Don’t Stop Until you are Proud

– Life’s positive Proverb

We Say “Don’t Stop Until you learn GSTR -1 completely” today.

GST is a Practical Topic and everyone should learn this to file their monthly GST returns properly.

This topic of “GSTR -1 complete guide” is a Practical and Complete guide, you are going to gain full and complete knowledge on “GSTR 1”. This topic will be more detailed and exhaustive. So, please spare your valuable time to learn this topic. We shared valuable inputs for your knowledge purpose.

Let’s begin…!!

Bakset of Mangoes

- What is GSTR -1?

- Who has to file GSTR -1?

- Who has to file GSTR -1 Monthly & Quarterly and what is the Due date to file GSTR -1?

- Can a person opt for a Quarterly return?

- Can a person change his type of filing of GSTR-1 return from Quarterly return to Monthly return?

- How to file GSTR 1?

- How should I enter the Turnover Value in GSTR-1?

- Is there any difference between Taxable Value and Invoice Value?

- When the Debit Notes will be reported in form GSTR- 1?

- When the Credit Notes will be reported in Form GSTR-1?

- How to report Supplies to SEZ units or SEZ Developers in GSTR-1?

- How Exports will be treated in GSTR-1?

- How HSN-wise summary of Outward supplies will be reported in GSTR-1?

- How many changes can i make to uploaded invoices?

- In case Supplier of the goods received an Advance from customer, explain its Treatment?

- What if the Taxpayer failed in filing of GSTR-1 by due date?

- I have submitted the GSTR-1 but I received the above said notice?

- I have not filed the GSTR-1 within due date, is there any penalty applicable?

- How to Cancel any invoice in GSTR 1 after filing?

1. GSTR -1 Meaning ?

- GSTR -1 means, it is a “Statement of details of Outward supplies of

> Goods (or)

> Services (or)

> Both”.

In simple words, the “Supply” represents

Sales made by an enterprise over a period of time [or] Providing/ Rendering of Consultancy [or] Professional Services over a period of time [or] both. - GSTR- 1 is a Monthly / Quarterly return for Sales made or Services rendered during a period. It needs to be filed by the every registered GST Dealer. This GSTR-1 is also called as “Form GSTR-1”

- The details of Outward supply includes

> Details of Invoices (No.of Invoices issued during the period)

> Dr Notes

> Cr Notes

> Details of Exports

> Any advance received

> Any advance adjusted

> Revised Invoices, if any

2. Who has to file GSTR -1?

- GSTR-1 is to be filed by both Casual taxable persons i.e. Composite dealers as well as Registered taxpayers.

- Whether the person made either Zero Sales for a particular month (or) Crores of Sales in another month

- He shall file the return Electronically either Monthly (or) Quarterly

- Based on their Annual Turnover

Note: As per the Provisions of GST act, It is mandatory to file “Nil” return even though there are no Sales in a period.

In simple words, GSTR-1 is to be filed by every registered dealer irrespective of Sales made. Those Outward details are to be filed either on a Monthly basis (or) Quarterly basis based on their Annual Turnover.

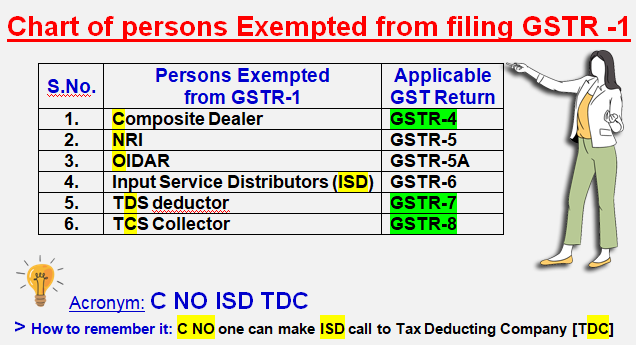

Is there any exemption from filing GSTR-1?

Yes..!!

There are certain persons who are exempted from filing of GSTR-1. It means the following persons are not required to file form GSTR-1.

