres of Petrol per month for the worth of Rs.500/-

Then, What about 60 Liters of Petrol?

You need to spend it for 12 months i.e. for a full year of 60 Liters (i.e. 5 Ltrs x 12 Months)

Don’t get shocked..!

It’s business.

UPI Payments

It is to be noted that If you make any UPI Credit card transactions, then, all UPI on Credit Card transactions will accrue 0.50% Reward Points on every INR 150 spent, across spending categories.

1000 Reward Points

The Kotak Rupay Credit Card offers 1,000 Reward points as a Welcome benefit on spending Rs.500/- within 30 days of issuance of the credit card.

Imagine, I accumulated Reward points..!

But, How can I redeem & What’s it worth..!

Keep on reading my dear readers.

2. Reward Redemption

Minimum Reward Points

To qualify for redemption, the cardholder should accumulate 300 Reward Points. However, the redemptions against cashback are allowed in the multiples of 300 Reward Points only.

What is the Worth of Reward Points?

For a limited time, this Credit cardholder can redeem Reward Points as an Instant Cashback at a rate of 1 Reward Point = Rs.0.25/- rupee worth.

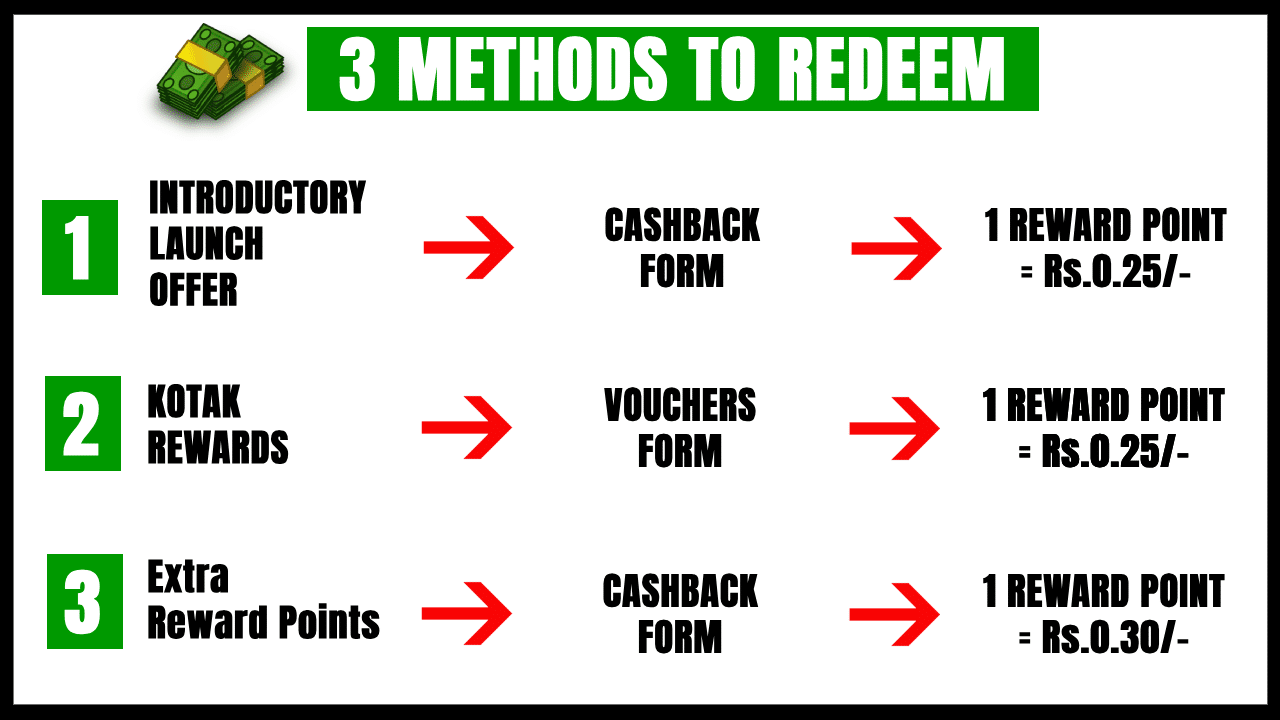

3 Ways to Redeem?

The Kotak Rupay Credit Cardholder can redeem reward points in any of 3 methods

1. Introductory Launch Offer – Cashback form

2. Kotak Rewards – Vouchers form

3. Indian Oil’s XTRAREWARDS Points

How to redeem Kotak Indianoil Reward Points

Let’s check each method.

