HDFC Pixel Play Credit Card

Introduction

India’s Largest Private Sector Bank, HDFC Bank has launched a New credit card with a 5% Cashback. i.e. HDFC Pixel Play Credit Card.

It’s a Virtual credit card.

Simply, a Digital Credit Card.

Don’t worry my dear friends, you will be provided a Physical card as well.!!

While going through this HDFC Pixel card’s features, I Observed 2 Special things.

As far as I know, I don’t think this facility has come in any credit card.

In this article, I will discuss every point in detail for your better understanding of this credit card, and also let’s see whether to take this Credit card or not.

Without further ado, Let’s get started..!

HDFC Pixel Play Credit Card Overview

| Particulars | Description |

|---|---|

| Credit Card Type | Cashback & Reward Type |

| Joining Fees | Rs. 500+ GST |

| Renewal Fees | Rs. 500 + GST |

| Best for | Online Shoppers |

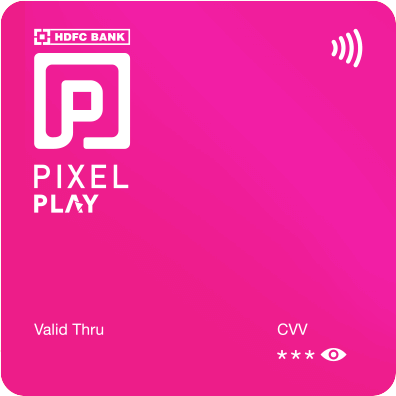

If you look at this Credit card, at first look, it’s a bit different in a Square shape.

Generally, Credit cards used to come in Horizontal shapes. Later on, shaped to Vertical. Now this card turned to a Square shape.

Let’s see how many more shapes are going to be introduced in this segment. This HDFC Pixel Play Credit Card comes in 3 different colors Yellow, Pink, and Blue colors.

If you look at the top left of this credit card, you can see the “HDFC Bank Logo”. Below it, you can see the Letter “P” which represents Pixel Play.

If you look at the top right of this credit card, there will be a “Contactless Logo” symbol.

If you look at the bottom left of this card, then it shows “Valid through” i.e. the Validity of this credit card. At the right bottom of this card, you can see a 3-digit CVV number that looks secured with an eye symbol.

Now, Let’s crack this Square Credit card features and benefits.

HDFC Pixel Play Credit Card Benefits

What Benefits do you get from HDFC Pixel Play Credit Card?

Let me go through the Top benefits offered by HDFC Pixel Play Credit Card [Incl. My Analysis]

Firstly, when it comes to the benefits of this Pixel Play credit card, let’s talk about its Reward benefits.

1. Reward Benefits up to 5%

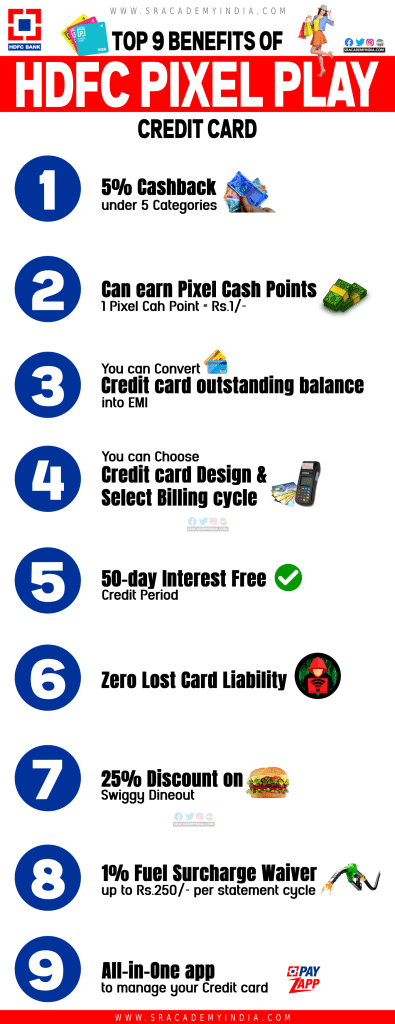

i) 5% Cashback

By using the HDFC Pixel Play Credit Card, the cardholder can earn Reward Benefits in the form of Cashback.

