SBI Reliance Credit card

Introduction

In recent times, more people are using Credit Cards. One of the main reasons for using it is that in case of an emergency time, there is no need to ask your Friends, Colleagues, or Relatives.

One such New Credit Card has been launched combined by Reliance and SBI. They have launched 2 types of Credit Cards.

1. Reliance SBI Card,

2. Reliance SBI Card Prime.

In this article, I’m going to discuss the former one i.e. “Reliance SBI card“.

Without further ado let’s see What are the Features or Benefits this Credit card is offering? And I also share my Genuine opinion on this Credit card by discussing its Drawbacks as well.

Let’s get Started..!!

You can watch this post content on YouTube [In Telugu]

What Benefits you get from this Credit Card ?

Let me go through 5 Top benefits offering by this Credit Card [Incl. My Analysis]

1. Welcome Benefit

As a Welcome benefit, this Credit Card is offering a Reliance retail voucher worth of Rs.500/- rupees to this Card holders. If you go to the any Reliance retail outlets Physically and do any shopping, then, you can use this Rs.500/- voucher.

To avail this feature on this card, you have to pay the Joining fee of Rs.499/- excl GST to this card.

My Analysis

If you pay Rs.499/- as a Joining fees , you will get Rs.500/- worth of Reliance retail voucher as a benefit. To make the shopping, you will go either on your Bike or Car and you will incur some Fuel charges as well.

Not only that if you visit store physically, for the name sake you may buy something for the worth of either Rs.1000 or Rs.2000/- . So. Here you have given extra money to Reliance in the name of Shopping.

So, please consider if you feel this is a benefit.

Also, if you spend Rs.50,000/- rupees on this card in one year, you will get Rs.750/- rupees worth of Reliance Retail Watcher & Rs.1,000/- Reliance Retail voucher if you spend Rs.80,000/- annually.

Whereas, If you spend more than Rs.1,00,000/- in one year, you are not supposed to pay Renewal fees for the next year. Simply, Zero Renewal Fees.

This feature can’t be said to be very beneficial to the Cardholder but if you spend through this credit card for any of your need, then, this voucher might be helpful for you.

“It’s not wrong to spend for your need and take the benefit but never spend it for the sake of benefit without need.”

Ultimately, You will loose your money My dear Friend.

2. Reward Points

Let’s see how many reward points you will get by this Credit Card.

This Reliance SBI card is a Contactless card. And the card holder will get 5 Reward points for every Rs. 100 they spend on this card.

You can also get a 5% discount on Reliance Trends, Ajio, Centro, Zivame, Urban ladder, Jio Mart by using this card. But the Maximum discount you get is Rs. 250 per month only.

Those who buy monthly groceries regularly on JioMart, this might be beneficiary to those custtomers.

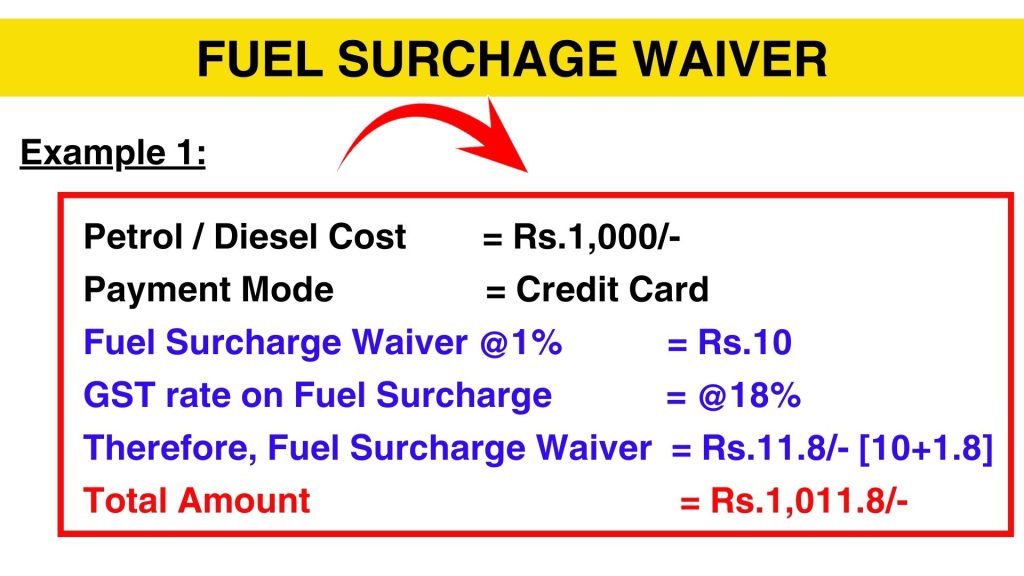

3. Fuel Surcharge Waiver

By using this Credit Card If you spend on Petrol/Diesel between Rs.500-Rs.4,000/- in selected fuel stations, then, normally a Fuel Surcharge will be charged. It may be around 1-3% of your Fuel Cost.

