Do you have extra money to Save in Fixed Deposits?

Are you thinking to deposit Money in State Bank of India ?

Then, in this article, I will show you How to Open Fixed Deposit in SBI up to R.1 Crore rupees online through SBI Internet banking easily.

Let’s get Started..!!

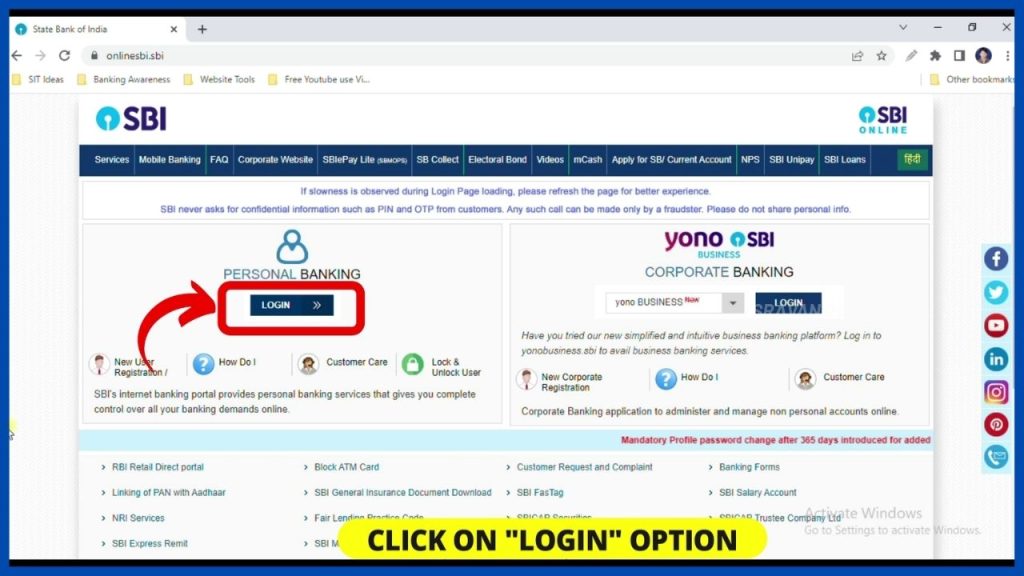

Step 1:

To open your Fixed Deposit, firstly, Open any Internet browser like Google Chrome. Then, type “www.Onlinesbi.sbi” in the address bar/search bar and Press “Enter”.

Step 2:

After that, click on the “Continue to Login” option under the Personal Banking category.

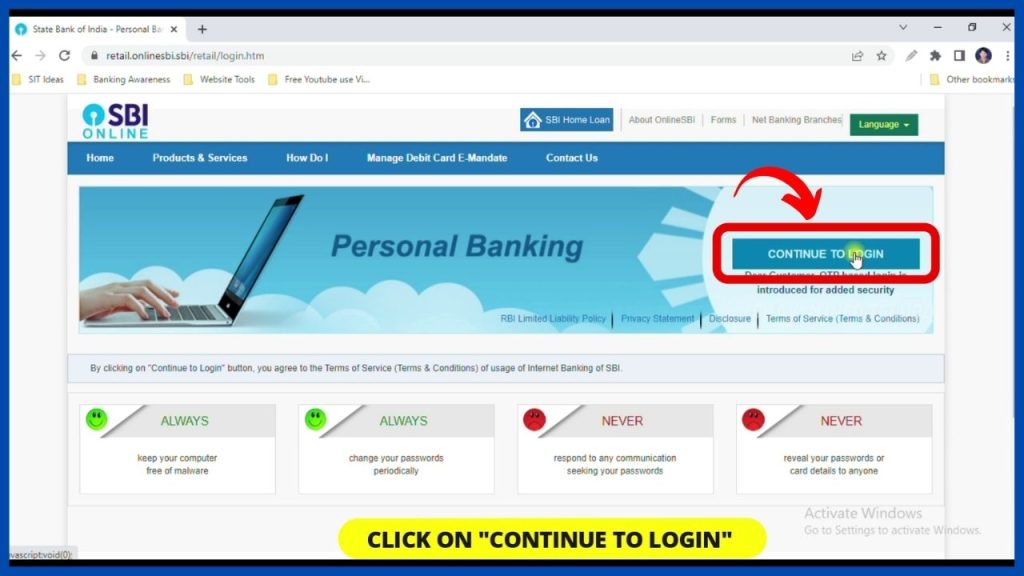

Step 3:

Now, you click on “Continue to Login”.

