You will transfer money to your Friends or Family. To transfer money from one bank account to another, We use different modes of transfer like NEFT, RTGS, and IMPS. You might have heard about these 3 terms.

We had published articles on NEFT and RTGS, if you have not read give them a try.

In this article let’s discuss completely about IMPS.

Let’s get started..!!

IMPS Meaning

IMPS stands for “Immediate Payment Service”.

IMPS was launched by the National Payments Corporation of India (NPCI) in 2010 to facilitate instant money transfers between banks and customers.

IMPS enables individuals and businesses to transfer funds from one bank account to another in a secure and efficient manner.

How IMPS works?

If you want to Transfer money from one bank account to another bank instantly within seconds, then you can go with the IMPS mode of transfer.

How much time does it take to complete my IMPS transfer?

It takes zero waiting time to process your IMPS transfer. The second when you completed the IMPS transfer from the Sender account, the beneficiary account will be credited within Seconds.

Why IMPS started?

A lot more people might doubt that as we have other modes of transfer like NEFT and RTGS, then what is the need of initiating IMPS?

The Indian banking industry has faced certain challenges in making Inter-bank fund transfers till the year 2010.

The reason is that the existing electronic fund transfers like NEFT and RTGS should be operated during banking hours only. It is the main constraint to send money beyond banking hours.

It was the main drawback point at that point of time for both NEFT and RTGS. That loophole created an opportunity to implement a new mode of transfer to transfer money beyond banking hours i.e. IMPS mode of transfer.

Then, what NPCI has done.!

As NPCI observed that there is a challenge to make a fund transfer after banking hours, they conducted a pilot study with 4 banks i.e. State Bank of India (SBI), Bank of India, Union Bank of India (UBI), ICICI banks and designed a new Mobile Payment system in August 2010.

Later on, 3 more banks i.e. Yes Bank, Axis Bank, and HDFC Banks also participated in this designing process.

Finally, in November 2010, the Deputy Governor of the Reserve Bank of India (RBI) Smt Shyamala Gopinath officially launched the IMPS mode of Transfer.

Key features of IMPS

1. Instant Transactions: IMPS enables the immediate transfer of funds in real-time and the recipient’s or beneficiary account will be credited, typically within seconds.

2. 24/7 Availability: IMPS generally operates round the clock i.e. 24 x 7 Unlike traditional banking hours including weekends and holidays, which ensures maximum convenience for users.

3. Mobile-Friendly: IMPS transactions can be initiated through mobile devices like smartphones or feature phones and making it accessible to a large number of users.

4. Multiple Options: IMPS transactions can be conducted through various modes and channels, including Mobile banking apps, Internet banking portals, ATMs, or by visiting a Bank branch.

5. Secure and Prompt: IMPS utilizes secure authentication methods to guarantee the safety of transactions. The immediate fund transfer feature makes it ideal for urgent or emergency situations.

6. Recipient Registration: Prior to initiating an IMPS transfer, users are required to register the recipient’s bank account details, such as the account number and the Indian Financial System Code (IFSC).

7. Extensive Coverage: IMPS is widely available across most banks in India, making it a widely accepted mode of fund transfer.

How to do IMPS ?

IMPS can be done either Online or Offline.

You can use this IMPS mode of transfer in Internet Banking or Mobile Banking in Online. Whereas, in offline, you can make IMPS transfers through ATM Machines.

IMPS Limit

IMPS is meant for Immediate and Instant money transfers only. The Minimum and Maximum limits for IMPS transfers are as follows.

Minimum Limit

The Minimum IMPS limit to make a transfer is Rs.1/- only

Maximum Limit

The Maximum IMPS limit to make a transfer changes from bank to bank.

SBI IMPS Limit

The Maximum limit to transfer through IMPS is Rs.5,00,000/- per day.

