AU Bank Altura Credit Card

Introduction

AU Small Finance Bank is an Indian Scheduled Commercial Small Finance Bank based in Jaipur, Rajasthan and It started its banking operations in the year 1996.

This bank offers a Cashback Credit card to their customers i.e. AU Bank Altura Credit Card.

As per the AU Bank website, this card provides various offers on daily spending i.e. You can earn Cashback on Groceries, Utilities, and Fuel, and also you can earn cash back on Milestone spending.

However, the AU Bank Altura Credit Card also offers a Quarterly Railway Lounge facility, Card liability cover, Express EMI facility, and a lot more.

Without further ado let’s see What Features or Benefits this Credit card offers. And I also share my Genuine opinion on this Credit card by discussing its Drawbacks as well. You can also apply for this Credit card as well.

Let’s get Started about “AU Bank Altura Credit Card “..!!

AU Altura Credit Card Overview:

| Credit Card Type | Cashback Credit Card |

| Joining Fees | Nil |

| Renewal Fees | Rs.199 + GST |

| Best for | Train Travellers |

What Benefits do you get from this AU Bank Altura Credit card ?

Coming to the AU Bank Altura Credit Card is designed especially for Cashback lovers. And it looks in a vertical stylish format with an Orange, Pink, and White combination.

On the Top left-hand side of this credit card, you can see the card name “Altuta”.

On the top right side of the card, you can see, the Chip card symbol, and right beside it you can see the “Contactless logo” symbol which supports Near-Field communication (NFC) technology.

In the middle of this card, you can see the Cardholder’s name.

Looking at the bottom of this credit card, you can see the “AU Small Finance Bank Logo” and on the bottom right-hand side, you can see “Type of Credit card network” as “Visa Platinum”.

Now, Let’s crack this vertical credit card features and benefits.

AU Altura Credit Card Benefits:

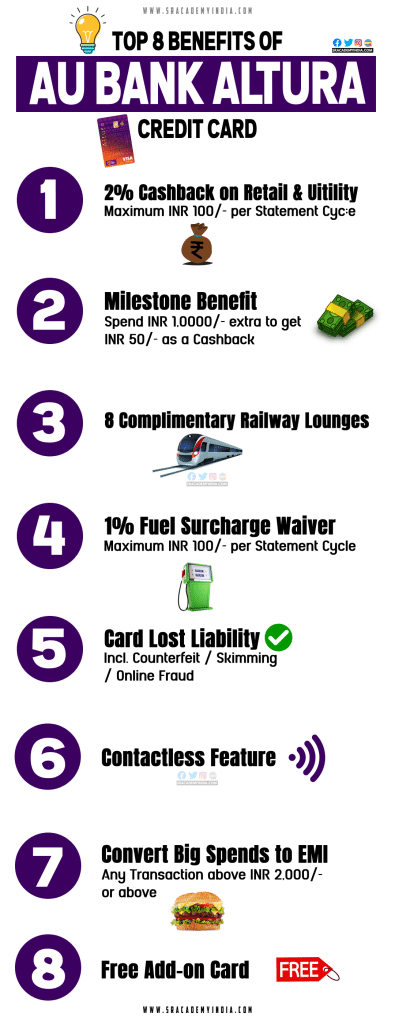

Let me go through the 8 Top benefits offered by this Credit Card [Incl. My Analysis]