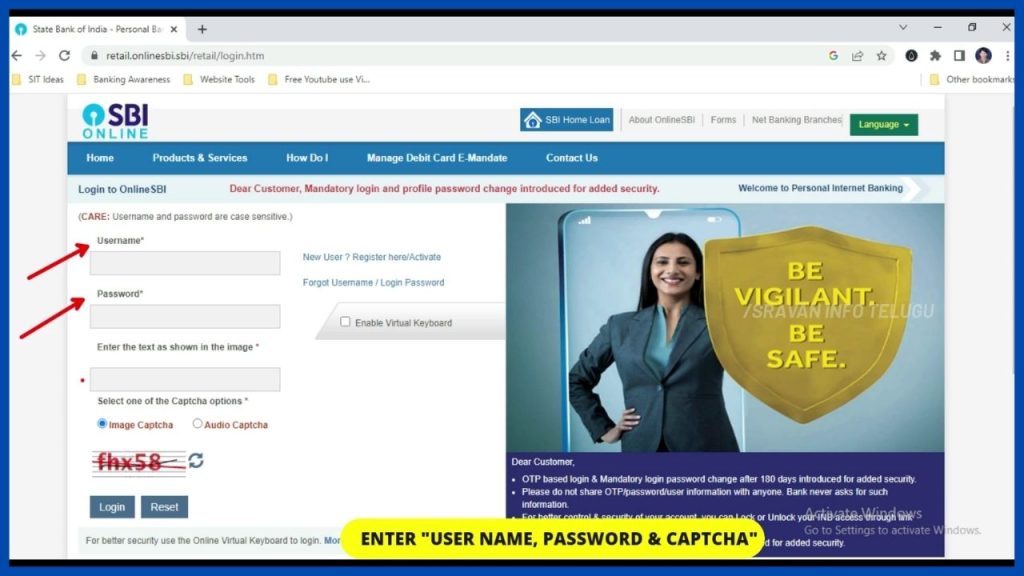

Step 4:

Later on, you enter your SBI Internet Banking User name, Password & Captcha and Click on the “Login” button.

Note: Be careful while entering the logins, otherwise there is a chance that your SBI Internet banking will be blocked.

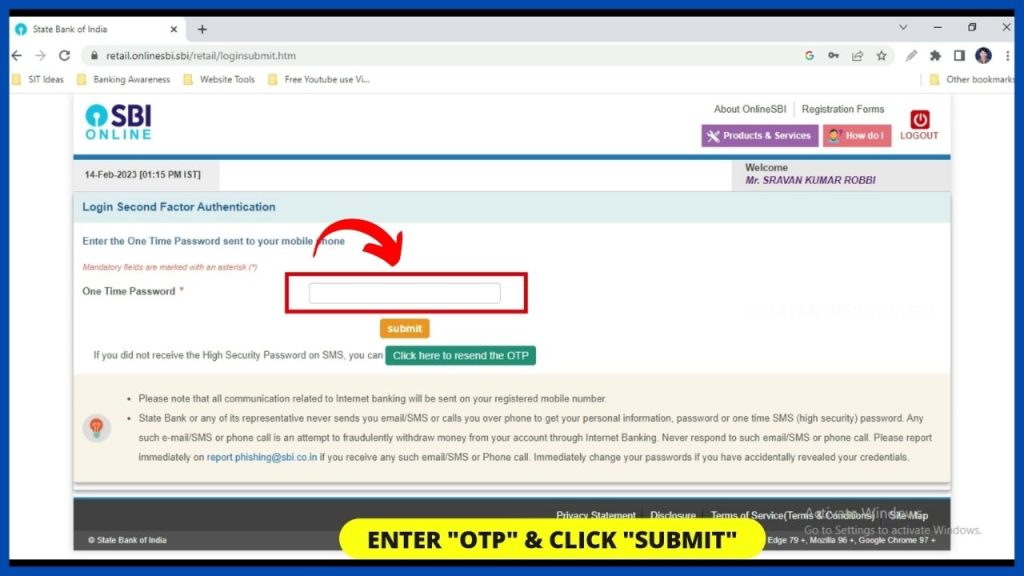

Step 5:

Now an “OTP” will be sent to your registered mobile number, Enter it and click on the “Submit” button. As soon as you click on it, your SBI Internet banking dashboard will open in 3-4 seconds.

