“Stick to the Basics” is the one of the most used sentence if you watch cricket.

This sentence will often said by the Commentators, when any batsman / bowler is out of form.

Basics play crucial role in any industry. To become an expert in any field you must start with learning basics. As you are going to learn basics of Accounting for that you must have the basic understanding of accounting i.e. “Accounting Basics for Students“

Let’s get started..!!

What is Accounting?

As defined by American Institute of Certified Public Accountants (AICPA),

“Accounting is an Art of Recording, Classifying, Summarizing in a significant manner and in terms of money or money’s worth, transactions and events which are, in part at least, of a financial character, and interpreting the results there of “

Let me explain in detail..!!

> Recording – It means recording of financial transactions in the form of Journal Entries

> Classifying, Summarizing – Proper classification of recorded transactions through Ledger accounts like Asset, Liability, Equity, Capital, Income, Expense etc.,

> In a significant manner – means Recording transactions in a chronological order or any other logical manner

Eg: Date-wise, Month-wise etc.,

> In terms of money or money’s worth – Money means “Physical Cash or Bank Balance” and Money’s worth means “Equivalent to cash” i.e. Shares or Gold etc.,

> Transactions and events – Accounting deals with Transactions and events of financial nature only. Accounting does not deal with the Non-financial transactions.

> Interpreting the results – It includes Analysis the business has earned Profit earned or Loss occurred or Expenses increased or revenue decreased. It may be either Balance sheet analysis (or) MIS Reports (or) any other Analysis reports etc.,

Accounting Process

After understanding the Accounting definition in detail, you must understand how an accounting process works. Before the accounting begins, the prior stage of process of accounting starts with “Source documents“

Source documents

A source document is the original document which contains the details of any business transaction. A source document contains the key and primary information about a transaction like details of Buyers / Seller involved , Amount paid / Payable, Date, and the substance of the transaction.

Before recording any transaction into the books of accounting (i.e. before accounting starts), it must be supported with some standard evidence. Such evidence may be either Internal or external i.e. “Source documents”

Source documents are normally printed with a unique number like Tax Invoice number or Cash receipt number etc. So, it can be differentiated in the accounting system easily by the accounting department. The pre-numbering of documents is particularly useful, since it allows a company to investigate whether any documents are not available.

Examples of source documents include:

- Bank Statements

- Deposit Slips

- Purchase / Sale Orders

- Purchase Bill / Invoices

- Sales Invoices

- Electricity / Telephone Bills

- Payroll Reports

- Maintenance Service report

- Lease agreements

- Rate Contracts etc.,

Journal

Now let’s understand about “Journal”

“A Journal is the Primary / First book where all the financial transactions of a business will be recorded”

Journal entries are recorded in a chronological order based on source documents like Bank Statement, Purchase Bills, Sales Invoice etc.,

Every transaction recorded in a journal should be supported by a proper narration which explains the nature of such a transaction.

A Journal book is not a Single book. As per the Nature and Size of the organization Journal books are further classified into several subsidiary books like

- Purchase Day Book – To record all the purchases made

- Sales Day book – To record all the sales made

- Purchase Returns Books- To record all the purchase returns

- Sales Returns Book – To record all the sale return details

- Cash Book etc., – To record all the cash payments & receipts

However, while passing these entries one must ensure that both the Debit (Dr) and Credit (Cr) sides of account totals should match.

Nowadays, the Journal books have been replaced by computers. Since there is no physical recording of transactions into the long note books, all the entries are recorded and stored in computers using cloud based technology.

Note:

Before you write the Journal entry, an Accountant shall decide for each transaction what ledger accounts get involved and whether those accounts are either to be debited or credited.

Format of Journal entry

A Journal will be divided by 5 vertical columns

- Date

- Particulars

- Ledger Folio – Represents Ledger number / Serial number of the Ledger

- Debit Amount

- Credit Amount

| Date | Particulars | L.F | Dr (Rs.) | Cr (Rs.) |

| (1) | (2) | (3) | (4) | (5) |

Let’s understand with the help of an example.

