F]ixed deposits are a popular investment option due to their safety and guaranteed returns. If you are looking to invest your savings and earn a fixed interest rate over a specific period, opening a fixed deposit is a smart choice.

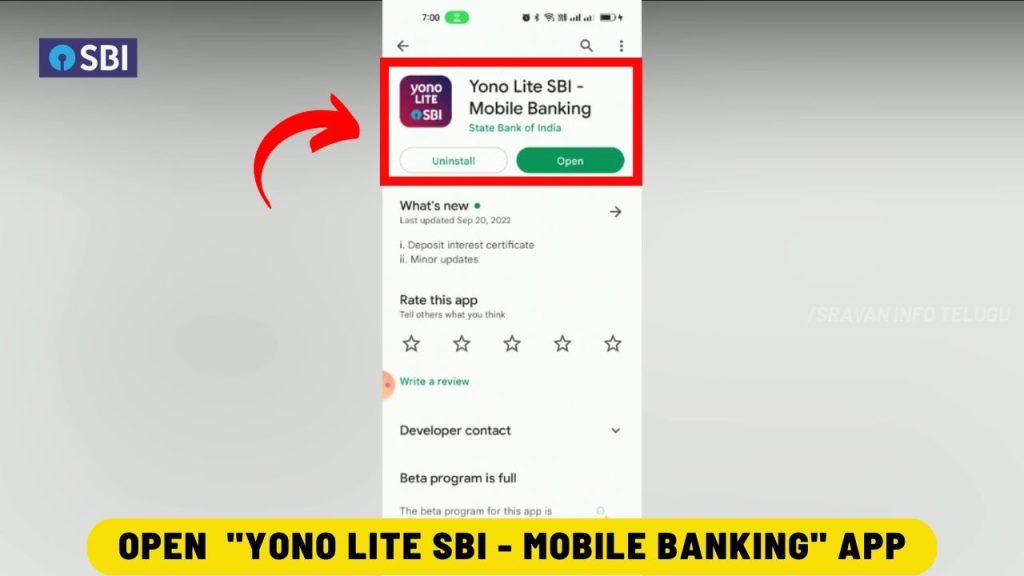

Today in this article, let’s see how to open fixed deposit in State Bank of India yono i.e. through SBI Mobile Banking App, and also what are the Minimum and Maximum limits for creating a Fixed Deposit (FD) and how much interest will be paid.

Let’s get started to learn How to open a Fixed Deposit in State Bank of india..!!

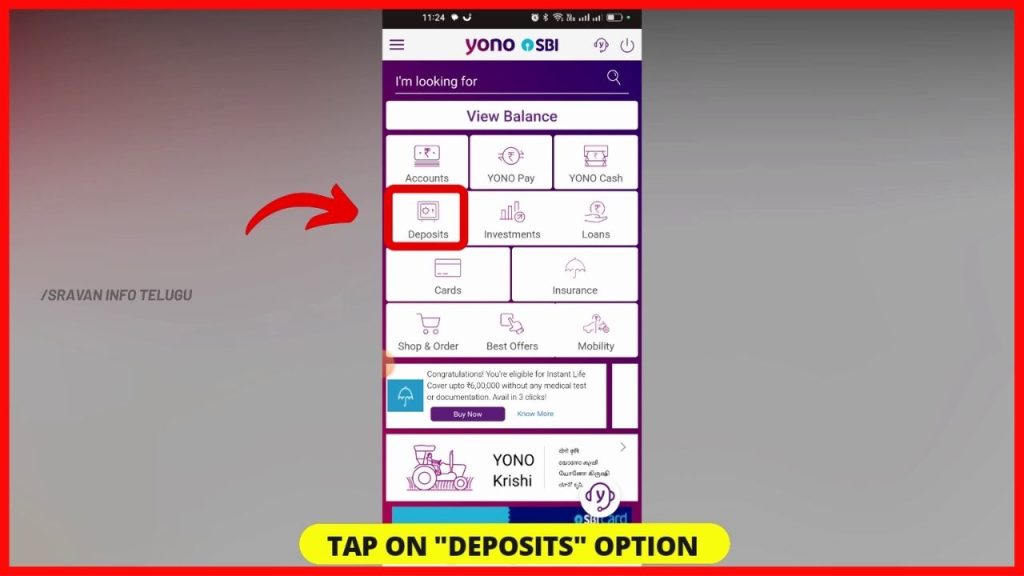

Step 2:

Now tap on the “Deposits” option to open your Fixed Deposit in SBI Yono.

