New Tax Regime changes in Budget 2024

Introduction

Budget 2024 has been presented by Mrs. Nirmala Sitaraman ji on 23.7.2024 in the Parliament. In this budget, with respect to personal taxation a few amendments were proposed. Out of which the major amendment is the Rationalisation of Capital Gains taxation.

Now let’s not touch the capital gains taxation here, in this article we’ll discuss only the changes made in new tax scheme.

As mentioned in the Budget speech, more than 2/3 of the people have opted for New Tax regime. This Budget again made slight changes in the new tax regime to make it even more attractive to the taxpayers. And surprisingly there are NO changes in the Old tax scheme, not even in the slab rates. Government’s intention is very clear that they slowly encourage taxpayers to move towards New Tax regime.

New Tax Regime changes in Budget 2024

There are total 4 changes in the New tax regime, let’s understand.

1. Changes in the Tax Slab rates

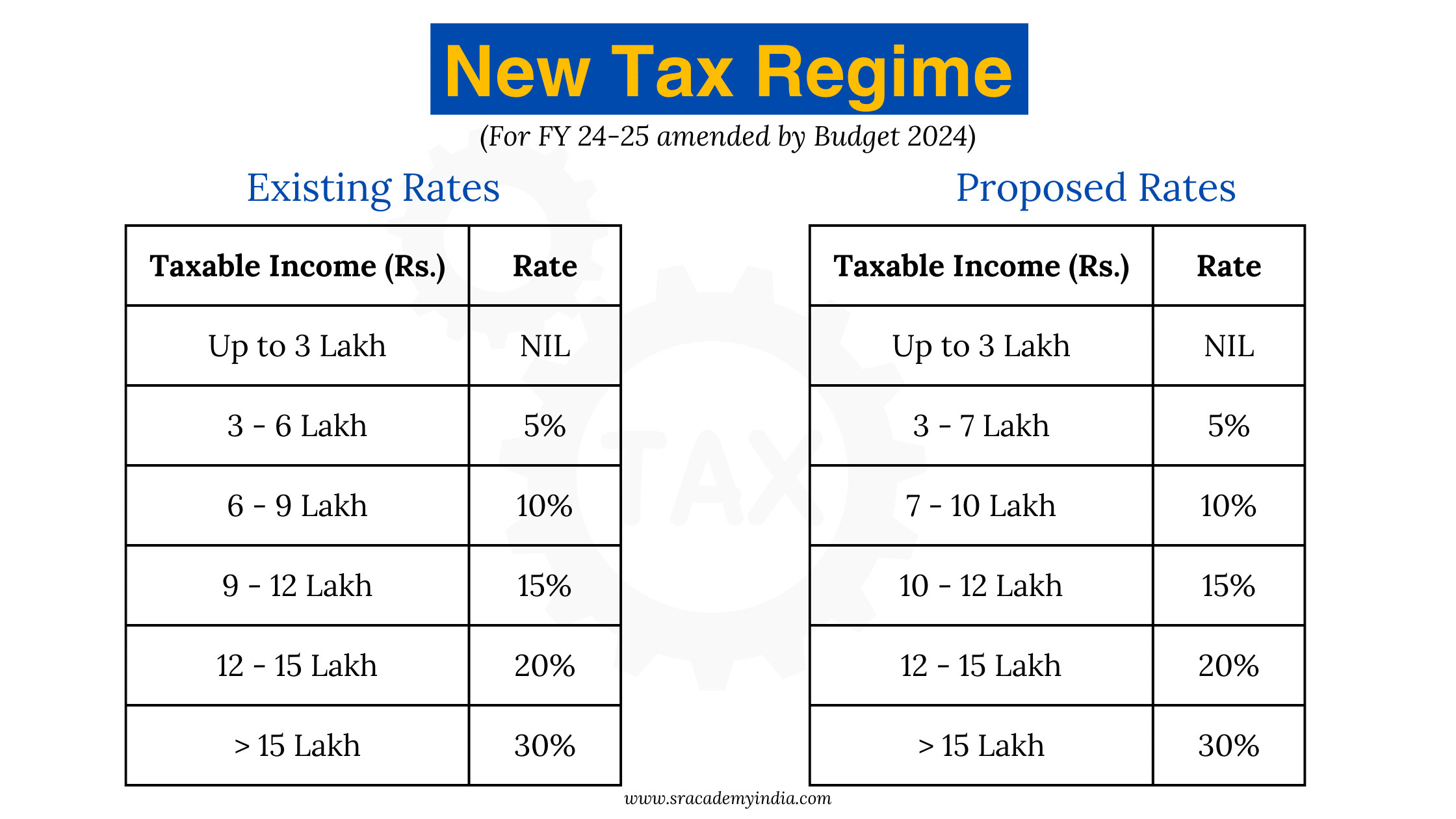

Though slab rates are unchanged, income slabs are slightly tweaked to provide small benefit to the taxpayers, which include:

Previous income slab of 3-6 lakh is now changed to 3-7 lakh which is taxable @5%. Also, 6-9 lakh slab is now changed to 7-10 lakh and 9-12 lakh slab became 10-12 lakh. Remaining income slabs and basic exemptions limits are intact.

Below you can see the comparative chart of existing rates and proposed rates in the Budget 2024 under the New Tax regime.

Above slabs are applicable for FY 24-25 (i.e. AY 2025-26). Pls do remember, there is no change in Rebate and marginal relief benefits under sec 87A.

As you already know, if you opt for new tax regime certain exemptions and deductions are not available. Benefits available under new tax regime are discussed in the later part of this article.

2. Standard Deduction limit enhanced

Standard deduction for Salaried and Pensioners proposed at Rs. 75,000 from existing Rs. 50,000. This deduction can be claimed under sec 16 of Income Tax Act.

3. Family Pension Deduction limit enhanced

Family Pension deduction under sec 57 of Income Tax Act is proposed at Rs. 25,000 from existing the existing limit of Rs. 15,000.