Example :

Mr.X started a business with Rs.10,00,000/- on 1st Jan

| Transaction | Accounts Involved | Nature of Accounts | Debit (Rs.) | Credit (Rs.) | Reason |

| Mr.X started a business with Rs.10,00,000/- | Cash Capital | Asset Liability | 10,00,000 | 10,00,000 | Increased Increased |

The Journal entry for the above transactions is as follows:

| Date | Particulars | L.F | Dr (Rs.) | Cr (Rs.) |

| 01st Jan | Cash a/c Dr To Capital A/c (Mr. X started a business with capital) | – | 10,00,000 | 10,00,000 |

Ledger:

What is Ledger and How it works?

Generally in every organization there will be numerous journal entries in a financial year. Out of which, identifying

(i) how much the company spent towards a particular expenditure or

(ii) how much revenue generated from a particular source of income is almost impossible.

Suppose, if you want to identify how much value spent for purchase of goods in a particular month.

How will you check it.. ?

For that you need to “look for all purchases accounted for in the journal entries and sum it up”.

Looks easy, isn’t it?

But certainly not.

However, you can give a try only for small or medium sized organizations with minimal transactions.

Whereas, for the Large organizations the same method was certainly not a wise move. Moreover, It is a hectic and time-consuming process.

So what’s the alternative method for it? That’s “Ledger”.

“A Ledger is a book where all the recorded journal transactions will be classified and posted “

Ledger plays a key role in Identifying all the transactions at one place, which are done by any entity in a particular period. It gives you all the details of the transactions related to an Asset, Liability, Expense & Income in a particular period. Ledger helps in quick decision making.

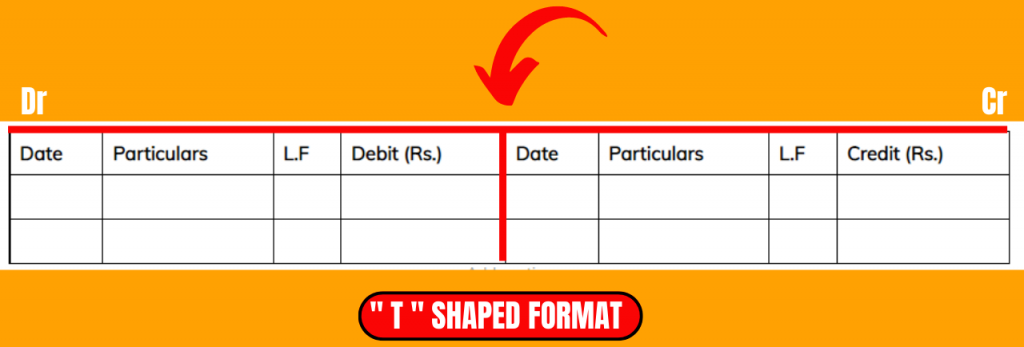

Ledgers in accounting are traditionally represented by “T” form structures which were widely used.

The Specimen of “T” format is as follows.

Example:

From the above example of

Mr. X started a business with Rs.10,00,000/- on 1st Jan.

For posting Journal entries into Ledger, i am creating two ledger accounts

1. Cash Ledger account

2. Capital Ledger account

Dr Cash Account Cr

| Date | Particulars | L.F | Debit (Rs.) | Date | Particulars | L.F | Credit (Rs.) |

| 01 st Jan | To Capital Account | 10,00,000 | |||||

Dr Capital Account Cr

| Date | Particulars | L.F | Debit (Rs.) | Date | Particulars | L.F | Credit (Rs.) |

| 01 st Jan | To Cash Account | 10,00,000 | |||||

Trial Balance (TB):

“Trial balance is a statement which represents the balances of all ledgers at one place”.

It is prepared to ensure that all the debit and credit aspects of the transactions, on any particular day are matching with each other. Normally Trial balance will be prepared at the end of the period. The period may be either a Quarter or Half year or Full year i.e. Financial year.

The two reasons why Trial balance is prepared:

- To check the arithmetical accuracy of the books of accounts.

