How to Transfer Money from HDFC app

Introduction

Mr.Varma, a 32-year-old Hyderbadi, joined a BPO company as a fresher. After a month, the HR department offered him a Corporate HDFC Savings Bank account to credit his monthly Salary.

He happily accepted it without any further questions..!!

Everyone works for Money, right.!

As per the company timelines, the Accounts department credited his Salary to his HDFC account.

As this is his first salary and still unmarried, he wants to transfer some amount to their family who are living in a village. Ofcourse, his family needs money and he wants to transfer it.

But, unfortunately, Mr.Varma does not know How to Transfer Money from HDFC app to his father’s ICICI bank account.

In this article, we delve into a complete step-by-step comprehensive guide on How to transfer money from HDFC to Other bank Online.

Let’s get started..!

Are there any Pre-requirements to make money transfer in HDFC..!!

Yes..!

Pre-requirements for Money Transfer in HDFC

To make money transfer from HDFC to other banks like ICICI, SBI, Union bank etc., you should have the following Pre-requirements.

| S.No. | Pre-requirements |

|---|---|

| 1. | Android /IOS mobile |

| 2. | HDFC Mobile banking app |

| 3. | HDFC Login Credentials |

| 4. | Beneficiary Bank account details like – Beneficiary name, – Bank Account number, – Beneficiary bank, and – IFSC code |

Ensure all the above-mentioned details are readily available to you before you make HDFC Fund transfer.

Let’s begin with Process..!!

9 Steps How to Transfer Money from HDFC app

Let’s check simple 9 steps on How to Transfer Money from HDFC app to other banks quite easily.

Step 1:

Open the “HDFC Mobile banking app” on your Mobile.

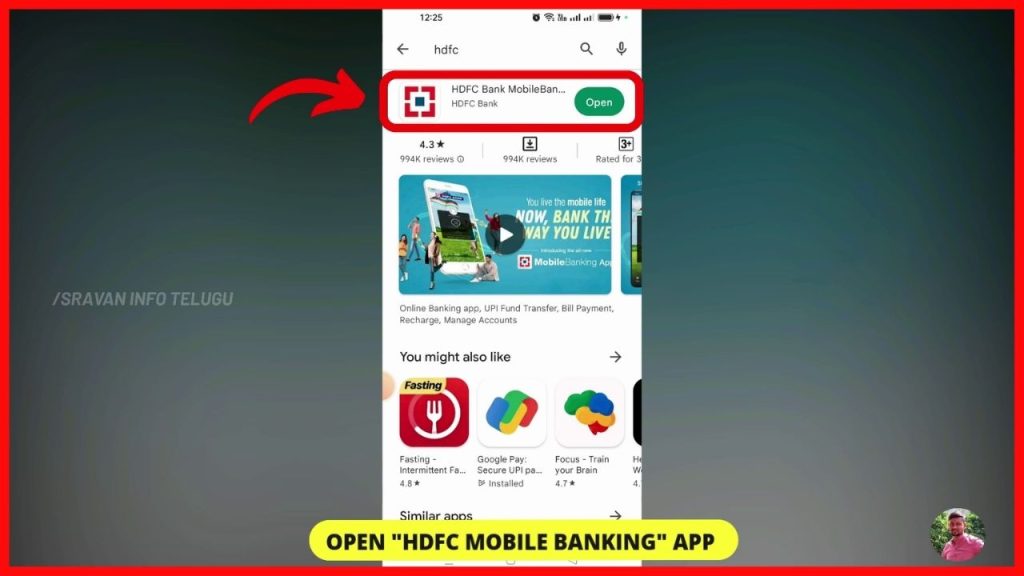

Step 2:

Now, Login into the HDFC app by using the

– User name,

– Password (or) using your Fingerprint or

– By using your HDFC PIN number.

