Generally in India, Permanent Account Number (PAN) card will be issued by 3 departments.

- Income Tax (IT) Department

- National Securities Depository Limited (NSDL) and

- Unit Trust of India Infrastructure Technology And Services Limited(UTIITSL)

In order to Download your PAN card online, firstly you need to check who issued your PAN card.

How would I know that..?

The PAN card issued authority is generally displayed on the back side of your PAN Card. In my case, the issuing authority is UTIITSL.

In this thread, if your card is also issued by the UTIITSL authority, then, we will see “How to download PAN card from UTIITSL” easily.

Let’s get started to learn PAN card download online..!!

Click on the below link to Watch it in Telugu

Step 1:

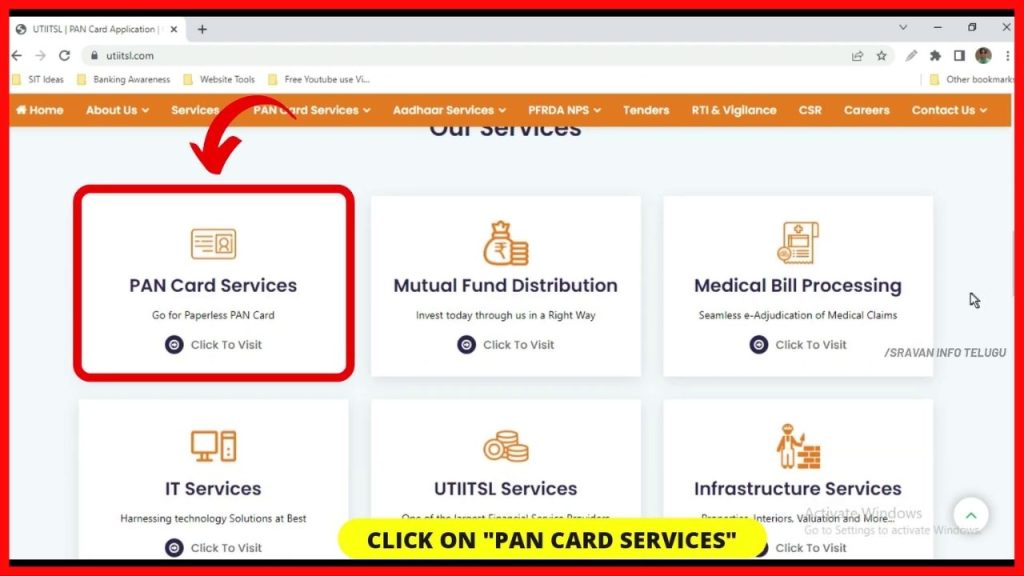

Visit UTIITSL Website to download pan card online.

Step 2:

Now, if you come to the little bottom, it shows the “Our Services” section, and Click on “PAN card Services”.