Here, the Cardholder can earn up to 5% Cashback on your payments through this credit card.

I told you at the beginning of this article about 2 Special Features, Let me share 1st Special feature here.

The HDFC Pixel Play Credit Cardholders are offered 5% Cashback under 5 Categories. Here, the cardholder can choose only 1 category out of 5 categories based on his spending.

Simply, the cardholder can choose the category of cashback he wants to avail of.

Usually, Credit card companies offer Credit cards with a special discount on specific categories of spending, but with this Pixel Play credit card, the cardholder can choose the spending category as per their spending behavior.

With the HDFC Pixel Play Credit Card, If you select the “Dining & Entertainment” Category, then the Cardholder will get 5% Cashback on the spending they make through this card on Book My Show and Zomato.

Selecting the “Travel” category will give you 5% cashback on Make My Trip & Uber spending.

However, if you select the “Grocery” category then on Blinkit & Reliance Smart Bazaar, you will get 5% cashback.

If you select the “Electronics” Category then Croma & Reliance Digital.

If you select the “Fashion” Category you can earn 5% cashback through Nykaa & Myntra.

The cardholder can select only one category out 5 of categories.

Therefore, I request you to first identify the Expenditures you want to spend with your credit card, then, select the category based on your highest monthly spends.

Cashback Limit

The Maximum Cashback per statement cycle capped is up to Rs.500 rupees only. For that, the cardholder is required to spend Rs.10,000 rupees through this credit card.

If they spend more than Rs.10,000 in a statement cycle, then, the cardholder is not eligible for Cashback in this category i.e. Zero Cashback.

| Particulars | Maximum Cashback per Statement Cycle |

|---|---|

| For Spends up to Rs.10,000/- | Up to Rs.500/- rupees |

| For Spends morethan Rs.10,000/- | Zero Cashback |

My Analysis

Generally, Credit card companies offer one offer per Credit card. But in this HDFC Pixel Play Credit Card, it’s the choice of the cardholder to select the category according to their spending habits.

This feature is beneficial for middle-class spenders to earn some bucks back on shopping.

