1. Introduction

Understanding the income tax calculation is quite complicated unless you learn it the right way. Be it income tax slabs, exemptions and deductions or any other provision, careful interpretation of the provision is required to arrive at the correct tax liability.

In this article, let’s understand the procedure for tax calculation which makes you confident in calculating your taxes for any financial year.

But before going into that, let’s quickly understand some of the basics associated with tax slab rates:

2. Classification of Taxpayers:

Under the Income Tax Act, Individual taxpayers are divided into 3 categories according to their age i.e. Normal individuals, Senior citizens and Super Senior citizens.

| Category of Individual | Age (at any time during the FY) |

| Normal Individuals | Below 60 Yrs |

| Senior Citizens | 60 – 80 yrs |

| Super Senior Citizens | 80 Yrs and above |

Under the old tax regime, tax slab rates vary for Senior citizens as well as Super Senior citizens. However, under the new tax regime, income tax slab rates remain the same irrespective of an individual’s age.

Now, let’s understand income tax calculation under both old and new tax regimes for FY 2023-24 (AY 2024-25).

3. Income Tax Slab rates for FY 2023-24 (AY 2024-25)

Old Regime

1. Slab Rates

For Senior Citizens (whose age is 60 or more but less than 80 years)

| Taxable Income (in Rs.) | Tax Rate |

| Upto 3 Lakh | Nil |

| 3 – 5 Lakh | 5% |

| 5-10 Lakh | 20% |

| > 10 Lakh | 30% |

For Super Senior Citizens (whose age is 80 years or more)

| Taxable Income (in Rs.) | Tax Rate |

| Upto 5 Lakh | Nil |

| 5-10 Lakh | 20% |

| > 10 Lakh | 30% |

2. Rebate

As per sec 87A of the Income Tax Act, Up to Rs. 5 lakh taxable income Resident individuals can claim a rebate of Rs. 12,500 or 100% of income tax whichever is lower.

3. Surcharge

If taxable income exceeds Rs. 50 Lakh, surcharge will be applicable which is as follows:

| Taxable Income (in Rs.) | Surcharge Rate |

| Up to 50 Lakh | Nil |

| 50 Lakh – 1 crore | 10% |

| 1 -2 crore | 15% |

| 2 – 5 crore | 25% |

| > 5 crore | 37% |

4. Health and Education Cess

4% on Basic tax – Rebate (if applicable) + Surcharge (if applicable)

New Regime

Under the new tax regime, slab rates remain the same irrespective of an individual’s age. Hence for both the Senior citizens and Super senior citizens’, a single slab system applies which is as follows:

1. Slab Rates

| Taxable Income (in Rs.) | Tax Rate |

| Upto 3 Lakh | Nil |

| 3 – 6 Lakh | 5% |

| 6 – 9 Lakh | 10% |

| 9 -12 Lakh | 15% |

| 12 – 15 Lakh | 20% |

| > 15 Lakh | 30% |

Pls, do note that the above slab rate system was revised in Budget 2023 and is effective from FY 2023-24.

2. Rebate

Budget 2023 amended sec 87A rebate limit for new tax regime. The earlier limit was Rs. 5 Lakh but from FY 23-24 onwards, the revised limit is Rs. 7 Lakh. So resident individuals who have taxable income up to Rs. 7 Lakh may opt for the new regime to avail this higher rebate limit and pay ZERO tax.

In addition to this, individuals whose taxable income is marginally above Rs. 7 lakh and could not avail of rebate u/s 87A can claim marginal relief up to taxable income of Rs. 7,27,700.