1. Introductory Launch Offer

– It is a Limited period offer exclusively for Kotak Indian Oil Credit Cardholders.

– Customers can redeem their accumulated Kotak Reward Points in the form of Cashback.

2. Kotak Rewards

Under Kotak Rewards, you can redeem your accumulated Kotak Reward Points against Merchandise, E-Vouchers of the latest brands, Movie vouchers, Travel, Mobile recharge, etc.,

3. Indian Oil’s XTRAREWARDS Points

Under 3rd option, the Kotak Rupay Credit Cardholder can redeem their accumulated Kotak Reward Points against XTRAREWARDS Points in multiples of 300 Kotak Reward points only.

For 300 Kotak Reward points = 250 Indian Oil XTRAREWARD points = Worth of Rs.75/-

Apart from Reward Points, What are the other major benefits I can get with this card..!

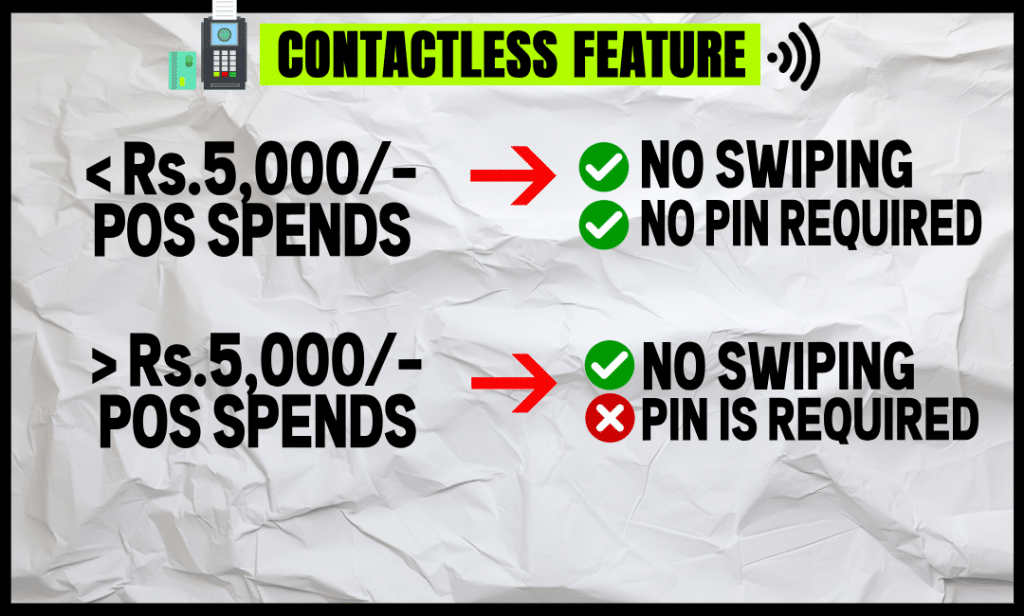

3. Contactless Card feature

The Kotak Indian Oil Credit Card comes with Contactless technology.

With this feature, in India, you can make payment using this Credit card at the Point of Sale (POS) Machine for a Maximum Payment of Rs.5,000/- per transaction without entering the PIN.

If you want to make a payment of more than Rs.5,000/-, then, this card holder should input the Credit card PIN to complete the payment.

4. Petrol / Diesel Benefit

By using this Credit Card, If you spend Petrol/Diesel between Rs.100-Rs.5,000/- in any Indian Oil fuel outlets across the country, then, a Fuel Surcharge will be charged. It may be around 1-3% of your Fuel Cost.