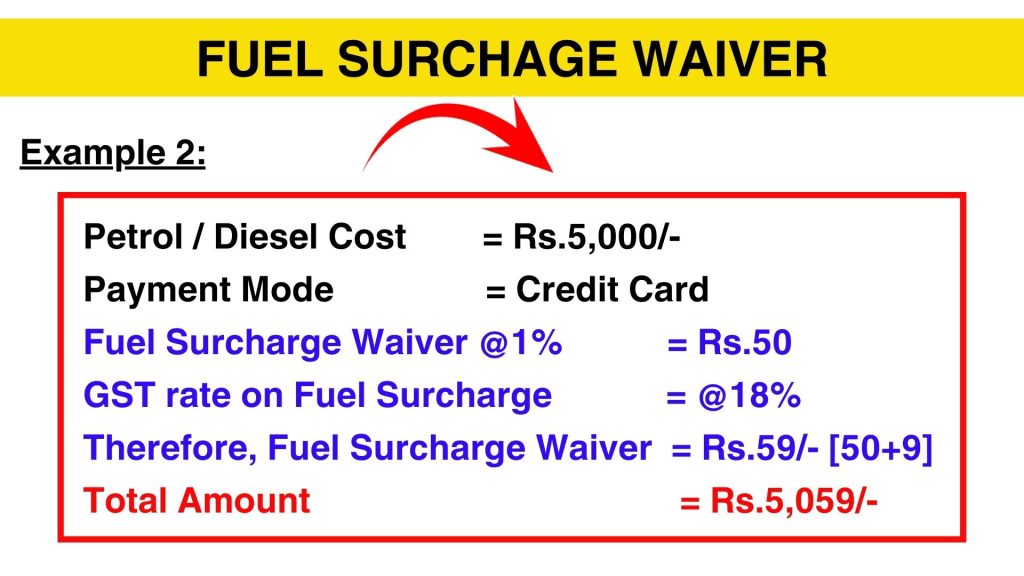

In case you paid it through this card, you will be eligible for “Fuel Surcharge Waiver“. Let me clarify you about Fuel Surcharge Waiver with 2 Examples

I really don’t understand why Credit card companies are highlighting Fuel Surcharge Waiver..!! This is not even a Nominal benefit to the Card user because you have to pay it only if you use this Credit card. Normally if you pay it in cash there will be No such Surcharges at all.

4. Can I Withdraw Money ?

By using this SBI Reliance Card, they can Withdraw Money from Visa or MasterCard ATMs anywhere.

5. Can I convert any Transaction into EMI ?

Which Purchase transactions can be converted into EMI?

If you find it difficult to pay the amount you have spent, there is a facility to convert your Purchase transactions into EMI, but for this you should know about the facility called “Flexi Pay“.

If you use this credit card and do any Purchase transaction above Rs.2,500/- rupees then, you can convert those transactions into EMI through the www.sbicard.com and give username and password and you have a chance to convert to this EMI within 30 days from the date of transaction.

Other Features

You can use this card at almost 3,25,000 outlets in India and also in Foreign countries. If you shop at any outlet, if that particular outlet accepts Visa or MasterCard, then, you can use this card and can make payments.

Moreover, you can pay your Electricity bill payments, Mobile bills, other Utility bills etc by using this Reliance SBI card.

How to apply

If you want this SBI Reliance Credit Card card, You can apply.

Apply NowCredit Card Charges [Must Read]

1. Cash Withdrawal charges

A Transaction fee would be levied on all such Cash Withdrawals from Domestic or International ATM’s. Such fees would be billed to the Cardholder in the next statement. A transaction fee of 2.5% or Rs.500/- whichever is higher will be charged at domestic and international ATMs.

It is my sincere and humble request for all the Credit Card users that Whatever the Credit card you use, you Please don’t make any Cash Withdrawals by using your Credit Card. Consider this as my Personal request.

A Small request to all

You can Withdraw Money using this Credit card but Don’t withdraw cash from any credit card. If you have urgent cash requirement / Cash crunch, then I suggest you to take a Gold Loan or a Personal Loan. Those are much better options.

Because in a Personal Loan, every month you pay Principal amount plus Interest as an EMI. The rate of interest for Personal Loan ranges from 15 to 20% p.a. on a higher note.

Do you know how much Interest you will be charged on Credit Cards ?

As per the SBI Card website, the Rate of interest will be charged is upto 3.50% per month. It means you have to pay up to 42% per annum as a Finance / Interest charges on your Credit Card Outstanding balance.

In short, the Rate of interest you will be charged on a Credit card is more than double the interest you will be charged on a Personal Loan.

2. Interest charges / Finance Charges ?

You have used this Credit card and bought all the stuff you need.

But you don’t have enough money to pay the Credit Card Outstanding amount.

Then, the bank will charge you Interest between @3.75% per month. It means, the Annual interest is almost 42% per annum.

3. Late payment charges

Apart from Interest charges, if you delay paying this Credit card Outstanding by 1 day, you will have to pay Penalty Charges on top of your Credit card Outstanding.

Generally, the Late payment charges ranges from Minimum Rs.0/- rupees to Maximum Rs. 1,300/- depending on your Credit card outstanding.

So if you use credit card you have to be very organized and should deal with Credit card timelines properly.

4. Over the limit charges

You might not have heard about these charges earlier. Let check it out.

If you spend more than available limit on the credit card. That means you have over used your Credit card. Then, you will be charged with “Over The Limit charges”.

The more you spend than your Credit card limit, the more you will be charged i.e. @2.50% on the overdrawn amount. The Minimum amount will be charged starts from Rs.600/- rupees.

Final Analysis

The SBI Reliance card features are not effective. It has all the common features that are in available in every regular credit card. Since it was launched from a prestigious Reliance company, I expected little more features which are truly beneficial to the customers like Free petrol of 5 Litres per month or Reduction in Finance charges from 42% to 30% etc.,

On a overall, I felt that you will get a little discount on Groceries and i felt a little better with that. Let’s hope that we can expect better benefits in the future.

To Whom Useful ?

You can try this card even if you don’t even have a Single Credit card as It has a Global access & that too it tied up with SBI.

Thanks for your time 🙂