3. Surcharge

The surcharge rate will be the same as under the old regime which is as follows:

| Taxable Income (in Rs.) | Surcharge Rate |

| Up to 50 Lakh | Nil |

| 50 Lakh – 1 crore | 10% |

| 1 -2 crore | 15% |

| > 2 crore | 25% |

4. Health and Education Cess

4% on Basic tax – Rebate (if applicable) + Surcharge (if applicable)

4. Income Tax Calculation – Practical Understanding

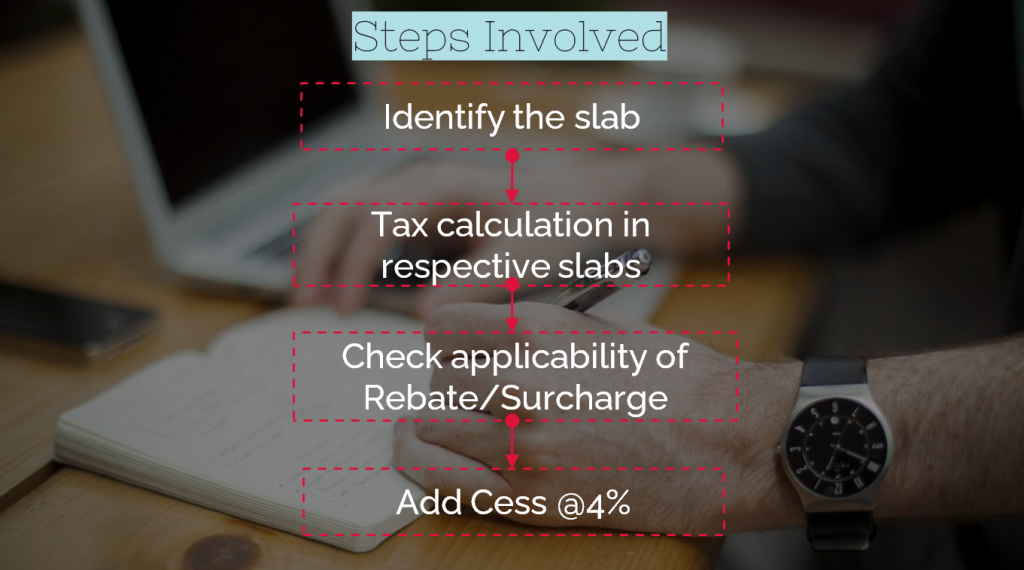

Calculating the income tax for any financial year can be easily done by using the given below 3-step process.

Step1: Identify the slab in which taxable income falls

Step2: Calculate tax at each slab level

Step3: Check for the applicability of the Rebate, Surcharge and finally apply 4% HEC on it

Now let’s move on to the practical understanding of tax calculation. First, we will see practically how to calculate for Senior Citizens (i.e. age is between 60 – 80 years).

(i) Income Tax Calculation for Senior Citizens (Practical Understanding) – Old Scheme

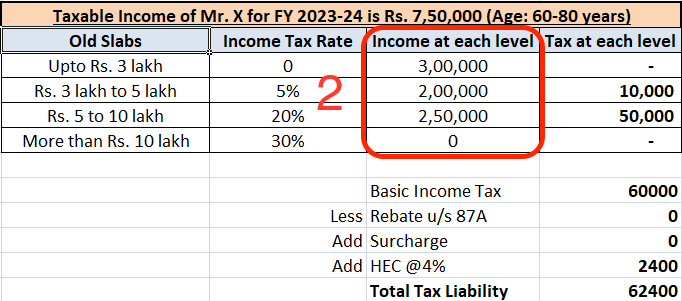

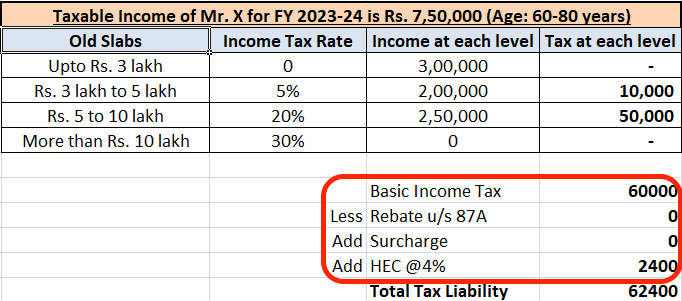

Let’s assume X (age 65 years) is having taxable income of Rs. 7,50,000 for FY 2023-24. Tax calculation would be as follows:

If we apply the 3-step calculation process to the above example, it would be as follows:

Step1: Identification of the slab in which Rs. 7.5 Lakh falls. It falls in 5 – 10 Lakh slab which is the third slab

Step2: Tax calculation at each level. So to do that first split 7.5 lakh into the respective slabs.