- Input Service Distributors (ISD) –This person files GSTR-6 instead of GSTR -1

- TDS Deductor

A person who is liable for deducting TDS – This person files GSTR-7 instead of GSTR -1 - TCS Collector

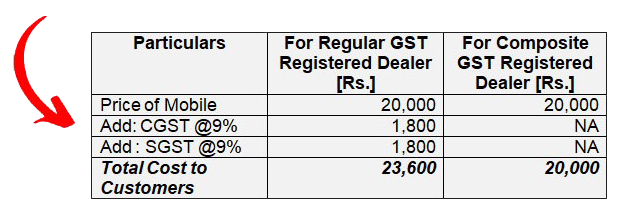

A person who is liable for collecting TCS – This person files GSTR-8 instead of GSTR -1 - Composite Dealer

The person who registered their business under the Composition scheme of GST will be called as “Composite dealer”.This person files GSTR-4 instead of GSTR -1.

Under this scheme, the Annual Turnover of the business is below Rs.1.50 Crores only. It means these businesses will not collect any GST from the Customers.

In simple words, you get the same products at an economic price from the Composite dealers. Normally you will see some shops & establishments hang boards of “Composite Dealer”, here is the reason behind it. No GST on Composite goods.

5. Supplier of Online Information &Database Access or Retrieval services [OIDAR] – This person files GSTR-5A instead of GSTR -1.

6. Non-Resident Taxable Persons [NRI]

The person who Import goods or services fromOutside India – This person files GSTR-5 instead of GSTR -1

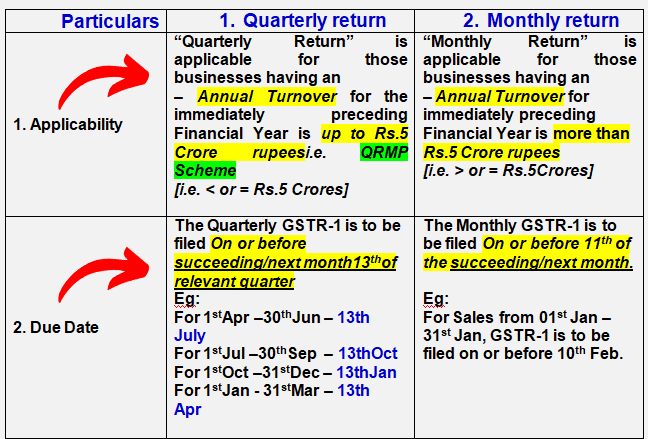

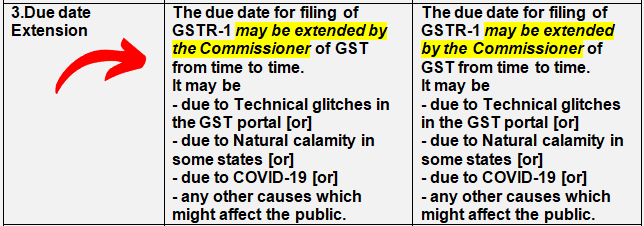

3. Who has to file GSTR -1 Monthly& Quarterly and what is the Due date to file GSTR -1?

The Due date to file GSTR-1 depends on the Annual Turnover of the business. It may be either a Monthly return or Quarterly return.

How to decide which return is to be filed by the registered person?

How to decide which return is to be filed for the Current Financial year?

Normally the Registered person of the business shall assess their “Annual Turnover” for the current financial year, based on his estimation only he can opt for either “Quarterly return” or “Monthly return”. For one year it may be a Quarterly return and for another year it may be a Monthly return. But the taxpayer shall decide at beginning of the financial year before filing the return only. He will be asked to file either Quarterly or Monthly return, once it has been decided then no further choice of filing of return will generate for the financial year.

Read More: 3 Cases: What is GST Means & How GST works

4. Can a person opt for a Quarterly return?

Yes.

A person can opt for a Quarterly return if he satisfies any one of the following conditions

- For an Old/ Existing business: When the business Turnover for the preceding financial year was up to Rs.1.50 Crores

Eg: M/s.Jithendra Kumar & Co., registered under GST on 1st July 2019 (FY 2019-20) with an aggregate Turnover of Rs.79 Lakhs. Therefore, the person is eligible & can opt to file a “Quarterly return” for the FY 2020-21 as the Turnover of the business is less than Rs.1.50 Crores

[or]

2. For the Newly incorporated business: When a person is registered his business during the Current period and his business Turnover for the Current financial year was upto Rs.1.5 Crores

Eg: M/s.Steel Manufacturing& Co., registered under GST on 1stNov, 2020 (FY 2020-21) with an aggregate Turnover of Rs.1.49Crores. Therefore, the person is eligible & can opt to file a “Quarterly return” for the FY 2021-22 as the Turnover of the business is less than Rs.1.50 Crores during the preceding FY of 2020-21.