1. Cashback Benefit

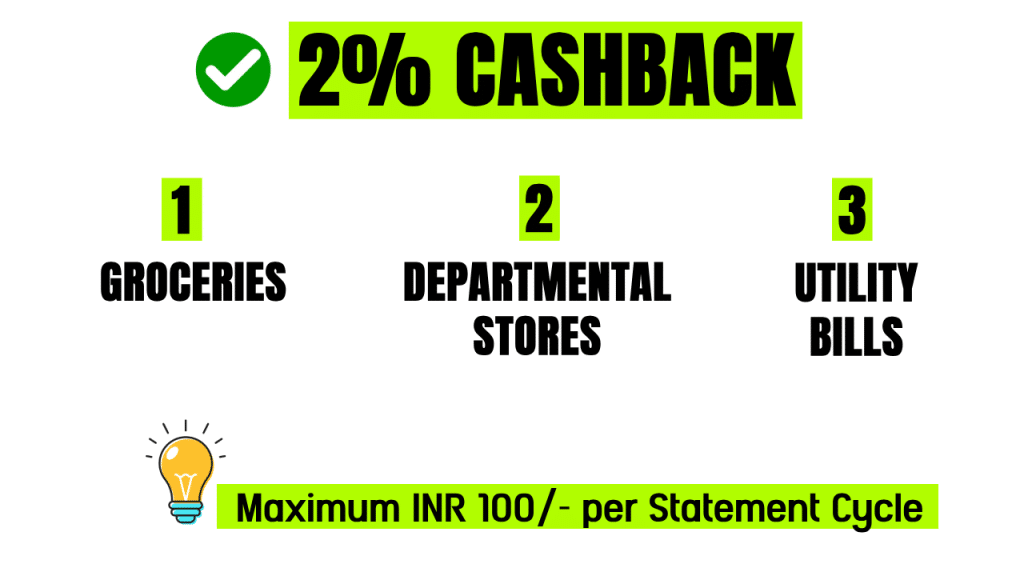

2% Cashback:

The AU Bank Altura Credit cardholders will get 2% Cashback on all Retail spending they shop at

– Grocery stores,

– Department stores, and also

– For Utility bill payments.

The Maximum cashback you will get per statement cycle is INR 50/- only.

For Example:

Let’s check the below 2 cases to understand it better.

Case 1

If you buy Online groceries worth Rs.2,000/- in a month, then, you will be eligible for 2% cashback i.e. Rs.40/- per statement cycle in this case.

Case 2

If you buy Online groceries worth Rs.4,000/- in a month, then again you will be eligible for 2% cashback.

Here, the Maximum cashback you are eligible per billing statement is Rs.50/- only under this category and not Rs.80/-

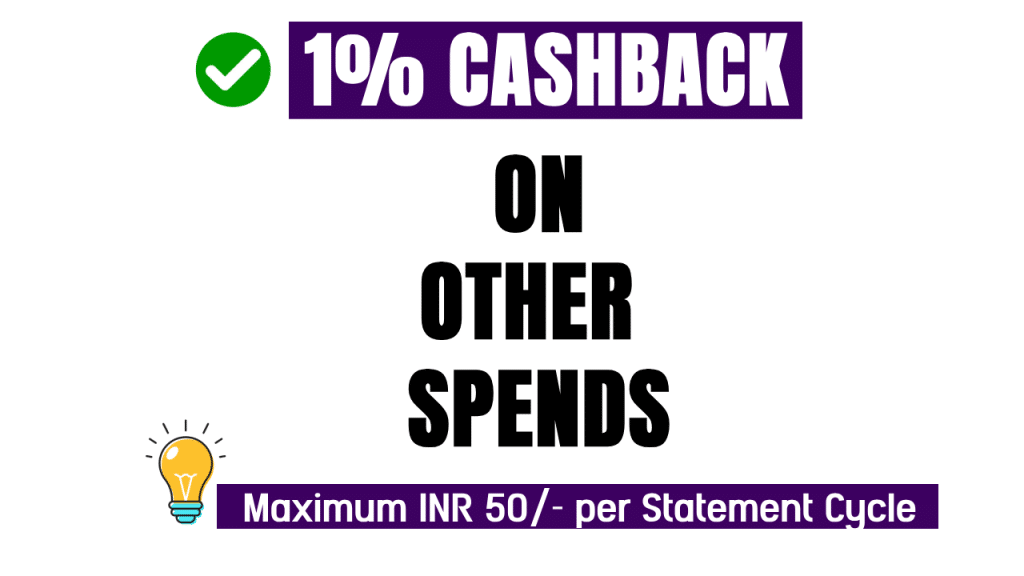

1% Cashback:

However, You will get 1% Cashback on all other retail spends. The Maximum cashback per statement cycle is Rs.50 only.

Zero Cashback:

You will get Zero Cashback on

– Fuel payments,

– Rental payments,

– Wallet Loadings & Cash transactions are excluded from earning cashback.