4. NPS Deduction for Non-govt employees

Deduction for NPS of a non-govt employee proposed at 14% of salary instead of 10%. Due to this amendment, employer can claim 14% deduction under sec 36 as business expense and even employee also can claim upto 14% deduction under sec 80CCD.

New Tax regime deductions and exemptions for FY 2024-25

Those who opt for new tax regime, the following deductions and exemptions are ONLY available.

Exemptions

1. Interest on Public Provident Fund under sec 10(11)

2. Interest on Sukanya Samriddhi Account under sec 10(11A)

3. Exemption relating to various Retirement benefits under sec 10(10) like Gratuity, Pension and Leave encashment.

4. Exemption under sec 10(14) relating to Conveyance/Travelling allowance for official purposes and Transport allowance of Rs. 3200 allowed for blind, deaf and dumb employees.

Deductions

1. Employer contribution to National Pension Scheme under 80CCD(2)

2. Interest on borrowed capital for rented property

3. Central Government contribution to Agniveer Corpus Fund under 80CCH(2)

4. Deduction to the employer for creating employment under 80JJAA

To put it simply, the most common deductions like HRA Exemption, Sec 80C & 80D deductions, Deduction for Professional tax are not eligible under the new regime. But as mentioned earlier, Standard deduction can be claimed up to Rs. 75,000 under sec 16.

Rebate under New Tax regime

There is NO change in the rebate limit in Budget 2024. Those who opts for new tax regime can claim rebate under sec 87A if their taxable income is up to Rs. 7 Lakh. In such case, they can claim rebate of Rs. 25,000 or 100% tax liability whichever is less.

In addition, if total income is above Rs. 7,00,000 but below Rs. 7,27,700 they can claim marginal relief under sec 87A.

Conclusion

With the amendments in Budget 2023 and 2024, new tax regime has become more attractive than the old regime. Unless you are claiming most of the exemptions under sec 10 and deductions available from sec 80C to 80U, new tax regime will be beneficial in most of the cases. But it is always recommended to check tax liability under both the regimes before opting one.

Hope you have enjoyed reading this article, thank you for your time.