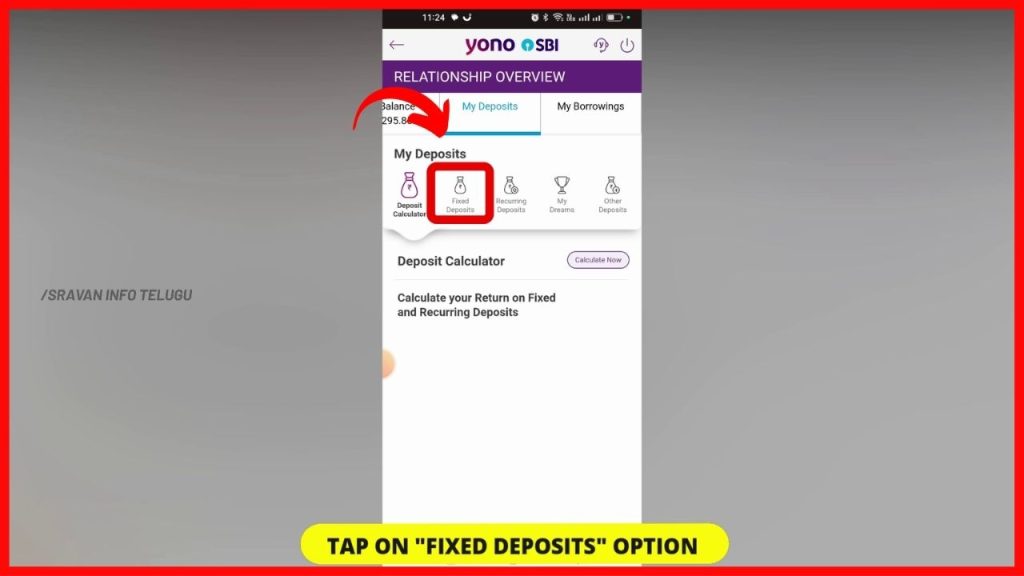

On tapping, it will land you on the new page and there tap on the “Fixed Deposits” option under the section of “My Deposits”

Step 3:

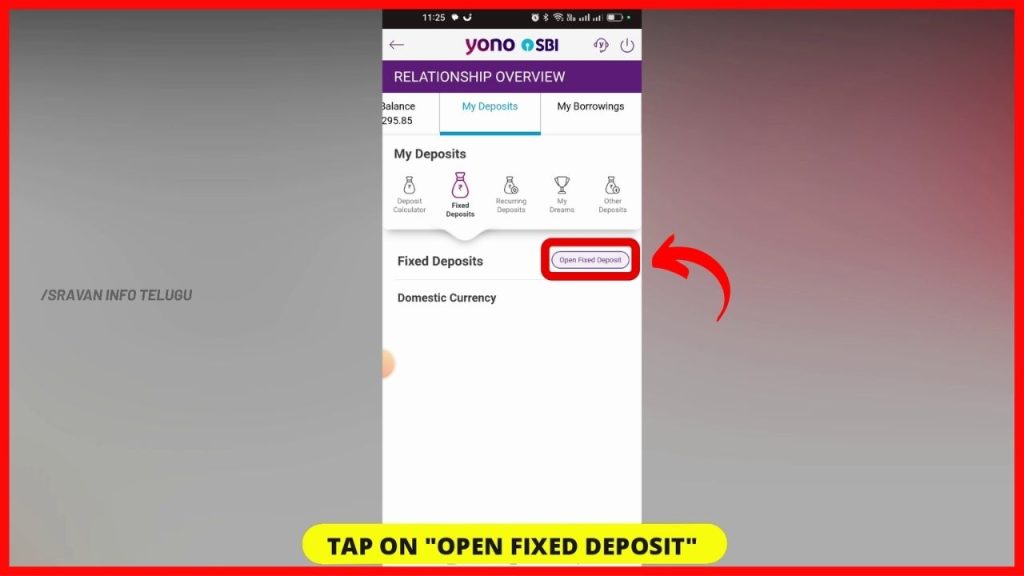

Now in that section, you will get an option to open your Fixed deposit, just tap on “Open Fixed Deposit”.

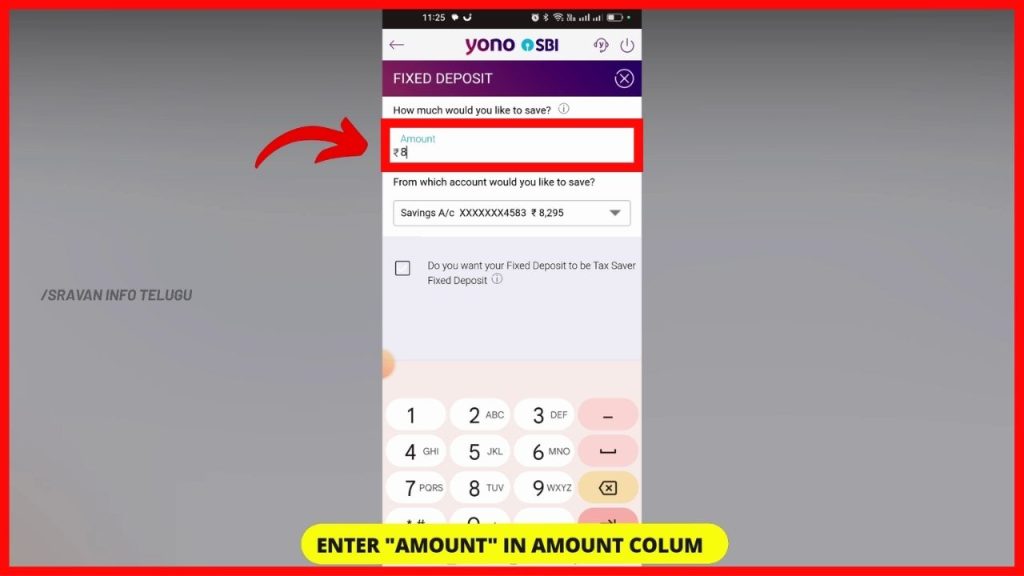

Step 4:

Now it displays “How much you would like to save?”. Here enter the Amount you want to create as a Fixed Deposit in the “Amount” column

If you want to open a regular FD, then, you have to select a period within five years. You can deposit a Minimum of Rs.1,000/- and a Maximum of up to Rs.1 Crore.

In case, if you want to Create a Tax Saver FD, then, you should hold your investment for a Minimum period of 5 years term. In Tax Saver FD, you can open an FD with a Minimum amount of Rs.1,000/- and a Maximum amount of up to Rs.1,50,000/- per Financial Year.

Here, Financial Year means Year starts from 01st April and Ends on 31st March of every year.