W.e.f 1st April 2024, AU Bank Altura Credit Card has excluded Educational, Government, and Bharat Bill Payment System (BBPS) transactions from Cashback. Therefore, this cardholder is not eligible for cashback for these transactions.

My Analysis

The Maximum Cashback you can get on this AU Bank Altura Credit Card is up to Rs.100/- per billing cycle and it is too low for the cardholder.

Usually, Credit card companies won’t offer any cashback benefit on Utility bill payments but this AU Bank Altura Credit card offers 2% Cashback and it is better to some extent.

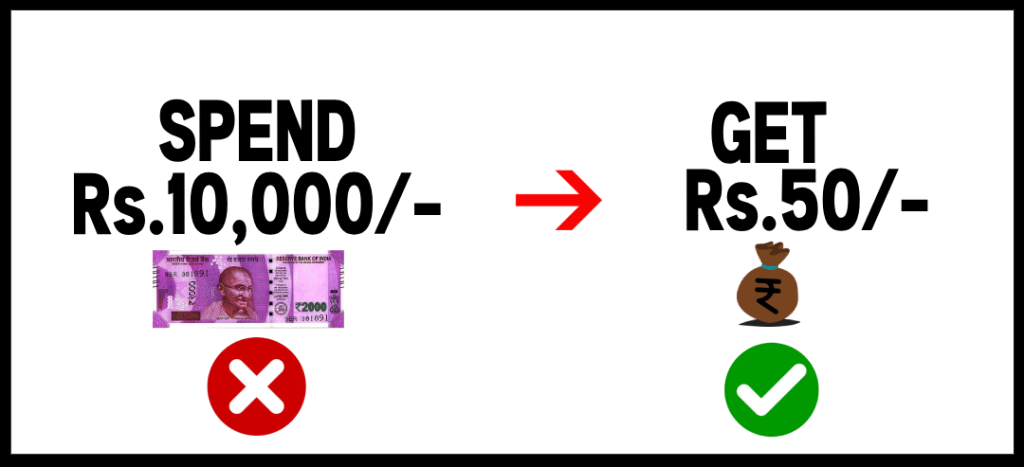

2. Milestone Benefit

On a minimum spend of Rs.10,000/- on retail spending in every statement cycle, then this Altura Credit Card AU Bank user will get an Additional cashback of Rs.50/-.

My Analysis

Here, the cardholder will get a 0.50% benefit in terms of Cashback. This feature can’t be said to be beneficial to the Cardholder but if you spend through this credit card for any of your needs, then, this Milestone benefit might be helpful for you.

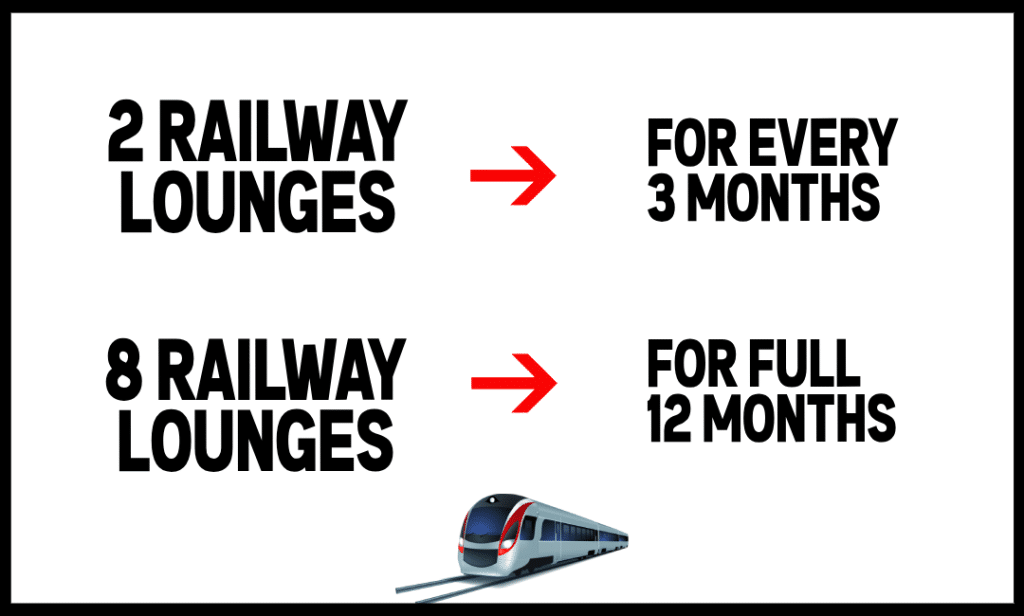

3. Are you a Frequent Train Traveller?

If you travel more by Trains, then, You can use this Credit card to avail of the 2 Complimentary Railway Lounge benefits per calendar quarter i.e. 8 times a calendar year.

