Now-a-days we use UPI’s like PhonePe, Google Pay for instant Money transfers. No matter how much we all use UPI’s, the need for UPI is same as the need for Banks.

By using UPI‘s, one can send an amount of upto Rs.1,00,000/- per day. But if want to send more than Rs.1,00,000/- in a day, then, you can do it through banks with either NEFT, RTGS or IMPS.

But for instant money transfers, the National Payments Corporation of India (NPCI) has announced New IMPS rules.

What are those New IMPS rules?

What are it’s limits and let’s find out the difference between the existing IMPS rules with the latest ?

Also, Let’s see how these new IMPS rules will be beneficial to the customers.

1. What is the New IMPS rule?

National payments corporation of india (NPCI) have newly announced latest IMPS rules and those rules are applicable from 1st February 2024. With the new rules, you can transfer up to Rs 5,00,000/- instantly from one bank account to another bank without adding beneficiary.

In case if you want to transfer below Rs 5,00,000/- from SBI to HDFC Bank or from ICICI bank to Canara bank or to any other bank, then, you can easily transfer it quite by IMPS.

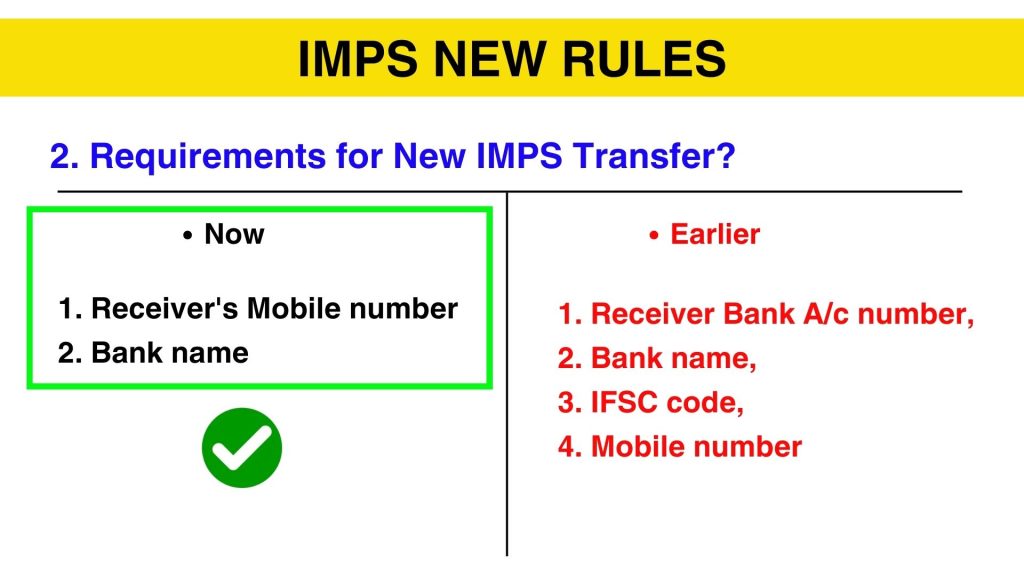

2. Required details to transfer money ?

I want to make IMPS transfer of Rs.4,00,000/-.

What details are required for the Sender ?

Old IMPS Rules:

If the sender wants to transfer money to the receiver, according to the earlier IMPS rules, IMPS transactions can be made on 2 basis.

1. P2A basis

Under this, the Beneficiary Account Number and IFSC code are required for successful IMPS transfer.

2. P2P basis

Whereas under P2P basis, an IMPS transaction can be done using Beneficiary’s Mobile Number along with MMID i.e. Mobile Money Identifier.

New IMPS Rules:

As per the New IMPS guidelines, all you have to do is that the Sender has to enter the Receiver’s Mobile number along with the Bank Name of the receiver i.e.to whom he wants to transfer money.

Once you enter it, all the receiver details will be displayed on the screen. Confirm the displayed details and you can successfully make IMPS transfer.

Likewise just by filling 2 details, you can easily make IMPS transfers.

Simply, when you transfer money to a New beneficiary, you can transfer money instantly without adding him/her.

Earlier, you had to enter the Receiver Bank Account number, Bank Name, IFSC code, Mobile number and you used to transfer the money then the IMPS transfer was complete.

According to the revised IMPS rules, if you enter Receiver Mobile number and Bank Name, the IMPS payment will be completed.

3. How does IMPS works?

Before making IMPS Transfer, the Sender needs to map the Default MMID of the Receiver bank with the Sender MMID.

MMID stands for “Mobile Money Identifier”. By mapping the sender and receiver MMID, banks can easily track the receiver’s identification.

The new IMPS services will be available in Mobile banking, Internet banking, Bank branches, ATM’s, SMS, IVRs channels. So the New IMPS feature is available in these channels from 1st February 2024 itself.

Also Read: IMPS Limit | IMPS Charges | Features [Complete Details]

4. Two Bank accounts are linked to the Same Mobile number ?

I wants to transfer Rs.3,00,000/- to my friend. But his Mobile is linked with two bank accounts/ What should I do now..?

In such a case, the money will be transferred to the Receiver’s Primary / Default account. Then, money transfer will be done.

In case the receiver does not select any of the option then, there is a chance of transaction failure or rejection.

Thanks for your time 🙂