As we all know, the Annual Information Statement (AIS) is a very crucial document in our Income Tax Return filing. Every year before filing our ITR, we need to cross-check the information displayed in AIS and file the returns accordingly to avoid unnecessary complications in the future.

What is an Annual Information Statement (AIS)

AIS is a tax passbook, which reflects all your financial transactions done in a financial year. That means all your incomes from various sources i.e. Salary income, Dividend, Bank interest, Credit card transactions and Cash deposits which are reported by the reporting entities will be reflected in your AIS.

How to submit Feedback in AIS

To access this statement, please visit www.incometax.gov.in and login with your credentials.

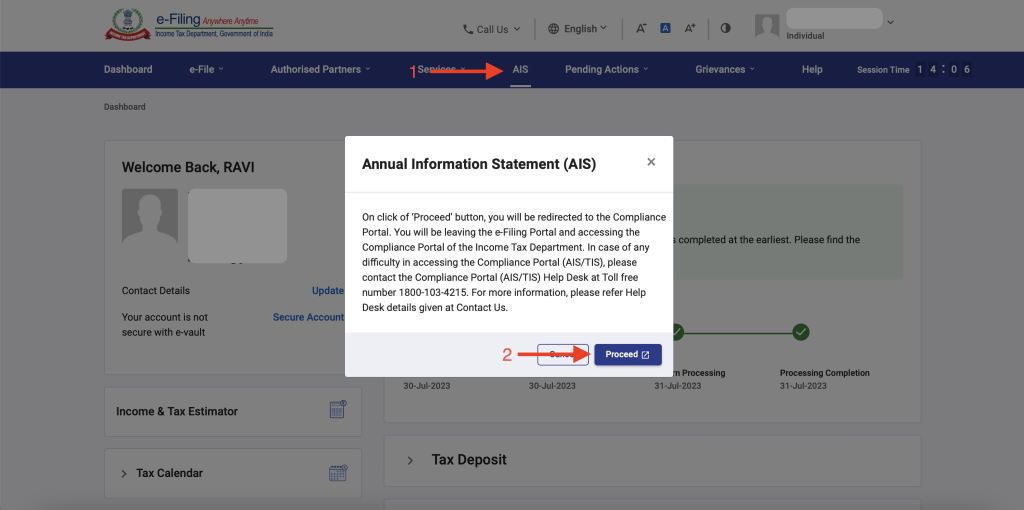

Step1: After logging in, Click on “AIS” Tab and click “proceed” on the pop-up. You will be redirected to the compliance portal on the new tab.

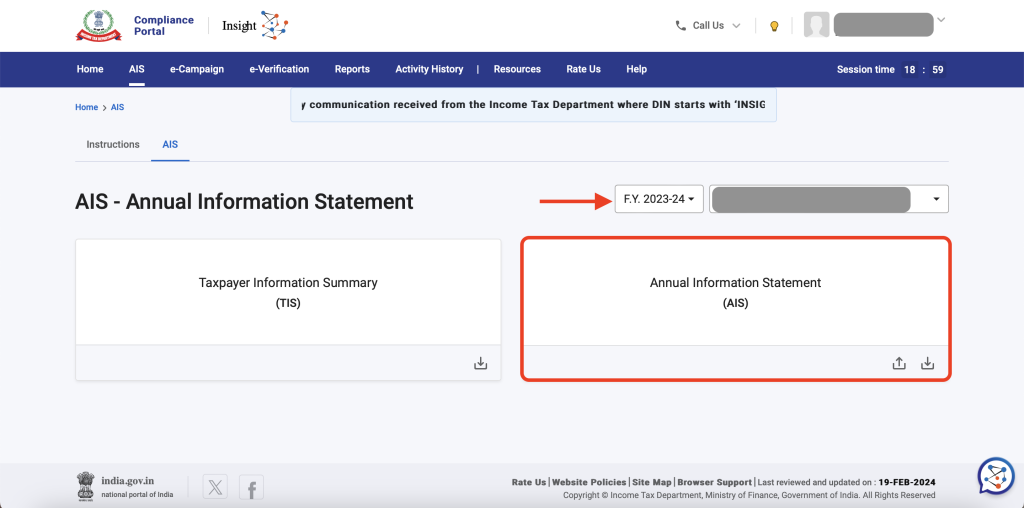

Step 2: Choose the relevant financial year and click on “AIS” tab.