5. Can a person change his type of filing of GSTR-1 return from Quarterly return to Monthly return?

Yes. A person has the facility to change the frequency of filing of GSTR-1 from Quarterly to Monthly only when the person has not filed any return during the current financial year according to his original frequency.

6. How to file GSTR 1?

Before filing GSTR-1:

A person shall check &keep all the below-mentioned before filing Form GSTR-1

1. The taxpayer should be a

– Registered taxpayer under GST&

– Should have an Active GSTIN during the tax period for which FormGSTR-1 has to be furnished;

Eg: GST No. 29ABCDE1234F2Z5

2. The taxpayer should have valid login credentials to login into GST Portal

Eg: Username & Password

3. In case the digital signature is mandatory, the taxpayer should have an active and non-expired/ revoked digital signature (DSC)

Is DSC mandatory for filing of GSTR-1?

DSC is mandatory to

- All Public Limited companies

- All Private Limited companies

- Indian Limited Liability Partnership firms (LLP’s) &

- Foreign LLP’s

4. In case taxpayer wants to use EVC, they must have access to the registered mobile number of the Primary AuthorizedSignatory.

At the time of filing of GSTR-1:

As discussed a registered taxpayers shall submit all the details of Outward supplies of goods & services. To make it briefly read this article fully.

The following details to be furnished in GSTR-1 for a particular tax period.

1. Invoice details of Supplies made to Registered persons i.e. B2B

B2B means Business to Business.

“When supplies are made by one Registered GST person to another Registered GST person”

The Supplies may be either

- Inter-State (i.e One State to another) [or]

- Intra State (i.e. Within State)

B2B Invoices will be mentioned in Tables 4A, 4B, &6.

2. Invoice details of Supplies made to Unregistered persons i.e. B2C

“B2C” means Business to Customer.

When supplies are made by the Registered GST person to an Unregistered GST person

3. Invoice details of Supplies made to Unregistered persons i.e. B2C (Large)

“B2C (Large)” means Business to Customer (Large).

when supplies made by the Registered GST person to an Unregistered GST person having an Invoice value of more than Rs.2,50,000)

4. Nil rated, Exempted, and Non-GST Supplies

5. Tax Liability (Advances received)

6. Adjustment of advances

7. HSN-wise summary of Outward Supplies

8. Documents Issued

9. Amended Tax Liability

10. Amended Adjustment of advances

11. Amended B2C (Others)

Keep reading the article, We discussed in this article.

7. How should I enter the Turnover Value in GSTR-1?

- For the Newly incorporated business: The Turnover value is to be entered in “Table 3” of Form GSTR-1. It is not auto-populated. So it should be entered manually as the business is New and No information will be available in the GST Portal for the First year.

- For an Old/ Existing business: From the Second year onwards the Turnover will be auto-calculated based on information provided by the recipients through their

– Annual returns of GSTR-9

– Along with PAN based Turnovers

But the Turnover value is editable and you can also amend it.

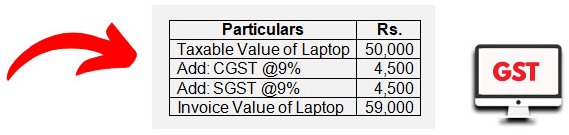

8. Is there any difference between Taxable Value and Invoice Value?

Taxable Value

The Value of Goods & Services without inclusion of GST will be called as “Taxable Value”

Invoice Value

The Value of Goods & Services with inclusion of GST will be called as “Invoice Value”

Eg: Mr. Reliable, UP has acquired a Laptop for a price of Rs.59,000/-within the state with GST @18%.

9. When the Debit Notes will be reported in form GSTR -1?

Debit notes are simply “Purchase Returns”.

Then, Why the Purchase returns will be shown in GSTR-1??

Here, in GSTR – 1 the Purchase returns means the goods returned from the recipient which were supplied earlier by you i.e.Supplier. It means

Debit Notes of Recipient = Credit Notes of Supplier

These Debit notes will be shown/reported in the return of the month in which they are issued by the supplier.

Read More : Did you know.!! When, Where and How GST started

10. When the Credit Notes will be reported in GSTR-1?

Credit notes are simply “Sales Returns”.

When?

