Before you start reading this article, I recommend you to read Part 1 of Ratio analysis i.e. “6 Liquidity and Solvency Ratios“

Once you completed the above article, you can have a better idea of other formulae discussed in this article. If you are well familiar with the Liquidity and Solvency ratios, you can go ahead with this article. Right now.

Let’s get started..!!

1. Inventory Turnover Ratio

Inventory turnover ratio Meaning

It represents the relation between the Cost of goods sold and the Average inventory held during the year. It indicates the number of times the value of inventory is converted into Revenue. And also to check whether the business has any excess inventory in comparison with Revenue / Sales.

It measures how efficiently the business inventory is managed.

Inventory Turnover Ratio Formula

Here,

Cost of Goods Sold = Opening Inventory + Purchases – Closing Inventory

Average Inventory = Opening Inventory + Closing Inventory 2

Inventory turnover ratio Interpretation

Higher ? Indicates Favorable i.e. Reduced Storage and other handling cost

Lower ? Indicates Unfavorable i.e. Sales drop, Excess Inventory, Inefficient inventory management.

2. Trade receivable Turnover Ratio

Trade receivable turnover ratio Meaning

It measures the company’s ability to collect its receivables.

It also measures how many times a company’s receivables are converted into Cash/revenue over a certain period.

The trade receivables ratio also measures the Company’s efficiency in managing the credit to its customers. And also how much time it takes to collect outstanding amounts during an accounting period from its customers.

Trade receivable turnover ratio Formula

Here,

Net Credit Sales = Revenue from Credit Sales – Sales returns (if any)

Average Accounts receivables =Opening Accounts receivables + Closing A/R’s 2

Trade receivables Turnover ratio Interpretation

Higher ? Indicates Favorable. I.e Business has good collection mechanism & Customers making payments faster.

Lower ? Indicates Unfavorable i.e. Delay in customer payments & improper collection mechanism.

Also Read: Golden rules of Accounting – An easy understanding

3. Trade payable Turnover Ratio

Trade receivable turnover ratio Meaning

It measures how much time the business pays to its suppliers/creditors. Trade payable turnover represents how efficient the business is in making payments to its suppliers/creditors. It is a short-term debt and also known as the “Accounts Payable turnover ratio”

Trade Payable turnover ratio Formula

Here,

Net Credit Purchases = Total credit purchases – Purchase returns (if any)

Average Accounts receivables = Opening Accounts P/b’s + Closing Accounts P/b’s 2

Accounts Payable Turnover Interpretation

Higher ? Indicates Favorable. I.e. Business makes payments to suppliers/creditors on time.

Lower ? Indicates Unfavourable i.e. Business takes a long time to make payments.

4. Capital employed Turnover ratio

Capital Employed Turnover Ratio Meaning

It measures how efficiently the company generated sales from its capital employed. This ratio helps the creditors and inventory to determine the firm’s capacity to generate revenue from the Capital employed.

Capital Employed Turnover Ratio Formula

Capital Employed Turnover Ratio Interpretation

Higher ? Indicates Favorable i.e. utilization of Capital employed and shows the company’s ability to generate maximum profit with the minimum amount of capital employed.

Lower ? Indicates Unfavorable.

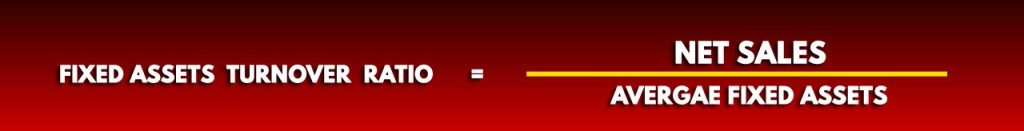

5. Fixed assets Turnover Ratio

Fixed assets Turnover ratio Meaning

It measures how well a firm is generating Sales from its existing fixed assets. It means how efficiently the company’s machines and equipment produce sales.

Fixed assets Turnover ratio Formula

Net Sales = Total Sales – Sales returns – Discounts (if any)

Average Fixed Assets = (Opening balance of FA + Closing balance of FA)/2

Fixed assets = Gross Fixed assets – Accumulated depreciation

Fixed assets Turnover ratio Interpretation

Higher ? Indicates Favorable i.e. Business is using Fixed assets more efficiently.

Lower ? Indicates Unfavorable i.e. Business is using Fixed assets less efficiently.

6. Working Capital Turnover Ratio

Working capital Turnover ratio Meaning

It measures how efficiently a company generates sales for each rupee of Working capital they use. It establishes the relationship between Net Sales generated by the business with Working capital.

Working Capital Turnover Ratio Formula

Working Capital Turnover Ratio Interpretation

Higher ? Indicates Favorable. I.e. More efficient in generating Sales by utilizing Working Capital.

Lower ? Indicates Unfavorable. I.e. In-efficient Sales.

Also Read: 40 Basic accounting terminology everyone should know

I hope you understood the “6 Turnover and Activity Ratios” concept.

Please Comment “GOOD” if you like the article and it encourages us. Also, share this article with your Finance related Friends & Family…

Thanks for reading..!!!

Disclaimer: The materials provided herein are solely for information purpose. No attorney-client relationship is created when you access or use the site or the materials. The information presented on this site does not constitute legal or professional advice and should not be relied upon for such purposes or used as a substitute for legal advice from an attorney licensed in your state.

Also, every effort has been made to avoid errors or omissions in this material. In spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition. In no event the author or the website shall be liable for any direct, indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information.