Introduction

Filing the Income Tax Return (ITR) beyond the due date will lead to late fees under section 234F of the Income Tax Act, which is Rs. 1,000 if total income is not more than Rs. 5 lakh & Rs. 5,000 if total income is more than Rs. 5 lakh. Such late fee needs to be remitted before filing ITR using Challan-280 at TIN-NSDL website.

In this article, let’s understand how to pay the income tax late fees online at TIN-NSDL portal through Challan-280. This can be done in 2 ways:

- Post-Login method

- Pre-Login method

I. Post-Login method

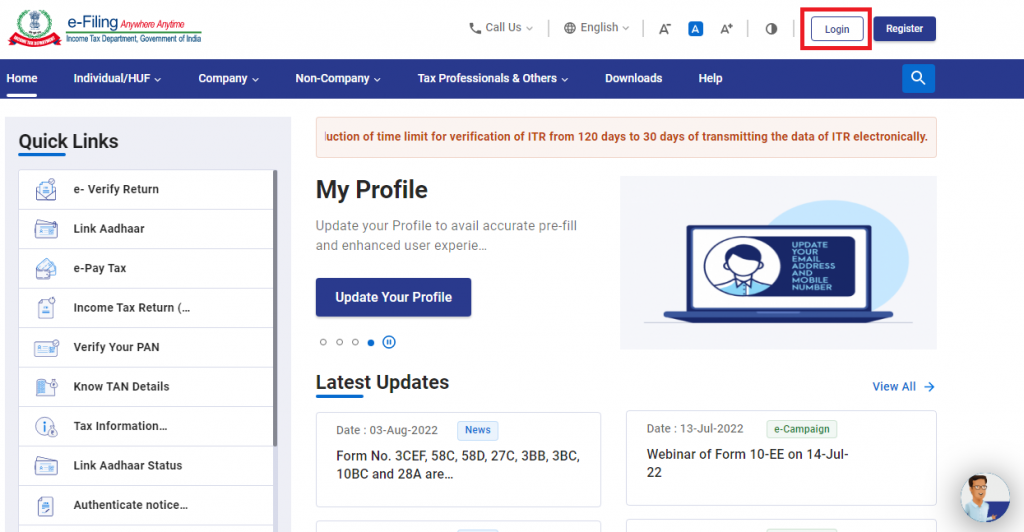

1. Login to the Income Tax portal

Use your credentials to login to Income Tax Website

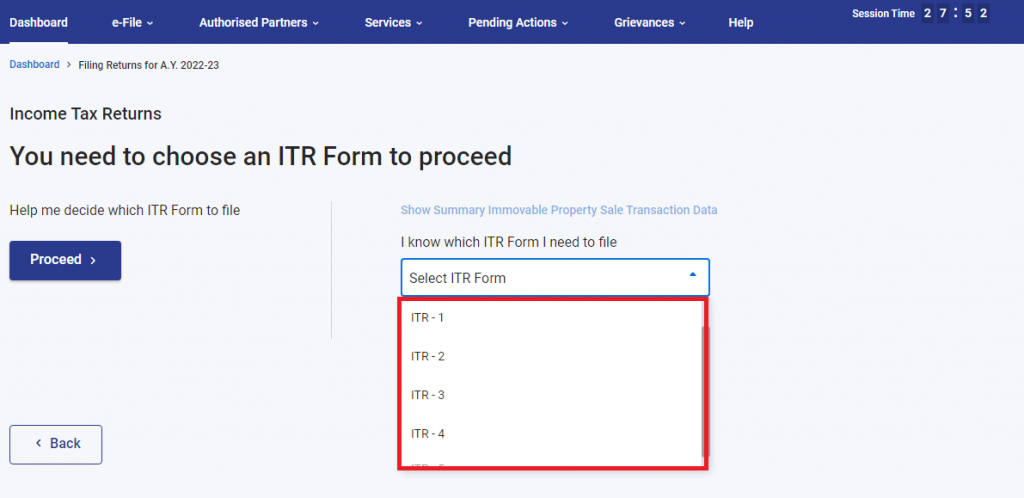

2. Choose and Fill the relevant ITR form

3. Fill ITR form until you see “Pay now”

After filling all the sections of ITR, you will see “Pay now” button

4. Click on “Pay now” to reach NSDL website

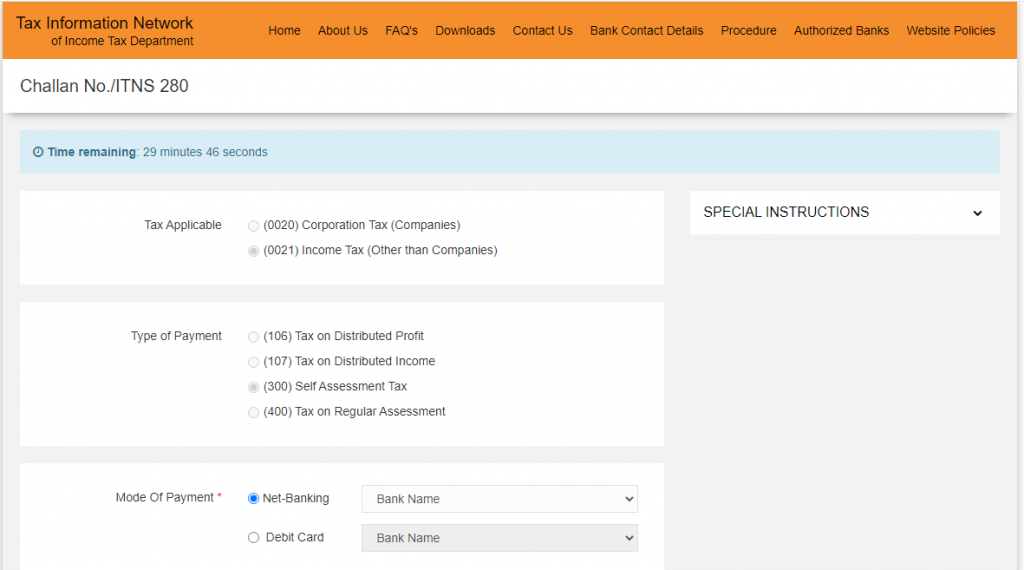

Upon clicking “Pay now”, you will be redirected to TIN-NSDL website (see below)

