In this article let’s discuss in detail, is it mandatory to file Income Tax Return (ITR) for FY 2024-25 aka AY 2025-26 for Individual taxpayers. In addition, we are also going to discuss when you can voluntarily file (though it is not mandatory as per Income Tax Laws) your Income Tax Return.

As per the general understanding, every individual has to file an income tax return (ITR) if their total income is more than the basic exemption limit.

But there is a lot of confusion regarding

(i) which income has to be considered? (whether it is Gross Total Income or Total Income)

(ii) what if the taxpayer doesn’t have any tax liability?

(iii) what if TDS has been already deducted by the employer?

In simple words: As per sec 139(1) of the Income Tax Act, every individual whose total income before deducting Chapter VI-A deductions, certain sec 10 exemptions & Capital Gain exemptions is more than the basic exemption limit, then such individual has to file his/her income tax return mandatorily.

Introduction

Before going into the main topic, first, let’s quickly understand what is an Income Tax Return (ITR).

“Income Tax Return” is a form through which we communicate our income or loss details of a particular financial year and taxes paid on such income to the Income Tax Department.

Depending on the nature of income & category of an assessee, different types of ITR forms are prescribed by the department. Anyway, we are not going in-depth regarding ITR forms here, we will discuss it in another article.

Now at least you know what is an ITR form, Right?

So, Let’s focus on the main topic.

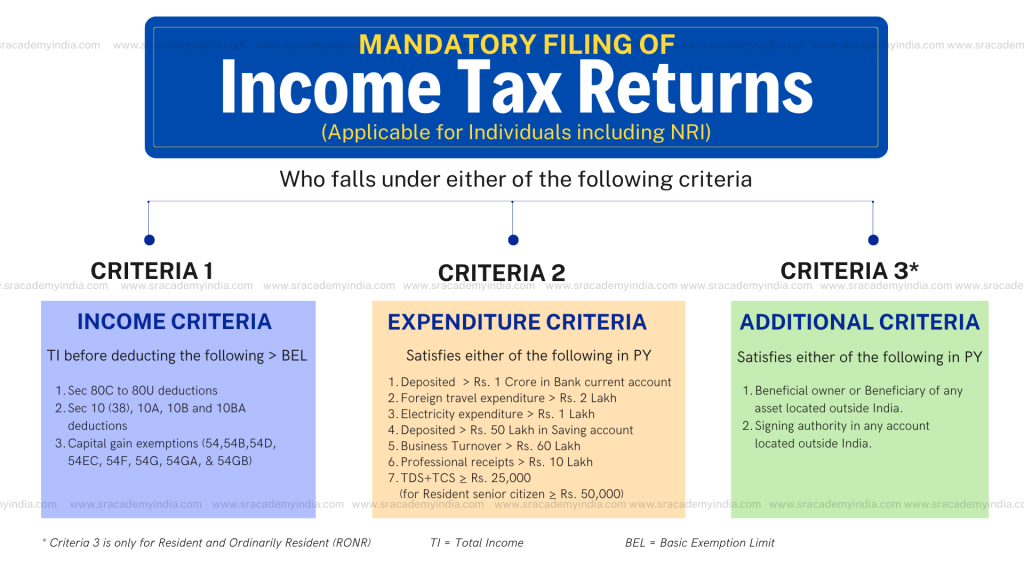

Mandatory Filing of Income Tax Return

As per sec 139(1) of the Income Tax Act, Individuals (including NRI) who fall under either of the criteria mentioned below need to file their ITR mandatorily.

- Income criteria

- Expenditure criteria

Whereas, Resident and Ordinarily Residents (RONR) should also watch out for one more criterion (i.e. Additional criteria), in addition to the above two criteria. Meaning, that for RONR ITR filing is mandatory if it falls under either of the three criteria.

Let’s elaborate further.

Income criteria

If your Total Income before deducting the following exemptions/deductions is more than the basic exemption limit (refer image below) then ITR filing is mandatory.

- Chapter VI-A deductions (i.e., deductions from section 80C to 80U)

- Section 10 deductions – 10(38), 10A, 10B, 10BA

- Capital Gain deductions – 54, 54B, 54D, 54EC, 54F, 54G, 54GA, or 54GB

Meaning, you need to add back the above deductions/exemptions (if any) claimed by you while arriving at your Total Income to determine the applicability of mandatory ITR filing. (Remember both Total Income and Taxable Income are the same & often used interchangeably, which means Gross Total Income less Chapter VI-A deductions)

Basic exemption limits under both tax regimes are given below for quick reference:

| New Tax Scheme | Old Tax Scheme |

| Rs. 3 Lakh (Irrespective of age) | Rs. 2.5 Lakh (aged below 60 yrs) |

| Rs. 3 Lakh (Irrespective of age) | Rs. 3 Lakh (aged between 60-80 yrs) |

| Rs. 3 Lakh (Irrespective of age) | Rs. 5 Lakh (aged 80 yrs or more) |

Don’t worry. Let’s run through a quick example:

