SBI Missed Call balance check

Generally, individual customers who have SBI bank accounts can check their Savings bank account balance by using different methods. You can check your SBI bank balance by using the ATM by giving a Missed call from your registered mobile or by using your Online Internet banking or Mobile banking services etc.,

In this article, We are going to discuss not only SBI missed call balance check but also we are finding other Methods and Modes of checking SBI Bank balances.

Let’s get started to learn SBI Missed Call Balance Check.

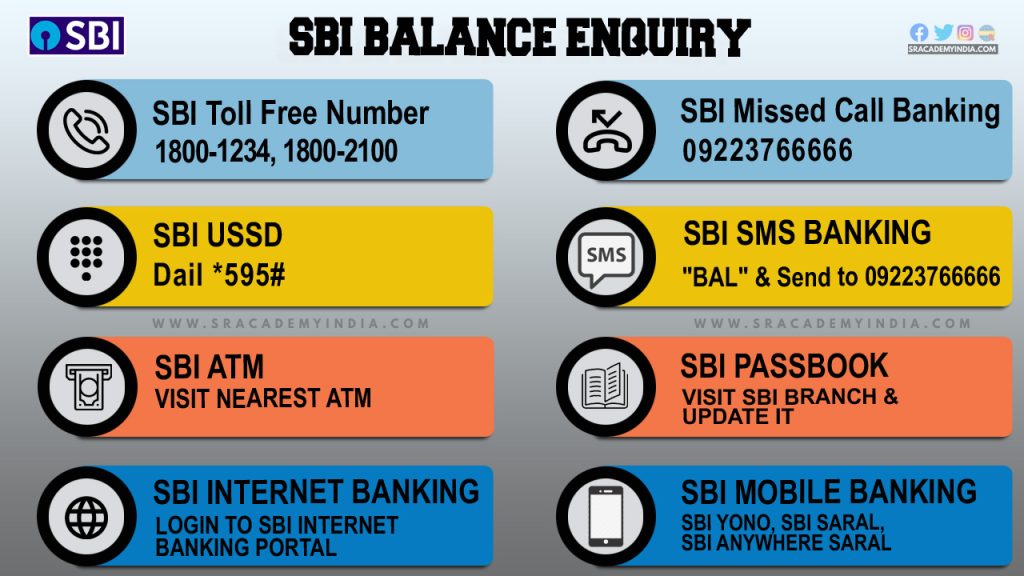

Different Modes and Methods of SBI Balance Enquiry

In this article, we are going to discuss on 11 different methods of checking SBI Bank Balance.

1. SBI Account Balance enquiry Through Missed Call

– SBI customers can check the SBI account balance by giving a missed call from their registered mobile.

– It can be done either by Android phones or by using small phones with no Android facility.

– This Missed call feature is mostly useful for Senior citizens, Super senior citizens, and also for Rural people with Illiteracy can be helpful.

| SBI Missed call balance check number | 0922 37 66666 |

| SBI Account Mini Statement | 0922 38 66666 |

How to Do It?

1. In order to check the SBI bank balance, you need to give a Missed call to the Toll-free SBI number 09223766666 from your SBI Registered Mobile number.

2. If you want to get a Mini Statement of your SBI bank account, then you can give a Missed call from your SBI registered mobile number to 09223866666.

Even the Rural SBI customers who are illiterate can utilize this facility as they can simply give a missed call to this number and can get the SBI bank account balance quite easily.

2. SBI Account balance through SMS

How to Register:

1. SBI Customers who want to avail Banking services by SMS, need to complete a One-time Registration process. To complete it you can Send SMS, ‘REG Account Number’ to 07208933148

Eg: REG 12345678901 & Send it to 07208933148

2. You can send it from your registered mobile number of that particular account. A confirmation message will be received indicating successful/unsuccessful registration.

3. If registration is successful then you can start using the services.

4. If registration is unsuccessful:

– Check the SMS format and Destination Mobile number

– Ensure that your mobile number from which the SMS is sent is updated with the Bank for that account number. If not, you need to visit your home Branch and update the same.

Customers having an SBI Bank account can also send an SMS by typing “BAL” to 09223766666

If you want to get a Mini statement of your SBI bank account, then you can send an SMS from your registered mobile number by typing “MSTMT” to 09223866666

| SBI SMS balance check number | Type “BAL” & Send to 09223766666 |

| Sbi account Mini Statement by SMS | Type “MSTMT” & Send to 09223866666 |

3. SBI Bank Account balance By Toll free numbers

In case you don’t know how to operate Internet banking a Mobile banking by using the Internet. But you would like to know the bank balance immediately. For that, you have no necessity to go to any nearby SBI ATM’s.

Simply take your Mobile. Just Dial from your SBI registered mobile number to the below Toll-free number to get your State Bank of India bank balance.

| Toll-Free Number | 1800-2100 |

| Toll-Free Number | 1800-1234 |

4. SBI Account balance Through SBI ATM

SBI customers who visit ATMs for any financial transaction purpose, if they want to check their SBI Bank balance, then, they can do it by using your SBI Debit card.

Steps to Check the SBI Bank balance

Step 1: You just need to Insert your SBI ATM debit card on the right side of the ATM machine.

Step 2: Enter your Four-digit ATM PIN.