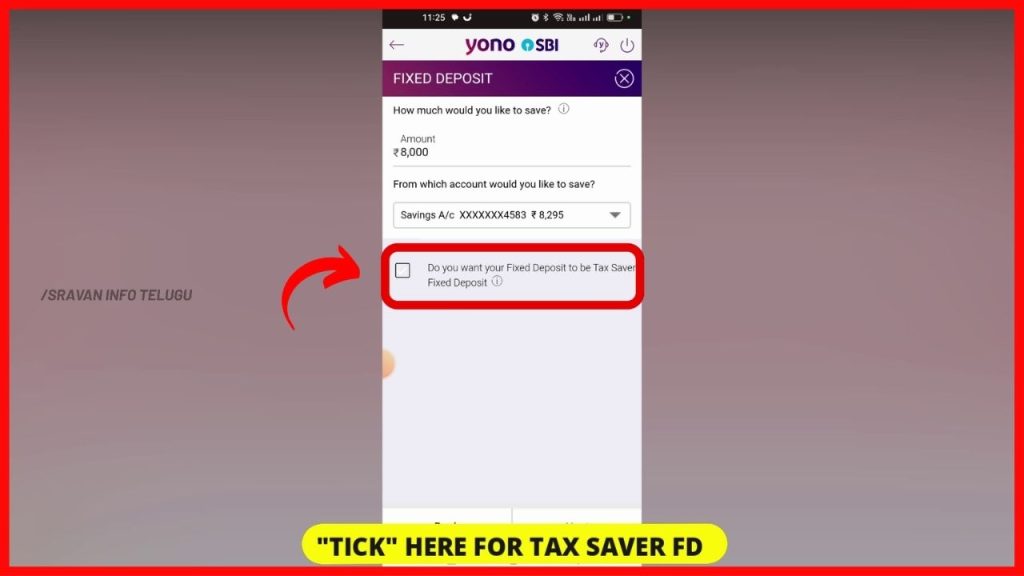

Step 5:

Tick here if you want to create a Tax Saver FD.

Untick it, if you are creating a Regular FD for a period of Less than 5 Years. After that tap on the “Next” button.