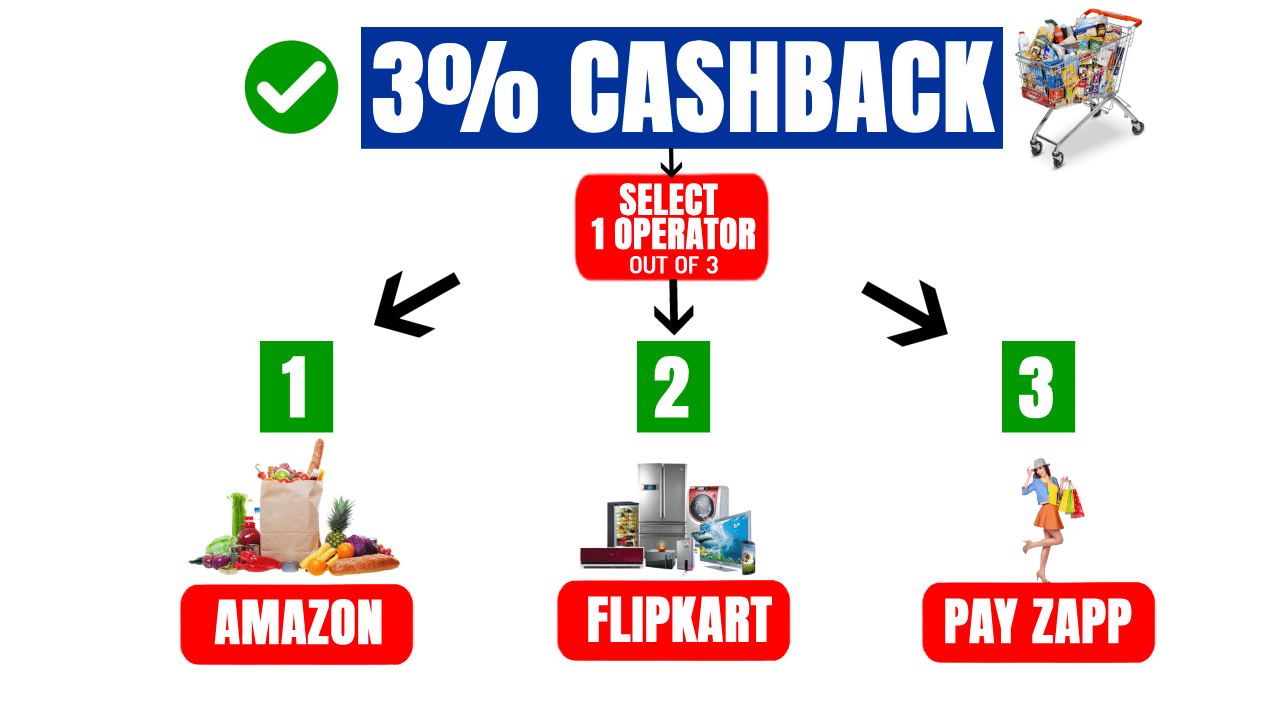

ii) 3% Cashback

Now, Let’s discuss under which segment you can earn 3% Cashback with this Credit card.

Do you Shop at Amazon or Flipkart regularly..!

Then, you must know this Cashback benefits my dear folks.

If you are a regular shopper at Amazon or Flipkart, then this HDFC Pixel Play Cardholder can select one E-Commerce operator out of 3 below aggregators to earn 3% Cashback.

1. Amazon,

2. Flipkart

3. HDFC PayZapp app.

Cashback Limit

The Maximum Cashback per statement cycle capped is up to Rs.500 rupees only. For that, the cardholder is required to spend Rs.16,600 rupees through this credit card.

If you spend more than Rs.16,600 in a statement cycle, then, the cardholder is not eligible for Cashback in this category i.e. Zero Cashback.

| Particulars | Maximum Cashback per Statement Cycle |

|---|---|

| For Spends up to Rs.16,600/- | Up to Rs.500/- rupees |

| For Spends more than Rs.16,600/- | Zero Cashback |

iii) 1% Cashback

However, if you spend on any other category, then, the HDFC Bank offers you 1% Unlimited Cashback.

Zero Rewards

Apart from that, It is also to be noted that if you spend in any of the below categories, then, the cardholder is not eligible for Cashback i.e. Zero Cashback.

1. If you convert your credit card transactions to EMI,

2. Loaded money into the Wallet,

3. Rental payments,

4. Government services transactions.

2. Earn 2000 Pixel Cashpoints

The second benefit, we are going to discuss about Pixel Cash points.

We discussed earlier about Cashback.

But, now we are going to talk about “Pixel Cash Points”.

What’s the difference between “Cashback” and “Cashpoints”?

Usually, the earned Cashback on credit cards will be credited to the Credit Card Statement. But, if you earn Cashback through this HDFC Pixel Play Credit card, then, the Cashback will be accumulated in the form of “Pixel Cash points”.

Pixel Cash points are nothing but “Reward points”.

Just a name change!

In old movies of the duo, if a person has a mole on his face, you will be treated like a villain. Otherwise, he is a hero.

But, here both are the same.

Reward Points and Pixel Cash points both are the same.

Minimum Reward Points

To qualify for the redemption of Pixel Cash Points, the cardholder should accumulate a minimum of 1000 Pixel Cash points with a Validity of 2 years from the Date of Accumulation.

If the cardholder makes any Insurance payments with this credit card, then, they can be eligible to accumulate up to 2000 Reward Points only per day.

