In this topic, you are going to learn “What GST means”. We are trying to make it crystal and synopsis kind of explanation to make you understand well. You are going to gain full and complete knowledge on “What is GST means and also how GST works”. This topic is explained more in general nature to understand it. So, please spare your valuable time. We shared valuable inputs for your knowledge purpose.

What GST means

GST stands for “Goods and Service Tax”. It is an Indirect Tax that is applicable all over India. GST is a Value-added Tax, which will be levied on “Supply” which may be in relation to Goods or Services.

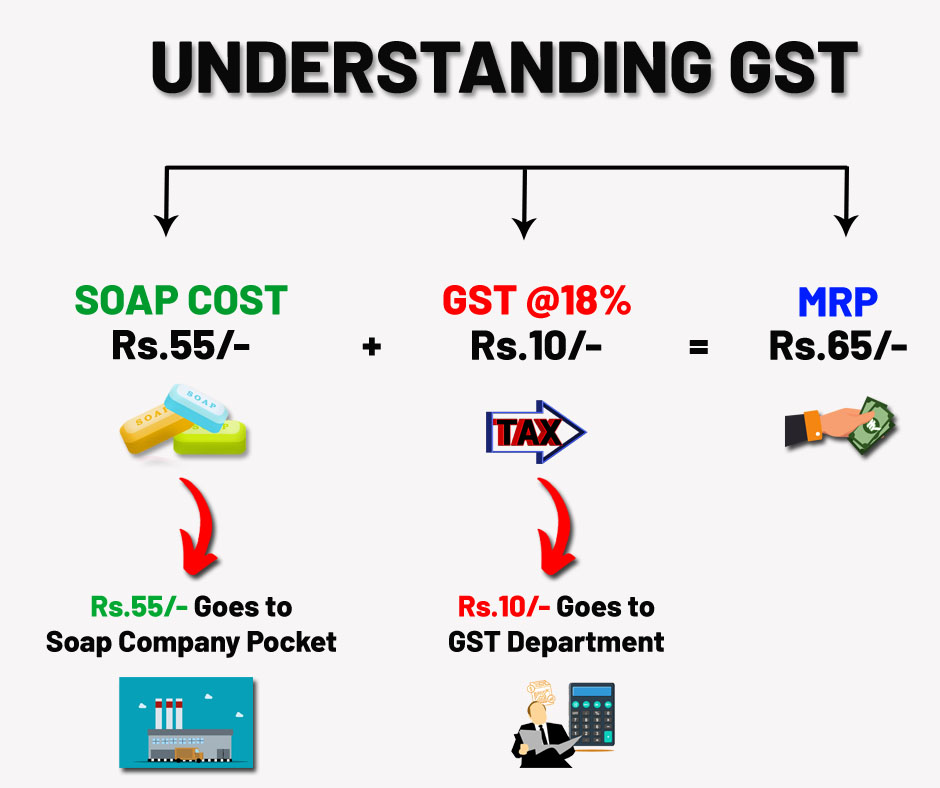

When you buy a Soap you can see MRP i.e. Maximum Retail Price (incl. of all taxes) on its pack right…!

It means when you buy the soap with Rs.65/- with GST of 18% (Incl. of all taxes). The GST portion is Rs.10. In such a case out of Rs.65/-, Rs.55/- (Rs.65-Rs.10) will be paid to Soap Company and the balance Rs.10/- will be paid to the government. The amount you paid of Rs.10/- of GST to the government by collecting the money from you and paid by the soap company.

Eg: Soaps, Groceries, Electronics, Steel, Cars, Machines, etc.,

In simple, GST is levied on

1. Manufacture or Sale of goods and / or

2. Provision of Services

To know it a little brief and also to understand better I will explain to you in 3 Cases in which GST will be levied..!!

Case 1: When you Manufacture Goods

GST will be levied in case you manufacture any goods (except a few). i.e. Manufacturer. The Manufacturer has to pay GST on the Raw material purchased and any value added to it.

Eg: Soap, Toothpaste, Groceries, Steel, Electronics, Car, Machine, etc.,

Case 2: Goods not Manufactured but bought it from others

You don’t have a Manufacturing idea.

You don’t have Costly Equipment.

You don’t have a huge investment.

You don’t know the Formula of Product to manufacture.

Then what you will do, you may buy the goods from others.

GST will be levied even though you have not manufactured Goods but you bought them from others. Simply, buying the goods from the supplier and selling it to customers does not involve any process. Such dealing will be called “Trading” and the person who purchases the goods through this deal will be called a “Trader”.

The Trader or Retailer needs to pay GST on the products purchased from the Manufacturers or Distributors as well as the margin that has been added.

Eg: Dealers, Wholesalers of Steel cannot process the Steel into bars they simply buy it from the Steel Manufacturers etc.

Case 3: When you render Services

You are not manufacturing the goods (or)

You are not buying it from others.

Then, will GST be applicable to me..!!!

Yes…

Provided, you are rendered any services to the clients.

In case, when you not dealing with goods but you are rendering services also GST will be applicable. It means you are providing value to customers.

Eg: Tax consultants, Cab service providers like Ola, Uber, etc., Professional services like CA, CMA & CS & Courier services, Bike rentals, etc.,

In short, any person who is covered under any of the above cases, will be covered under the GST in India subject to provisions of GST.