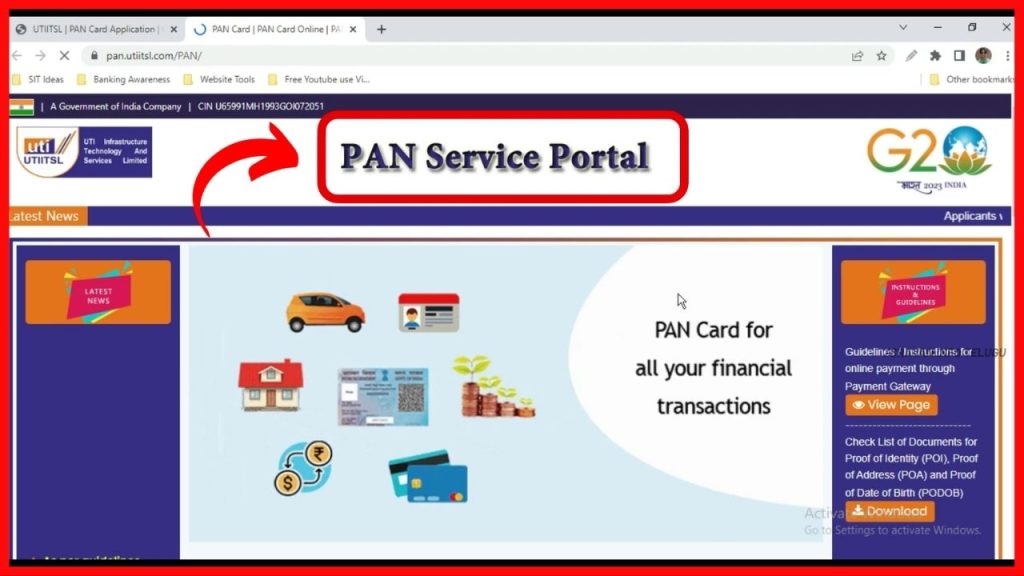

Then a new page of the “PAN service portal” will be opened.

Step 3:

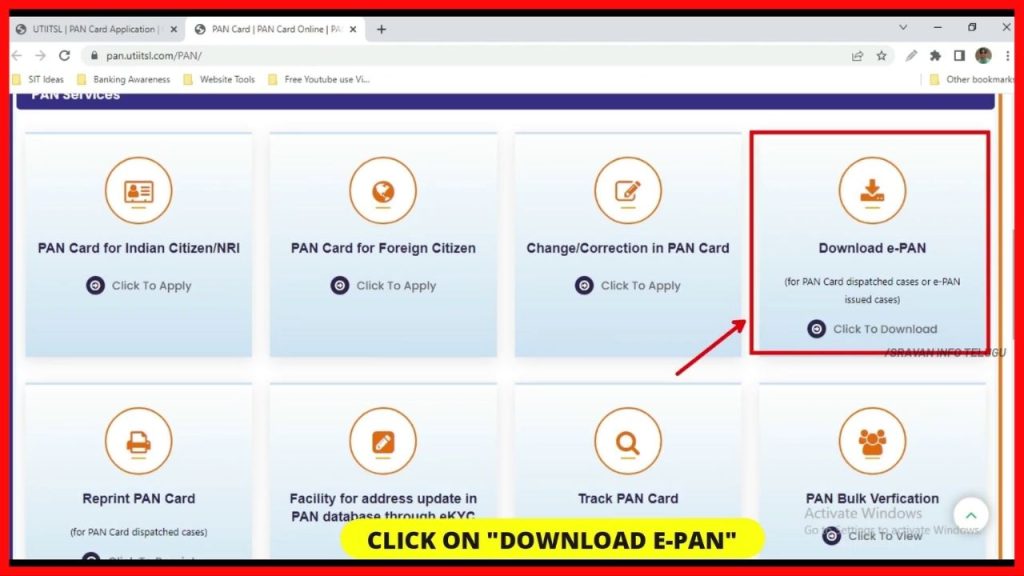

If you scroll down a bit again, there you can see the “PAN Services” section.

If the PAN card has already been dispatched to you or PAN has already been issued to you, then, click on the “Download E-PAN” option to download your PAN card.

Step 4:

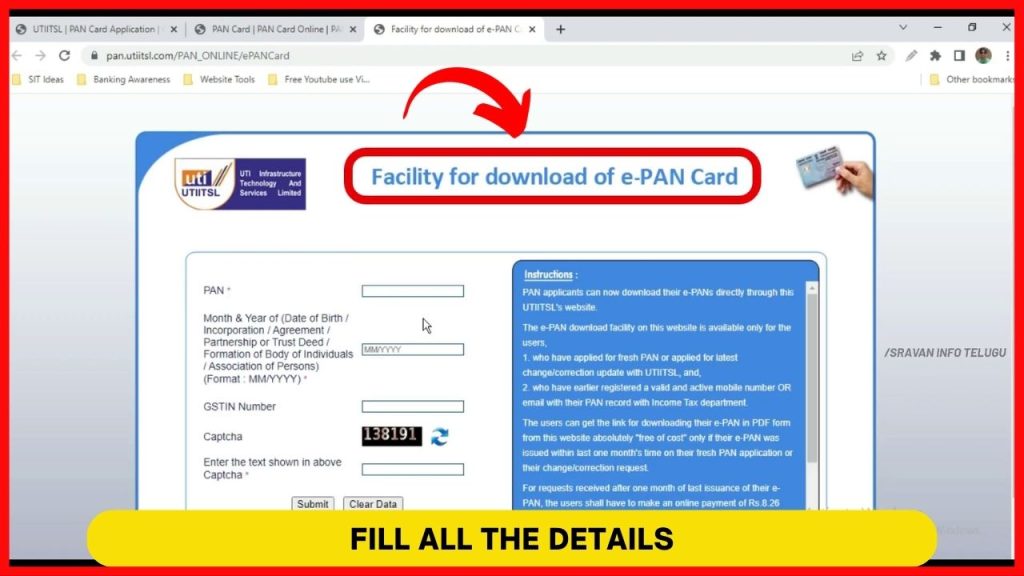

Once you click on that, another new web page “Facility for download of e PAN card” will be opened in a sky blue color.

Here, For the PAN card download onlineyou need to enter the below details

- PAN Number: It is a 10-digit Alpha Numeric number.

- Date of Birth: It is to be entered in the format of MM/YYYY.

It means you need to enter the Month of birth in 2 digits format and the Year of birth in 4 digits. - GSTIN Number: The GST number is optional only. You can simply skip this.

- Captcha: Enter the Captcha as shown above and click on the “Submit” button.

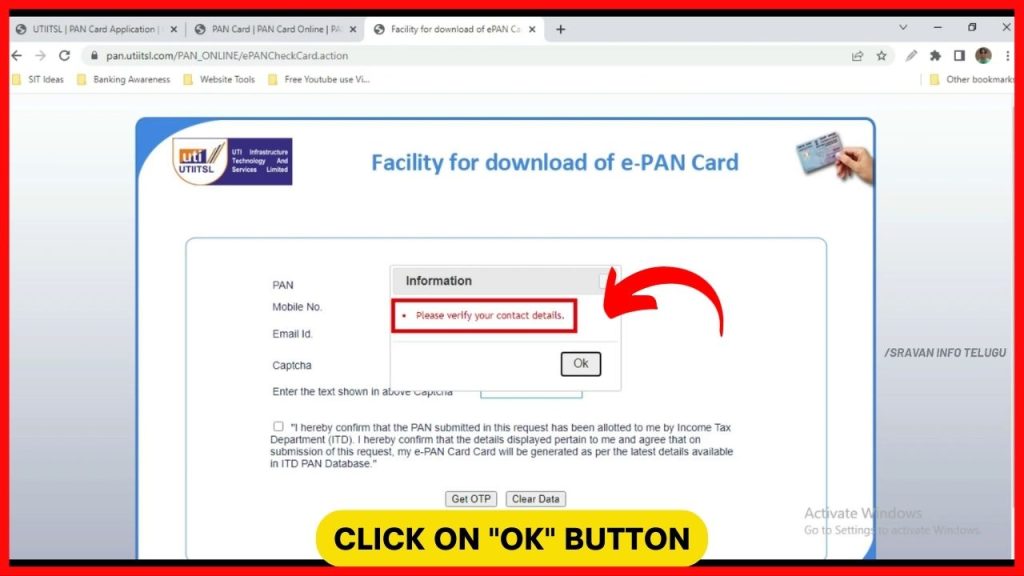

Step 5:

After clicking on that, a Popup message will be displayed that says “Please verify your contact details”. Click on the “Ok” button.

Now your PAN Number, Mobile number, E-Mail ID will be displayed.

If the displayed details are correct, then enter “Catcha” and Tick on the acceptance to confirm that the PAN details are yours, and Click on “Get OTP”.

