Are you an individual having a small business in your town or city?

Are you falling short of funds in your business?

Are you planning to buy some Machinery or Equipment, but you don’t have enough funds..!!

Then you should think of Mudra Loan.

What is Mudra Loan?

To whom it will be offered?

How much amount of money will be offered?

Let’s crack the answers to all your questions & Let’s get started..!!

1. What is Mudhra Loan?

Mudra Loan is a Loan given by the Government of India for your business, also known as Mudra Loan.

These Loans are given through the Pradhan Mantri Mudra Yojana scheme (PMMY). It was started in 2015 for those who are having their own business in India. Simply, we can call them the Non-corporate small business sector (NCSBS) i.e. those who do small business. It can be Micro Small Medium Enterprises. That’s MSME’s.

The full form of MUDRA is Micro Units Development and Refinance Agency Limited.

2. Eligibility

Who can apply for this Mudra Loan?

Whether you are a Sole proprietor or an Individual, your business is a Partnership firm, a Private Limited Company, or any other Legal form of business, they are eligible under this seal. Your business does not have to be a company.

The below-mentioned industries can apply for the Mudra loan;

– Agriculture sector

– Business vendors

– Food Production industry

– Handicraftsmen

– Restoration and repair shops

– Self-employed entrepreneurs

– Service-based companies

– Shopkeepers

– Small-scale Manufacturers

– Truck owners

If you have a Trading business.

Even if you have provided any services to your customers. Moreover, you will be provided with this loan even if it is for agricultural activities.

Even if you have done professional courses like CA/ICWA/CS/Architect/Medical Professional you are eligible for this.

So whoever you are, you can apply for Mudra.

Click on the below link to Watch it in Telugu

3. Category of Loans

Through Pradhan Mantri Mudra Yojana, How much Loan amount will be sanctioned?

Basically, there are 3 categories of Loans in this PMMY scheme of Mudra Yojana.

1. Shishu Yojana

2. Kishore Yojana

3. Tarun Yojana

Let’s discuss in detail the 3 schemes.

1. Shishu Yojana

Firstly, let us talk about Shishu Yojana.

Who can apply for this scheme?

It is meant for Small traders like Micro small businesses or business owners, if you want a loan up to R.50,000/- through this Shishu Yojana scheme, then, you can apply for it.

And for whom is this Shishu Yojana scheme best?

This scheme is for those who are starting a New business or want to start one. For those who want to apply for this loan, you have to present your proposal in detail mentioning your business idea and also, you have to mention the Loan amount you want through the application.

If you already have an existing business, then you have to mention your existing line of business activity and how much sales you make.

Banks will not collect any processing fee from you in this scheme.

2. Kishore Yojana

If you want a loan between Rs.50,000/- rupees to Rs.5,00,000/- rupees for your business, then, you have to select this category of loan.

This is beneficial for those who have an existing business and have a small cash requirement.

While applying for this scheme, you have to provide information about existing banking and credit facilities of your business i.e. already existing Savings account or Current account or Cash credit or Term loans or Letter of credit or Bank guarantee in the name of your bank.

3. Tarun Yojana

It is also another category of loan given to Small business owners. By this loan, if you want a Loan for your business up to Rs.10,00,000/- rupees, then, you have to select this category. This is also used for existing businesses.

Whichever of these three loans you want to apply for, you have to apply online. Also, I will discuss which bank will provide these loans to you.

Also, if you want to apply for a Sishu yojana under Rs.50,000/-, there is a separate application for that, and if you want to apply for the Kishore and Tarun scheme, there is a common application for it.

4. Type of Loans

What types of loans will be offered under Mudra Yojana?

The business loan given to you is for you to start a new business as well as to buy some capital items say, Commercial vehicles for Missionary purchase and to Buy any Equipment you need for your business and also for working capital purposes.

Besides, they also provide loans like cash credit/bank guarantee.

The State Bank of India (SBI) provides you with Working capital as well as Term Loan as well.

If it is Union Bank then they are giving you a Composite Loan along with all the above-mentioned loans.

Besides that, you can also avail a loan for the Expansion of your business.

But you have to spend such an amount only for the purpose for which it is sanctioned, i.e. if you are sanctioned a Loan to buy capital items, you should not use it against the working capital requirement.

After the loan is sanctioned, the Government authorities officially have the right to visit and inspect your premises and also the factory at any time. In case, if they know that you are not followed the pre-mentioned norms, there is a chance that they will take proper action.

5. Purpose of Mudra Loan

Micro, small, and medium enterprises (MSME’s) play a crucial role in contributing to the economy of the country. The Mudra loan helps MSME’s by fulfilling the following mentioned purposes;

1. Commencing a New business

2. Expanding and growing an existing business

3. Training as well as the Hiring of competent staff

4. Purchasing of Machinery

5. Achieve Working capital for business

6. Purchase of Commercial Vehicles

7. Purchase of Equipment

8. Capacity expansion

9. Modernization

6. Banks offering Mudra Loans

Which banks actually give these loans?