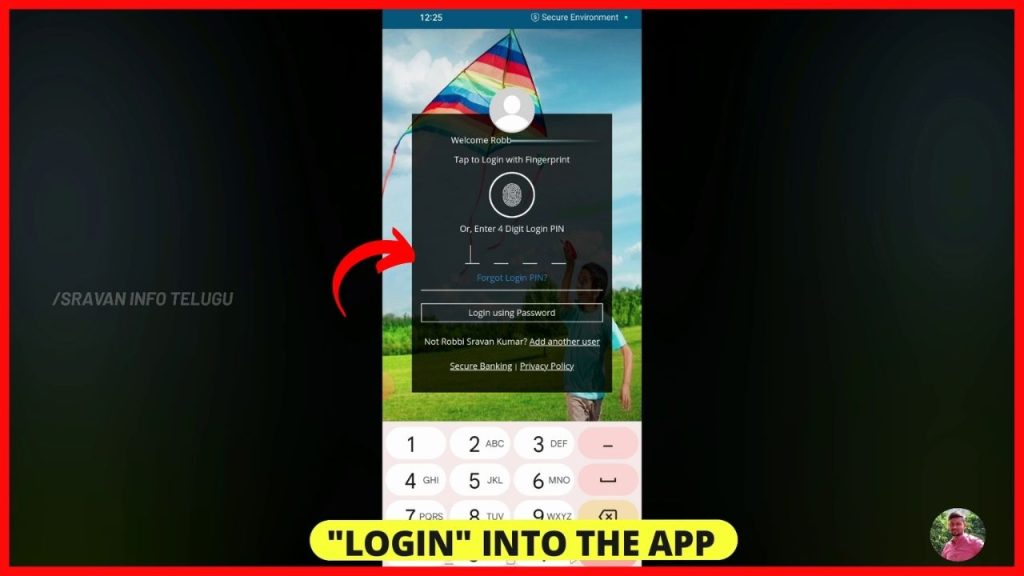

Step 3:

After logging in, your HDFC Dashboard will look like this.

Now, Tap on the “Menu” section which appears on the top left.

Step 4:

To make money transfer from one bank to another like HDFC to ICICI, HDFC to SBI and to any other Bank i.e. Inter – Bank transfers.

Tap on the “Money Transfer” option.

Here, you can see your Savings Bank Account number and also the Available balance in your HDFC Bank account.

It is the account from which the amount will be transferred to the beneficiary.

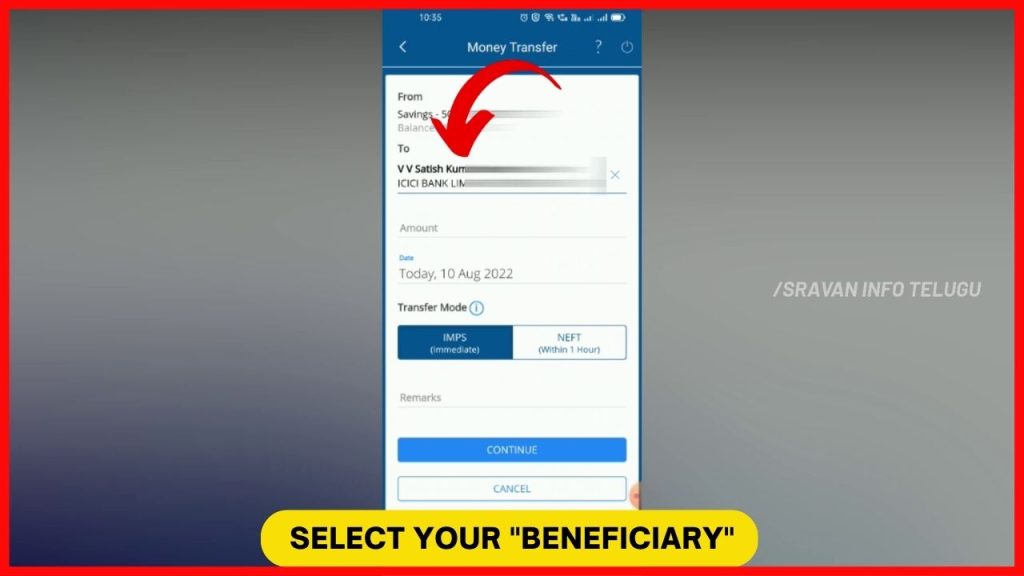

Step 5:

After that, you need to select the Beneficiary to whom you want to transfer money from your added list.

If no beneficiary is added, you need to add your beneficiary by tapping on “Add / Manage Payee”

Tap on “Enter Payee Name” to Select the beneficiary to whom you want to transfer money.

