Introduction

In this article, let’s understand about the Sec 194Q applicability. Sec 194Q of Income Tax Act inserted by Finance Act, 2021 & it is effective from 1.7.2021. It deals with TDS on purchase of goods.

Sec 194Q applicability arises when buyer is purchasing goods worth more than Rs. 50 lakhs (single or multiple transactions) from a Resident seller during any financial year, then either at the time of credit or payment whichever is earlier, buyer need to deduct TDS @ 0.1% on the amount exceeding Rs. 50 lakh under Sec 194Q of Income Tax Act. If seller is not having PAN, then TDS rate is 5% instead of 0.1%.

First, we will discuss about the applicability of Sec 194Q and later we will try to understand the provision with the help of an example.

Applicability of Sec 194Q

To understand the applicability, first let’s see what the provision says:

Any person, being a buyer who is responsible for paying any sum to any resident (hereafter in this section referred to as the seller) for purchase of any goods of the value or aggregate of such value exceeding fifty lakh rupees in any previous year, shall, at the time of credit of such sum to the account of the seller or at the time of payment thereof by any mode, whichever is earlier, deduct an amount equal to 0.1 per cent of such sum exceeding fifty lakh rupees as income-tax.

If we put it in simple words, when buyer is purchasing goods worth more than Rs. 50 lakhs from a Resident seller during any financial year, then either at the time of credit or payment whichever is earlier, buyer need to deduct TDS @ 0.1% on the amount exceeding Rs. 50 lakh under Sec 194Q of Income Tax Act.

Here points to be noted are:

1. All persons who are buying goods are NOT covered under this section. It is only for those buyers, whose turnover from business during the immediately preceding FY of the financial year in which purchase is made exceeds Rs. 10 crores &

2. Purchase value of Rs. 50 lakh need not be in one transaction. Aggregate value of all transactions in a year should exceed Rs. 50 lakh.

Want to learn through our video lecture?

English Video:

Telugu Video:

Rate of TDS

Rate of TDS under Sec 194Q is 0.1% on the amount exceeding Rs. 50 lakh. If seller is not having PAN, then TDS rate is 5% instead of 0.1%.

Effective Date

This is applicable from 1st July, 2021. However, value of purchases made during Apr-June’21 are to be considered for threshold limit calculation of Rs. 50 Lakh.

Non-applicability of Sec 194Q

Now, Let’s see when sec 194Q is not applicable.

1. If TDS is applicable for the same transaction under any other provisions of the act

2. If TCS is applicable for the same transaction under Sec 206C other than 206C (1H)

3. It is not applicable on purchase of services and

4. Import of Goods

In the above cases, provisions of sec 194Q are NOT applicable.

