Introduction

An Annual Information Statement (AIS) is one of the key documents in the Income Tax Return filing, which reflects various financial transactions of an assessee in the relevant financial year.

Importance of AIS

Annual Information Statement (AIS) is like a tax passbook which contains TDS/TCS information, SFT transactions and Tax payment details like advance tax, self-assessment tax etc along with lot of other information.

While filing income tax returns, it is always a good practice to verify the transactions reflected in AIS and suitably disclose income related to those transactions in the ITR. Filing an income tax return without considering these transactions will lead to a mismatch between ITR data and AIS, which may turn your ITR into a Defective return.

How to download AIS from the portal

Follow the simple steps mentioned below (along with the pictures) to access your AIS easily for any year.

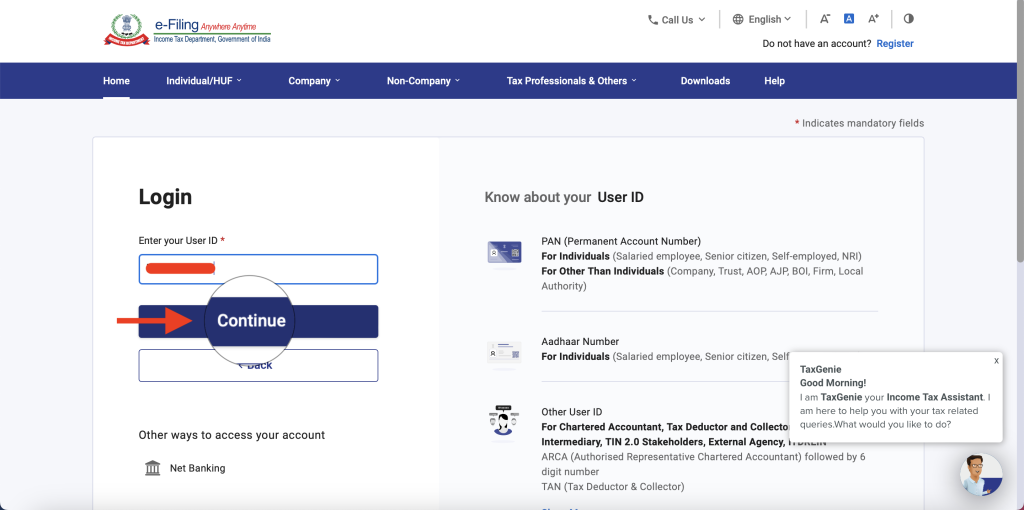

Step 1: Go to www.incometax.gov.in & click on “Login”