The Railway lounge includes the facilities of

– AC Comfortable Seating arrangements

– Free WIFI,

– Free of cost tea & coffee,

– 1 Buffet Meal,

– Buffet Evening snacks,

– Newspaper & magazine.

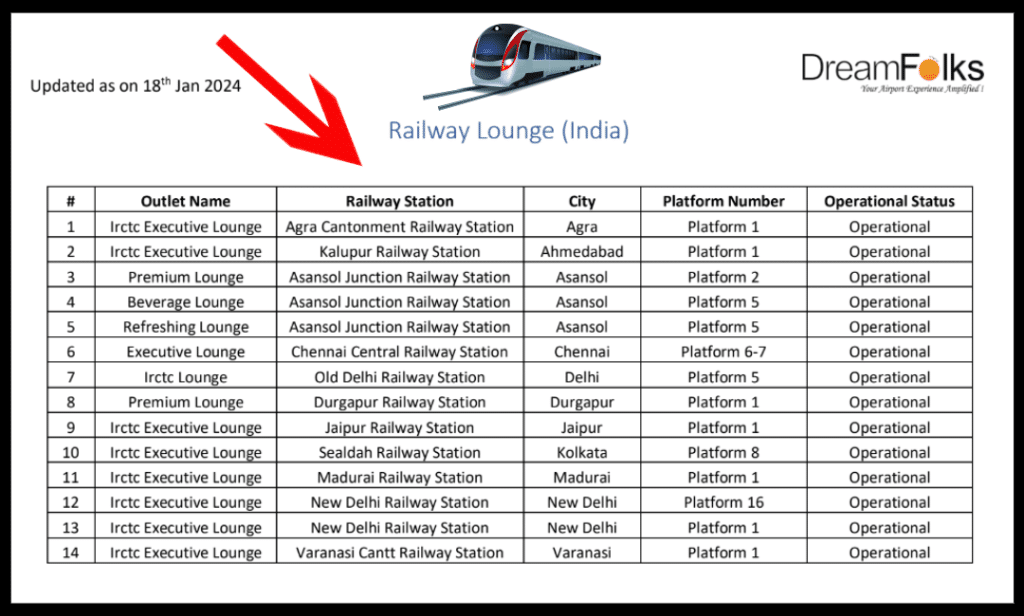

By using this Railway Lounge Facility, you can avail the stay for up to 2 hours only. The Major drawback is that this Lounge benefit is provided only in the 14 stations across India.

Here is the list of 14 Railways lounges across India.

To avail of this benefit, the AU Small Finance Bank Altura credit card holder will have to be swiped at the Point of Sale (POS) machine in that lounge. Then, an amount of Rs.2/- will be deducted from your card account as a Confirmation.

4. Petrol / Diesel Benefit

By using this Credit Card, If you spend Petrol/Diesel between Rs.400-Rs.5,000/- in any fuel station in the country, then, a Fuel Surcharge will be charged. It may be around 1-3% of your Fuel Cost. In case, you have paid these bills through this card, then, you will be eligible for a “1% Fuel Surcharge Waiver“.

The Maximum Fuel Surcharge waiver you get is up to Rs.100/- per statement cycle.

My Analysis

I really don’t understand why Credit card companies are highlighting Fuel Surcharge Waiver..!! This is not even a Nominal benefit to the Card user because you have to pay it only if you use this Credit card. Normally if you pay it in cash there will be No such Surcharges at all.

Also Read: How I lost Money by Paying Petrol Bills with Credit Cards

5. Lost your Credit Card

In case, if you have lost your Credit card & suffered any Financial loss, then, you carry Zero Card liability on any fraudulent transactions made with the card after reporting the loss to the AU Small Finance bank under the cover of “Card Lost Liability“

Also, you are protected against Card Counterfeit/Skimming and Online fraud. The maximum benefit you can get is not mentioned by the bank.