Step 6:

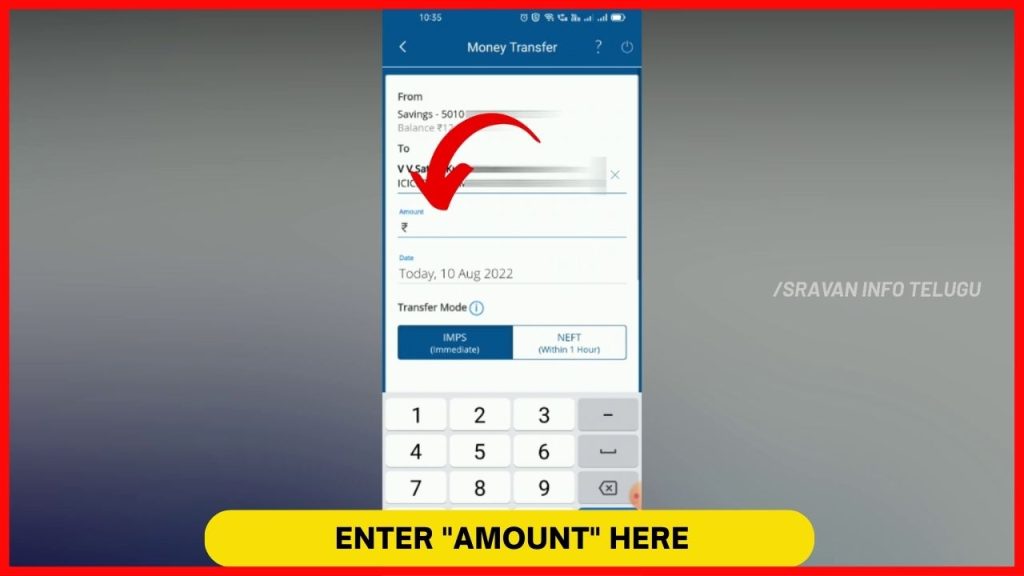

Transfer Limit

Now, in the “Amount” column enter the Amount of money you want to transfer.

But, How much amount I can transfer?

Using National Electronic Fund Transfer (NEFT), you can transfer a Maximum of Rs.2,00,000/- per transaction.

Using IMPS, you can transfer a Maximum of Rs.5,00,000/- per transaction.

Whereas, as per the customer’s TPT limit, the Maximum amount of funds that can be transferred per day is a up to Rs.50,00,000/-

| S.No. | Mode of Transfer | Transfer Limit |

|---|---|---|

| 1. | NEFT | Maximum of Rs.2,00,000/- per transaction |

| 2. | IMPS | Maximum of Rs.5,00,000/- per transaction |

| 3. | TPT | Maximum of up to Rs.50,00,000/- per day |

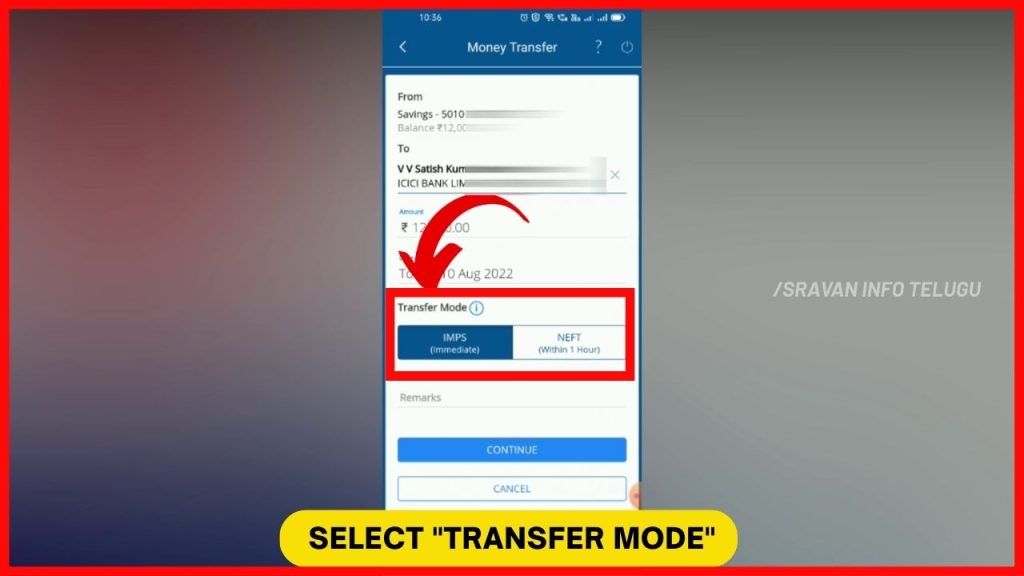

Step 7:

Time Limit

Later on, you need to select the money “Transfer mode”. It may be either through NEFT or IMPS.