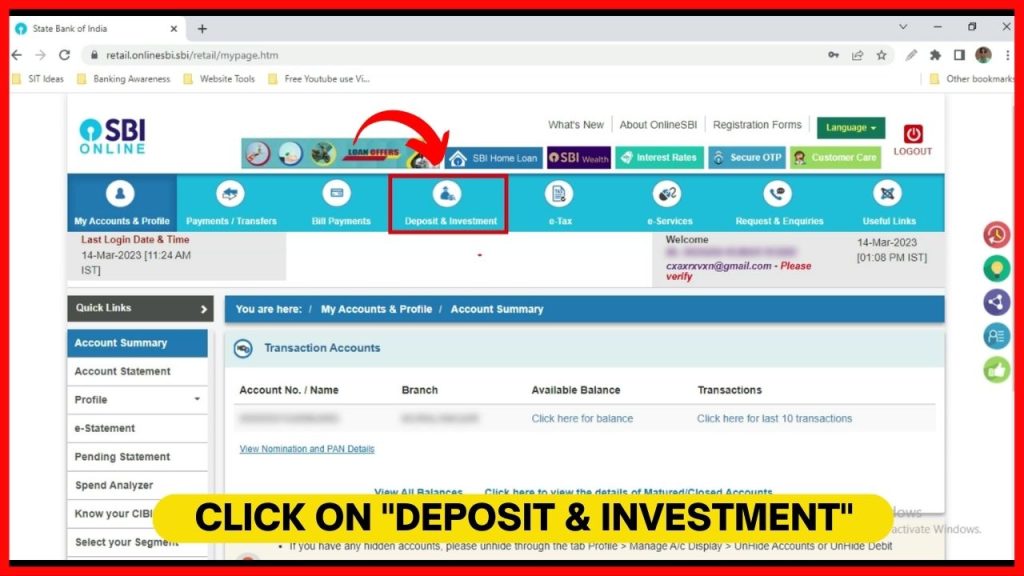

Step 6:

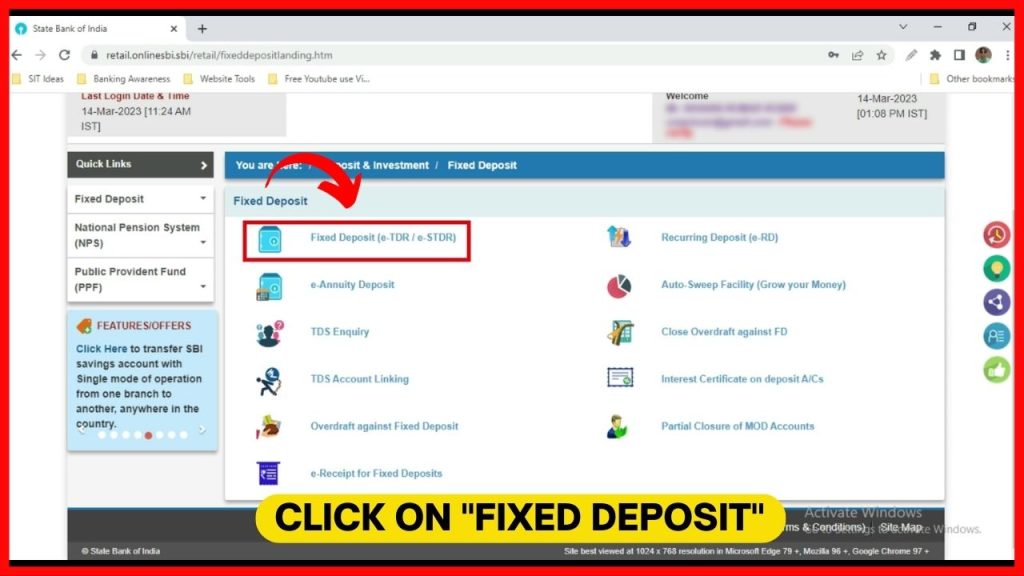

Now for opening a Fixed deposit in an SBI account, Click on “Deposits & Investments”

And Select the 1st option “Fixed deposit”. After that, Click on the “Fixed deposit E-TDR / E-STDR” option.

Step 7:

Here you need to know the difference between TDR and STDR.

TDR stands for “Term Deposit Receipt” and STDR stands for “Special Term Deposit Receipt”.

Simply, if you are depositing a Fixed Deposit (FD) for a short time period, then you have to select the TDR option. In which, you can open a fixed deposit for a period ranging from 7 days to 10 years.