Assume your salary income is Rs. 5,00,000 and interest income is Rs. 50,000 for FY 2024-25 (Age is 40 yrs). Out of such income, you paid Rs. 80,000 for LIC & Rs. 20,000 for Medical Insurance u/s 80D. Accordingly, your Taxable income will be as follows:

| Particulars | Amount in Rs. |

|---|---|

| Salary Income | 5,00,000 |

| Interest Income | 50,000 |

| Gross Total Income | 5,50,000 |

| Less: Deductions 80C to 80U (Rs. 80,000 + Rs. 20,000) | (1,00,000) |

| Total Income or Taxable Income | 4,50,000 |

This is the procedure for calculating your taxable income on which you need to pay taxes. However, for determining the eligibility to file ITR you should not consider Taxable income as the criteria. As mentioned above, we need to add back the deductions/exemptions claimed for arriving at your taxable income. After such addition, if your income is more than the basic exemption limit then you need to mandatorily file your Income Tax Return. Otherwise, not required.

So, if we add back the deduction amount of Rs. 1,00,000 (i.e. LIC Rs. 80,000 + Medical Insurance Rs. 20,000) to your taxable income of Rs. 4,50,000, it will be Rs. 5,50,000. Since Rs. 5,50,000 is more than your basic exemption limit (i.e. Rs. 2,50,000) you need to mandatorily file ITR.

But if you observe from a taxability perspective since your taxable income is below 5 lakhs you are eligible for sec 87A rebate and hence your tax is ZERO!!!

You might be wondering, “Why do I need to file ITR mandatorily when my tax is ZERO”?

You are right. But the thing is, the criteria for the determination of your TAX LIABILITY & ITR FILING are completely different. In the case of TAX LIABILITY, it is the total income after all exemptions and deductions. Whereas in the case of ITR filing, it is total income before certain exemptions and deductions. That’s why you need to file your ITR mandatorily even though your tax liability is ZERO.

Even the same thumb rule is applicable for a tax deduction (TDS) on your income i.e. though the tax is already been deducted from your income, still you need to file your ITR mandatorily if you are covered under any of the criteria.

Expenditure criteria

For any reason, if you are not falling under the Income criteria then you need to check for the Expenditure criteria mentioned below. Coverage under either of these criteria will make ITR filing mandatory.

Following are conditions under Expenditure criteria & either of the conditions needs to be satisfied for mandatory filing:

- Deposited an amount (or aggregate of amount) more than Rs. 1 crore in one

or more current accounts maintained with a bank or a cooperative bank or - Incurred foreign travel expenditure of more than Rs. 2 lakh for self or any other

person or - Incurred electricity expenditure of more than Rs. 1 lakh

- Deposited more than Rs. 50 lakh in a savings bank account

- Business turnover exceeds Rs. 60 lakh

- Professional receipts exceed Rs. 10 lakh

- TDS deducted + TCS collected in a financial year is Rs. 25,000 or more. For Resident senior citizens, the limit would be Rs. 50,000 instead of Rs. 25,000.

Additional criteria

This criterion is only for Residents and Ordinarily Residents (RONR). If your Residential Status is RONR for any previous year, then in addition to the above two criteria you also check for the following:

- The beneficial owner or Beneficiary of any asset (including financial assets) located outside India or

- Signing authority in any account located outside India

If you don’t fall under any of the above-mentioned criteria then you need not file ITR mandatorily. In such a case, you can file your ITR voluntarily if you wish to do so.

Key Point: If you fall under any of the above discussed criteria, then ITR filing is mandatory even though you don’t have any tax liability or TDS been already deducted on your income.

Voluntary filing of Income Tax Return

Voluntary filing is, to file your ITR for any of the following reasons even though you are NOT bound to do so under the Income Tax Act. It can be:

- To claim an income tax refund.

- To carry forward loss under any head.

- To claim as proof of income or Networth

- For obtaining any loan from Financial Institutions

- For VISA processing

Income Tax Return filing due date

If you want to file your ITR (as a part of a mandatory requirement or voluntarily), make sure to file it within the due dates specified by the Income Tax Act. For FY 2024-25, the following are the due dates to file ITR.

| Individuals covered under any Audit or Working partner of a Firm | 31st October 2025 |

| For other Individuals | 31st July 2025 |

Consequences for Non-filing of Income Tax Return

If ITR filing is mandatory for you, better not to miss the filing. Otherwise, you need to face the following consequences:

- Loss (except loss from House Property) cannot be carried forward

- The late filing fee will be levied u/s 234F

- Interest will be levied u/s 234A

- Exemptions under sections 10A, and 10B, are not available.

- Part-C deductions of Chapter VI-A shall not be available.

- You may get notice u/s 142(1) from the department.

Now, let’s summarise.

Conclusion

As per Income Tax laws, ITR filing is NOT compulsory for all. It is mandatory only for individuals who fall under any of the two criteria mentioned above. If you are RONR, don’t forget to check additional criteria as well (when you don’t fit under both the Income & Expenditure criteria).

If you do not fall under the mandatory ITR filing category, you can even file your ITR voluntarily. In either of the cases, make sure to file your returns within due dates so that you will be free from certain penalties/consequences stipulated under the act.

Hope the concept is clear now.

Still, having doubts? Don’t hesitate to reach out through comments. See you with another interesting topic very soon.

Thank you for your time.