How to Deposit Money in SBI ATM

Introduction

Ms. Ishitha, a business entrepreneur has more money in hand than required.

Mr. Satyanaraya, a Naval employee received back his hand loan money from his old friend but he doesn’t know how to deposit it into his bank account through ATM.

Generally, we have cash on hand in two situations

1. When you have received cash from Employment, Business, Friends or Family, or any other sources

2. When you withdraw cash from your Bank account.

If you have excess cash on your hand for any reason, you may deposit it in the Bank for safety purposes.

If you want to deposit such money in your Bank account, then, you might have to stand in a queue for a long time. To avoid bank lines and also to reduce the regular work for the bank employees, the RBI guided the bankers to request route their customers deposit their excess cash through ATMs only.

In this blog post, I will guide you to deposit excess cash into your State Bank of India (SBI) bank account easily through your ATM Debit Card.

Let’s see how to deposit money in SBI ATM..!!

If you want to watch “How to deposit cash in SBI ATM” in Telugu, Click on the video below

15 Simple Steps on How to Deposit Money in SBI ATM

Let’s follow these simple 15 steps on How to Deposit Money in SBI ATM without any hustle.

Step 1:

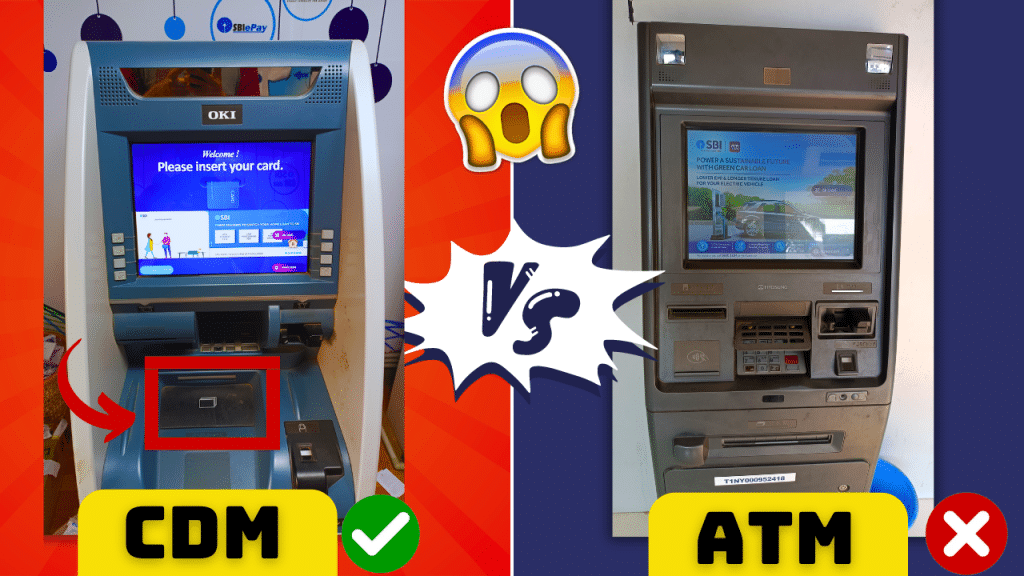

To deposit money in SBI ATM, you should have to go to the Cash Deposit Machine (CDM) in SBI.

In these machines only you can deposit your money. You cannot deposit money in an ATM. The CDM machines are generally attached to bank branches and are also available in SBI E-Corners.

How CDM machine will be different from a regular ATM Machine..!