Since we have divided 7.5 lakh into 3 slabs (as shown in the above pic), let’s calculate tax at each level.

At the first level, X has a 3 lakh income and tax will be ZERO as the basic exemption limit itself is 3 lakh. At 2nd level income is taxable at a 5% rate, so for 2 lakh income tax will be Rs. 10,000. Similarly at the 3rd level, for 2.5 lakh income tax will be Rs. 50,000. So, total basic income tax is Rs. 60,000

Step3: Check the applicability of Rebate and Surcharge

Rebate: Since X’s income is more than Rs. 5 lakh, X is not eligible for rebate.

Surcharge: For surcharge applicability, X’s income should be more than Rs. 50 lakh. So both Rebate and Surcharge are NOT applicable.

HEC: It should be 4% on (Income tax – Rebate + Surcharge, if applicable). Since Rebate & Surcharge are not applicable, 4% on basic income tax will give the final tax liability of X.

Then, the final tax liability has to be adjusted for Self-assessment tax, Advance Tax and TDS, if any. After adjusting the same, If the resultant amount is positive then the balance tax has to be paid. Contrary to this, the taxpayer will be eligible for a refund.

Now, let’s move on to the tax calculation of Super Senior Citizens (whose age is 80 years and above)

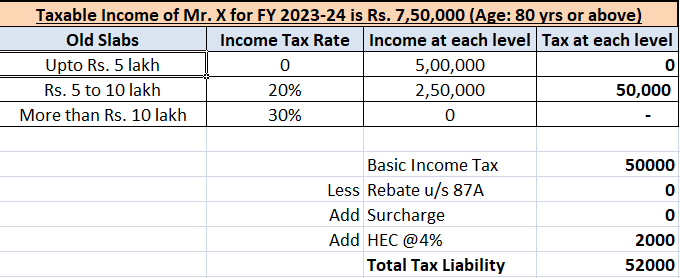

(ii) Income Tax Calculation for Super Senior Citizens (Practical Understanding) – Old Scheme

For this example, Let’s assume X (age 82 years) is having taxable income of Rs. 7,50,000 for FY 2023-24. Tax calculation would be as follows:

Again, If we apply the 3-step calculation process to the above example, it would be as follows:

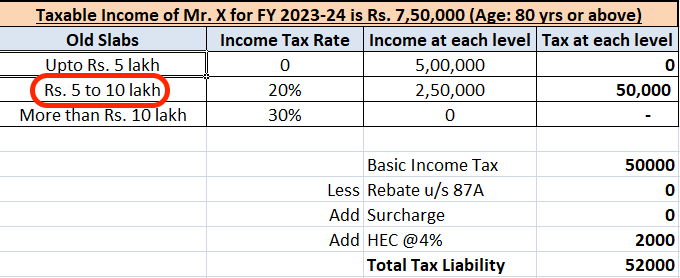

Step1: Identification of the slab in which Rs. 7.5 Lakh falls. It falls in a 5 – 10 Lakh slab which is 2nd slab

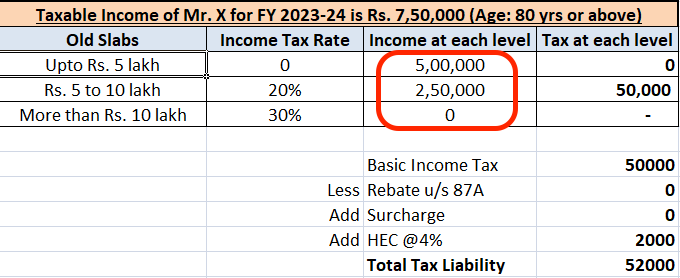

Step2: Tax calculation at each level. So to do that first split 7.5 lakh into the respective slabs.