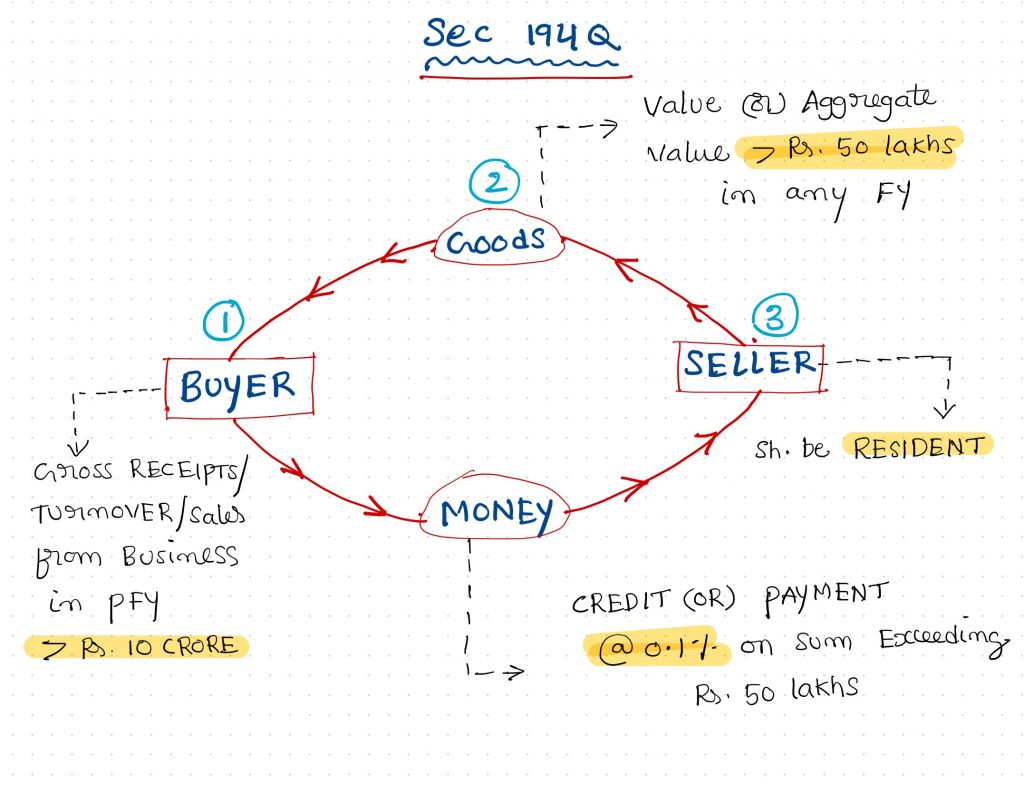

Diagrammatic Understanding

Now, let’s try to understand the provision easily with the help of the following diagram.

In the above diagram, I have breakdown the provision into 3 elements for easy understanding.

One is Buyer,

second one is Goods &

third one is Seller.

If all the three elements are satisfied then only Sec 194Q will be applicable. Otherwise, it is not.

Buyer: Let’s start with number one i.e. Buyer. For the purpose of Sec 194Q, buyer means any person whose turnover or sales or gross receipts from business in Previous financial year is more than Rs. 10 crore.

Goods: Second element is Goods. Value of goods in a single transaction or multiple transactions in a financial year should be more than Rs. 50 lakh.

Seller: And third component is Seller. Here the only condition is: Seller should be resident.

So, if all these 3 conditions are satisfied, then while making credit or payment, buyer shall deduct TDS @ 0.1% on the amount exceeding Rs. 50 lakh. Remember, if even one of the element is missing out of the three elements in a transaction, then sec 194Q will NOT be applicable.

Practical Understanding

Let’s take an example.

Question: X procures goods worth Rs. 80 lakh from Y (Resident) on 2.7.2021. X’s turnover in FY 20-21 is Rs. 15 crores.

This is the transaction. Whether TDS is applicable on this transaction?

.

. .

. . .

Answer: Yes. You are right. TDS is applicable.

Let’s see how.

As mentioned in our diagram, every transaction need to satisfy above three conditions/elements. If we relate this example to the above diagram, first one is buyer and to become eligible buyer, his/her turnover in immediately preceding financial year of the financial year in which purchase is made should be more than Rs. 10 crore. In this example, purchases are made by X in FY 21-22 and hence its immediate preceding financial year will be FY 20-21 and in that year X’s turnover is Rs. 15 crore. So X is eligible buyer under Sec 194Q.

Second one is, Goods and value of such goods should be more than Rs. 50 lakh in relevant financial year. Our relevant financial year is, FY 21-22. Since the value of goods purchased by X in FY 21-22 is Rs. 80 lakh, second condition is satisfied.

And the final condition is, Seller should be Resident. He is anyway resident. So even third condition is also satisfied.

So all the three conditions regarding the applicability of Sec 194Q are satisfied and hence TDS is applicable on this transaction as per Sec 194Q. So X while making payment to Y deduct tax @ 0.1% on the amount exceeding Rs. 50 lakhs i.e. 30 lakh * 0.1%.

| Total value of goods brought by ‘X’ in FY 21-22 | Rs. 80,00,000 |

| (-) Exemption amount | Rs. 50,00,000 |

| Amount eligible for TDS under Sec 194Q | Rs. 30,00,000 |

| TDS under Sec 194Q (Rs. 30,00,000*0.1%) | Rs. 3,000 |

| Amount payable to ‘Y’ after TDS (Rs. 80,00,000 – Rs. 3,000) | Rs. 79,97,000 |

| Amount payable to Govt as TDS | Rs. 3,000 |

Hope you got some basic idea regarding the applicability of Sec 194Q of Income Tax Act.

In the next article, we will discuss about the guidelines issued by CBDT with respect to its applicability along with examples.

Liked the content!!!

Join our mailing list to stay updated