- To check whether the journal entries are properly posted to ledger accounts and they are balanced as per double entry system of recording.

Format of Trial Balance

The format of Trial Balance is as follows:

| S.No. | Account Heads | L.F | Debit (Rs.) | Credit (Rs.) |

| 1 | Capital | xxx | ||

| 2 | Cash | xxx | ||

| 3 | Machinery | xxx | ||

| 4 | Revenue | xxx | ||

| Total | xxx | xxx |

Example:

From the above example of

Mr. X started a business with Rs.10,00,000/- on 1st Jan

| S.No. | Account Heads | L.F | Debit (Rs.) | Credit (Rs.) |

| 1 | Capital | 10,00,000 | ||

| 2 | Cash | 10,00,000 | ||

| Total | 10,00,000 | 10,00,000 |

Financial Statements

The financial statements includes:

- Profit and Loss account – To ascertain Profit or Loss

- Balance Sheet – To know What a Business Owns i.e. Assets & What a business Owes i.e. Liabilities

- Cash Flow Statements – To ascertain total Inflow and Outflow of funds

- Notes to accounts – Interpretation for the items considered in the accounts

To assess the financial performance of any entity, we need to interpret their financial statements properly. Financial statements gives complete insights about the performance of an entity, which is the basis for the top management to take relevant decisions effectively.

Financial Statements can be prepared easily which shows the true & Fair view of the financial position and operating results of the business. Preparation of Financial statements can be considered as an end to the Accounting Cycle.

Now let’s discuss on important topics in Accounting basics

A) Assets

“Assets are the resources which are Owned by the enterprise. It may be either purchased (or) constructed & having the future economic value”.

Assets includes

- Fixed Assets (Incl. Tangible assets)

- Current Assets (Incl. Tangible assets)

- Fictitious Assets

- Intangible assets

Assets are broadly classified into 2 categories

- Non-current Assets and

- Current Assets

Non-current Assets are classified into

- Property, Plant & Equipment

- Non-Current Investments

- Long-term Loans & Advances

- Other Non Current Assets

Current Assets are further classified into

- Inventories

- Trade Receivables

- Cash and Bank Balances

- Short Term Loans and Advances

- Other Current Assets

Non- Current Assets

Fixed Assets

Fixed Assets are the “Long-term assets which are having an useful life of more than 1 accounting period & held for earning future economic benefits”.

Fixed assets may be

- Tangible Assets &

- Intangible Assets.

As per “AS 10, Property Plant & Equipment “ fixed assets are the assets which are

- held not for re-sale.

- having the useful life of more than one accounting year.

- held either for Producing or Providing Goods or services.

For Example, M/s Ajay constructions Pvt Ltd purchased a JCB of Rs.25,00,000/- for construction purpose useful of 10 years. Here, JCB is a Fixed Asset since it is bought not for resale and having a useful life of more than 1 year i.e.10 years and also JCB is bought for providing services to the its customers.

Fixed assets are further classified into Wasting assets and Non-wasting Assets

- Wasting Assets – Assets which lose their value by Wear & Tear

Eg: Plant & Machinery , Buildings etc.,] or by passage of time i.e. Leasehold Land - Non-Wasting assets – Assets which lose won’t their value by any of the above mentioned reasons i.e. Freehold Land

Now let’s understand tangible and intangible assets.

Tangible Assets

Tangible assets are the assets which are having physical existence which includes long term and short-term assets.

Long-term tangible Assets are:

- Land

- Buildings

- Plant and Machinery etc.,

Short-term tangible Assets are:

- Inventories

- Trade receivables

- Cash and bank balances etc.,

Example 1:

Plant & Machinery which is having a useful of 10 years i.e. Tangible asset which is also a Non-current asset.

Example 2:

Cotton Yarn which is used as raw material in the manufacture of clothes purchased by M/s Karthikeya Industries can be termed as short term Tangible asset i.e. Inventory.

Note:

Tangible asset is classified based on its physical existence but not on whether it is a current or Non-current asset.

