Did you hear IFSC and SWIFT code..!!

We generally use these 2 Words in banking while making Money transfers.

The Money can be either transferred either within India or outside India. Let’s find out in this article, Is IFSC code and SWIFT code same and the purpose for which these terms will be used.

SWIFT (Society for Worldwide Interbank Financial Telecommunication) Code are two different systems used for Funds transfer, but they serve different purposes and are used in different contexts.

IFSC

The term IFSC full form is the “Indian Financial System Code”.

IFSC is used for domestic funds transfer within India. It is an Alphanumeric Code that identifies a bank branch. The Reserve Bank of India (RBI) assigns an IFSC code to each branch of every participating bank.

IFSC is widely used for Electronic fund transfer systems like National Electronic Funds Transfer (NEFT) and Real Time Gross Settlement (RTGS)

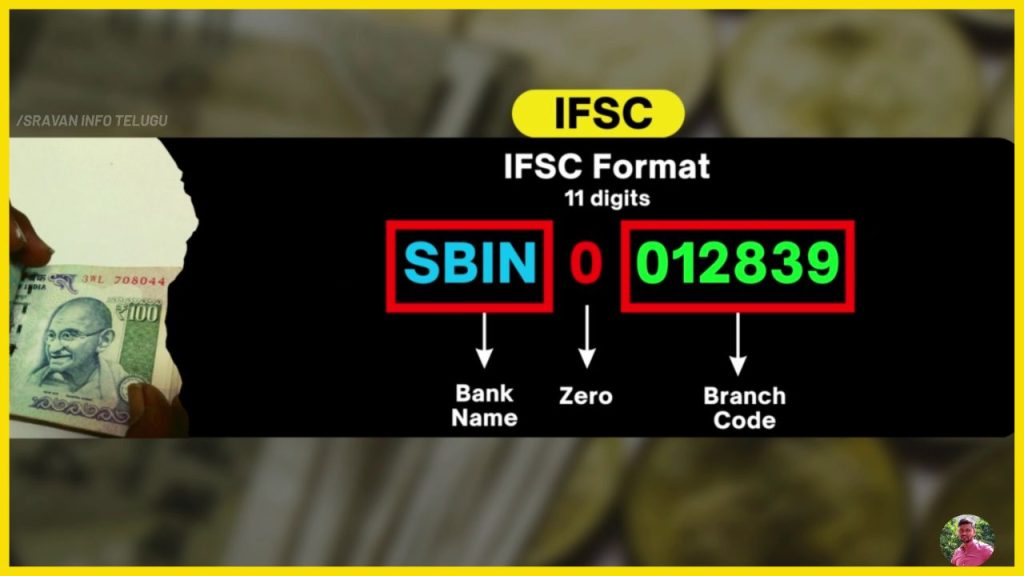

IFSC Code Format:

1. The IFSC code is comprised of 11 characters.

– The First 4 characters indicate the Bank’s name,

– The 5th character is always – ‘0’ &

– The remaining 6 characters specify – the Branch Code.

2. For Example, ICIC0001234,

– “ICIC” stands for the ICICI Bank,

– “0” serves as a Control Character &

– “001234” denotes the ICICI Bank branch.

SWIFT:

The term SWIFT code stands for “Society for Worldwide Interbank Financial Telecommunication Code”.

SWIFT code is used for International funds transfers. It is a standard format code that uniquely identifies a particular bank worldwide. SWIFT codes are essential for secure and efficient cross-border transactions. SWIFT code also known as a Bank Identifier Code (BIC).

The SWIFT code is comprised of either 8 or 11 characters.

For Example,

An 8-character SWIFT code looks like this “ABCDUS33”.

On the other hand, an 11-character SWIFT code with a branch extension would look like this “ABCDUS33XYZ”.

– The First 4 characters of the SWIFT code indicate – Bank’s name.

– The following 2 characters indicate – Country and

– The Last 2 characters identify – Location of the bank’s primary office or Headquarters.

In some cases, a three-character extension (XXX) can be added to specify a particular branch of the bank.

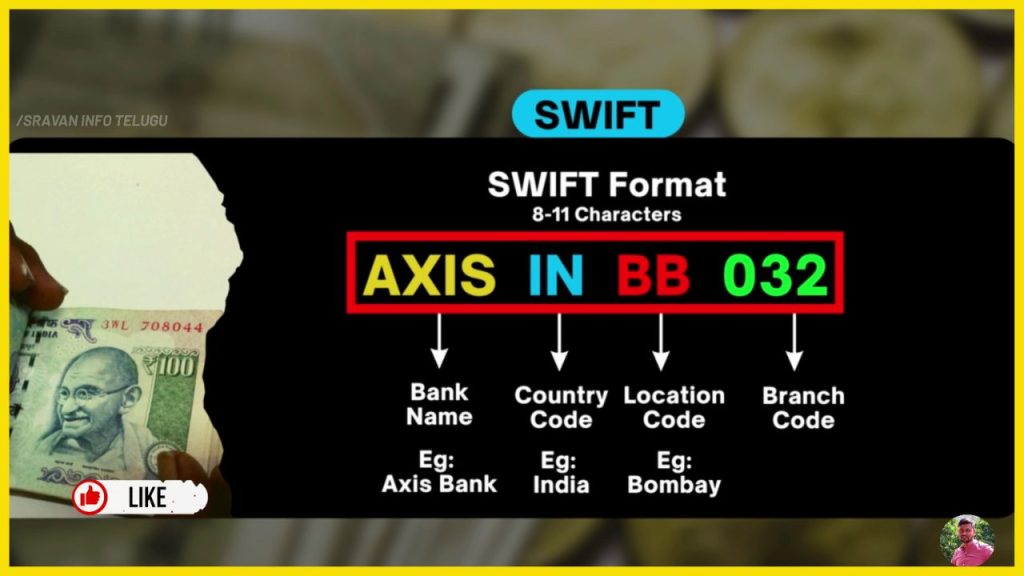

Swift Code Format:

To understand clearly, let’ see the Example SWIFT code of AXIS Bank.

1. Bank Code: First four letters of “AXIS”, represent your Bank Name, that too in short form.

2. Country Code: The next two characters of “IN” represent the country in which the bank is located.

3. Location code: The next 2 characters of “BB”, can be anything either characters/numbers. It represents your Bank headquarters / Main office location.

4. Branch code: Last 3 digits will also identify your bank branch.

Eg: AXIS-IN-BB-032

Thanks for reading 🙂