Yes Bank Rupay Credit Card

Introduction

Nowadays, Most Credit Card companies offer Lifetime Free credit cards to their customers to attract them. These companies earn money through Interest charges ranging from 42%-50% per annum depending on the Credit card issuer.

In this article, I’m going to discuss one such credit card i.e. from “Yes Bank Rupay Credit Card “

YES Bank is a Mumbai-based Private sector Bank, that started its operations in the year 2004 and offers various Banking and financial products like Credit Cards, Consumer Banking, Corporate Banking, and a lot more.

However, the YES Bank offers a Lifetime Free Virtual Credit card to its customers in the form of a Yes Bank Rupay Credit Card.

A virtual Credit card is simply a Digital Credit card with no physical existence.

Therefore, In this post, I will discuss every point in detail for your better understanding of this credit card, and also let’s see whether to take this Credit card or not.

Without further ado, Let’s get started..!

Yes Bank Rupay Credit Card Overview

| Particulars | Description |

|---|---|

| Credit Card Type | Reward Points |

| Joining Fees | Nil |

| Renewal Fees | Nil |

| Best for | Shoppers |

On first look, this Yes Bank Rupay Credit card comes in Dark Blue and White colour.

If you look at the top right of this credit card, you can see the issuing bank name as “YES Bank”.

On the right below, you can see the “Contactless Logo” symbol.

Along with that, at the right bottom of this credit card, you can see “Type of Credit card network” as “Rupay” which enables making UPI Payments. At the bottom of it, it is mentioned as “Credit” which represents a “Credit Card”.

Finally, If you look at the middle of this credit card, you can see a Chip card as well.

Now, Let’s crack this Credit card’s features and benefits.

Keep on Reading..!!

Yes Bank Rupay Credit Card Benefits

What Benefits do you get from Yes Bank Rupay Credit Card?

Let me go through the Top 5 benefits offered by Yes Bank Rupay Credit Card [Incl. My Analysis]

1. UPI Payments

With this Rupay Credit Card, the cardholder can make UPI Payments.

Rupay Credit cards are cards that can be linked with any UPI app (like Phonepe, Paytm, Google Pay, etc) and can complete the payment by scanning the QR code.

Let’s imagine this situation..!!

On Sunday, You went to a small Vegetable shop to buy fresh veggies to store them for a week. After you collected all the veggies, you complete weighing and it’s time to pay.

Mr.Ramu, an Individual shopkeeper, billed Rs.1,750/- for your veggies and suggested making a UPI payment.

All of a sudden, you realize that your savings bank has no sufficient balance and you don’t carry any physical cash as well.

Now, how would you pay?

In such a situation, Rupay Credit Cards might be the savior, as it helps you to link your Credit card to any UPI apps.

Once you link it, you can Scan the QR Code and can complete your payment even though you don’t have sufficient Bank balance.

Whenever you find a situation of No Money, then, this Credit card helps you to complete UPI Payment even in small shops.

As you know, you will not find POS machines in the small shops to swipe your credit cards.

In such a situation, this card might be helpful.

My Analysis

Paying seamlessly is a quite good option.

However, if you fail to make a full credit card payment by the due date, you will be charged huge Interest charges.

Keep in Mind..!!

2. Reward Points

The Yes Bank Rupay Credit Card also allows you to earn Reward Points on your both Offline and Online spending.

Let’s check how many reward points one can earn.

Offline

With this Yes Bank Rupay Credit Card, on every Rs. 200/- spent offline on UPI transactions above Rs.2,000/-, then, you will get 4 Reward Points.

Simply, to become eligible for offline Reward Points, each time you need to make at least a UPI transaction above RS.2,000 rupees.

The Maximum reward points one can earn in a month is 5000 reward points.

These reward points feature is not beneficial as the customer needs to spend more to get a few nominal reward points.

Online

However, this Yes Bank Rupay Credit Cardholder can earn 2 reward points for every Rs.200/- spent on all Online spends.