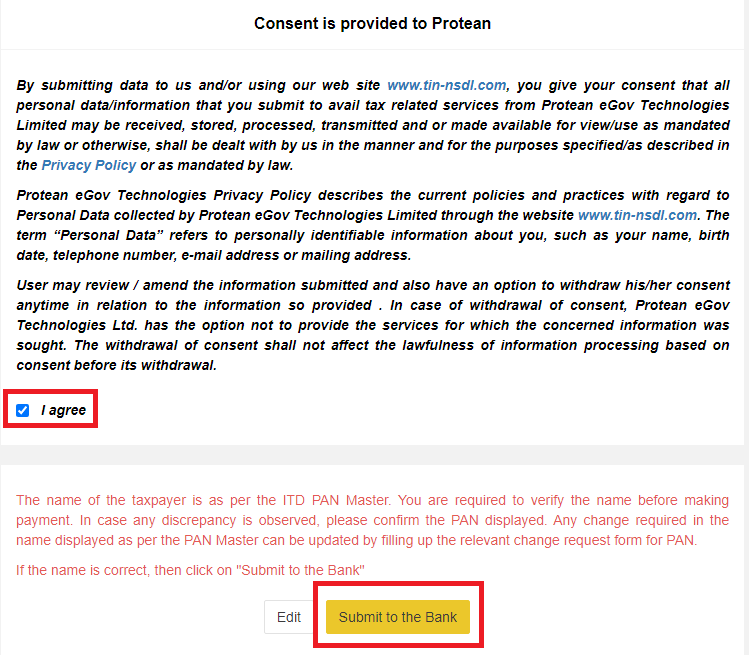

5. Check Pre-filled information and Confirm

Thoroughly verify the pre-filled information such as

- PAN, Assessment Year, Name and Address

- Choose Tax applicable depending on the category of assessee

- Companies – Code 0020

- For other than Companies – Code 0021

- Type of Payment should be “Self Assessment” and Code is 300

and check “I agree” button and click on “submit to the bank” as shown below

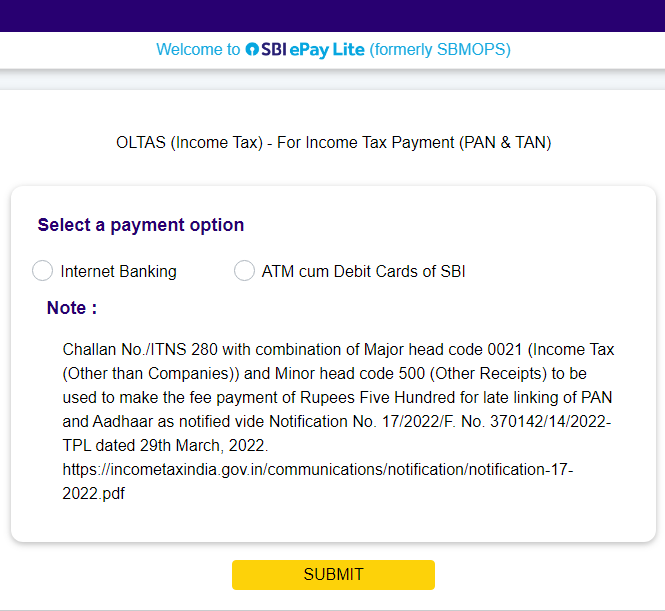

6. Pay through Debit card/Internet banking

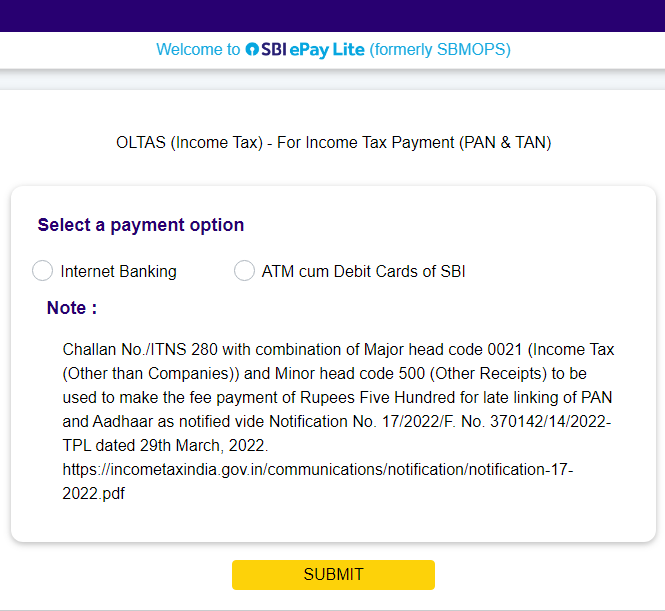

Choose from either Net banking or Debit card and pay the late fee

7. Download the Challan

Soon after the payment is done, download the challan and enter payment details in ITR. Also keep the challan for future reference.

II. Pre-login method

Now, we will go through the process of paying the tax without login to the Income Tax portal. The only disadvantage with the pre-login method is, all the information in Challan-280 has to be entered manually unlike the post-login method.