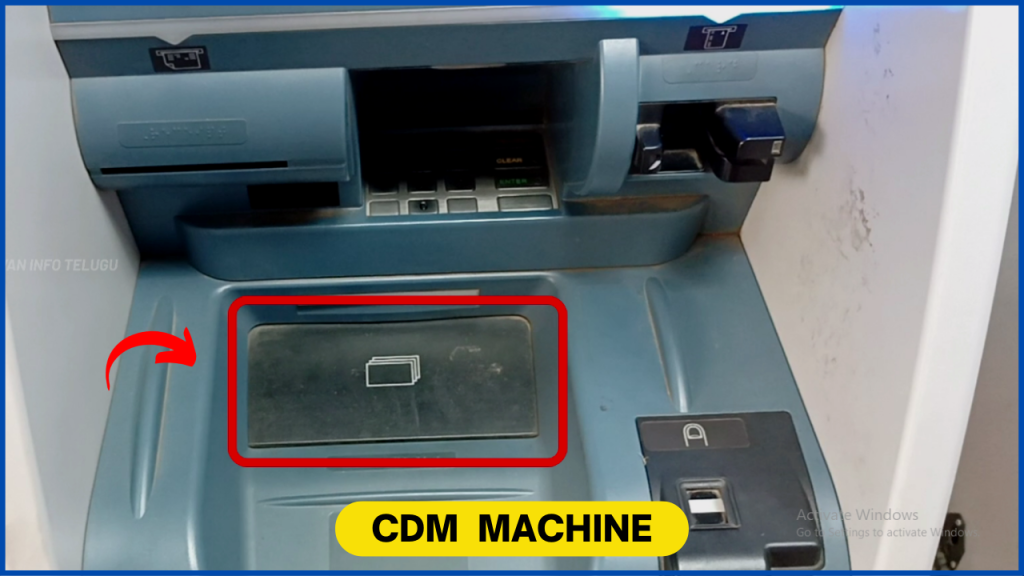

For the CDM machines, if you notice below the number pad there will be a small rectangular-shaped box. In this box only, you have to deposit the cash.

This facility will not be available in general ATMs. Only Cash deposit machines will have it.

Step 2:

Now, to deposit your money, You have to insert your SBI ATM Debit card on the right side of your ATM.

After inserting the card, a message will be displayed like “You should not remove your Debit card until this entire transaction is completed”

Step 3:

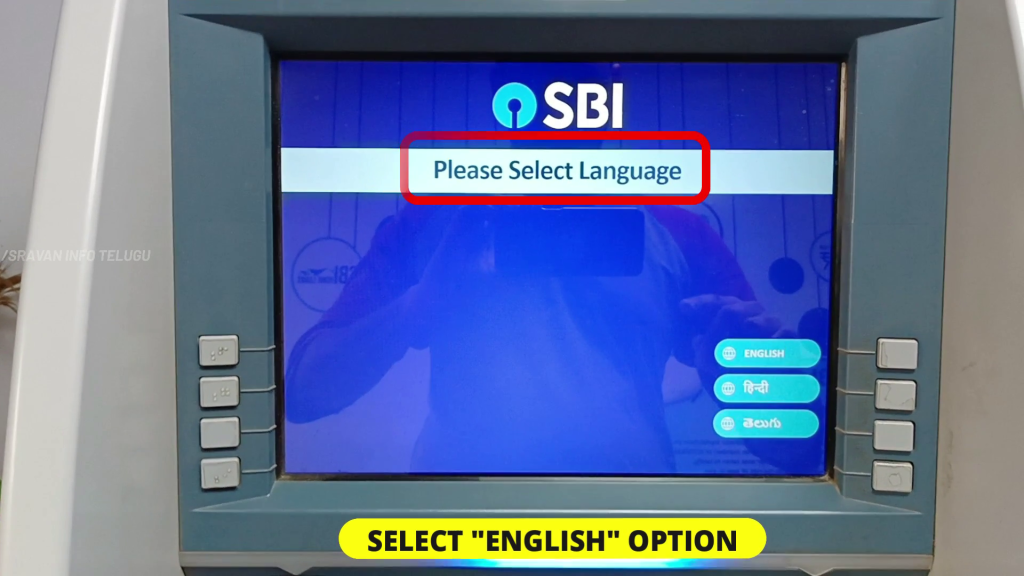

Later on, you have to select “Language”, In which you want the transactions on the ATM screen.

You will get 3 options like

1. English

2. Hindi

3. Telugu (Any Local language)

I select the “English” language.