What’s the Worth of Reward Points?

This HDFC Pixel Play Credit cardholders can redeem their Pixel Cash Points at a rate of

1 Pixel Cash Point = Rs.1/- rupee worth

For Example,

If you have earned 1000 Pixel Cash Points that is equal to Rs.1,000 rupees.

How Can I Redeem?

The HDFC Pixel Play Credit Cardholders can redeem their Pixel Cash Points / Reward points through the “HDFC PayZapp app”.

In case you keep your Credit card idle, just like PAN or Aadhar for one year i.e. in an inactive state, then all the accumulated reward points earned on this credit card will become zero.

However, I request you to Don’t overspend unnecessarily with your Credit card, because of fear of losing reward points.

Try to maintain a clear gap between spending and overspending.

My Analysis

In my opinion, I see Reward Points offered on Credit cards as Peanuts only.

The reason behind that is you cannot get any worthy benefit for the reward points you accumulated. Simply, you will get nominal benefits on your spending.

In case you have a requirement to spend through a credit card, then you will be rewarded for the accumulated points.

Considering the HDFC Pixel Play Credit card, 1 Pixel Cash Point is worth Rs.1/- rupee is a true worth for the customer.

Generally, Credit card companies offer a Reward point worth of Rs.0.25 paisa Therefore, the Reward points / Pixel Cash Points under this category are worth accumulating.

3. Convert your Outstanding balance into EMI

If you make any Big spends through this HDFC Pixel Play Credit Card, but you don’t have enough money to clear your Credit card outstanding balance, then, this credit card holder can convert the Credit card Outstanding amount into EMI. i.e. Pay in Parts

You can avail of this benefit with Zero documentation, Emails, or Phone calls.

Just you need to select your desired tenure from the Payzapp app and convert your outstanding balance into EMI.

But it’s not Free.

To convert it, you need to pay Rs.199+GST as Processing fees.

Moreover, If you want to pay your converted EMIs as Preclosure, then, you will have to pay a 3% amount on your Credit Card balance outstanding as a Pre-closure charge.

4. Customize your Card

Now it’s time to reveal the 2nd Special feature..!

Generally, Credit cards come with no change in card design and Billing cycle. However, the HDFC Pixel Play Credit Card comes with 2 choices.

1. Choosing the Credit card design.

2. Selection of the Billing cycle.

My Analysis

Creditcard design selection can be seen as just an option. However, it’s not beneficial from the customer’s viewpoint.

Coming to the 2nd choice the best part of this card is the selection of the Billing cycle.

Generally, after applying for credit cards, many cardholders are troubled in finding out the Billing cycle. Usually, there’s a gap between the Salary credited date and the Credit card Billing due date. To minimize this gap, this credit cardholder can enjoy this privilege by selecting the Card due date.

This special feature is beneficial for the customer.

For Example,

If the Cardholder receives Salary on the 10th of every month, then, the Credit card outstanding bill comes on the 30th. In the meanwhile, the cardholder’s savings become empty for many reasons like House Rent, EMI, Groceries, Partying, Restaurants, Tours, and a lot more.

5. Enjoy Interest-Free Credit Period

This HDFC Pixel Play Credit Card comes with a 50-day credit period from the date of purchase.

6. Protect your Credit Card from Hacked

Another benefit of this HDFC Pixel Play Credit Card is Zero Lost Card Liability.

Let me clarify..!

If you have taken this HDFC Pixel Play Credit Card and later on for any reason or by mistake it has disappeared or someone has stolen your card.

In such a case, firstly this credit card user should call HDFC Bank customer care service numbers either 1800 202 6161 / 1860 267 6161 within India or +91 22 6160 6160 from outside India and should complain.

By making such a complaint, what benefit customer will get?

By chance, if any online transaction is noticed on post complaint to the HDFC Bank from your credit card fraudulently. Then, you will be protected from financial loss under zero lost card liability.