In the case of STDR, you cannot invest for the short-term period, you need to hold the investment for a Minimum period of 180 days and up to a Maximum of 10 years.

Step 8:

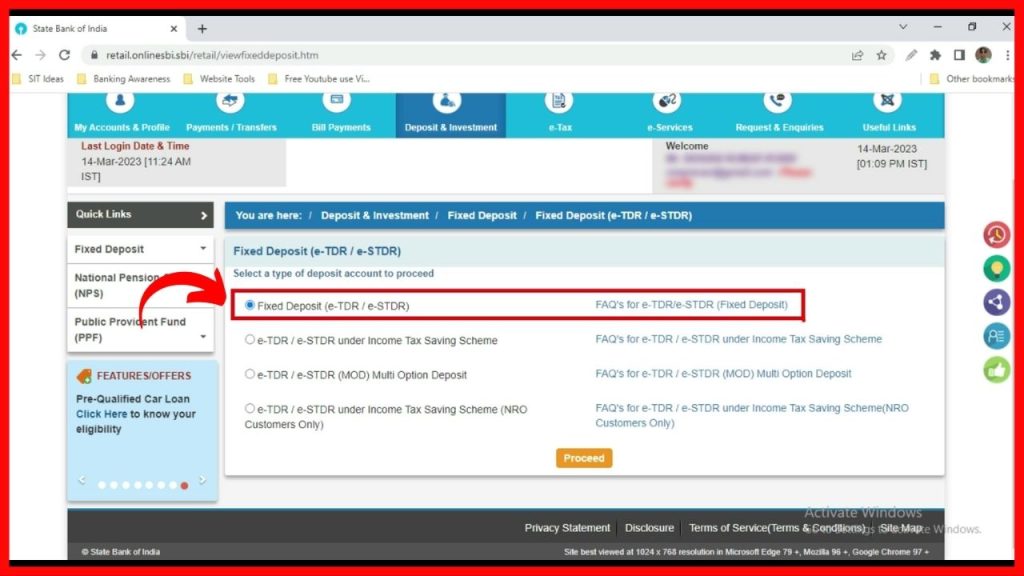

Now you will get 4 options to open your Fixed Deposit in SBI.

1. Fixed deposit (e-TDR /e-STDR)

In this, you can open your Fixed Deposit for a period of less than 5 years.

2. e-TDR /e-STDR Under Income Tax Savings Scheme

In this option, you have to hold your Fixed Deposit for at least 5 years.

3. e-TDR /e-STDR Multi option deposit (MOD).

In this option, you can open both Term deposit and Special Term Deposit (STD). Whereas, the tenure starts from year 1 and lasts up to 5 years.

4. e-TDR /e-STDR Under Income tax savings scheme for NRO’s

Those Non-residents of India (NRI’s) who hold an account called Non-Resident Ordinary (NRO’s)

Step 9:

Now, if you want to make a short-term fixed deposit for a period of less than 5 years, then, select the 1st option of “Fixed deposit”

And click on the “Proceed” button.

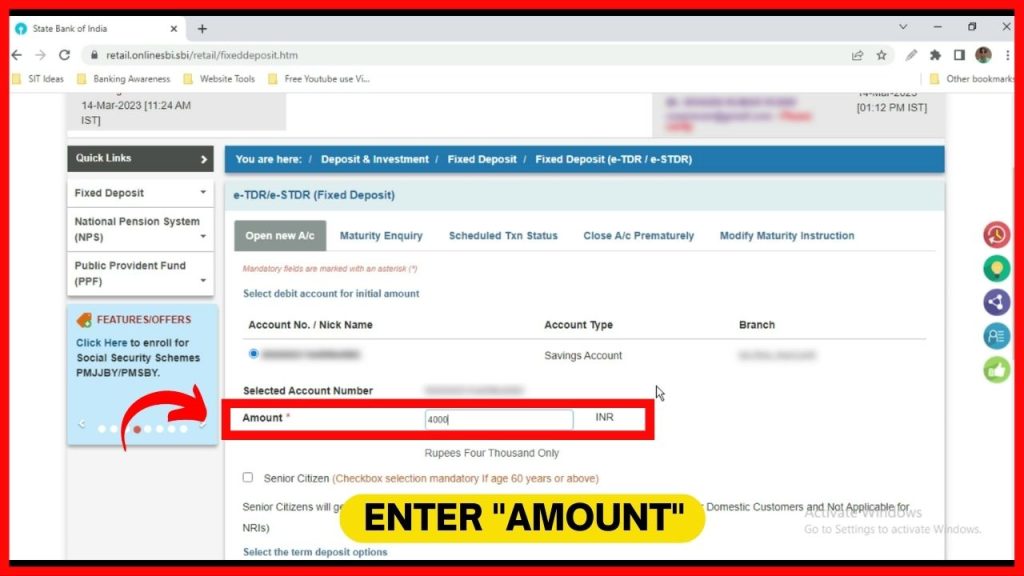

Step 10:

Here the account number from which you want to create a Fixed Deposit will be selected as default. Now, in the “Amount” column, enter the amount you want to make as FD.