Whenever the business gets any returns from Customers those detailed are to be shown in return of form GSTR- 1in the month in which they are issued to the customers. But it should not be later the September month following the end of the financial year in which such supply was made [or] due date of furnishing of the relevant annual return, whichever is earlier.

Eg:

M/s.Mahesh Textiles of Andhra Pradesh made Sales of Rs.20 Lakhs for the month of Feb’21. Due to defective textile, a purchaser returned the value of Rs.3 Lakhs on 8th Mar,21.

Case 1: If GSTR-1 is not filed before 8th Mar, 2021:

Now Mr.Mahesh shall report Rs.3 Lakhs in “Credit Notes” of GSTR-1 for the month of Feb’21 including Invoice details and details of GST.

Case 2: If GSTR-1 is filed before 8th Mar, 2021:

Now Mr.Mahesh shall report Rs.3 Lakhs in “Credit Notes” of GSTR-1 in the month of Mar’21 including Invoice details and details of GST. He can’t file it in the month of Feb’21.

Case 3: If Credit notes are forgotten to be shown in Mar, 2021 GSTR-1:

Now in this case, since Mahesh Textiles forgot to declare those Credit notes in Mar 2021 GSTR-1, then he shall report Rs.3 Lakhs in “Credit Notes” of GSTR-1 by 30th Sep 2021 or before the filing of GSTR9 whichever is earlier.

Also Read: When, Where & How GST started

11. How to report Supplies to SEZ units or SEZ Developers in GSTR-1?

In case the supplier of goods made any supplies to SEZ units or SEZ developers in such a case those supplies will be shown as

“Supplies made to registered taxpayers” i.e.B2B Supplies.

Such supplies shall also mention with the “SEZ Flag”

12. How Exports will be treated in GSTR-1?

Exports will be treated as “Zero Rated (0) & Inter-State Supplies”. It means for exports “IGST” will be applicable. For the exports, the Taxpayer will have 2 Options.

- Export >Don’t pay IGST> Claim ITC refund on purchased goods [or]

- Export >Pay IGST> Claim refund of IGST

Shipping Bill:

As we know for every export, a shipping bill is mandatory for the shipment of goods from one country to another.

But in the case of filing GSTR-1, the Shipping bill number is not mandatory while declaring export invoices. It means the Exporter can export the goods without mentioning the Shipping bill number and Date but the taxpayer shall declare those details in GSTR-1 once it is been received in the month in which he receives it through the amendment section of form GSTR-1.

13. How HSN-wise summary of Outward supplies will be reported in GSTR-1?

HSN-wise summary of Outward supplies contains all the consolidated information of all the Supplies made by Invoices for that particular month which shall be entered manually by mentioning the applicable HSN code of supplies made.

In simple, all the supplies made by the supplier will be mentioned by the applicable HSN- wise.

14. How many changes can I make to uploaded invoices?

A registered taxpayer can make any number of changes to the uploaded invoices details like they can modify them or can delete them. As the data entered will be in the Draft version, the taxpayer can make a number of changes irrespective of the due date till the GSTR-1 is submitted. Once submitted he can’t make any changes.

15. In case the Supplier of the goods received an Advance from the customer, Explain its Treatment?

In case the Supplier of goods has received any Advance from the customer in such a case, the Supplier shall mention those details of “Amount of advance received” and also the supplier is liable to pay “GST” (tax) on itin the form GSTR-1 in a month in which payment is received.

16. What if the Taxpayer failed in filing of GSTR-1 by the due date?

In case the Registered taxpayer is unable to file the return within the due date, then GST department will serve a System generated return defaulter notice in Format 3A.

17. I have submitted the GSTR-1 but I received the above-said notice?

In GST, Return submitted is different from return filed. Firstly, the Taxpayer should submit the return and then file it. Mere submission of return is not final.

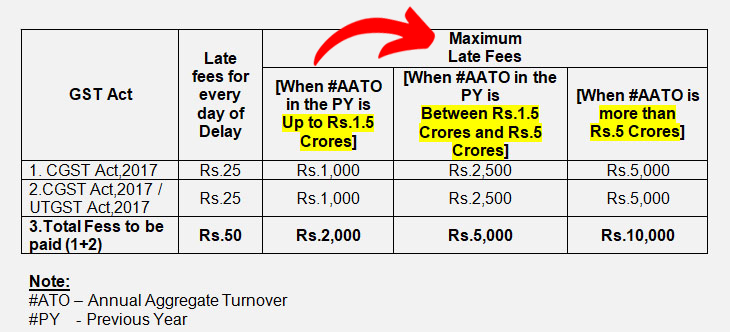

18. I have not filed the GSTR-1 within due date, is there any penalty applicable?

In case the Taxpayer fails to file the return, the applicable Late fee is as follows.The 43rd Meeting of the GST CouncilNew Delhi, 28th May, 2021 issued the following guidelines.