In case, you have paid these bills through this card, then, you will be eligible for a “1% Fuel Surcharge Waiver“.

The Maximum Fuel Surcharge waiver you get is up to Rs.100/- per statement cycle.

5. Concierge services

A Concierge service can be either an Individual or an organization that provides personalized assistance with different aspects like Managing households or providing chauffeur service for a price.

For Example,

A Staff member of the Hotel helps the accommodated guests in making reservations for tours, taking messages and delivering, securing luggage, etc., The Hotel staff member will provide all these services by charging some fee.

The Kotak Indian Oil Credit Cardholder can avail personal Concierge and assistance for the following

– Car rental and Limousine referral and reservation

– Flower Delivery

– Gift Delivery

– Golf reservations

– Movie ticket booking

– Restaurant referrals and bookings and many more

If this cardholder, wants to avail of concierge and assistance services, can Contact 1800-26-78729.

6. Personal Accident Insurance

This benefit is related to Personal Accident cover.

The IndianOil Kotak Credit Card also provides a Personal Accident Cover benefit to their cardholders with a coverage of Rs.2,00,000/-

7. Add-on-Card [Free]

If anyone in your family wants an add-on Credit Card, then, the Bank will provide you with a facility to set the Spend limit as per your desire and also allow you to track the spends you made through this add-on card separately.

Kotak Indian Oil Credit Card Eligibility:

Who is Eligible for Kotak Indian Oil Credit Card?

– The Primary applicant with a Minimum age of 18 years and a Maximum age of 65 years

– The add-on applicant should be aged above 18 years of age are eligible to apply for this card.

Kotak Indian Oil Credit Card Apply

How to Apply for Kotak Indian Oil Credit Card?

If you want this Credit card, you can easily apply for Kotak Indian Oil Credit Card.

Kotak IOCL Credit Card Charges [Must Read]

If you are applying for this Kotak Rupay Credit Card then looking at the benefits won’t help you, my dear friends. You should look at the charges as well.

The overview of the Top charges of the Kotak Indian Oil Credit Card is as follows.

| S.No. | Particulars | Description |

|---|---|---|

| 1 | Joining fees | Rs.449 + GST |

| 2 | Renewal fees | Rs.449 + GST |

| 3 | Cash advance charges | Rs.300/- |

| 4 | Interest charges | @3.50% p.m ; @ 42% p.a. |

| 5 | Late payment charges | Rs.0 – Rs.700/- |

| 6 | Over-the-limit charges | Rs.500/- |

| 7 | Foreign currency Markup | 3.50% of the transaction value |

1. Joining fees

If you want to use this Kotak Indian Oil Credit Card, then, on 1st year you will have to pay a Joining fee of Rs.449 excluding GST. With GST, you should pay Rs.530/-

2. Renewal fees

If you want to use this Kotak Indian Oil Credit Card from the second year onwards, then, you will have to pay a Renewal fee of Rs.449/- per year excluding GST. With GST, you should pay Rs.530/- per year.

If you have spent Rs.50,000/- in the previous year by using this credit card, then the Annual fee on this credit card of Rs.530 will be waived i.e. you are not required to pay the Renewal fee on this credit card in the next year.

If you are looking for a FREE Credit card, without Joining Fees and Renewal fees, then, you can check here.

3. Cash advance charges / Cash Withdrawal charges

You can Withdraw Money using this Kotak Rupay Credit Card but Don’t withdraw cash from any credit card.

If you withdraw money by using this Kotak Indian Oil Credit Card, a Transaction fee of Rs.300/- will be levied on all such Cash Withdrawals at ATMs. Such transaction fees would be billed to the Cardholder in the next statement.

It is my sincere and humble request for all the Credit Card users that Whatever the Credit card you use, you Please don’t make any Cash Withdrawals by using your Credit Card. Consider this as my Personal request.

A Small request to all

If you have an urgent cash requirement / Cash crunch, then I suggest you take a Personal Loan or Gold Loan.