Here through TDR or STDR, you can deposit a Minimum amount of Rs.1,000/- and a Maximum of Rs. Up to 1 crore.

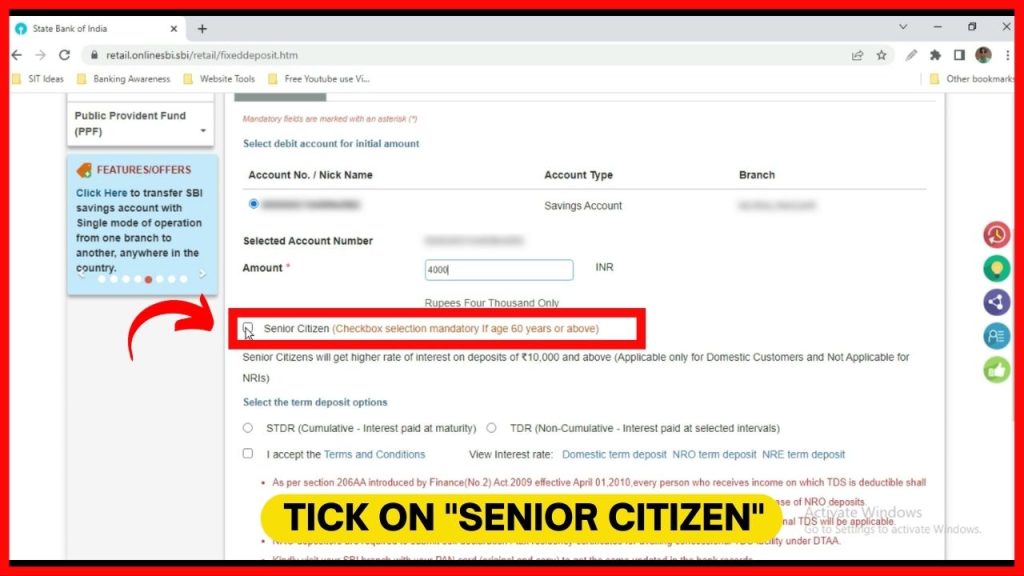

Step 11:

If you are a Senior Citizen (i.e.Aged 60 years or more), then put a Tick on to get additional interest. If you are not a Senior citizen i.e. less than 60 years aged person, then, skip this option.

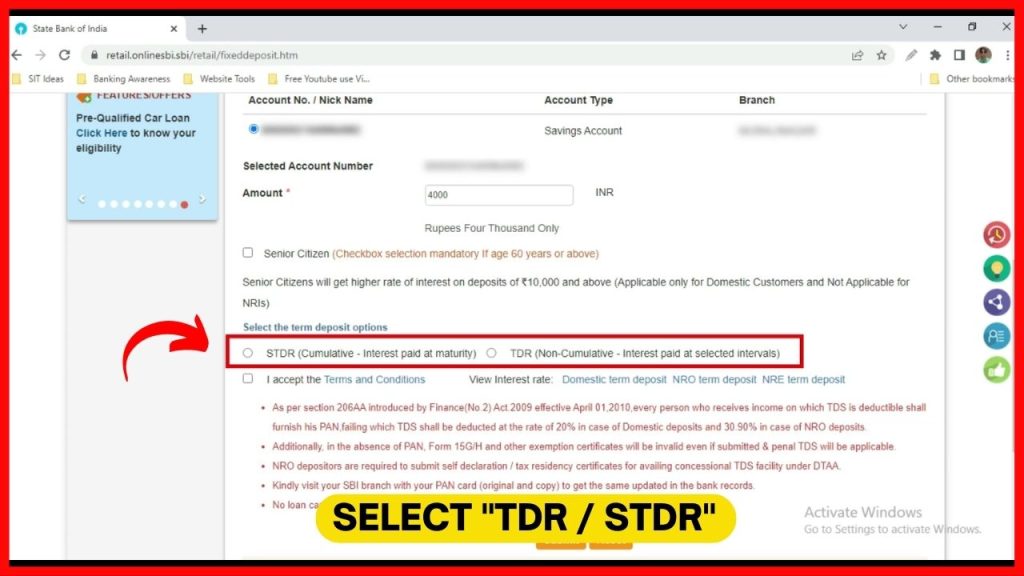

Now you should select your FD option.