However, to avail of this benefit, this AU Altura Credit card must be in an active state. That means, in the last 180 days from the date of card loss, you must have done at least 1 transaction/activity on any ATM/POS/E-Commerce terminal.

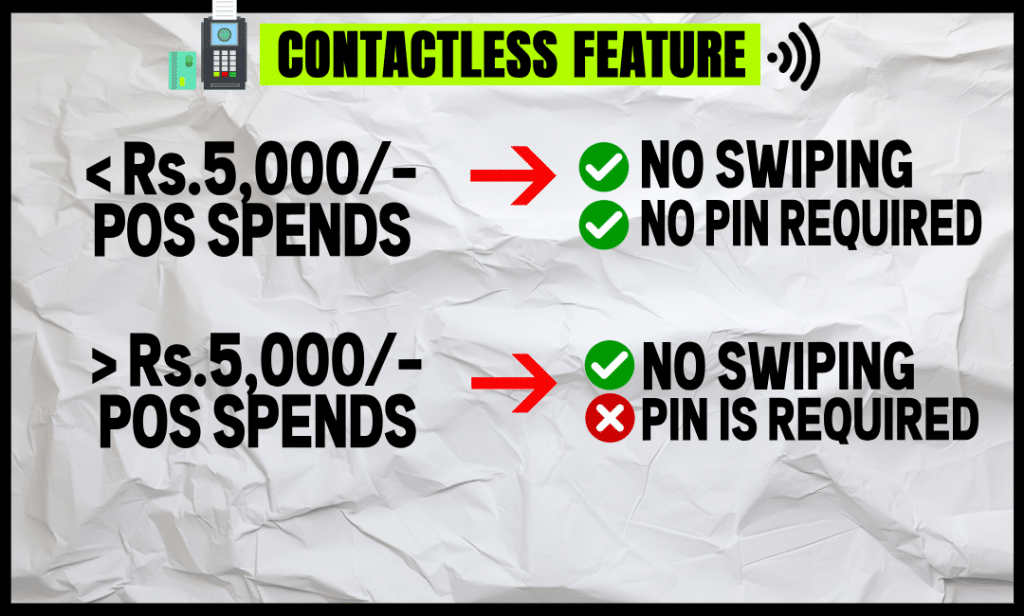

6. Contactless Card feature

The AU Altura Bank Credit Card comes with Contactless technology.

With this feature, in India, you can make payment using this Credit card at the Point of Sale (POS) Machine for a Maximum Payment of Rs.5,000/- per transaction without entering the PIN.

If you want to make a payment of more than Rs.5,000/-, then, this card holder should input the Credit card PIN to complete the payment.

7. Can I convert any Transaction into EMI ?

I spent money online & offline with this credit card!

But it seems huge to pay it next month itself.

Can I convert it into EMI?

Yes.

Any transaction above Rs.2,000/- rupees can be converted into EMI on select tenure of your choice.

For that, you can simply call the AU Credit card Customer Care helpline to book your XpressEMI.

8. Add-on-Card [FREE]

If anyone in your family wants this AU Bank Altura Credit Card, then, the Bank will provide you with an Add-on-card which is a Lifetime Free Credit card.

Who is Eligible for an AU Bank Altura Credit card?

AU Bank Altura Credit card Eligibility:

– The Primary applicant with a Minimum age of 21 years and a Maximum age of 60 years

– The add-on applicant should be aged above 18 years of age are eligible to apply for this card.

How to Apply for AU Bank Altura Credit Card?

AU Bank Altura Credit card Apply:

If you want this Credit card, you can easily Apply for AU Bank Altura Credit Card.

AU Altura Bank Credit Card Charges [Must Read]

If you are applying for this Altura credit card then looking at the benefits won’t help you, my dear friends. You should look at the charges as well.