Here 1 Reward point worth is not mentioned by YES Bank.

My Analysis

In my opinion, I see Reward Points offered on Credit cards as Peanuts only.

The reason behind that is you cannot get any worthy benefit for the reward points you accumulated. Simply, you will get nominal benefits on your spending.

In case you have a requirement to spend through a credit card, then you will be rewarded for the accumulated points.

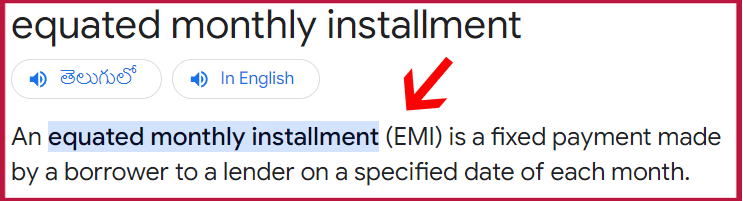

3. Instant EMI

In case, if the cardholder makes any big spends on Television, Fridge, or AC, then, the cardholder can convert those big transactions into Instant EMI i.e. any transaction of Rs.1,500/- or more.

For Offline Spends

If you make any big purchase at a retail store, then, you should ask for instant EMI at the payment counter before making the payment.

For Online spends

However, if the cardholder makes an online spends, then, the cardholder needs to select the easy EMI option while making the payment on the partner app or website.

The easy EMI conversion can be completed with Zero documentation. However, the easy EMI facility is not free. Therefore, the cardholder should pay a processing fee of Rs.199/- or Rs.399/- as applicable.

To avail of this feature, you should pay Interest charges @16% per annum for flexible tenures of 3,6,9,12,18,24 & 36 months.

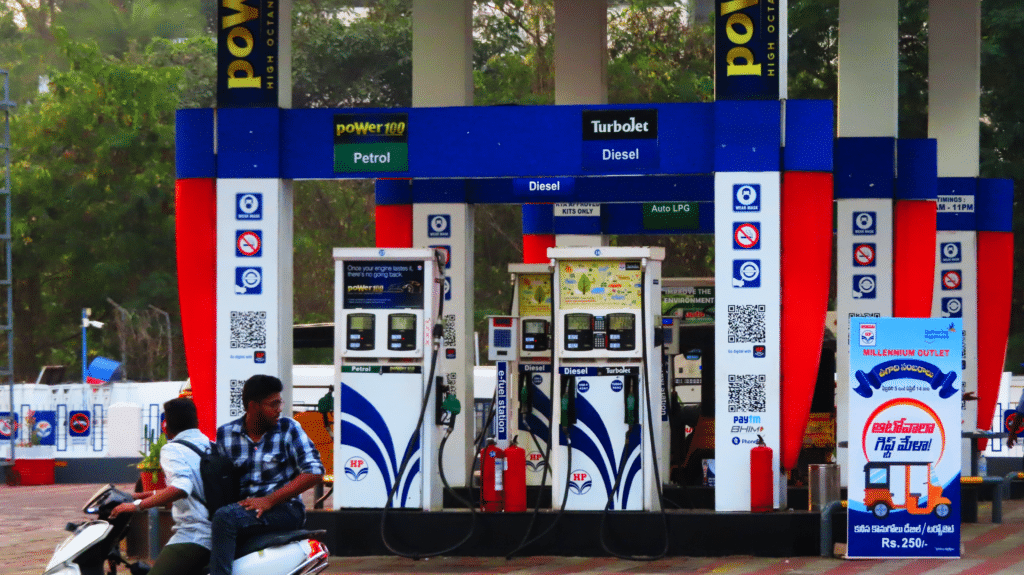

4. Fuel Surcharge Waiver

By using this Credit Card, If you spend on Petrol/Diesel between Rs.400-Rs.5,000/- in any fuel outlets across the country, then, a Fuel Surcharge will be charged. It may be between 1-3% of your Fuel Cost.