The Department of Financial Services (DFS) has advised that Commercial banks, Regional rural banks (RRB’s), Small Finance Banks, and NBFC’s in India will also offer this mudra loan.

So, it is available in almost all banks.

7. Interest Rate

What is the rate of interest on this Mudra loan?

The rate of interest changes from one bank to another. If it is an SBI Mudra loan, then, the Rate of interest for Shishu, Kishore, and Tarun Yojana also has an almost 9.75% p.a.

Charges

In case, it is Union Bank of India (UBI) – Flat Rs.500/- + Actual stamp duty, if any (Out of pocket expenses will be recovered by the Bank)

8. Security/Guarantee

May I need to provide any Guarantee / Security for this?

Yes. The borrower of this loan has to put his / her Personal guarantee for this and also Promoters Directors, Proprietor, Partners have to put in a guarantee.

Moreover, the Third-party guarantee is not required as the loan is covered under the scheme called Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) scheme.

Primary: All assets created out of the Bank’s finance shall be charged in favour of the Bank by way of Hypothecation / Mortgage etc.,

9. Application Process

If you apply for this Loan, check the Credit track record of the Applicant with the details you have submitted, so check whether the applicant has paid their Bank Loans on time as much as possible. Also, make sure your bank accounts don’t have any defaults. Then, the chances of rejection of your application will be less.

10. Checklist Documents

Let’s know the checklist of documents to be submitted under 3 schemes.

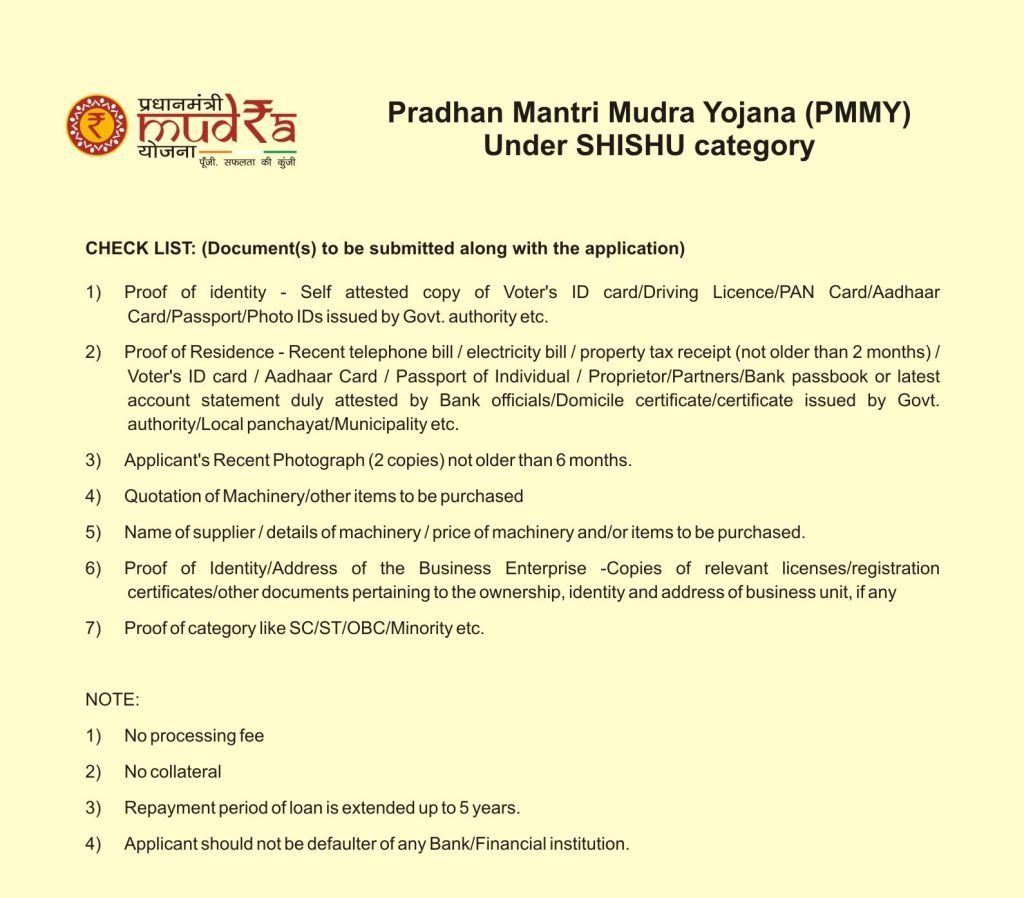

Sishu checklist

Checklist for Kishore and Tarun

11. Loan Repayment

How is the repayment of the loan done?

The Re-payment starts from 1 year to 5 years depending on the loan you take. Moreover, in some banks, also give you a Moratorium of up to Six months depending on the income generation activity you do.

For the same, the State Bank of India (SBI) provides 7 years repayment period.

All repayments will also have to be made on an EMI basis.

That’s it for Mudra Loans. We hope this information will be useful to all those who are doing business with a lot of hard work and passion, and we wish all of you who are doing business to rise to the level of people like Tata Birla.