Step 2: Enter your PAN and continue

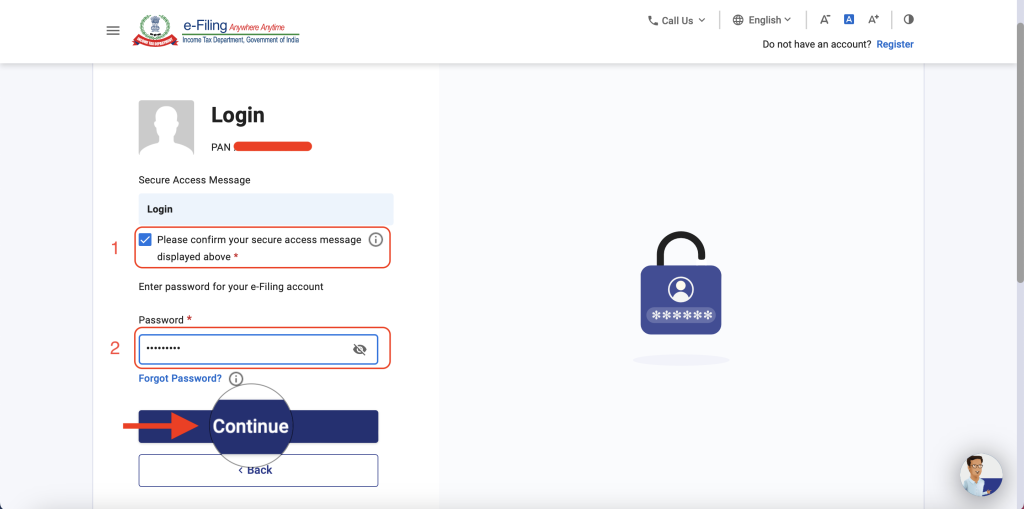

Step 3: Check this box, enter your password and click continue

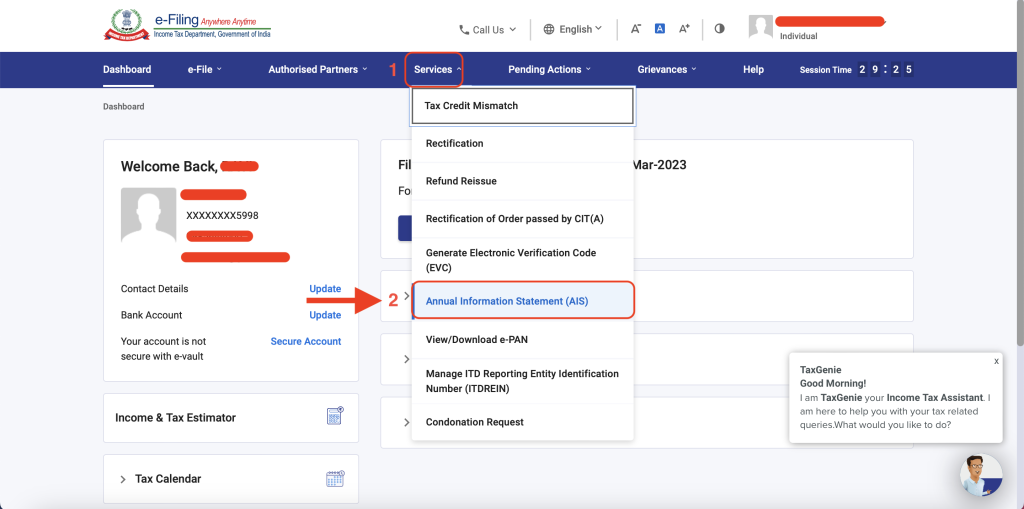

Step 4: After login, click on “Annual Information Statement” under the Services tab

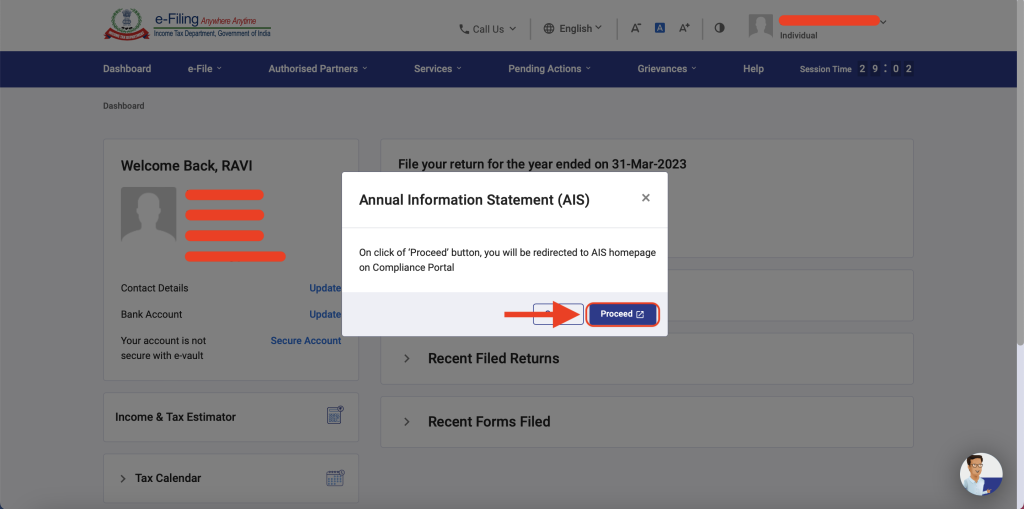

Step 5: You will be prompted to confirm “Proceed”, click on it. You will be landed on Compliance Portal to access your AIS

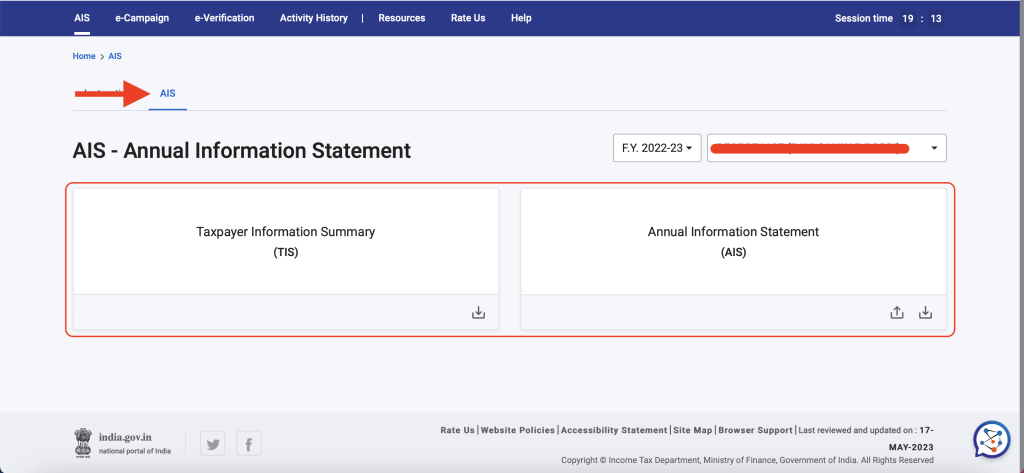

Step 6: Click on AIS tab to access your Taxpayer Information Summary (TIS) and Annual Information Statement (AIS)