In case, you have paid fuel bills through this card, then, you will be eligible for a “1% Fuel Surcharge Waiver“. The Maximum Fuel Surcharge waiver you get is up to Rs.125/- per statement cycle.

I wrote a detailed article on Fuel Surcharge along with an analysis of whether it is useful or not.

Read here: How I Lost Money by paying Fuel bills with Credit Cards

5. Additional Benefits

This Yes Bank Rupay Credit Cardholder will also get the below 4 minor benefits.

Let’s check how beneficial to the cardholder..!!

EMI on call

This cardholder can effortlessly transform their expenditure into EMI via on-call service

Quick loan

In case, you have any urgent financial needs, then, this rupay credit card holder can access loans up to your credit card limit.

You Pay now

with this option, you can set to pay your monthly bill payments without any Hassle

E mandate

This Credit cardholder can establish standing instructions for subscriptions, bill payments, insurance, and more

As I mentioned earlier, these are minor benefits only and can be helpful during the card utilization process.

Yes Bank Rupay Credit Card [Must Read]

If you are applying for this Yes Bank Rupay Credit Card then looking at the benefits won’t help you, my dear friend. You should look at the charges as well.

The overview of the Top charges of the Yes Bank Rupay Credit Card is as follows.

| S.No. | Particulars | Description |

|---|---|---|

| 1 | Joining fees | Nil |

| 2 | Renewal fees | Nil |

| 3 | Interest charges | @3.80% p.m ; @ 45.60% p.a. |

| 4 | Foreign currency Markup | 2.75% of the transaction value |

| 5 | Rental Payments | 1% of the Transaction amount |

| 6 | Utility Payments | 1% of Transaction amount |

1. No Joining fees

If you want to use this Rupay Credit Card, then, you will be offered Zero Joining fees as a welcome offer. i.e. Free for the first year.

2. No Renewal fees

However, If you want to continue using this Rupay Credit Card from the second year onwards also, then, you are not liable to pay any Renewal fees.

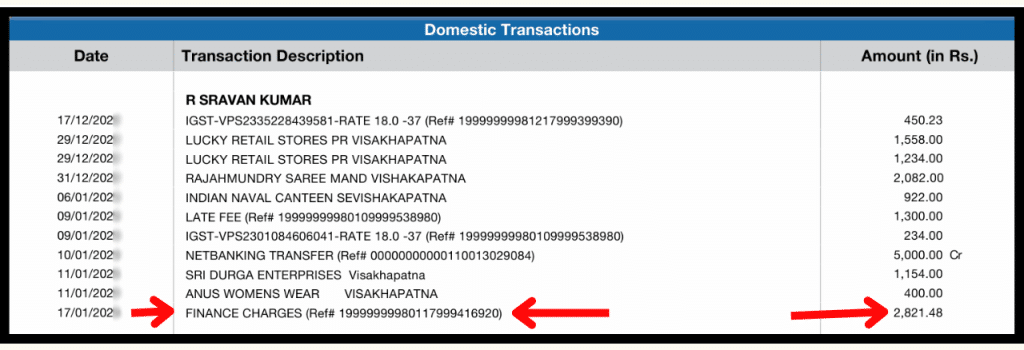

3. Interest charges / Finance Charges?

Do you know how much interest you will be charged on this Credit Card?

You must know it, boss.!

For Example,

You have used this Rupay Credit Card and bought all the stuff you need.

But you don’t have enough money to pay the Credit Card Outstanding amount.

Then, this bank will charge you interest @3.80% per month. It means the Annual interest the bank will charge is almost up to 45.60% per annum.

These finance charges won’t be stopped until you pay off your Credit Card’s outstanding balance in Full.

4. Foreign Currency Markup

Also, whatever international transactions you do by using this credit card, you will be charged a foreign mark fee of 2.75% on that transaction.