The overview of the Top charges of the Altura Credit Card is as follows.

| S.No. | Particulars | Description |

|---|---|---|

| 1 | Joining fees | Nil |

| 2 | Renewal fees | Rs.199+GST |

| 3 | Cash advance charges | 2.5% or Rs.500/- w.e.h |

| 4 | Interest charges | @3.59% p.m ; @ 43.08% p.a. |

| 5 | Late payment charges | Rs.0 – Rs.1,100/- |

| 6 | Over-the-limit charges | 2.5% or Rs.500/- w.e.h |

| 7 | Foreign currency Markup | 3.49% of the transaction value |

| 8 | Reward Redemption Fee | Rs. 99 + GST |

1. Joining & Renewal Fees

Should I pay the Joining fee for it?

This AU Altura Bank Credit Card comes with Zero Joining fees. i.e. Free for the first year i.e. you are not required to pay card joining charges.

However, you should pay Renewal Fees from the Second year onwards i.e. 235/- (Rs.199 + 18% GST).

Can I avoid payment of the Renewal Fee?

Yes. But you spend some money on it.

Check how..!!

Conditions for Annual Card Fee Waiver

– If you want to avail 1st Year fee waiver, this cardholder is required to make Rs.10,000/- on Retail spending within 90 days of card set up.

– If you want to avail Annual fee waiver, from the 2nd Year onwards, then, the cardholder is required to make Rs.40,000/- on Retail spending in the previous card anniversary year.

| Year | Spend Limit | Condition |

|---|---|---|

| For 1st Year Fee waiver | Rs.10,000/- on Retail spends | Within 90 days of card set up |

| For 2nd year onwards Fee waiver | Rs. 40,000/- retail spends | In the previous card anniversary year |

2. Cash Withdrawal charges

You can Withdraw Money using this AU Bank Altura Credit Card but Don’t withdraw cash from any credit card. If you withdraw money by using this AU Bank Altura Credit Card, a Transaction fee will be levied on all such Cash Withdrawals at ATMs. Such transaction fees would be billed to the Cardholder in the next statement.

A transaction fee of 2.5% or Rs.500/- whichever is higher will be charged.

It is my sincere and humble request for all the Credit Card users that Whatever the Credit card you use, you Please don’t make any Cash Withdrawals by using your Credit Card. Consider this as my Personal request.

A Small request to all

If you have an urgent cash requirement / Cash crunch, then I suggest you take a Personal Loan or Gold Loan.

Those are much better options.

In a Personal Loan, every month you pay the Principal amount + Interest as an EMI. The rate of interest for Personal Loans usually ranges from 15-20% p.a. on the higher side in most cases.

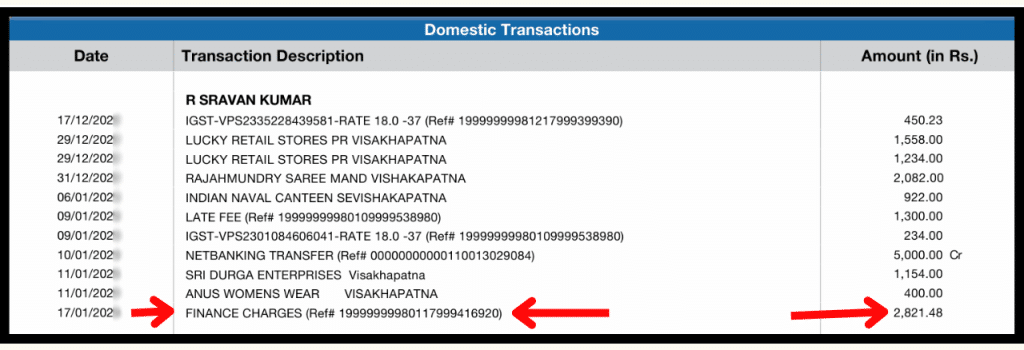

Apply Now3. Interest charges / Finance Charges?

AU Bank Altura Credit Card Interest rate:

Do you know how much interest you will be charged on this Credit Card?

You must know it, boss.!

For Example,

You have used this AU Credit Card and bought all the stuff you need.

But you don’t have enough money to pay the Credit Card Outstanding amount.

Then, the AU Small Finance bank will charge you interest @3.59% per month. It means the Annual interest the bank will charge is almost up to 43.08% per annum.

These finance charges won’t be stopped until you pay off your Credit Card’s outstanding balance in Full.