Since we have divided 7.5 lakh into 2 slabs (as shown in the above pic), let’s calculate tax at each level.

At the first level, X has a 5 lakh income and tax will be ZERO as the basic exemption limit is 5 lakh. At 2nd level income is taxable at a 20% rate, so for 2.5 lakh income tax will be Rs. 50,000. So total basic income tax is Rs. 50,000

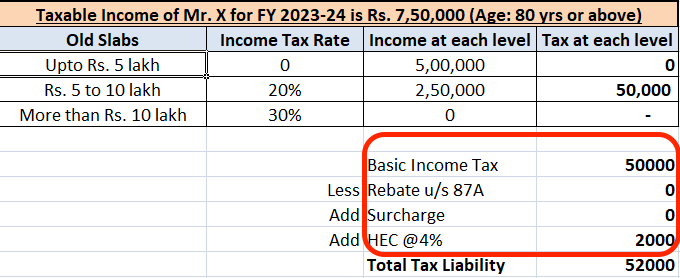

Step3: Checking the applicability of Rebate and Surcharge

Rebate: Since X’s income is more than Rs. 5 lakh, X is not eligible for rebate.

Surcharge: For surcharge applicability, X’s income should be more than Rs. 50 lakh. So both Rebate and Surcharge are NOT applicable.

HEC: It should be 4% on (Income tax – Rebate + Surcharge, if applicable). Since Rebate & Surcharge are not applicable, 4% on basic income tax will give you the final tax liability.

Final tax liability has to be adjusted for Self-assessment tax, Advance Tax and TDS, if any. After adjusting the same, If the resultant amount is positive we need to pay the balance tax. Contrary to this, you will get a refund.

In this way, one can easily calculate their income tax for any FY without using any tools.

(iii) Income Tax Calculation for Senior Citizens & Super Senior Citizens (Practical Understanding) – New Scheme

Now for the same example, we will calculate tax liability under the new scheme.

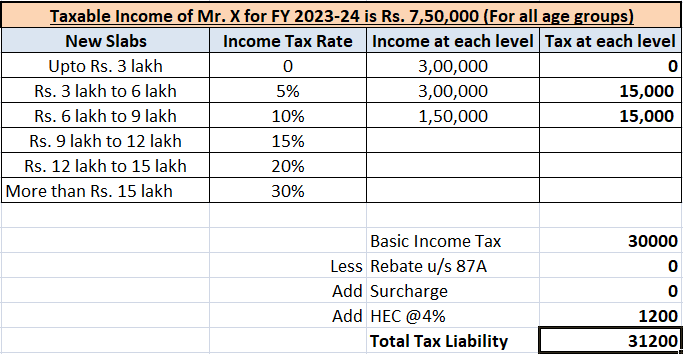

Again, let’s assume X (age 65 years) is having taxable income of Rs. 7,50,000 for FY 2023-24. Tax calculation under the new scheme would be as follows:

The only thing to remember is, that irrespective of an individual’s age slab rates under the new scheme would be the same for all individuals.

Again, If we apply the 3-step calculation process to the above example, it would be as follows:

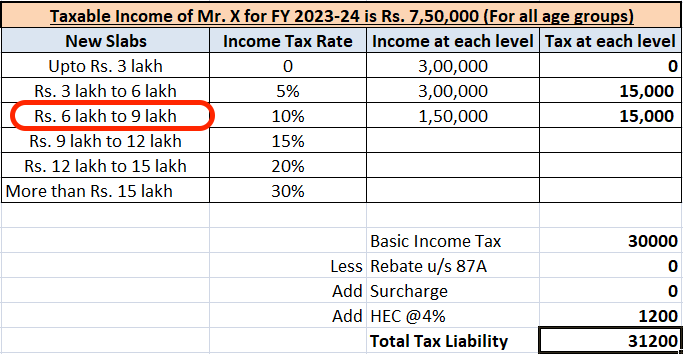

Step1: Identification of the slab in which Rs. 7.5 Lakh falls. It falls in a 6 – 9 Lakh slab which is the 3rd slab. Pls do remember slab rates for FY 23-24 have been revised in Budget 2023 and are effective from FY 23-24 onwards.