Those are much better options.

In a Personal Loan, every month you pay the Principal amount + Interest as an EMI. The rate of interest for Personal Loans usually ranges from 15-20% p.a. on the higher side in most cases.

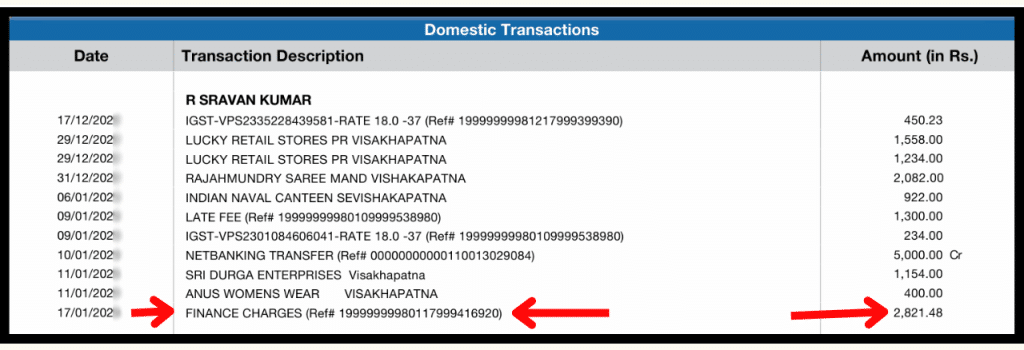

Apply Now4. Interest charges / Finance Charges?

Do you know how much interest you will be charged on this Credit Card?

You must know it, boss.!

For Example,

You have used this Indian Oil Credit Card and bought all the stuff you need.

But you don’t have enough money to pay the Credit Card Outstanding amount.

Then, the Federal bank will charge you interest @3.50% per month. It means the Annual interest the bank will charge is almost up to 42% per annum.

These finance charges won’t be stopped until you pay off your Credit Card’s outstanding balance in Full.

5. Late payment charges

Apart from Interest charges, if you delay paying this Kotak Rupay Credit Card Outstanding by 1 day, you will have to pay Penalty Charges on top of your Credit card Outstanding.

Generally, the Late payment charges range from a Minimum of Zero rupees to a Maximum of Rs. 700/- depending on your Credit card outstanding.

If your credit card outstanding balance is more than Rs.100/-, then you will attract Late payment charges.

| Credit Card Outstanding Balance is | Late payment charges |

|---|---|

| Less than Rs.100 | Nil |

| Between Rs.101-Rs.500 | Rs.100/- |

| Between Rs.501-Rs.10,000 | Rs.500/- |

| More than Rs.10,001 | Rs.700/- |

So if you use a credit card you have to be very organized and should deal with Credit card timelines properly.

6. Over Limit charges

If you spend more than the available limit on the credit card, that means you have overused your Credit card. In such a case, you will be charged with “Over The Limit charges”.

The more you spend than your Credit Card limit, the more you will be charged.

If you overused this Scapia Credit card than the given limit, then, you will be charged Rs.500/- rupees.

Kotak IOCL Credit Card Review

In my opinion, the IOCL Kotak Bank Credit card is designed especially for Indian Oil fuel spenders only. However, the maximum worth of Reward Points you can earn per statement cycle is INR 50 under the 5% category, for that you need to spend Rs.7,500 rupees. Here, the customer can get the benefit of 0.67%.

Coming to the IOCL 60 Liters of Free Petrol offer, the credit cardholder needs to spend a total of Rs.2,10,000 in a year. is not worth it., i.e. Rs.17,500 per month.

I found all other features mentioned above are not useful to credit cardholders except for Personal Accident cover. For taking the Personal Accident cover, no one will take a credit card.

Finally, for all the above-mentioned reasons, I’m not recommending this credit card to any category of people. Therefore please skip it.

Frequently Asked Questions

Still have any questions, Check the below Frequently Asked Questions for more clarity.