Intangible Assets

Intangible assets are the assets which do not have any physical existence which may either be purchased or developed.

As per AS 26, Intangible assets:

Intangible assets are the assets which

- are without physical existence.

- held for use, production of goods, rendering of services

- having Future economic benefit.

They are generally of long-term capital assets.

Example:

- Goodwill,

- Trademarks,

- Copyrights,

- Franchises, Licenses,

- Patents, Brands,

- Computer software etc.,.

Non-Current Investments

Investments which are held for more than 1 accounting period are “Non-Current Investments”

Non-current investments shall be classified as trade investments and other investments and further classified as:

- Investment in Property;

- Investments in Equity Instruments or Preference shares or Mutual Funds;

- Investments in Government or trust securities Eg: National Saving certificates;

- Investments in debentures or bonds;

- Investments in partnership firms;

- Other non-current investments (specify nature).

Long-term Loans & Advances

Long-term loans and advances shall be classified as “Capital Advances” or “Loans and advances to related parties”.

Examples:

- Security deposits

- Advances given for supply of materials

- Advances given for services

- Advances to employees

- Advance Income Tax & TDS etc.,

Other Non Current Assets

Other non-current assets shall be classified as:

- Long-term Trade Receivables

- Deposits with Banks having a maturity exceeding 12 months

- Interest accrued but not due etc.,

Current Assets

Current Assets are the assets which are

- having the useful life of less than 1 accounting year.

- which are meant for re-sale.

- which are useful in the company’s normal operating cycle.

Current Assets are short-term assets & generally meant for easily convertible into cash.

Example:

- Trade Receivables,

- Cash in hand,

- Cash at Bank,

- Inventories,

- Accrued Incomes,

- Short term investments,

- Short term Loans & Advances etc.,

B. Equity & Liabilities:

Equity and Liabilities are broadly classified into

- Shareholders’ Funds

- Share application money pending allotment

- Non-current liabilities

- Current liabilities

Shareholders funds again classified into

- Share capital / Capital

- Reserves & Surplus

- Money received against share warrants

Capital

Capital means Money invested in the business by the owner for generating future cash flows and earning profits.

In case of Company limited by Shares, the Owners will be called as “Share holders” and the amount of money contributed by them is called as “Share Capital or Owners Equity”

In case of Partnership firm, the owners will be called as “Partners” and the Capital contributed by the partners will be called as “Partner’s capital“

Type of account:

Capital is a “Personal account”

Accounting Treatment:

Share Capital will be shown under “Shareholder’s funds” on “Equity & Liabilities” side of the Balance Sheet.

Reserves & Surplus

Reserves are the Accumulated profit or the retained earnings after meeting the expenses kept aside by the company.

Surplus is the excess of Income over expenses which is also called Profit (or) Gain.

Accounting Treatment:

“Reserves & Surplus” will be shown under “Shareholder’s funds” on “Equity & Liabilities” side of the Balance Sheet.

Debit balance of statement of profit and loss shall be shown as a negative figure under the head “Surplus”

Non – Current Liabilities

Non-current liabilities are the long-term obligations which are to be settled by the company i.e., which may be repaid within a time period of more than one accounting year.

Long-term borrowings shall be classified as:

(a) Bonds/debentures;

(b) Term loans from banks.

(c) Loans and advances from related parties;

(d) Long term maturities of finance lease obligations;

(e) Other loans and advances

Current Liabilities

It is the short-term obligation which is to be settled by the company within the company’s normal operating cycle i.e., within the period of one accounting year.

Example:

- Trade Payables or Creditors

- Short term Provisions

- Duties & Taxes Payable,

- Income received in Advance,

- Interest Payable,

- Outstanding expenses

Effects of transactions – Rules

Golden rules of accounting are:

- Debit What Comes In and Credit What Goes Out – Real Account

- Debit the Receiver and Credit the Giver – Personal Account

- Debit all Expenses and Losses and Credit all Incomes and Gains – Nominal Account

Read more at: Golden Rules of Accounting – An easy understanding