If you do not complain, then, You are responsible for the financial loss and you should bear it.

7. Exclusive Dining Privileges

Do you spend money on Dining..!

If yes, with this HDFC Pixel Play Credit Card, you can save up to 25% on Dining expenses i.e. through Swiggy Dineout.

This offer can also be availed only if you make payments through the Swiggy Dine Out app. The Maximum discount offered per month is up to Rs.300 rupees only.

8. Fuel Surcharge Waiver

By using this HDFC Pixel Play Credit Card, If you spend Petrol/Diesel between Rs.400-Rs.5,000/- at any fuel station in India, then, a Fuel Surcharge will be charged. It may be around 1-3% of your Fuel Cost.

In case, you have paid these bills through this card, then, you will be eligible for a “1% Fuel Surcharge Waiver“.

The Maximum Fuel Surcharge waiver you get is up to Rs.250/- per statement cycle.

I wrote a detailed article on Fuel Surcharge along with an analysis of whether it is useful or not.

Read here: How I Lost Money by paying Fuel bills with Credit Cards

9. All-in-One app

The HDFC Pixel Play Credit card is to be managed through the Payzapp app of HDFC Bank.

This Virtual Credit card appears in this app. So, from here you can manage all the options of Pixel Credit card like

– Changing your Credit card controls,

– Checking reward points,

– EMI,

– Card statements,

– Repayments,

– Recent transactions,

Everything done with this card can be accessed through this PayZapp app.

Therefore, you can access all information related to this credit card from here, which means it will be used like an All-in-one app.

HDFC Pixel Play Credit Card Eligibility

Who is Eligible for an HDFC Pixel Play Credit Card?

1. For Salaried

Age:

Applicant with a Minimum age of 21 years and a Maximum age of 60 years

Income:

The Gross Monthly Income of more than Rs.25,000 are eligible for this credit card.

2. For Self Employed

Age:

Applicant with a Minimum age of 21 years and a Maximum age of 65 years

Income:

The Income as per ITR of more than Rs.6,00,000 per annum is eligible for this credit card.

HDFC Pixel Play Credit Card Apply

How to Apply for HDFC Pixel Play Credit Card?

To apply for this HDFC Pixel Play Credit card,

1. Download the updated Payzapp app from your Android / IOS and

2. Open the app

3. Now, you can apply through the banner “Apply now for Pixel play”.

HDFC Pixel Play Credit Card Charges [Must Read]

If you are applying for this HDFC Pixel Play Credit Card then looking at the benefits won’t help you, my dear friends. You should look at the charges as well.

The overview of the Top charges of the HDFC Pixel Play Credit Card is as follows.

| S.No. | Particulars | Description |

|---|---|---|

| 1 | Joining fees | Rs.500 + GST |

| 2 | Renewal fees | Rs.500 + GST |

| 3 | Cash advance charges | 2.50% or Rs.500/- w.e.h |

| 4 | Interest charges | @3.60% p.m ; @ 43.2% p.a. |

| 5 | Late payment charges | Rs.0 – Rs.1300/- |

| 6 | Over-the-limit charges | Rs.500/- |

| 7 | Foreign currency Markup | 3.50% of the transaction value |

1. Joining fees

If you want to use this HDFC Pixel Play Credit Card, then, on 1st year you will have to pay a Joining fee of Rs.500 excluding GST. With GST, you should pay Rs.590/-

If you have spent Rs.20,000/- rupees within 90 days of taking this card by using this credit card, then the Joining fee on this credit card of Rs.590 will be waived i.e. you are not required to pay the Joining fee on this credit card.

2. Renewal fees

If you want to use this HDFC Pixel Play Credit Card from the second year onwards, then, you will have to pay a Renewal fee of Rs.500/- per year excluding GST. With GST, you should pay Rs.590/- per year.

If you have spent Rs.1,00,000/- or more in a year by using this credit card, then the Annual fee on this credit card of Rs.590 will be waived i.e. you are not required to pay the Renewal fee on this credit card in the next year.