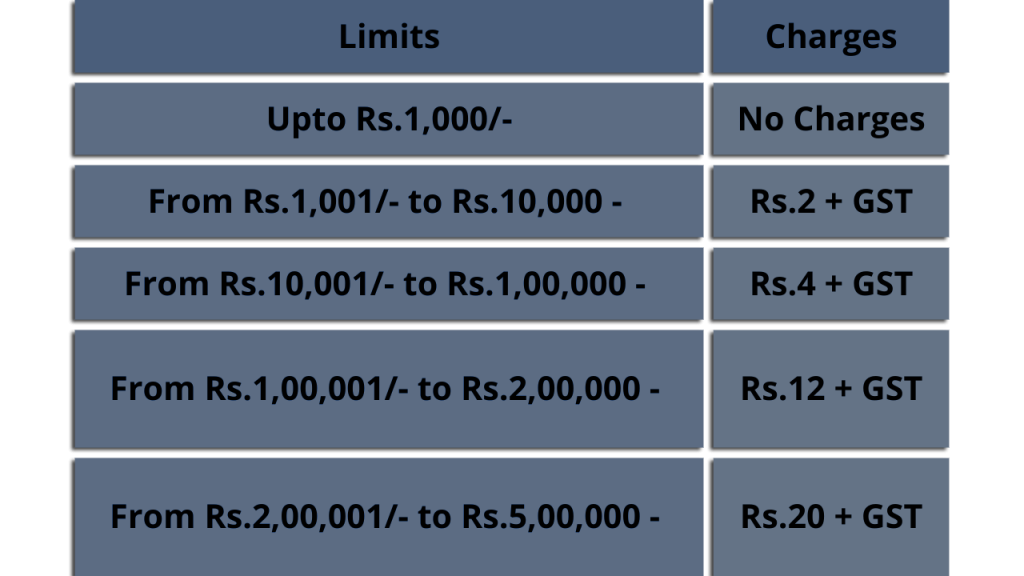

IMPS Charges

IMPS charges for Online SBI of Internet banking / Mobile Banking are as follows

> For IMPS Transfers up to Rs.5,00,00 rupees, It is Free. No charges will be leviable.

Offline SBI IMPS charges

In case, if you want to make an IMPS transfer, it is advisable to make it Online.

Mandatory details for IMPS Transfer

To make an IMPS transfer, the Mandatory details required are as follows

- Beneficiary Name

- Beneficiary Account number

- Beneficiary IFSC code

Can I make a money transfer without Beneficiary Name, Account number, and IFSC?

Yes. You can transfer money without Beneficiary Name, Account number, and IFSC using Mobile Money Identifier (MMID)

To whom IMPS is the beneficiary?

IMPS (Immediate Payment Service) mode of transfer is beneficial for various types of users due to its speed, convenience, and accessibility. IMPS is a real-time interbank electronic fund transfer service in India that allows customers to transfer funds instantly and securely.

1. Individuals: IMPS is mostly beneficial for individuals who want to make money transfers instantly to their friends, family, or other individuals. It is often used for emergency payments, for gifting to others, or for any financial transaction.

2. Merchants: Both Businesses and Merchants can use IMPS to receive their payments from their customers in real-time. It can be especially useful for small businesses, service providers, and vendors who want to offer a seamless payment experience to their customers.

3. Bill Payments: IMPS can be used for different bill payments like For paying Utility bills, Credit card bills, and other recurring payments. Those who prefer to make instant payments without the hassle of going to payment centers or dealing with delayed transactions IMPS is the most convenient mode.

4. Online Shopping: For their online purchases, E-commerce platforms may also offer IMPS as a payment option for customers who want to make immediate payments.

5. Travelers: IMPS can be useful for travelers who need to transfer money to their accounts or someone else’s account quickly while on the move or in an emergency.

6. Financial Institutions: IMPS is used by banks and financial institutions to facilitate instant fund transfers for their customers.

7. Overall, IMPS is beneficial for anyone who values real-time fund transfers and requires a quick, secure, and efficient mode of payment. It’s particularly advantageous in situations where time is of the essence or when immediate access to funds is necessary.

Thanks for Reading 🙂