Step 4:

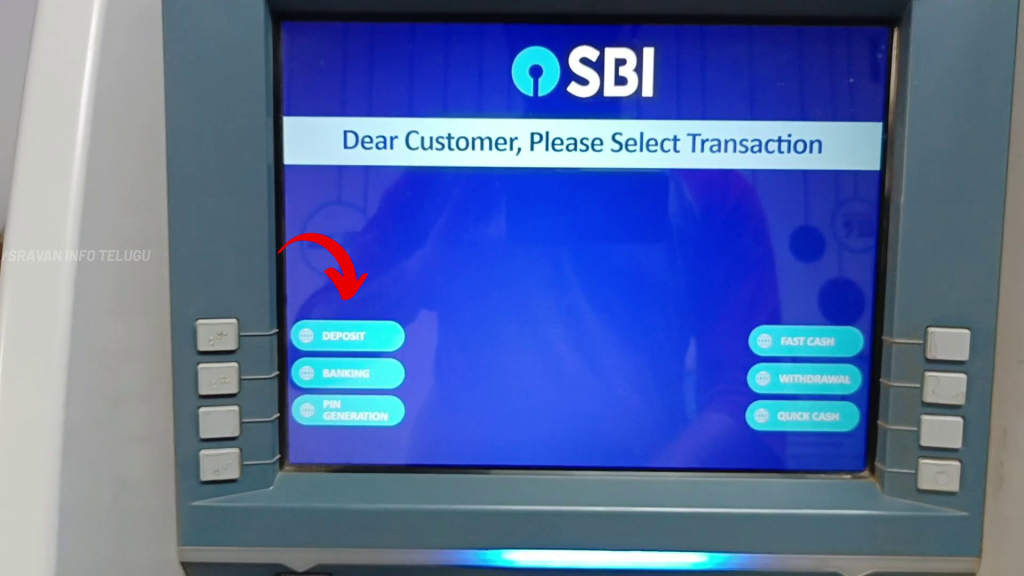

Now, you will be asked to “Select your Transaction”. To deposit the additional or extra money into your Bank account, select the “Deposit” option.

Step 5:

Later on, the ATM screen will be displayed showing “Please select the Deposit transaction”. Here, Tap on the “Cash deposit” option to deposit money in cash.

Step 6:

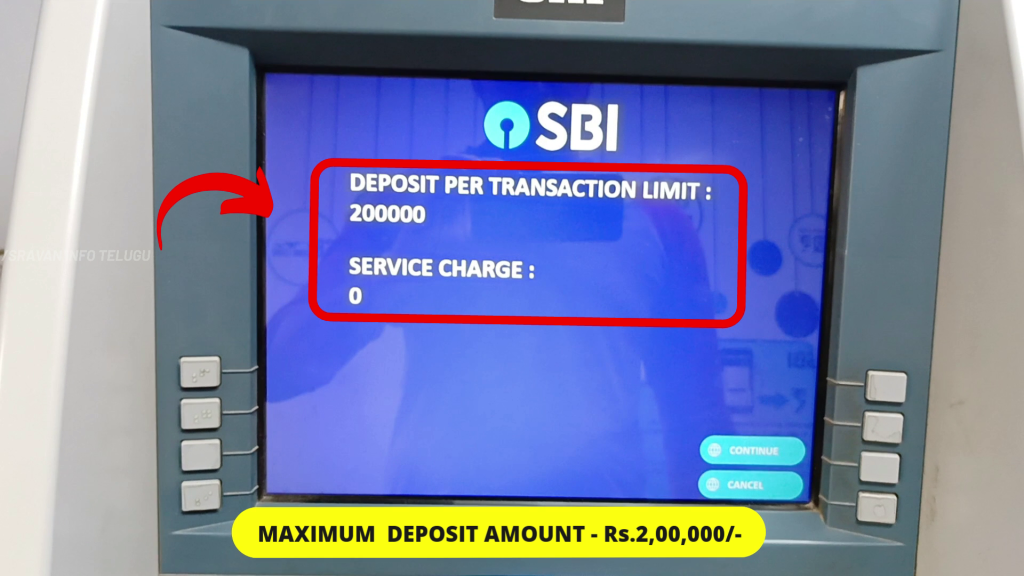

Now, it will display “Deposit per Transaction limit”

SBI Customers can deposit cash in SBI even up to Rs.2,00,000/- per transaction and for that you have zero service charge.

– The Maximum number of notes you can deposit per transaction is up to 200 currency notes.

