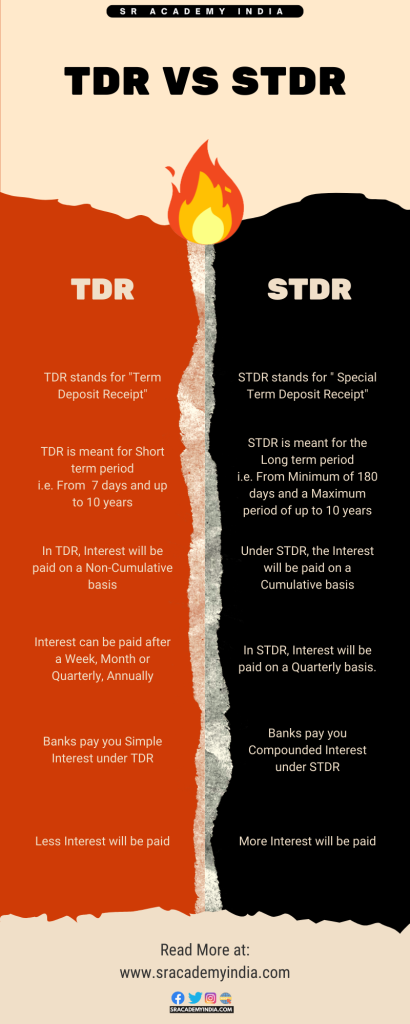

Whenever you make a Fixed deposit (FD) in a bank, you might have heard about TDR and STDR. Both TDR & STDR are different types of deposit options in a Fixed deposit.

Let’s see the difference between the two..!!

TDR

TDR stands for “Term Deposit Receipt”

In TDR, the Depositor agrees to deposit their money for a specific time period.

TDR is for those who open Fixed Deposits for a Shorter period of time. Those who want to create Fixed Deposits for Weekly, Monthly or Quarterly, then, they have to select this TDR option.

A TDR can be opened for 7 days and up to 10 years.

The Interest rates for TDR will also be Fixed at the time when you open your Fixed Deposit based on the Period. Generally, the longer the time period you hold, the higher the interest.

In case of a Term deposit receipt, you will be paid interest on a Non-cumulative basis.

After you select TDR your Fixed Deposit savings will be connected with a Savings Bank account.

Also, if your Fixed Deposit time period is complete, then the interest earned on your FD will be paid Monthly, Quarterly, and Annual basis which was connected to your savings bank account.

STDR

STDR stands for “Special Term Deposit Receipt”.

In the same STDR, you can’t invest in the short term. In the State Bank of India (SBI), you can open it for a Minimum of 180 days and a Maximum period of up to 10 years.

In STDR, Interest will be paid to the depositors on a Cumulative basis at the maturity time only. And it is not paid for every month and every quarter.

If you are planning to create a Fixed deposit for the long term, then, select this option. In this, you will get more interest than TDR.

Because banks reinvest the interest you earn quarterly with your FD amount.

Also in SBI, you can open a Fixed deposit with a Minimum of Rs.1000/- and a Maximum of Rs. Up to 1 crore either through TDR or STDR.

If for any reason the depositor wants to withdraw the amount before the maturity time, there is a chance that the banks will impose a penalty.

So, STDR is a better option than TDR if you want more interest.