Step 7: Choose FY for which you want to access AIS

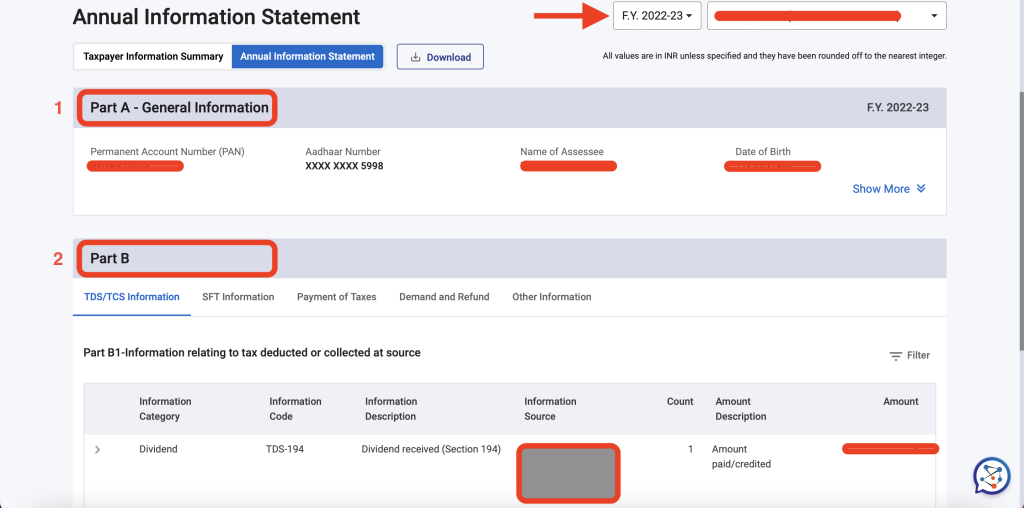

Then you will get the overview of AIS for the respective financial year

An Annual Information Statement (AIS) will have Part-A & Part-B. Part-A provides the personal information of the taxpayer including Name, PAN and DOB etc.

Whereas, Part B provides information relating to financial transactions done in the respective FY which includes:

- TDS/TCS information: Reflects transactions on which TDS/TCS has been collected along with the gross amount and tax

- SFT Information: Reflects all Specified Financial Transactions done by the taxpayers

- Payment of taxes: Reflects details of advance tax and self-assessment tax remittances

- Demand and Refund: Any demand due from and Refund due to taxpayers will be displayed under this tab

- Other information: Any other information which doesn’t fit under the previous tabs will be disclosed here, eg: Interest on Income Tax Refund

This way, you can your entire AIS statement for any financial year on the compliance portal.

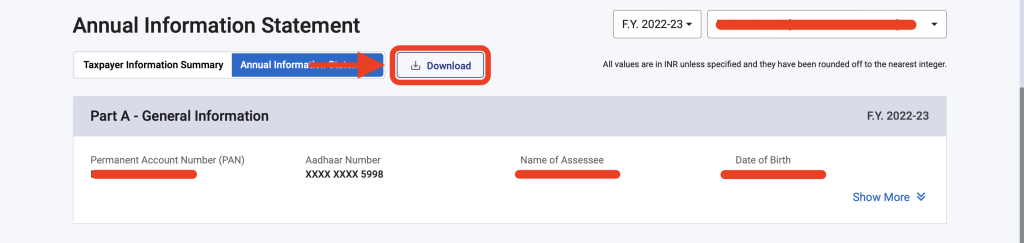

Instead, if you want to download it as a PDF you can do so by clicking on the download button as shown in the below.

Do remember, to access the PDF document you need to enter your PAN in lowercase along with the date of birth. Eg: PAN is ABCDE1234E & DOB is 12-12-1980, then password is “abcde1234e12121980”

Conclusion

Since AIS is a crucial document in ITR filing, pls do allocate some time to verify it and make sure to suitably consider these transactions while filing your Income Tax Return.

Hope you liked the article. Pls do comment for any queries, thank you for your time.