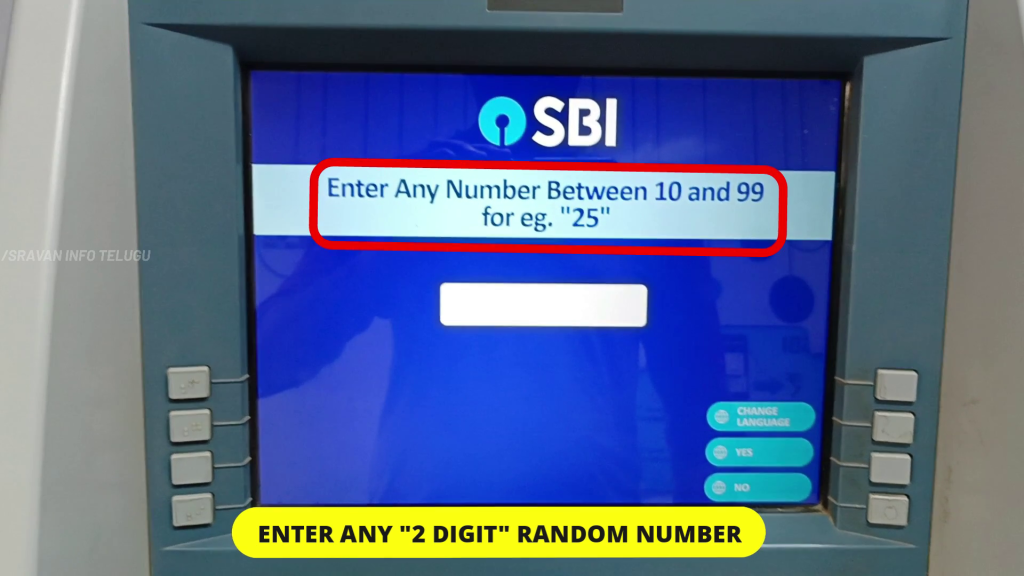

Step 7:

Now, Tap on the “Continue” option.

After that, you should enter a 2-digit random number between 10-99. It doesn’t matter which number you choose.

So, enter a 2-digit number randomly

For Example,

31,22,78, etc.,

Enter it and press the “Yes” button.

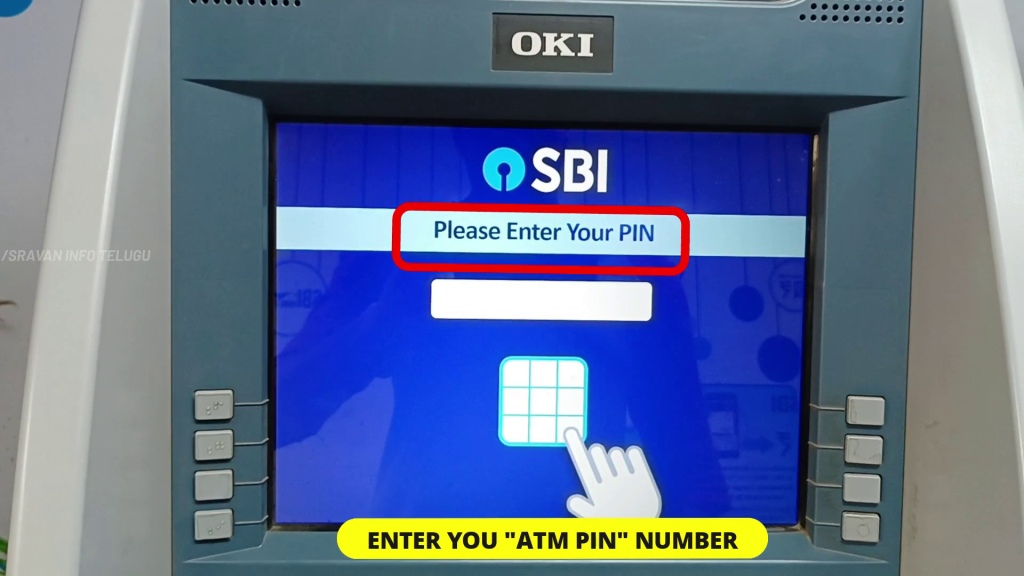

Step 8:

Now, the screen will be displayed as “Please enter your PIN”.

Enter your “SBI ATM debit card PIN”.

Step 9:

After that, you have to select your “Account type”.

