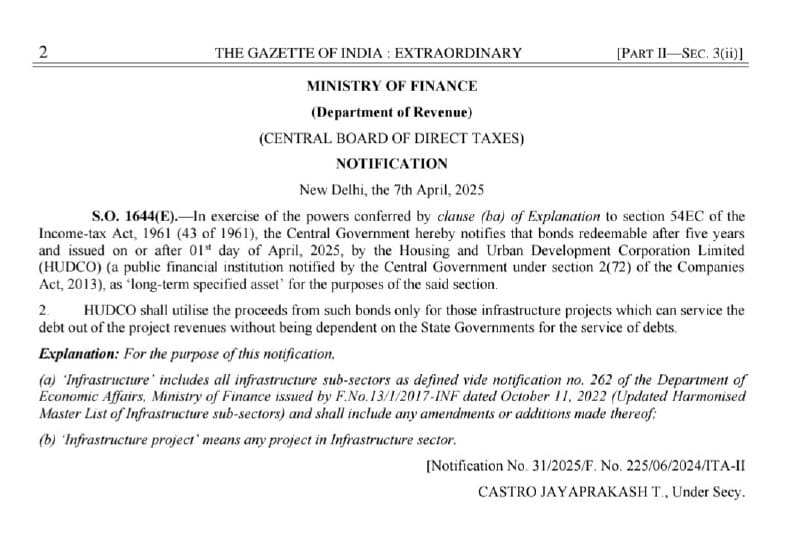

HUDC Bonds are now eligible for capital gains exemption under sec 54EC of Income Tax Act, 1961. CBDT recently issued notification no. 31/2025/F.no. 225/06/2024/ITA-II dated 7th April 2025 regarding the same.

Under sec 54EC, any long-term capital gain arising from the sale of assets like land or buildings shall be invested in specified long-term assets within 6 months from the sale of such assets.

Also, remember the lock-in period is 5 years, and the maximum investment is Rs. 50 Lakh.