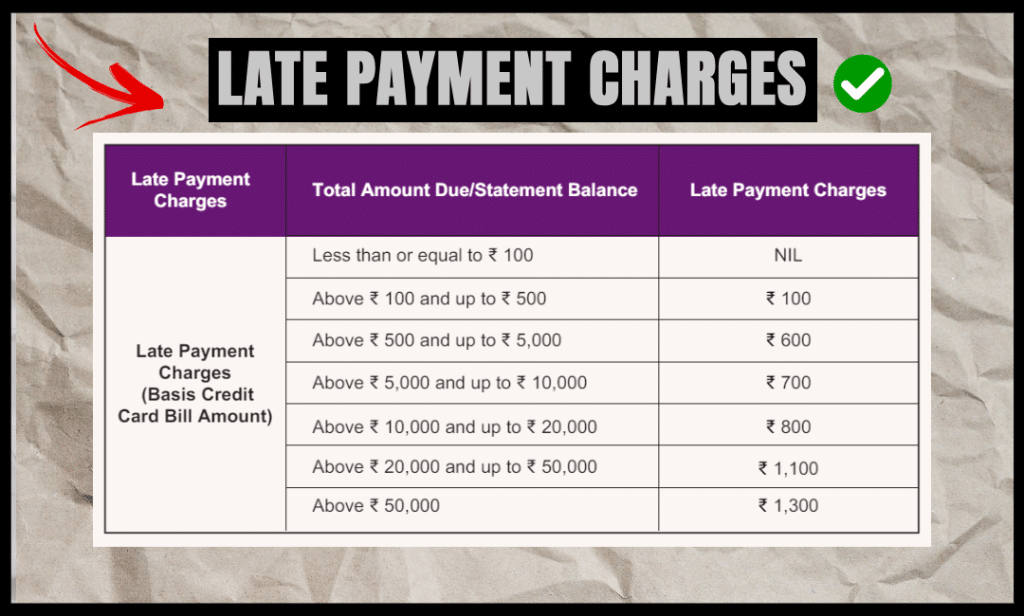

4. Late payment charges

Apart from Interest charges, if you delay paying this Credit card Outstanding by 1 day, you will have to pay Penalty Charges on top of your Credit card Outstanding.

Generally, even if you delay Credit Card payment by one day, AU Small Finance bank will charge you Late payment charges on your credit card. The Late payment charges range from a Minimum of Rs.100/- rupees to a Maximum of Rs. 1,100/-.

So, if you use credit card you have to be very organized and should deal with Credit card timelines properly.

5. Over the limit charges

If you spend more than the available limit on the credit card, that means you have overused your Credit card. In such a case, you will be charged with “Over The Limit charges”.

The more you spend than your Credit Card limit, the more you will be charged.

If you overused this AU Altura Credit card more than the given limit, then, you will be charged @2.50% on the overdrawn amount, or the Minimum amount of Rs.500/- rupees, whichever is higher will be charged.

6. Forex Markup Fees

AU Bank Altura Credit card International transaction Charges:

If you travel abroad and make any International transactions, you will be charged 3.49% of the transaction value as a Forex Markup Fee.

7. EMI Conversion Charges

In the case of Xpress EMI, 1% of the amount being converted to EMI, subject to a Minimum of Rs. 99 + GST will be charged.

In the case of Instant EMI, Rs.199 + GST as Processing Fees on every EMI transaction done at any Point-of-Sale unit or through Payment Gateway.

8. Reward Point Redemption

In case you accumulated Reward points, a nominal fee of Rs. 99 + GST will be levied on each successful redemption.

AU Bank Altura Credit Card Review

In my opinion, the AU Bank Altura Credit card is just a normal credit with no additional or extra features I have found useful to the customers.

The positive side of this card is, that this AU Altura credit card has no Joining fees. For customers looking for a Free credit card, it might be helpful for them only for 1st year only. Also one can make EMI Conversion for the spends of Rs.2,000/- is a little beneficial but you should bear the processing fee.

If you are a frequent Train traveler, then, the Railway lounge facility is somehow helpful for you.

However, the Fuel Surcharge waiver is not a benefit for the customer.

Offering 2% Cashback on Retail spend & Utility and also Milestone benefits are not real benefits to the customers.

