PAN requirement for cash transactions

In this article, we will cover PAN requirement for cash transactions. Currently furnishing PAN is mandatory for cash deposits more than Rs. 50,000 per day in a bank (including Co-operative) or post office (Rule 114B of Income Tax Rules)

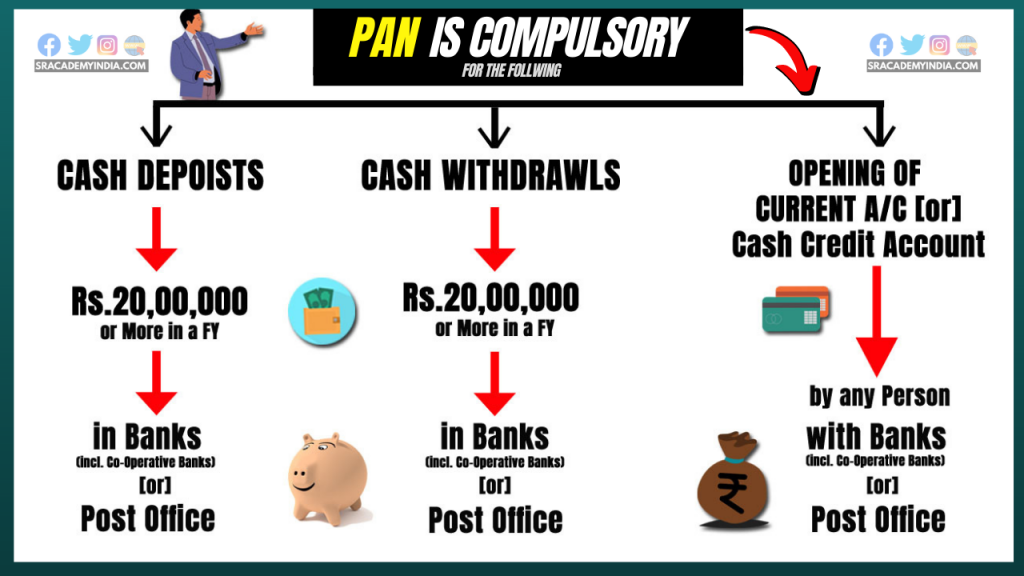

In addition to this, CBDT as per the recent notification no. 53 dated 10th May, 2022 has even mandated PAN for the following transactions also. They are:

- Cash deposits of 20 lakh or more in a Bank or Post office during a FY

- Cash withdrawals of 20 lakh or more from a Bank or Post office during a FY

- Opening of Current Account or Cash Credit account with a Bank or Post office

Let’s elaborate.

Background

Till now, PAN is mandatory only if we do cash deposit of more than Rs. 50,000 per day in a Bank or Post office.

Imagine a scenario, where a person is doing a cash deposit of Rs. 40,000 every day through out a year. All such cash deposits together will easily cross Rs. 1 crore in a year, but still such person need not quote PAN in any of those transactions since none of them were triggered the limit of Rs. 50,000 per day. So none of these transactions will be reported to Income Tax Department, which may lead to revenue leakage to the Government.

Hence to strengthen the reporting mechanism for these cash transactions, CBDT released the recent notification (Notification no. 53 dated 10th May, 2022)

Applicable for whom?

For all tax payers who are doing frequent cash withdrawals and frequent cash deposits.

Applicable from when?

26th May, 2022 onwards

What are the new rules inserted?

Rule 114BA and rule 114BB are inserted through this notification.

Rule 114BA

Excerpts of Rule 114BA

114BA. Transactions for the purposes of clause (vii) of sub-section (1) of section 139A.–– The following shall be the transactions for the purposes of clause (vii) of sub-section (1) of section 139A, namely:—

(a) cash deposit or deposits aggregating to twenty lakh rupees or more in a financial year, in one or more account of a person with a banking company or a co-operative bank to which the Banking Regulation Act, 1949 (10 of 1949) applies (including any bank or banking institution referred to in section 51 of that Act) or a Post Office;

(b) cash withdrawal or withdrawals aggregating to twenty lakh rupees or more in a financial year, in one or more account of a person with a banking company or a co-operative bank to which the Banking Regulation Act, 1949 (10 of 1949) applies (including any bank or banking institution referred to in section 51 of that Act) or a Post Office;

(c) opening of a current account or cash credit account by a person with a banking company or a co-operative bank to which the Banking Regulation Act, 1949 (10 of 1949) applies (including any bank or banking institution referred to in section 51 of that Act) or a Post Office.”;

Source: Income Tax Website

Understanding Rule 114BA:

- Cash deposits of 20 lakh or more in a Bank or Post office during a FY:

- Aggregate deposits has to be considered

- If you have multiple accounts in a bank then transactions from all such accounts are to be clubbed to arrive at this limit. So from now onwards, we need to check per day 50,000 cash deposit limit as well as 20 lakhs limit of cash deposits in a financial year.

- Cash withdrawals of 20 lakh or more from a Bank or Post office during a FY

- Aggregate withdrawals has to be considered

- Limits are same as Cash Deposits

- Opening of Current Account or Cash Credit account with a Bank or Post office

If you are already having PAN, then you will furnish the same to Bank or Post office.

Instead, if you are not having PAN yet, but you want to do any of these transactions which are specified above then you need to apply for PAN at least 7 days before the date of such transaction.

Rule 114BB

In addition, CBDT with this notification also inserted Rule 114BB which casts responsibility on banks and post offices to collect either PAN or Aadhaar from their customers when they do either of these above mentioned transactions.

Consequences for not furnishing PAN

Since Rule 114BB is effective from 60 days from the date of publication of official gazette which is 10 May 2022, If customer denies to provide PAN or Aadhaar then bank/post office may deny the transaction. That is the implication of Rule 114BB.

Disclosure to be taken care by Tax payers

Prior to this notification transactions which are done in excess of Rs. 50,000 per day are alone were reflected in Annual Information Statement (AIS). But from now onwards, any Cash deposits or withdrawals beyond the above mentioned limits will be reported by banks and post offices and the same will be reflected in the AIS.

- Check your Form 26AS & AIS before filing your ITR

- If any transactions are reported in your 26AS/AIS, income on those transactions has to be properly disclosed in the ITR.

Conclusion

Generally after knowing this kind of information our first doubt will be, whether we can do cash transactions or not?

From the beginning onwards, Government intention is very clear on cash transactions. If we do any kind of bank or digital transactions, government can at least track those transactions. Where as in case of cash transactions, it’s almost impossible to track.

Though Government cannot stop all these cash transactions, but by introducing these kind of rules at least they are able to know who is doing it and how many cash transactions are happening & whether they are paying taxes properly by disclosing their complete income.

So our responsibility as a tax payer is to disclose all our income from various sources, pay respective taxes and report to the income tax department through our ITR.