5. Rental Payments

This credit card Imposes a fee of 1% of the transaction amount or Rs.1 whichever is higher for wallet and rental transactions. Additionally, you are allowed a maximum of 3 rental payments within 30 days.

For Example,

If you pay a Rental Payment of Rs.15,000, then you will be charged additionally with 1% of fees i.e. Rs.150 or Rs.1 whichever is higher. Therefore, Rs.150/- will be charged additionally for your Rental payments.

6. Utility Payments

If the cardholder makes any utility transactions a charge of 1% will be applicable on all utility spends above Rs.15,000 rupees in a month.

Yes Bank Rupay Credit Card Review

In my opinion, this Yes Bank Rupay credit card is designed only to make seamless UPI transactions

This feature is helpful for customers who are short of savings bank account balances.

One more thing is that if you make any foreign currency transactions through this credit card, then, this Bank is charging 2.75% as a markup fee which is low as compared to other credit card companies which charge around 3.75%.

For this Rupay Credit card, All Master or Visa card network cardholders of Yes Bank are eligible, if you want to apply for this credit card, then, you can go with the above-mentioned 2 benefits only and the rest are just namesake.

Instead of this credit card if you are looking for a Rupay credit card I suggest you go with the Jupiter credit card which offers up to 2% cashback on Shopping, Travel, and dining.

Frequently Asked Questions

If you still have any questions, Check the below Frequently Asked Questions for more clarity.

1. What is a RuPay credit card?

A RuPay credit card is a contactless option that provides a secure and cost-effective alternative to global card networks such as Visa and Mastercard. These cards can be utilized for online shopping, in-store purchases at point-of-sale (POS) terminals, and ATM withdrawals. RuPay cards are widely accepted across most POS systems, online platforms, and ATMs throughout India, and they can also be used internationally due to a partnership with Discover Financial Services.

2. YES BANK RuPay Credit Card annual fee?

If you want to continue using this Rupay Credit Card from the second year onwards, then, you are not liable to pay any Renewal fees. i.e. Zero Renewal Fee

3. YES Bank RuPay Credit Card lifetime free?

The Yes Bank Rupay Credit Card comes with Zero Joining fees. i.e. Free for the first year i.e. you are not required to pay card joining charges.

4. Can I Link Phonepe in Yes Bank Rupay Credit Card?

As a Yes Bank Rupay Credit Card is a Visa Credit Card, the cardholder can link this credit card to their PhonePe.

5. Is the Yes Bank Rupay Credit Card a contactless card?

The Yes Bank Rupay Credit Card comes with Contactless technology.

In India, you can make payment using this credit card at the Point of Sale (POS) Machine for a Maximum Payment of Rs.5,000/- per transaction without entering the PIN.

If you want to make a payment of more than Rs.5,000/-, then, this card holder should input the Credit card PIN to complete the payment.

6. Can we use the Yes Bank Rupay Credit Card in petrol pump?

The Yes Bank Rupay Credit Card customers can fuel their vehicles at fuel stations. Whenever you pay with your Rupay Credit card, you should be liable to pay a Fuel Surcharge i.e. around 1-3% of fuel cost. However, with this Yes Bank Rupay Credit card, you will be eligible for a 1% Fuel Surcharge waiver.

7. Does the Yes Bank Rupay Credit Card have a Fuel Surcharge Waiver?

The Yes Bank Rupay Credit Card offers a Fuel Surcharge Waiver. If you spend Petrol/Diesel between Rs.400-Rs.5,000/- in any fuel station in the country, then you will be eligible for a 1% Fuel Surcharge waiver with a Maximum of Rs.150/- per statement cycle.

8. Yes Bank Rupay Credit Card reward points value

1 Reward Point worth of Yes Bank Rupay Credit Card is not mentioned by Axis Bank. But you can consider it as Rs.0.25 paisa by comparing the other Yes Bank credit cards.

Thanks for your time, my dear readers 🙂