Read: When, Where & How GST Started ?

Government of India Collects 4 types of GST

- CGST (Central Goods and Service Tax)

- SGST (State Goods and Service Tax)

- IGST (Integrated Goods and Service Tax)

- UTGST (Union Territories Goods and Service Tax)

How GST Flows / Works:

To understand GST clearly, one should know How GST flows..?

What is Input GST…!

What is Output GST..! &

As mentioned earlier, GST is not only a Value added tax but also a Destination based tax.

Let’s read it cautiously.

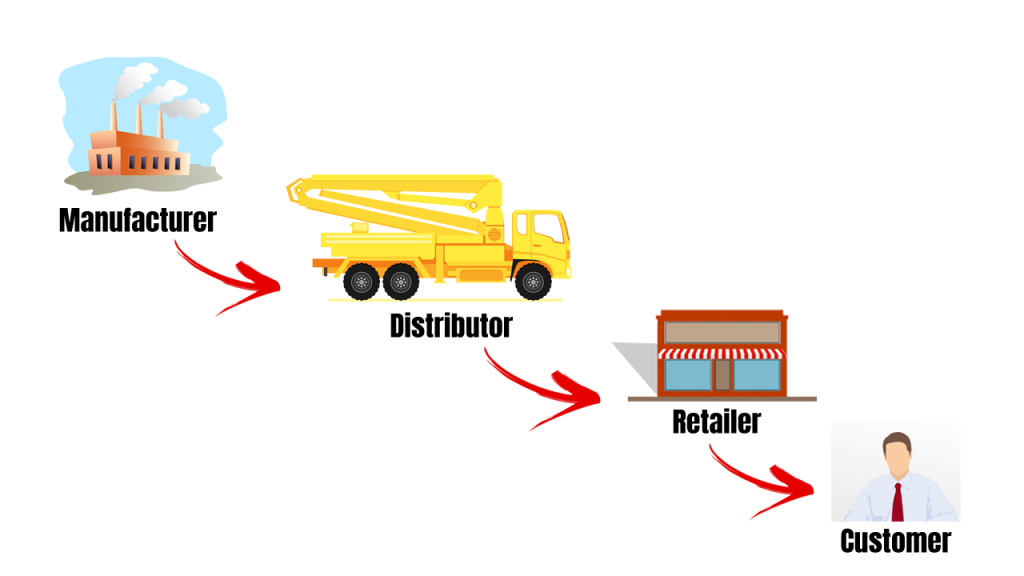

GST offers a Continuous chain of Credits that starts from the Manufacturer’s / Traders/ Producers / Service Provider’s point of view (i.e. Place of Origin) up to the Retailer’s level /consumer’s level (i.e. End point). GST is taxed only on the value-added at each stage of the supply chain.

For example, M/s Mounika Constructions Pvt Ltd engaged in Construction works who build flats & houses in Visakhapatnam city of Andhra Pradesh State of India. For that, they are in need of “Steel”. The Steel will be made from the Iron ores. These Ores will be available with M/s National Mineral Development Corporation (NMDC) of Chhattisgarh state which is near Andhra Pradesh state. Here the NMDC is the producer of Iron i.e. “Manufacturer or Iron Producers” and the place of manufacturing wil be called as “Place of Origin”

The NMDC will convert the Iron ores into different moulds by processing it at high temperatures. Then these iron bars will be cut into different moulds. Those moulds will be converted into different sizes of steel like 6mm, 8mm, 32mm, etc., Those steel materials will be distributed by the distributors to the different states like Andhra Pradesh and also to different major companies like Steel Plant of Visakhapatnam and also to their dealers and retailers. Now, the Retailers will distribute the Steel to the Shops as well as customers like M/s Mounika Constructions P Ltd (i.e. End Point).

Here, the dealers, as well as M/s Mounika Constructions P Ltd (i.e End point), are eligible to get GST Input tax credit (ITC) on the purchased steel bars.

In GST there is no cascading tax effect.

Cascading tax means simply “Tax on Tax”. It occurs when a product is taxed at every stage of production. This process is known as “Tax on Tax”

It is not there in GST.

In GST, the supplier at each stage is permitted to avail credit of GST paid on the purchase of goods and/or services (Input GST) and can set off this credit against the GST payable on the supply of goods and services to be made by him (Output GST).

In short, the Output GST on the supply of goods can be adjusted with Input GST. If still any unadjusted balance is there, it shall be remitted to Government. i.e.

Output GST – Input GST = GST P/b to Government

| Particulars | Rs. |

| 1. GST Payable on Goods [Output GST] | xxx |

| 2. Less: GST paid on Purchase of Goods/ Services [Input GST] | (xxx) |

| 3. GST Payable to Government i.e. Balance | xxx |

Thus, only the final consumer or customer bears the GST charged by the last supplier in the supply chain, with set-off benefits at all the previous stages. Since only the value-added at each stage is taxed under GST, there is no tax on tax or cascading of taxes under the GST system.

I hope you understood the “What is GST & How GST flows”

Please “COMMENT” on which of the above topic you like the most. Also, share this article with Friends & Family.

Thanks for reading…!!

Disclaimer: Every effort has been made to avoid errors or omissions in this material. In spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of by our team in our next article or edition. In no event, the author or the website shall be liable for any direct or indirect or special or incidental damage resulting from or arising out of or in connection with the use of information.