Step 3: Now multiple options will be displayed & You select the option of “Balance Enquiry”

Step 4: Your SBI bank account balance will be displayed.

5. SBI balance enquiry through Net banking

Step 1:

SBI customers who have registered for the Net banking facility can access their SBI bank account by logging into the SBI online banking website using their SBI Internet banking login ID and Password.

Step 2:

Now the dashboard will appear like this. Here you need to click on the “My Account” section.

Step 3:

Later on, your SBI savings account details will be displayed here. To know the SBI bank balance simply you can click on “view account balance”

Also read: SBI ATM PIN Generation Online with Pictures

6. SBI Bank balance checking through SBI Quick SMS service

To use the SBI Quick SMS service, firstly you need to register for it. To initiate the registration, you need to send an SMS in the following manner

“REG Account Number” to 09223488888

| SBI Quick SMS service | Type “REG<Space>Account Number” to 09223488888 |

Once you send this message, the SBI will send a registration confirmation message. Once you are registered, then, you can check your SBI bank account balance.

You can also get a Mini Statement, You can place a Check book request and also you can get an E-Statement, Loan Interest Certificate, and Home loan interest certificate through this same number.

7. SBI Bank balance check Through SBI passbook

Whenever you open an SBI bank account then the bank will be provided a passbook. The Passbook contains the details of your Bank Account number, Name, IFSC code and all other required bank details.

The passbook also contains the transactions done by the customers which need to be updated either from the Passbook printing machine available at the SBI branches or by requesting the banker.

In the Passbook, you can all your Debit and Credit entries including your Day balance as per your transactions.

But the major drop back in knowing the bank balance through a passbook is that it is one the oldest forms of checking the bank balance. Nowadays this facility is using by very few Senior citizens and Super senior citizens only.

8. SBI Account balance check Through Mobile banking

Checking the SBI bank account balance by using the Mobile Banking app is one of the fastest forms. For that firstly you need to register with the SBI for opting of this Mobile banking service.

SBI Account balance through SBI Yono

Step 1:

Customers who want to check the SBI Bank balance through Mobile must have an Android phone or iOS mobile.

Step 2:

Now then need to go to the Play Store and search for the “Yono SBI: Banking & Lifestyle” mobile banking app and download it.

Step 3:

Now, You need to log into your SBI account using your User ID or Password or through your Fingerprint or by using your PIN number.

Step 4:

Now you can check the SBI bank account balance by clicking on “Accounts” section you can check your SBI Bank Account balance.

9. SBI Account balance Through USSD

Unstructured Supplementary Service Data (USSD) is a global system for mobile communication that will be used to send text messages which is similar to a Short Message Service i.e. SMS.

This service is accessible to SBI customers what having either a Savings account or a Current account.

You can check the SBI bank account balance using USSD as follows

Step 1: To check your SBI Bank balance using USSD, you need to enter your User ID by dialing *595# from your registered mobile number.

Step 2: Now the user will get the response “Welcome to State Bank Mobile application”. Now you are required to select from the set of options and you choose the option “Enquiry”. For that you the user needs to reply with 1 serial number.

Step 3: Now you need to enter MPIN and select “Send”

Also Read: How to Deposit Money in SBI ATM – With Pictures

10. SBI balance check via UPI

Nowadays UPIs are one of the fastest money transfer apps. By using these apps you can also check your SBI bank balance.

PhonePe

For that, you need to open the “PhonePe” app on your Android or iOS device. On the homepage itself, you can see the section “Transfer money”. Under this section, you can see multiple options, to get Your bank account balance. Simply, tap on “Check balance”

Note: Your PhonePe must be linked with your SBI Bank account to check the Banka account balance.

Now you need to Select your bank account like SBI to check your bank balance.

Later on, you need to enter your “UPI PIN” number to check your bank balance quite easily.

11. Balance enquiry using SBI WhatsApp banking

Finally, You can also check the SBI Bank account balance by using WhatsApp.

SBI WhatsApp banking service helps you to check your SBI bank balance. If you are using Android or IOS mobile, then you can register for SBI WhatsApp banking together with multiple services. One of them is SBI bank account balance enquiry.

Before that you need to register for this service by sending a text message of “Hi” to +919022690226

Check the below video for Whats app Banking in SBI (Telugu Language)

My Analysis/ Opinion

In my opinion, all the modes are operated by the SBI to make customer convenient to know their bank balance easily.

Initially, the SBI came up with knowing the balance through a Passbook, and after that, it was updated with toll-free numbers and later on to SMS. Now it has come up with WhatsApp banking, Internet banking, Mobile banking as well as UPI services.

In all these modes you can make the balance enquiry for the State Bank of India. Among all these getting the balance through passbook and ATM, you need to move your legs from home and get these services. Whereas all other modes can be done by sitting at the home itself.

For the rural SBI customers if they are unable to text, then, they can use the services of either Missed call banking or the Toll-free numbers. Not only the balance enquiry you can also get other services like getting the mini statement they can fund transfer etc

Out of all these I use the Phone Pe or SBI Yono app since I just need to enter the Mobile PIN number to check the balance instantly and effortlessly. It is quite the fastest and easiest method for me to check the SBI Bank account balance.

Hope you enjoyed reading this article. Thanks for your time 🙂