I request you to spend money if you have the necessity and get the benefit. But never spend for the sake of benefit. Because if you spend Rs 1 lakh rupees then you will get Rs.500/- rupees wort of benefit i.e. 0.5% benefit to the customer.

If you are looking for a FREE Credit card, without Joining Fees and Renewal fees, then, you can check here.

3. Cash Advance charges / Cash Withdrawal charges

If you withdraw money by using this HDFC Pixel Play Credit Card, a Transaction fee will be levied on all such Cash Withdrawals at ATMs. Such fees would be billed to the Cardholder in the next statement.

A transaction fee of 2.5% or Rs.500/- whichever is higher will be charged at ATMs.

It is my sincere and humble request for all the Credit Card users that Whatever the Credit card you use, you Please don’t make any Cash Withdrawals by using your Credit Card. Consider this as my Personal request.

A Small request to all

You can Withdraw Money using this HDFC Pixel Play Credit Card but Don’t withdraw cash from any credit card. If you have an urgent cash requirement / Cash crunch, then I suggest you take a Gold Loan or a Personal Loan.

Those are much better options.

In a Personal Loan, every month you pay the Principal amount plus Interest as an EMI. The rate of interest for Personal Loans usually ranges from 15-20% p.a. on a higher note. Whereas in credit cards, you have to pay up to 42% per year at the rate of 3-4% per month.

That means the interest rate you pay on a credit card is more than double the rate of interest you pay through a personal loan.

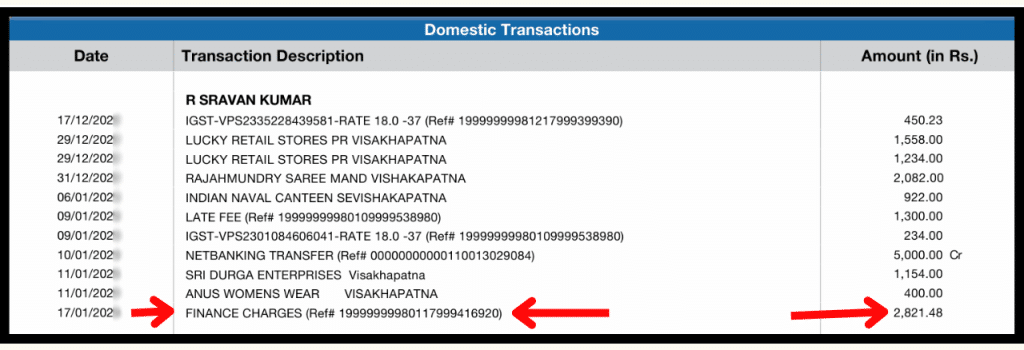

Apply Now4. Interest charges / Finance Charges?

Do you know how much interest you will be charged on Credit Cards?

You have used this HDFC Pixel Play Credit Card and bought all the stuff you need.

But you don’t have enough money to pay the Credit Card Outstanding amount.

Then, the bank will charge you interest between @3.60% per month. It means the Annual interest is almost 43.20% per annum.

These finance charges won’t be stopped until you pay off your Credit Card’s outstanding balance in Full.

5. Late payment charges

Apart from Interest charges, if you delay paying this HDFC Pixel Play Credit Card Outstanding by 1 day, you will have to pay Penalty Charges on top of your Credit card Outstanding amount.

Generally, the Late payment charges range from a Minimum of Zero rupees to a Maximum of Rs. 1,300/- depending on your Credit card outstanding. On this card, you don’t need to pay any late penalty charges as long as your credit card’s outstanding balance is less than Rs.100 rupees.

If your credit card outstanding balance is more than Rs.500/-, then you will incur Late payment charges.