Here you will get 2 options

1. Savings account – If you are an individual, then select the “Savings account” option.

2. Current account – If your bank account belongs to a Firm, Company or any other organization, then select the “Current account” option

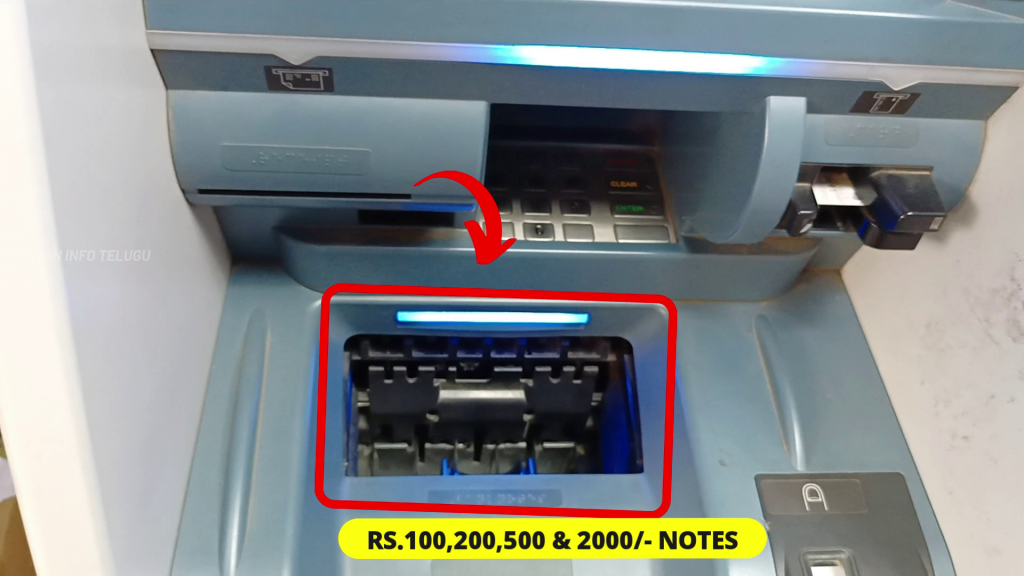

Step 10:

Now, a Small box will be opened in the CDM machine to deposit cash as we have already discussed.

In this Cash deposit machine, only Rs.100, Rs.200, Rs.500, Rs.2,000 notes will be accepted.

It is to be noted that cut notes or damaged notes CDM machine will not accept them. So, check once whether your notes are in good condition or not before inserting them.

Step 11:

Now, it’s time to deposit money in CDM.

Get ready with your cash.

Insert the amount you want to deposit into the CDM as shown below.

Once you keep the cash in the slot opened, you can close this box by clicking on the “Enter” option on the screen.

Once you select it, this cash deposit box closes.

Step 12:

After that, you will get the message showing, “Please wait for validating cash”. It means the machine will validate whether the inserted notes are in acceptable condition or not.