In the case of STDR, you will be paid Cumulative interest for your FD Maturity time. Select this option if you are planning to deposit for the Long term period, so you will get more interest.

In the 2nd Option of TDR, If you are planning for Short term period, you can select it.

In this option, the Interest payment will be made on a Non-cumulative basis. So you will get less interest as compared to STDR.

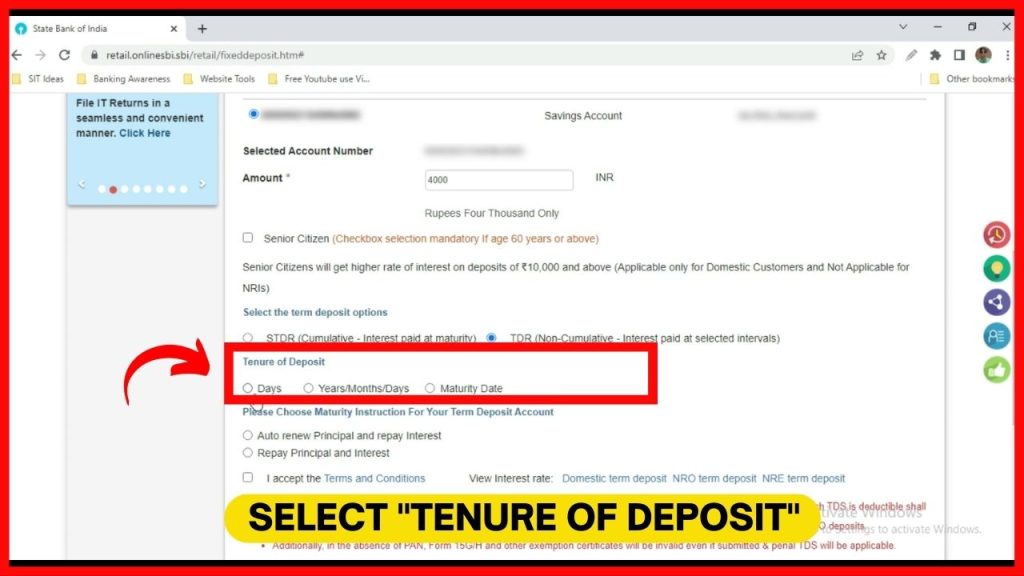

Step 12:

Now select the “Tenure of Deposit” i.e. for how long you want to hold your FD. It may be in Days, Month, Maturity date. Select any one of three.

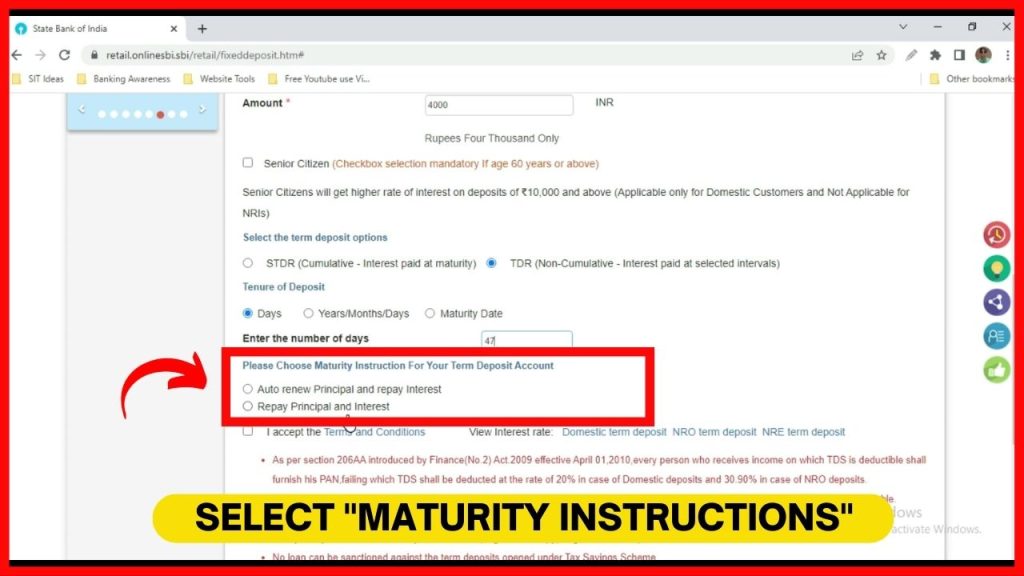

Step 13:

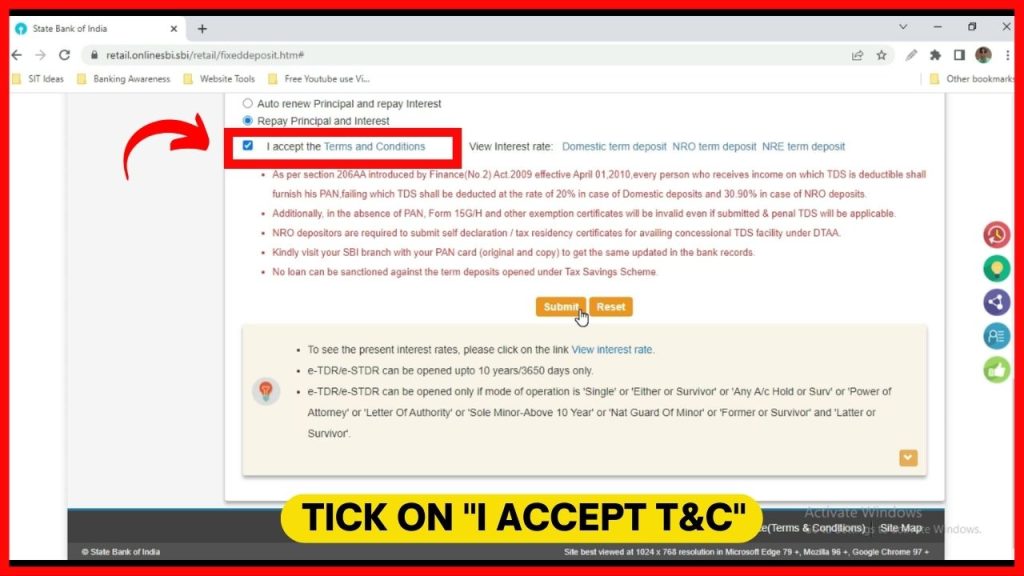

After that, you have to select “Maturity instructions”. If you want to renew your Fixed Deposit Principal amount at maturity time, then, select the “Auto Renewal Principal and repay interest” option, otherwise select “Repay Principal & Interest”.

Select “I Accept the Terms and Conditions” and click on the “Submit” button.

Step 14:

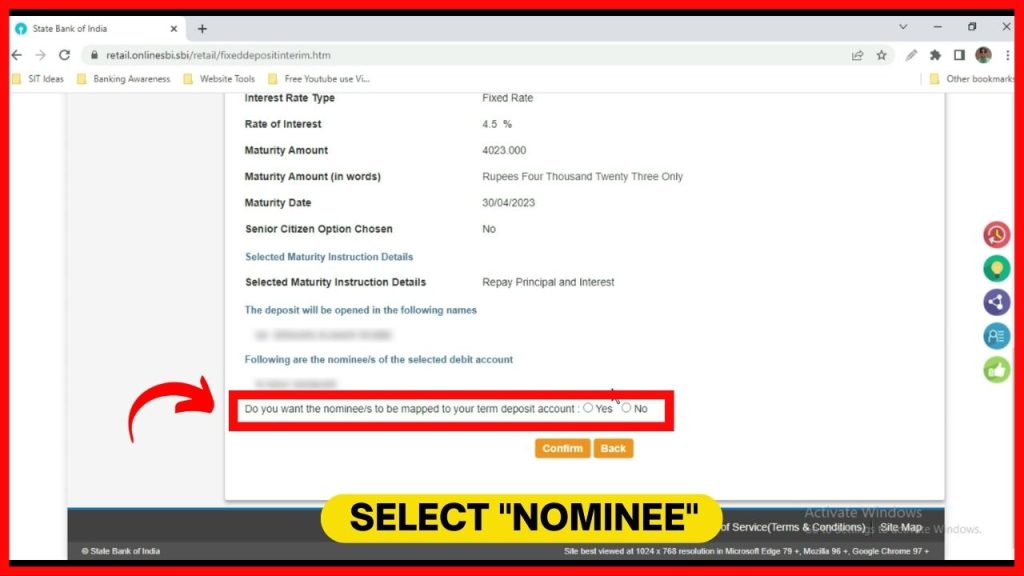

After that, depending on the details you have filled in, all your FD details will appear and if you want Nominee details to appear on your FD, select the “Yes” option, otherwise Select “No”.