So if you use a credit card you have to be very organized and should deal with Credit card timelines properly.

| Credit Card Outstanding Balance is | Late payment charges |

|---|---|

| Less than Rs.500 | Nil |

| Between Rs.101-Rs.500 | Rs.100/- |

| Between Rs.501-Rs.1,000 | Rs.500/- |

| Between Rs.1,001-Rs.5,000 | Rs.600/- |

| Between Rs.5,001-Rs.10,000 | Rs.750/- |

| Between Rs.10,001-Rs.25,000 | Rs.900/- |

| Between Rs.25,001-Rs.50,000 | Rs.1,100/- |

| More than Rs.50,000 | Rs.1,300/- |

6. Foreign Currency Markup

Also, whatever international transactions you do using this credit card, you will be charged a foreign mark fee of 3.50% on that transaction.

HDFC Pixel Play Credit Card Review

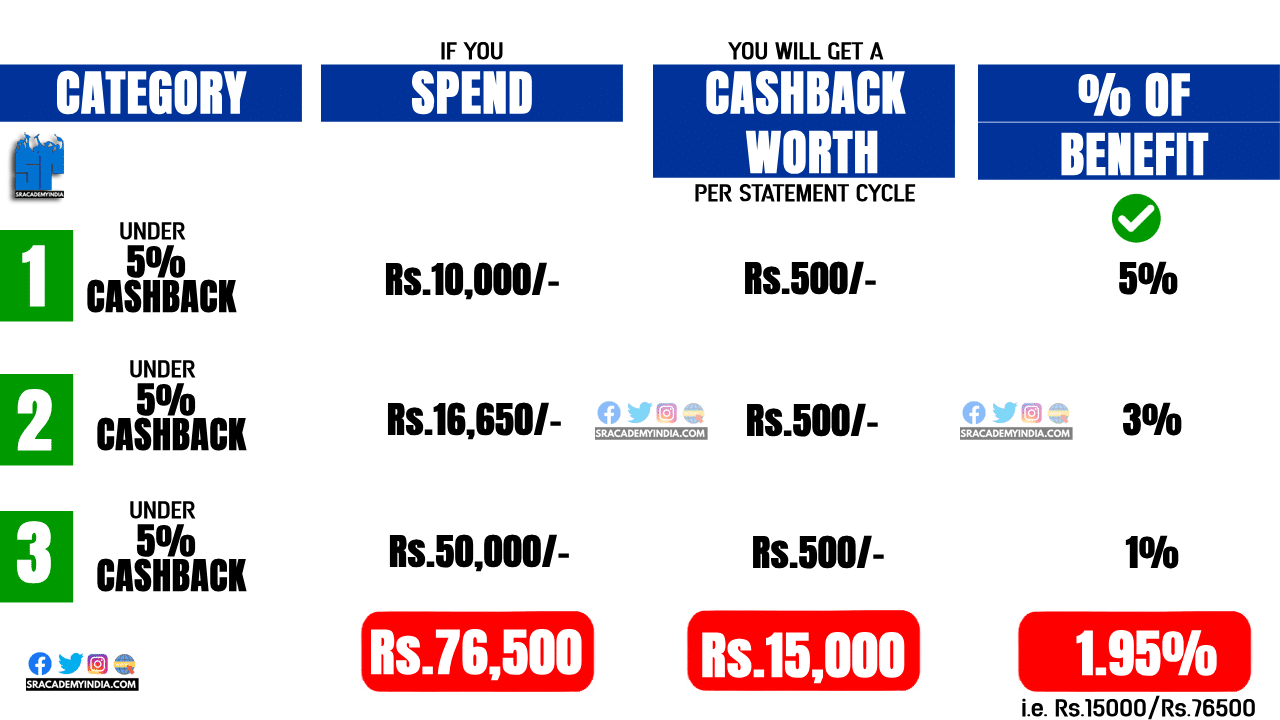

This HDFC Pixel Play Credit card focused mainly on Reward points. Here, the interesting thing is that from the 5%,3%, and 1% categories, the total benefit we get is not 9%. It’s Just 1.95% only.

To understand that math, check the below chart with simple math.