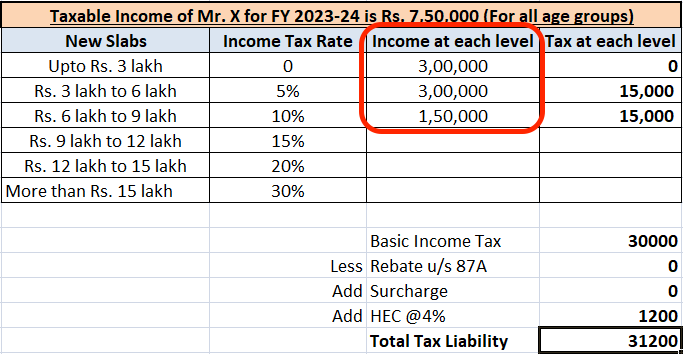

Step2: Tax calculation at each level. So to do that first split 7.5 lakh into the respective slabs.

The basic exemption limit under the new scheme is revised to 3 lakh from 2.5 lakh and it is effective from FY 2023-24. So for the first 3 lakh, tax would be zero. The next 3 lakh falls in the 2nd slab and the applicable tax rate is 5%. The balance of 1.5 lakh falls in the 3rd slab and the applicable rate is 10%.

So basic tax would be Rs. 30,000 from all slab levels.

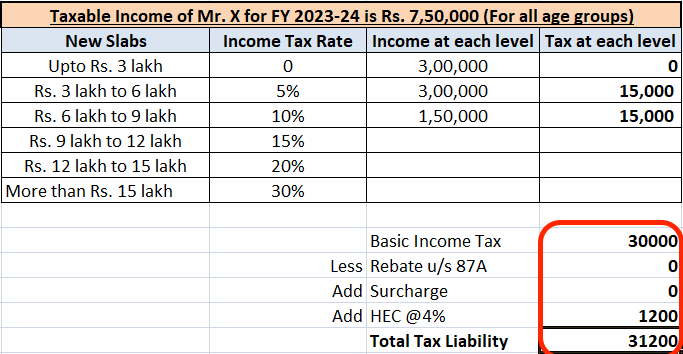

Step3: Checking the applicability of Rebate and Surcharge

Rebate: Since X’s income is more than Rs. 7 lakh, rebate is NOT allowed. Under the new scheme, the rebate limit is revised to Rs. 7 lakh from FY 2023-24 onwards.

Surcharge: Even under the new scheme for surcharge applicability, X’s income should be more than Rs. 50 lakh. So both Rebate and Surcharge are NOT applicable.

HEC: It should be 4% on (Income tax – Rebate + Surcharge, if applicable). Since Rebate & Surcharge are not applicable, 4% on basic income tax will give you the final tax liability.

Final tax liability has to be adjusted for Self-assessment tax, Advance Tax and TDS, if any. After adjusting the same, If the resultant amount is positive then the balance tax has to be paid. Contrary to this, the taxpayer will be eligible for a refund.

Conclusion

In this way, one can easily calculate income tax liability for any financial year without using any tools. But before choosing any scheme, make sure to compare the tax liability under both schemes.

Since individuals who do not have business income/professional income can shift tax regime every year, one may compare their tax outgo every year and shift between the schemes to achieve the maximum tax benefits.

Hope you have enjoyed this article, please ask your concern/queries in the comments section below. Thank you for your time.