1. Select Challan no. 280

Go to NSDL website and choose Challan no. 280

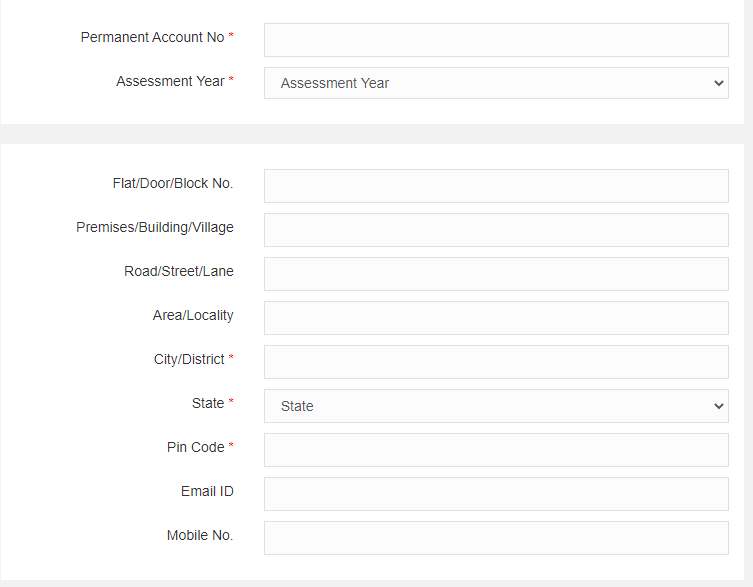

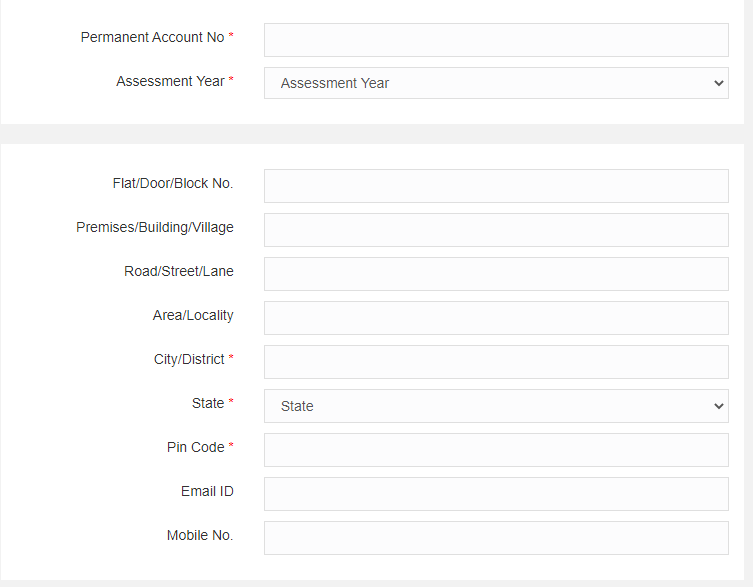

2. Fill all the Personal Information

Not all fields are mandatory. Fields marked with * (asterisk) are mandatory, rest are optional.

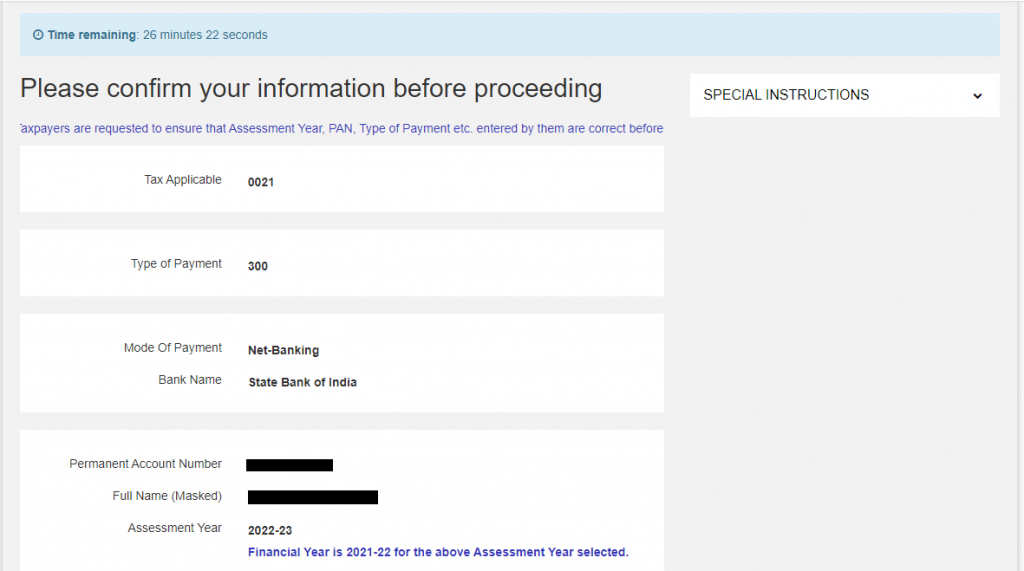

3. Reconfirm the information

Check all the information on this screen before going further. Quite often most of the people will choose wrong assessment year, so double check for which financial year you are paying for.

4. Pay through Debit card/Internet banking

Choose from either Net banking or Debit card and pay the late fee

5. Download the Challan

Soon after the payment is done, download the challan and enter payment details in ITR. Also keep the challan for future reference.

Conclusion

It is always recommended to file your ITR before due date so that you need not pay late fees and certain losses are also can be carried forwarded without any hassle. However, if you have to pay make sure to pay the late fee before filing Income Tax Return (ITR) and incorporate the payment details in the relevant section of ITR.