What they promise is one thing but finally what we get is another.

We think that under the 5% Cashback category, we will be in a through spend any amount, but the reality is far different.

If you want a credit card with Rs.1,500 cashback per month and you want to select your credit card Billing cycle yourself, then, apply for this credit card, otherwise skip it.

However, this HDFC Pixel Play Credit card does not have any Airport lounge facility and it is not a Rupay credit card.

Frequently Asked Questions

1. What is an HDFC Pixel Play Credit Card?

HDFC Pixel Play Credit card is a Virtual and Physical credit card that offers cashback of up to 5% per statement cycle under 5 categories of spending. It also allows the customer to select one category of spending out of 5 based on their spending behavior.

This HDFC cardholder can enjoy 2 special features

1. Choosing the Credit card design.

2. Selection of the Billing cycle.

2. Is HDFC Pixel Play Credit Card Rupay Card?

The HDFC Pixel Play Credit Card is not a Rupay Credit Card. But at present, it offers a Visa Card network to its customers.

3. Can I Link Phonepe in HDFC Pixel Play Credit Card?

As an HDFC Pixel Play Credit card is a Visa Credit Card, the cardholder can link this credit card to their PhonePe.

4. Is HDFC Pixel Play Credit Card have Lounge access?

The HDFC Pixel Play Credit card offers no Airport or Railway Lounge facility to its customers.

5. Is the HDFC Pixel Play credit card a contactless card?

The HDFC Pixel Play credit card comes with Contactless technology.

In India, you can make payment using this credit card at the Point of Sale (POS) Machine for a Maximum Payment of Rs.5,000/- per transaction without entering the PIN.

If you want to make a payment of more than Rs.5,000/-, then, this card holder should input the Credit card PIN to complete the payment.

6. Can we use HDFC Pixel Play Credit Card in petrol pump?

The HDFC Bank customers can fuel their vehicles at fuel stations. Whenever you pay with your Kotak Credit card, you should be liable to pay a Fuel Surcharge i.e. around 1-3% of fuel cost. However, with this HDFC Pixel Play Credit card, you will be eligible for a 1% Fuel Surcharge waiver.

7. HDFC Pixel Play Credit Card Fuel Surcharge Waiver Rule?

The HDFC Pixel Play Credit card offers a Fuel Surcharge Waiver.

If you spend Petrol/Diesel between Rs.400-Rs.5,000/- in any fuel station in the country, then you will be eligible for a 1% Fuel Surcharge waiver with a Maximum of Rs.250/- per statement cycle.

8. What is the Annual Fee of HDFC Pixel Play credit card?

If you want to use this HDFC Pixel Play Credit Card from the second year onwards, then, you will have to pay a Renewal fee of Rs.500/- per year excluding GST. With GST, you should pay Rs.590/- per year.

If you have spent Rs.1,00,000/- or more in a year by using this credit card, then the Annual fee on this credit card of Rs.590 will be waived i.e. you are not required to pay the Renewal fee on this credit card in the next year.

9. HDFC Pixel Play credit card reward points value

For a limited time, the HDFC Pixel Play Credit cardholder can redeem Reward Points as Instant Cashback at a rate of 1 Reward Point = Rs.1/- rupee worth.

10. What is HDFC Bank Full Form?

HDFC Bank stands for Housing Development Finance Corporation Limited. This bank is one of India’s premier private-sector banks. This Bank started its operations in 1994 from the Mumbai headquarters and provides a wide range of financial services and products such as banking, insurance, loans, credit cards, investment services, home loans, deposits, mutual funds, demat accounts, and personal loans.

11. HDFC Pixel Play Credit Card Customer Care Helpline?

For any questions or concerns about your HDFC Pixel Play Credit Card, you can contact the below Customer Care helpline toll-free number 1800 1600 / 1800 2600 (Toll-Free)

If you still have any questions, check the Frequently Asked Questions below for more clarity.

Thanks for your time my dear friends..!!