If you choose the NEFT option, it takes less than 1 hour to transfer money to the beneficiary account. Whereas,

If you choose IMPS, then, the amount will be transferred immediately to the beneficiary account on an instant basis.

| S.No. | Mode of Transfer | Transfer Time |

|---|---|---|

| 1. | NEFT | 1 Hour |

| 2. | IMPS | Immediate |

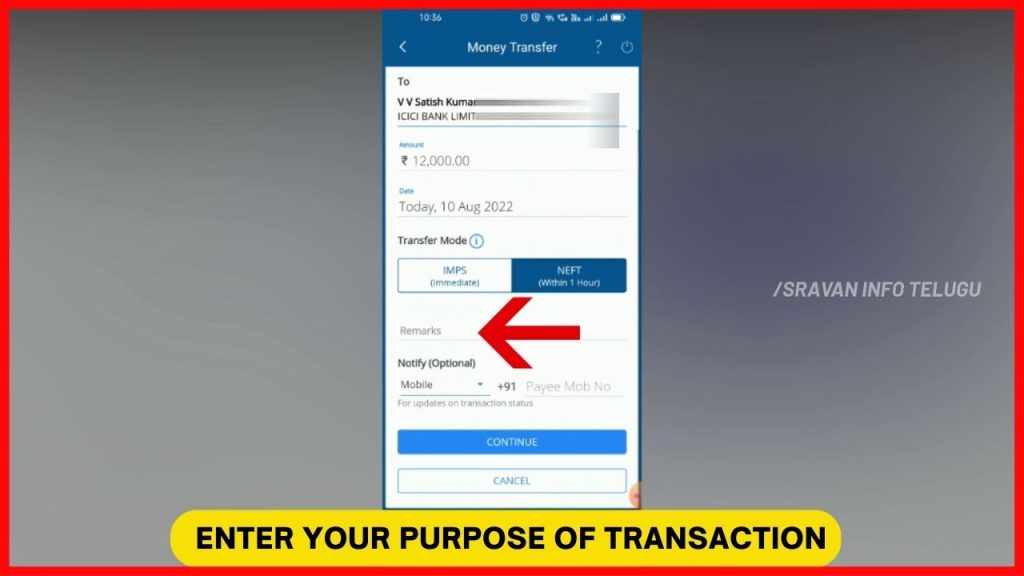

Step 8:

Now, select your Purpose of the transaction in the “Remarks” column like Shopping, Rent, etc.,

Later on, you can see “Notify (optional)”.

Here, you can enter the Beneficiary’s Mobile number to get notified when the amount gets credited to his/her account.

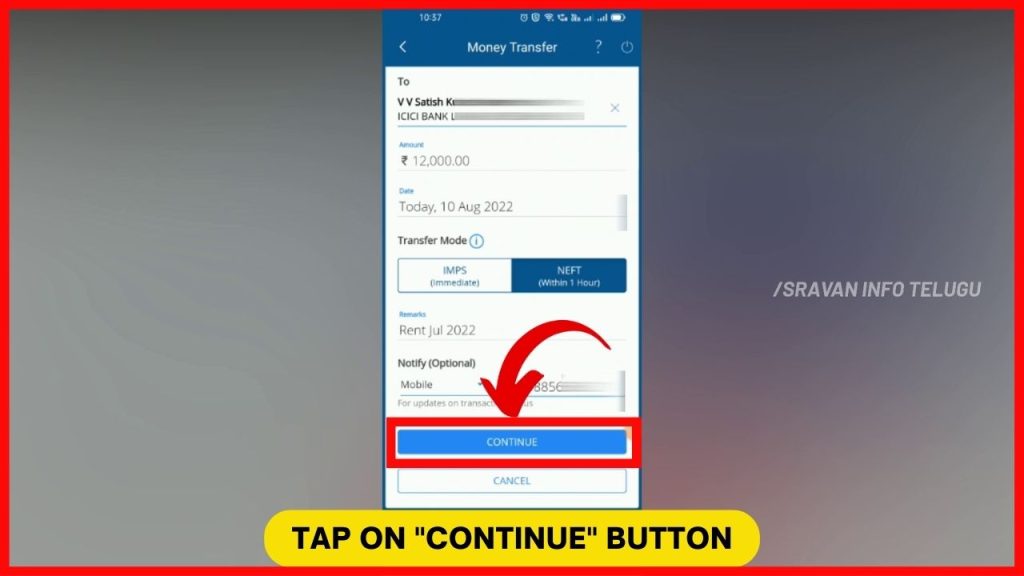

Step 9:

Now tap on the “Continue” button.