While comparing the number of benefits with charges, the cardholder will lose more money in the form of charges instead of getting benefits. Therefore, I’m not recommending this credit card for any category of people.

If you are looking for a Lifetime free Credit card with Unlimited Airport Lounge facility, then, I recommend a Federal Bank Credit card.

Frequently Asked Questions

1. What is Altura Credit Card?

AU Bank Altura Credit Card is launched by AU Small Finance Bank to tailor to the needs of 2% Cashback on all Retail spending, and 1% Cashback on all other retail spending with 8 Complimentary Railway Lounge facilities per calendar year.

2. What is the Meaning of Altura

Altura means High, Elevated, Deep, Profound, etc.,

3. Is Altura Credit Card Rupay Card?

The Altura Credit Card is not a Rupay Credit Card. But at present, it offers a Visa Card network to its customers.

4. Can I Link Phonepe in Altura Credit Card?

As an Altura Credit card is a Visa Credit Card, the cardholder can link this credit card to their PhonePe.

5. Is the Altura credit card Contactless card?

The Altura credit card comes with Contactless technology.

In India, you can make payment using this credit card at the Point of Sale (POS) Machine for a Maximum Payment of Rs.5,000/- per transaction without entering the PIN.

If you want to make a payment of more than Rs.5,000/-, then, this card holder should input the Credit card PIN to complete the payment.

6. Does the Altura Credit Card has Fuel Surcharge Waiver?

The AU Bank Altura Credit Card offers a Fuel Surcharge Waiver. If you spend Petrol/Diesel between Rs.400-Rs.5,000/- in any fuel station in the country, then you will be eligible for a 1% Fuel Surcharge waiver with a Maximum of Rs.100/- per statement cycle.

7. What is the Annual Fee of Altura credit card?

If you use an AU Bank Altura Credit card, then, you should pay Renewal Fees from the Second year onwards i.e. 235/- (Rs.199 + 18% GST). It can also be called as Card Annual Charges.

You can avoid this Renewal Fee for the 1st Year if this cardholder made Rs.10,000/- on Retail spending within 90 days of card set up.

If you want to avail this Annual fee waiver, from the 2nd Year onwards, then, the cardholder is required to make Rs.40,000/- on Retail spending in the previous card anniversary year.

8. AU Altura Credit Card Lifetime Free?

This AU Altura Bank Credit Card comes with Zero Joining fees. i.e. Free for the first year i.e. you are not required to pay card joining charges. But annually you meet the Spend base requirement, then only it’s free. Otherwise, the AU Altura Credit Card is not a Life-free credit card.

9. What is the Minimum Credit Score for AU Bank Credit Card?

The applicants who are applying for the AU Bank Credit Card should have a CIBIL Score of 750 or above.

10. How to avail Railway Lounge facility?

Step 1: The AU Bank Altura Credit Cardholder has to present his valid/active AU Small Finance Bank VISA/RuPay Credit Card.

Step 2: Provide a valid Train travel ticket at the entrance of the participating lounge to avail of the benefit.

Step 3: A Rs.2 transaction would be done by the Lounge operator as non-refundable card validation charges.

Step 4: The Cardholder will be given access to the Railway Lounge.

Any guests along with the Cardholder would be charged as per the prevailing lounge access rate.

11. Does the AU Altura Credit Card have Lounge access?

AU Bank Altura Credit card has a Railway lounge facility only.

If you travel more by Train, then, this Credit card can avail 2 Complimentary Railway Lounge benefits per calendar quarter i.e. 8 times a calendar year.

However, the AU Bank Altura Credit card has no Airport Lounge access.

12. Is Cashback eligible for Educational spending on AU Bank Altura Credit Card?

W.e.f 1st April 2024, AU Bank Altura Credit Card has excluded Educational, Government, and Bharat Bill Payment System (BBPS) transactions from Cashback. Therefore, this cardholder is not eligible for cashback for these transactions.

13. AU Small Credit Card Customer Care Helpline?

For any questions or concerns about your AU Bank Altura Credit Card, you can contact the below Customer Care helpline toll-free number 1800 1200 1500, 1800 26 66677

Thanks for your time folks 🙂