1. What is Kotak Indianoil Credit Card?

Kotak Indianoil Credit Card is a Co-branded Credit card launched by Kotak Mahindra and Indian Oil Corporation Limited (IOCL) to tailor to the needs of regular IOCL Fuel spenders.

This Kotak Mahindra Rupay Credit Card offers 4% as Reward Points on Indian Oil Fuel Spends, 2% Save on Grocery and Dining spends & 0.5% on all other spending.

2. Is Indian Oil Kotak Credit Card Rupay Card?

The Indian Oil Kotak Credit Card is a Rupay Credit Card. These cards are currently good for domestic use with lower processing fees.

3. Can I Link Phonepe in Kotak Rupay Credit Card?

As a Kotak Rupay Credit card is a Rupay Credit Card, the cardholder can link this Kotak UPI Rupay Credit card to their PhonePe.

4. Kotak Indianoil Credit Card Lounge Access?

The IOCL Kotak Credit card offers no Airport or Railway Lounge facility to its customers, as it is completely designed for Indian Oil Corporation Limited (IOCL) fuel spenders.

5. Is the Kotak Rupay Credit card Contactless card?

The Kotak Rupay Credit card comes with Contactless technology.

In India, you can make payment using this credit card at the Point of Sale (POS) Machine for a Maximum Payment of Rs.5,000/- per transaction without entering the PIN.

If you want to make a payment of more than Rs.5,000/-, then, this card holder should input the Credit card PIN to complete the payment.

6. Can we use Kotak Credit Card in petrol pump?

The Kotak Mahindra Bank customers can fuel their vehicles at fuel stations. Whenever you pay with your Kotak Credit card, you should be liable to pay a Fuel Surcharge i.e. around 1-3% of fuel cost. However, with this Kotak Rupay Credit card, you will be eligible for a 1% Fuel Surcharge waiver.

7. Does the Kotak Indian Oil Credit Card has Fuel Surcharge Waiver?

Yes. The Kotak Indian Oil Credit Card offers a Fuel Surcharge Waiver. If you spend Petrol/Diesel between Rs.100-Rs.5,000/- in any Indian Oil fuel outlets across the country, then you will be eligible for a 1% Fuel Surcharge waiver with a Maximum of Rs.100/- per statement cycle.

8. What is the Annual Fee of Kotak Indian Oil Credit Card?

If you want to use this Kotak Indian Oil Credit Card from the second year onwards, then, you will have to pay a Renewal fee of Rs.449/- per year excluding GST. With GST, you should pay Rs.530/- per year.

If you have spent Rs.50,000/- in the previous year by using this credit card, then the Annual fee on this credit card of Rs.530 will be waived i.e. you are not required to pay the Renewal fee on this credit card in the next year.

9. Kotak Indianoil Credit Card Lifetime Free?

If you want to use this Kotak Indian Oil Credit Card, then, on 1st year you will have to pay a Joining fee of Rs.449 excluding GST. With GST, you should pay Rs.530/-. Therefore, the Kotak Rupay Credit Card is not a Life-free credit card.

10. What is the Minimum Credit Score for Kotak Indian Oil Credit Card?

The applicants who are applying for the Kotak Indian Oil Credit Card should have a CIBIL Score of 750 or above.

11. Kotak Indianoil credit card reward points value?

For a limited time, the Kotak Bank Credit cardholder can redeem Reward Points as Instant Cashback at a rate of 1 Reward Point = Rs.0.25/- rupee worth.

12. How to redeem Kotak Indianoil Reward Points?

The Kotak Rupay Credit Cardholder can redeem reward points in any of 3 methods

1. Introductory Launch Offer – Cashback form

2. Kotak Rewards – Vouchers form

3. Indian Oil’s XTRAREWARDS Points – Cashback form

13. Kotak Indian Oil Credit Card Customer Care Helpline?

For any questions or concerns about Kotak Mahindra Credit Card, you can contact the below Customer Care helpline toll-free number 1800 266 2666

Thanks for your time, my dear folks 🙂