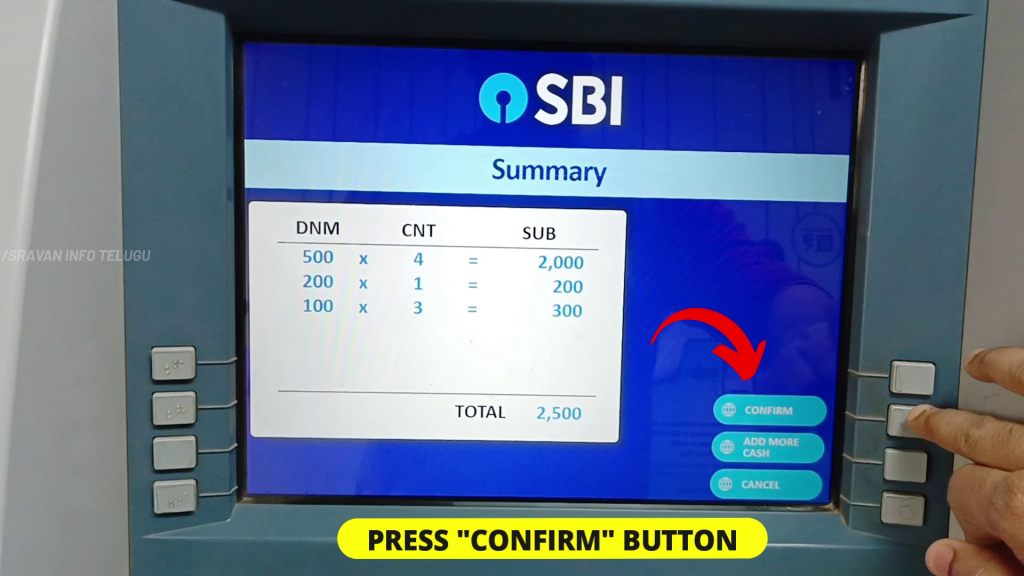

Step 13:

After that, you can see the denomination displayed on the ATM screen.

If all the notes are in are in good condition, then, the machine will validate all the notes.

Now, your deposited amount can be matched with the displayed amount.

In case, if the notes are in damaged condition, those notes can be taken back from the small rectangular shaped box.

If all is okay, press the “Confirm” option.

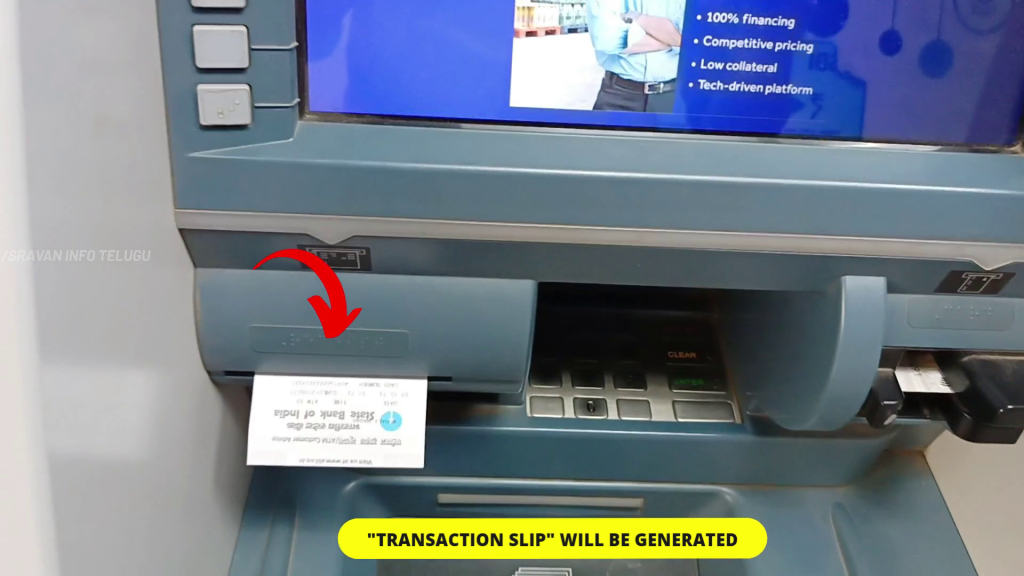

Step 14:

So your cash deposit transaction in the SBI CDM machine is completed successfully. To confirm it, you will get a slip from the left side of the CDM machine.

In that slip, you can see

– Your card number,

– Your cash deposit denomination details,

– The amount of money deposited,

– The available balance and all the other details in this slip.

Step 15:

Finally, a message will be displayed asking you to remove your State Bank of India ATM debit card from the CDM.

Frequently Asked Questions

Are ATM and CDM the same?

No. ATMs allow customers to Withdraw money. Whereas, CDMs allow both deposits and withdraws as well.

How much money I can deposit in an SBI ATM with an SBI card

SBI Customers can deposit cash in SBI even up to Rs.2,00,000/- per transaction and for that you have zero service charge.

How many currency notes I can deposit in an SBI ATM with an SBI card

The Maximum number of notes you can deposit per transaction is up to 200 currency notes.

Can I deposit money in an SBI ATM?

Technically No. The SBI Customers can deposit money in CDM Machines available at the SBI ATMs and E-corners and cannot deposit money in ATM Machine.

I hope you understand the “How to deposit money in SBI ATM” concept.

Please Comment “GOOD” if you like the article and it encourages us. Also, share this article with your Friends & Family…

Thanks for reading..!!!