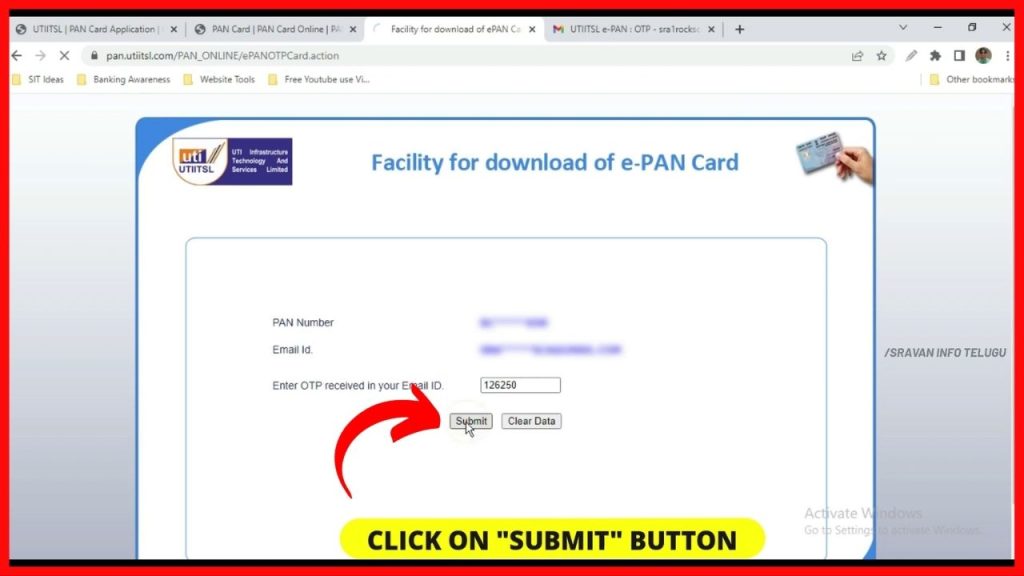

Step 6:

Once you click on that, another pop-up message will be displayed that says “OTP is send on your email”. Click on the “Ok” button and enter the 6-digit OTP received on your registered Mail ID and click on the “Submit” button.

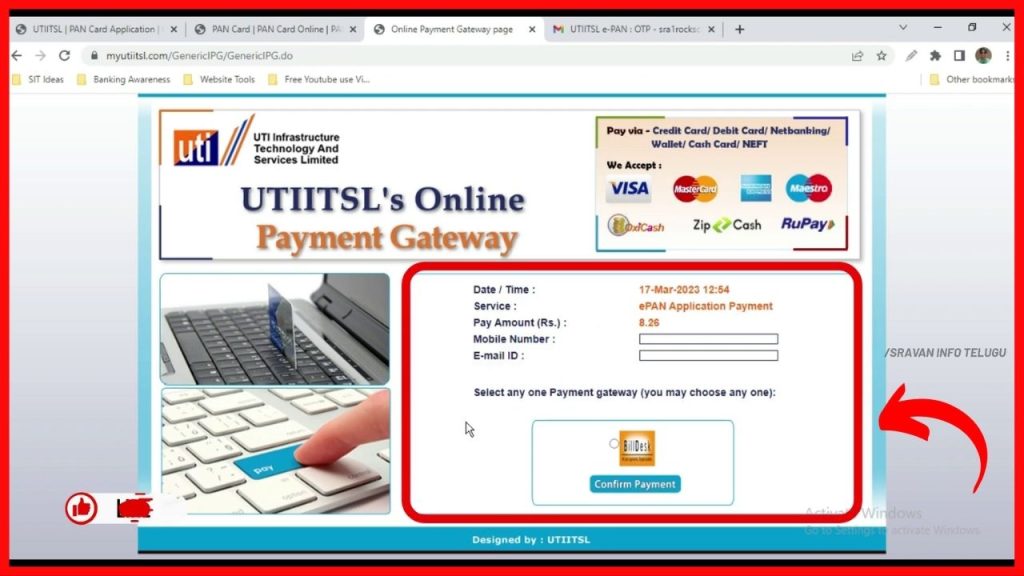

Step 7:

After clicking on that, the UTIITSL Online Payment gateway will be opened. It shows

1. Date /Time: The date and time of the Transaction

2. Service type: E PAN Application Payment

3. Pay amount: An amount of Rs.8.26/- to download your PAN card. To pay this amount of Rs.8.26/-, Enter your Mobile number and Email ID. And select “Billdesk” option at the bottom and click on “Confirm payment”