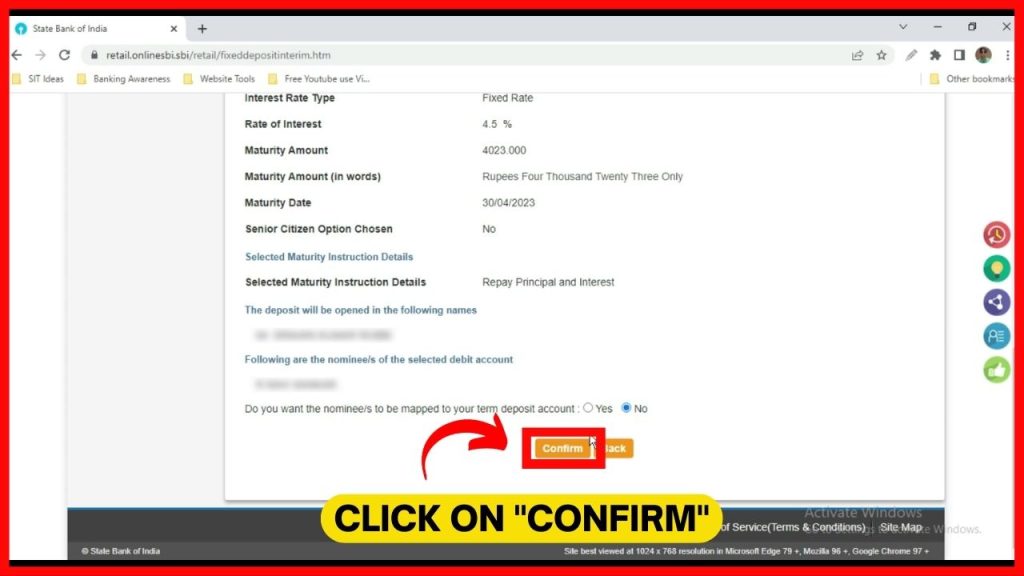

If all the details are OK, then, click on the “Confirm” button.

Step 15:

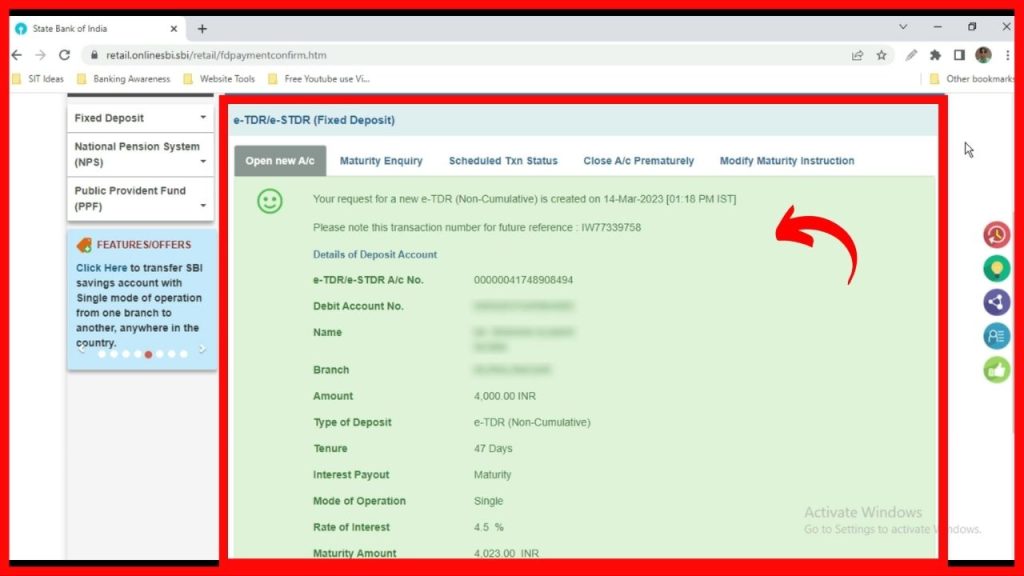

After clicking on that, you will get a message that “Your E-TDR Fixed deposit has been successfully created”.

Thanks for Reading 🙂