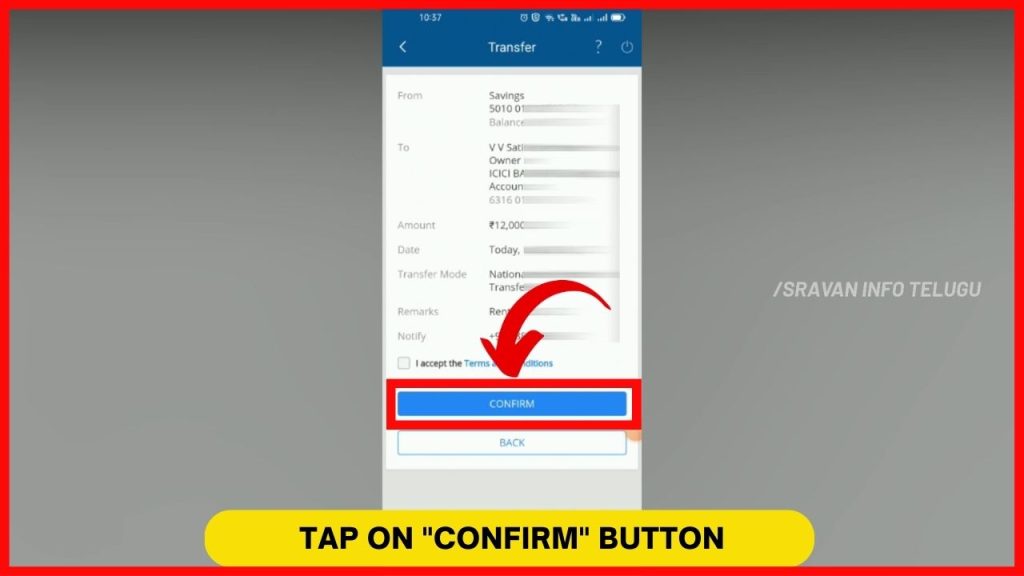

Step 10:

Check whether all the details entered are correct only. If all details are ok, then, tick on “I Accept the Terms and Conditions” and Tap on the “Confirm” button.

Finally, you will get a confirmation message that “You have Successfully completed the Transfer” along with the Reference number.

Frequently Asked Questions

How much I can transfer through the HDFC App?

You can send up to Rs.2 Lakh per transaction subject to the TPT limit. However, for the newly added beneficiaries, you can send the Maximum amount of Rs.50,000 in the first 24 hours.

What is TPT in HDFC?

TPT stands for Third Party Transfers, which are free and instant modes of transfer of money between two HDFC Bank accounts.

HDFC Transfer limit per day?

All default HDFC accounts have a limit of Rs.2 Lakhs per transaction through NEFT. Using IMPS, HDFC customers can transfer a Maximum of Rs.5,00,000/- per transaction. Whereas, as per the customer’s TPT limit, the Maximum amount of funds that can be transferred per day is up to Rs.50,00,000/-.

With RTGS, there is no limit. HDFC customers can transfer any amount.

HDFC NEFT Transfer Limit?

Using National Electronic Fund Transfer (NEFT) in HDFC, you can transfer a Maximum of Rs.2,00,000/- per transaction.

HDFC IMPS Transfer Limit?

Using IMPS, HDFC customers can transfer a Maximum of Rs.5,00,000/- per transaction only.

HDFC TPT Transfer Limit?

As per the customer’s TPT limit, the Maximum amount of funds that can be transferred per day is up to Rs.50,00,000/-.

HDFC RTGS Transfer Limit?

With RTGS, there is no daily transaction limits. Therefore, the HDFC customers can transfer any amount in a single day.

How long does it take to make an NEFT Transfer?

If you choose the NEFT option in HDFC, it takes less than 1 hour to transfer money to the beneficiary account.

How long does it take to make IMPS Transfer?

If you choose IMPS, then, the amount will be transferred immediately to the beneficiary account on an instant basis.

I hope you understood the “How to Transfer Money from HDFC app” concept.

Please Comment “GOOD” if you like the article and it encourages us. Also, share this article with your Friends & Family…

Thanks for reading..!!!

—————————————————————End——————————————————

Disclaimer: The materials provided herein are solely for information purposes. No attorney-client relationship is created when you access or use the site or the materials. The information presented on this site does not constitute legal or professional advice and should not be relied upon for such purposes or used as a substitute for legal advice from an attorney licensed in your state.

Also, every effort has been made to avoid errors or omissions in this material. In spite of this, errors may creep in. Any mistake, error, or discrepancy noted may be brought to our notice which shall be taken care of in the next edition. In no event, the author or the website shall be liable for any direct, indirect, special, or incidental damage resulting from or arising out of or in connection with the use of this information.