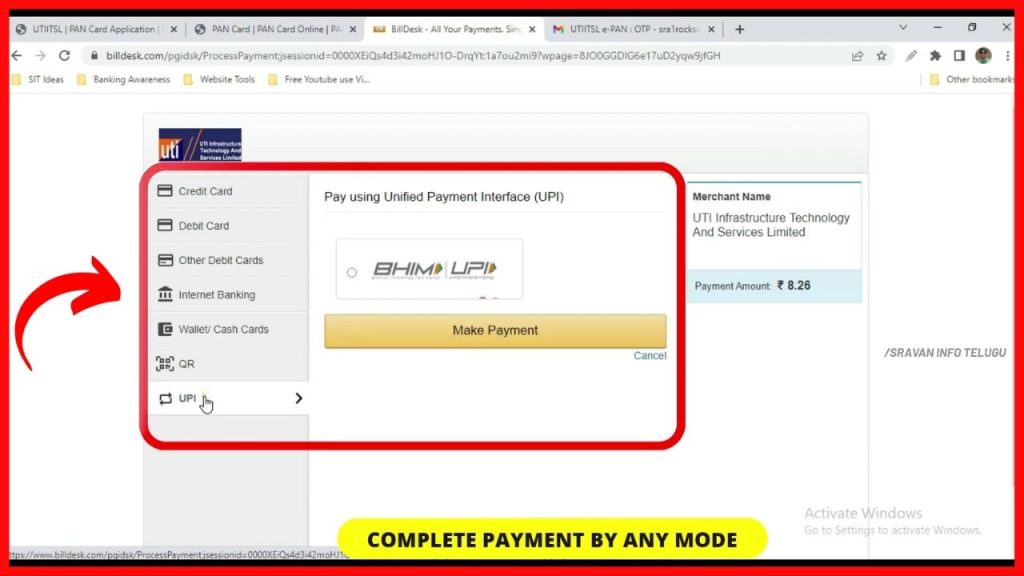

Step 8:

Now different payment options will be displayed to you like Debit cards, Credit cards, Internet banking, Wallets, etc. Complete the payment through any payment option.

Step 9:

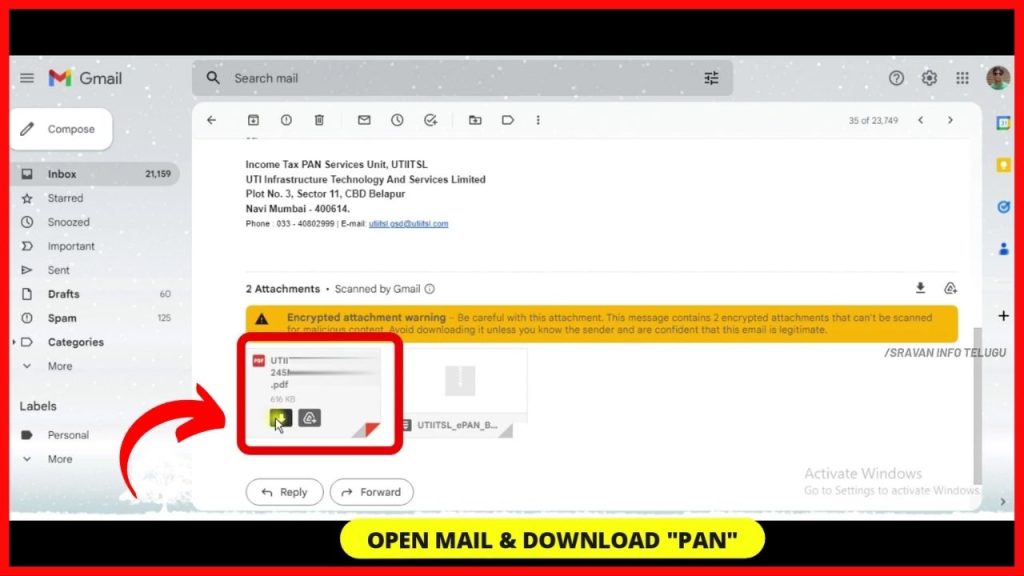

As soon as your payment is completed, you will be redirected to the facility for downloading of your PAN card.

Do not come immediately after submitting your PAN card. It will take some time and within 1-2 hours your PAN card will be sent to your registered mail id in PDF format.