A. The late fee for delay in furnishing of FORM GSTR1 to be capped, per return, as below:

- For taxpayers having Nil outward supplies in GSTR-1,

Late fees for every day of Delay: CGST Act,2017 –Rs.10/- per Day & SGST Act /UTGST Act,2017 –Rs.10/- per Day (Total Late fees to be paid per day – Rs.20)

Late fee to be capped at Rs.500/- (Rs 250 CGST +Rs 250 SGST) - For other taxpayers:

19. How to Cancel any invoice in GSTR 1 after filing?

As per the provisions and rule under the Goods and Services Tax Act 2017, GSTR-1 once filed then Invoices cannot be deleted. Then what you can do. The only way is that you can issue a Credit note of full amount against the invoice you want to cancel in the subsequent month only. In GSTR -1, No invoice cannot be deleted and there is no provision for revising the return.

If an invoice needs to be cancelled, a credit note works in most situations (Suggestive only). A credit note is a legal document used to ‘pay’ the invoice so that it does not become overdue.

A credit note shows the negative value of an invoice. For example, if you have invoiced a customer for Rs 1000, the invoice will have a balance of Rs 1000 in order to balance the amounts in your accounting.

It also corrects the invoice number sequence. So if the invoice that needs to be cancelled is number 112, the credit note will be number 113 and the next invoice you create will be 114. It’s important to keep in mind that invoice numbers cannot be reused, even if it has been countered with a credit note.

When you create an invoice and realize that it needs to be cancelled, be aware that there are some legal restrictions involved. Technically, you should never delete an issued invoice but instead use a credit note to cancel the invoice.

Bonus Points

From 1st Jan, 2022 onwards:

- Dudes, No errors please while filing GST Returns.

- Not filed GSTR-1 in time, then, your supplier cannot get the ITC.

- If you have not filed the previous period GSTR 3B, the current period GSTR 1 cannot be filed.

- Claim ITC as per GSTR-2B (Static Statement of ITC) only.

- If your supplier, do not furnish GSTR-1 on time, you cannot avail the credit of ITC in GSTR 3B.

- Missed GSTR-1 Invoices:

There may be chances that one or more of the invoices were missed while filing due to either negligence or might be forgotten to enter. In such a case, those missed invoices can be shown in the next month’s return filing. - The Tax Liability declared in GSTR 1 should be paid in GSTR 3B. The difference between the tax Liability of GSTR 1 and GSTR 3B is considered as Self-assessed tax.

- By mistake, you have declared more tax liability in your GSTR 1, you have no choice, but to pay this extra liability. (See last para below for some relief)

- By mistake, your supplier has mention the wrong date, wrong GSTIN or mention as B2C instead of B2B, you lose the ITC and you have to pay cash while filing GSTR 3B.

- No need to issue any Show cause notice by the GST officer for Tax recovery. Such amount can be collected directly by attaching the Bank account, if required.

Frequently Asked Questions [FAQ’s]

1. Can I change the Invoice date in GSTR -1 after filed it ?

You cannot change the Invoice date once you submitted the GSTR-1. The invoice date can be changed only before the Submission of the return only.

Final Thoughts

GSTR – 1 is a repetitive type of return. The Accounting department must pay great attention to avoid errors and file the return properly as the GST department has a very keen eye on the details mentioned.

Please do share if you like it. And also give your valuable comment as “Good” in the comment section, it encourages us to write better articles.

Disclaimer: The materials provided herein are solely for information purposes. No attorney-client relationship is created when you access or use the site or the materials. The information presented on this site does not constitute legal or professional advice and should not be relied upon for such purposes or used as a substitute for legal advice from an attorney licensed in your state.

Also, every effort has been made to avoid errors or omissions in this material. In spite of this, errors may creep in. Any mistake, error, or discrepancy noted may be brought to our notice which shall be taken care of in the next edition. In no event, the author or the website shall be liable for any direct, indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information.