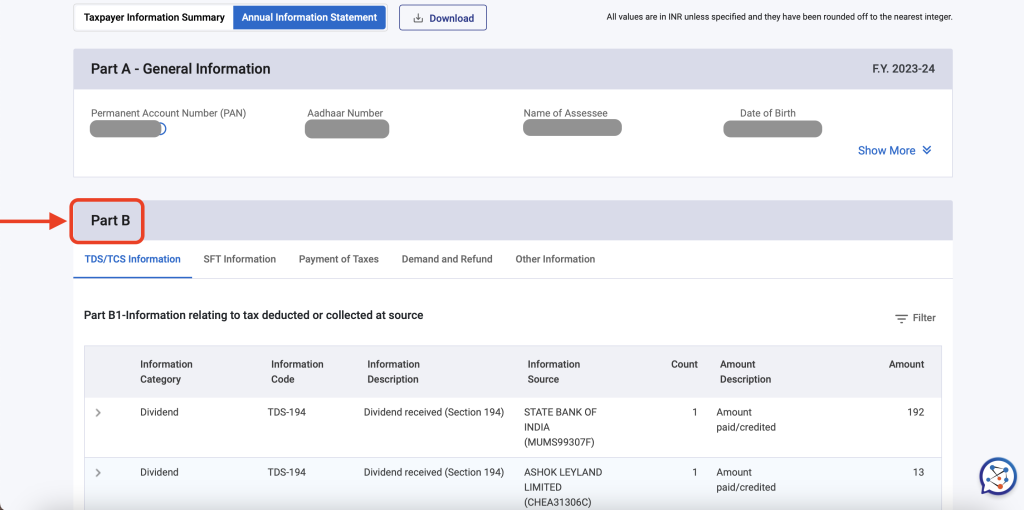

Step 3: You will be redirected to Part-B of AIS, where you can see the break-up of all your transactions.

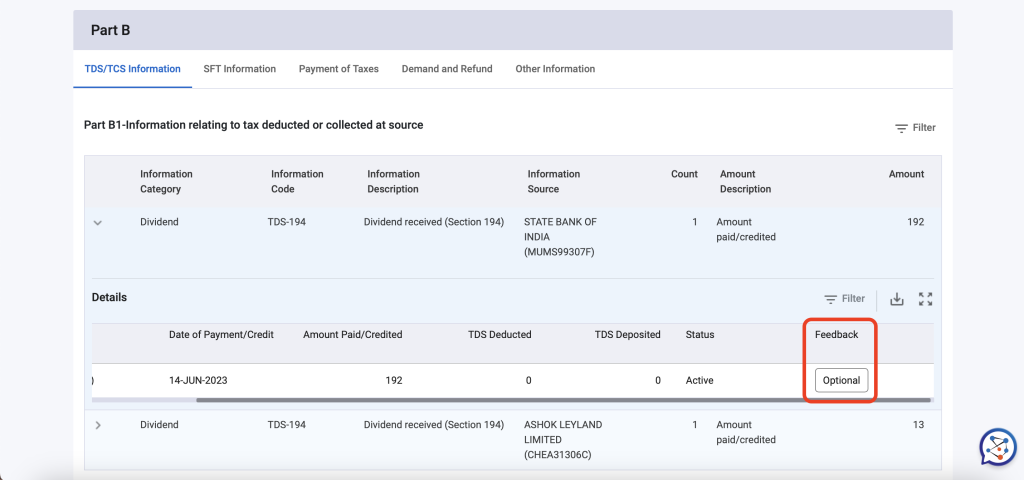

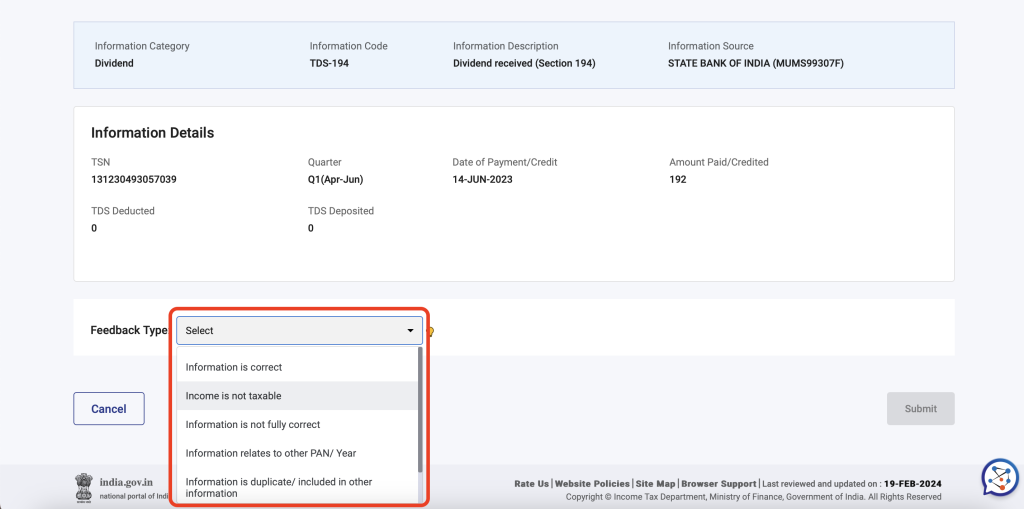

Step 4: Click on the transaction you want to change and click on feedback.

Step 5: Select the required field and submit the feedback.

In this way, you can check all the transactions appearing in your AIS for the respective financial year.

While verifying the transactions, you may notice all your transactions may not be reflected. Sometimes, the transaction which does not belong to your PAN may appear or any of your transaction may appear twice in the your AIS.

Transactions Under-booked in AIS: Consider and include them in ITR filing.

Transactions Over-booked in AIS: Submit feedback to rectify and then file ITR.

Whatever could be the reason, if you file ITR without considering transactions in your AIS, you will have a higher chances of getting income tax notice from the department. This is because soon after you file ITR, your ITR data will be matched against AIS data. Any mismatch between these two statements, will result in the issue of income tax notice.

Conclusion

Always make sure to check your Annual Information Statement (AIS) before filing your Income Tax Return. In case of any discrepancy, submit the feedback online on the Income Tax Portal and rectify it. Once it is rectified, you may proceed with the ITR filing.

Hope you have enjoyed reading the content, thank for your time.