Step 10:

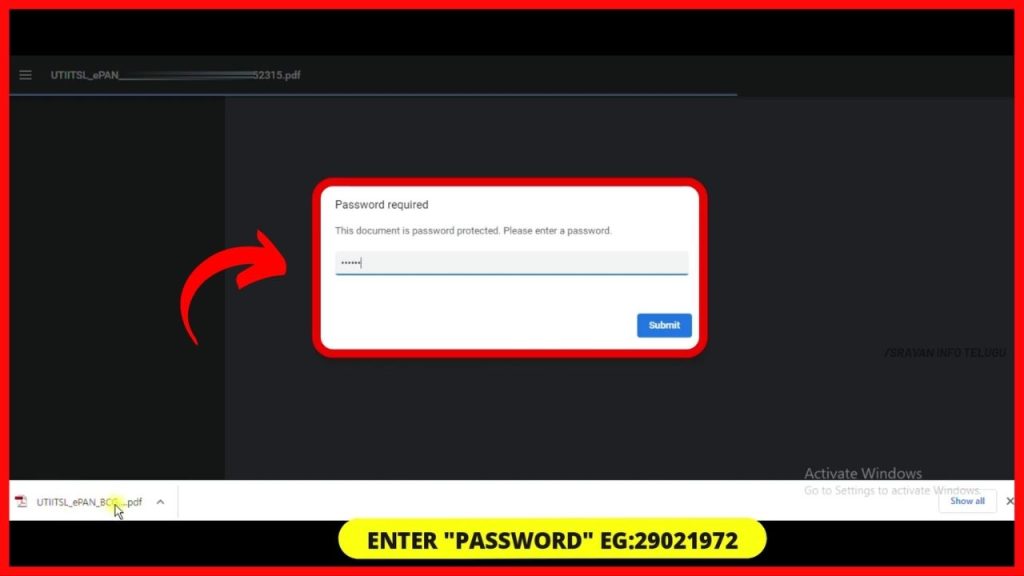

Now you download the PDF file of your PAN card and open it. Now, to open it you have to enter Password. Your PAN Card PDF Password is your Date of Birth.

Eg: If your date of birth is 29/02/1972 you can directly enter the number as 29021972 without slashes and Click on Ok button.

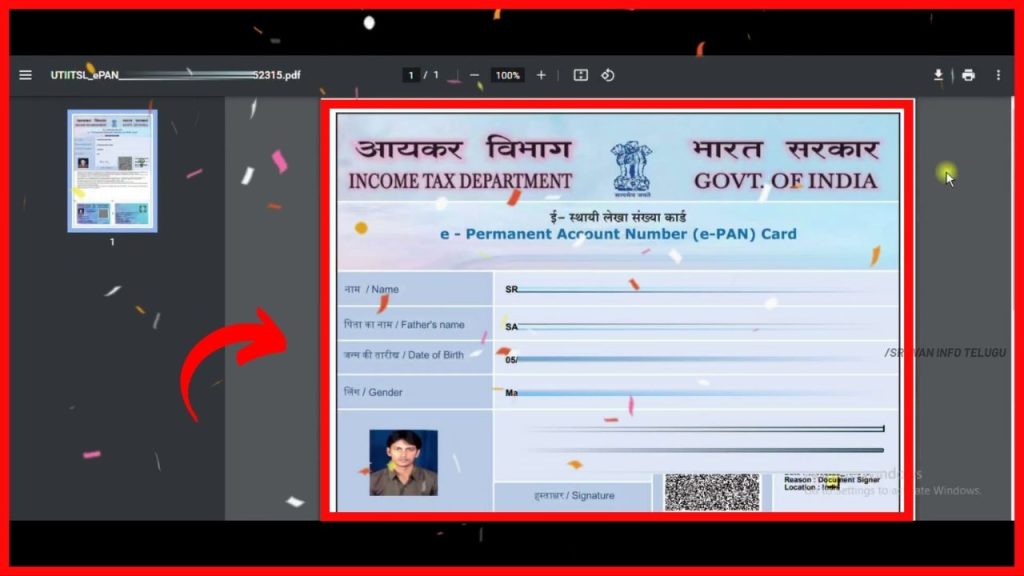

Once you click on it you see your PAN card is downloaded Successfully and you can Print your Card with Lamination as well for your future Financial transactions purpose.

Thanks for Reading 🙂