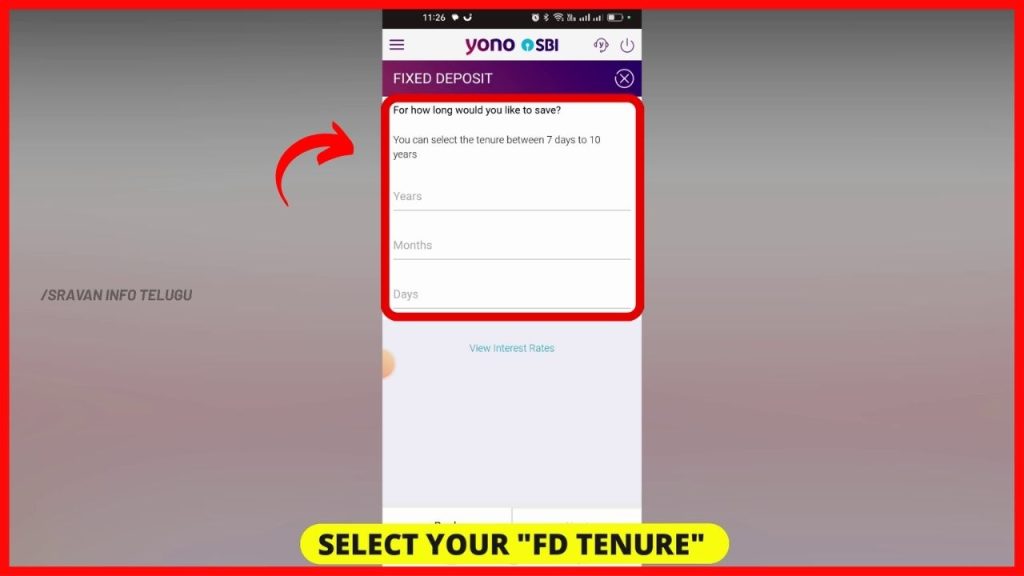

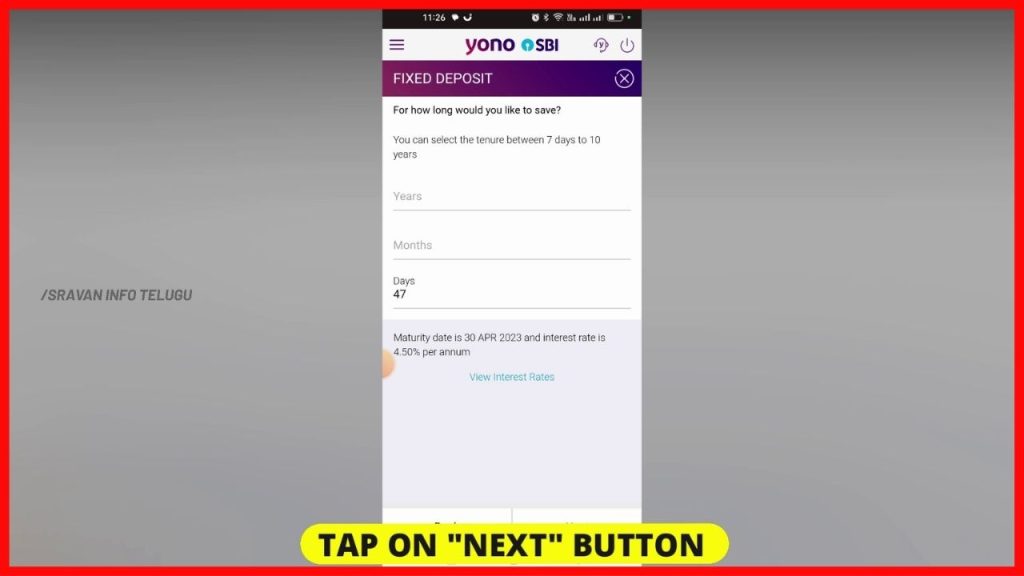

Step 6:

Now select the “Tenure” i.e. For how long you would like to Save” your FD. Now you can select the FD period in Years or in Months or in Days. You can select your tenure of deposit from 7 days to 10 years.

Click on the below link to Watch it in Telugu

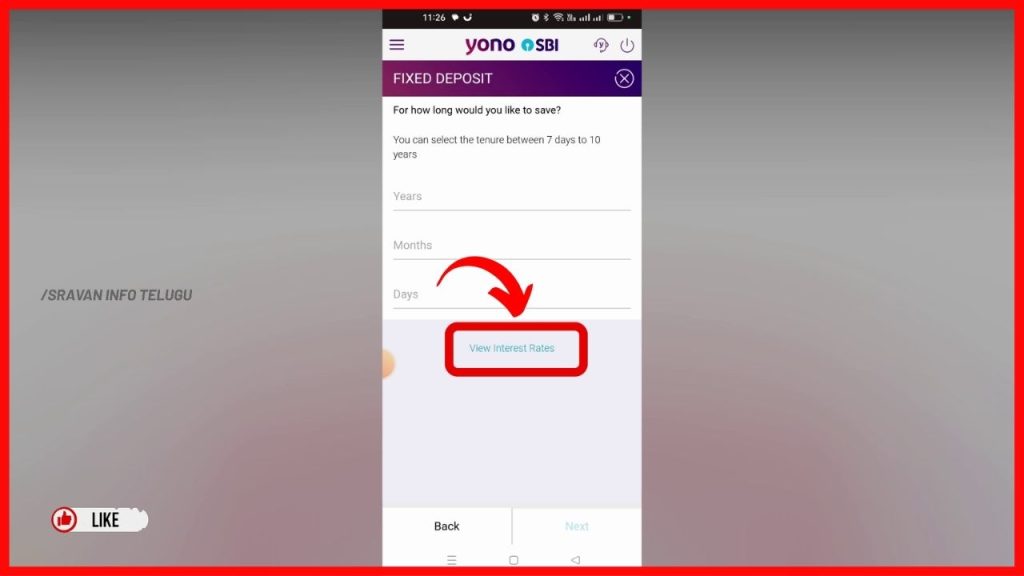

Step 7:

Also, if you want to check the interest rates of FD, Click at the bottom of the screen on “View Interest Rates”.

If you click on it, you can see interest rates ranges from 3% rate of interest to 7.1% depending on the period of your deposit.

Now enter the tenure either in years or months or days. Once you enter it, the Maturity date and the applicable interest rate will be displayed as per the given input details.

Now tap on the “Next” Button.

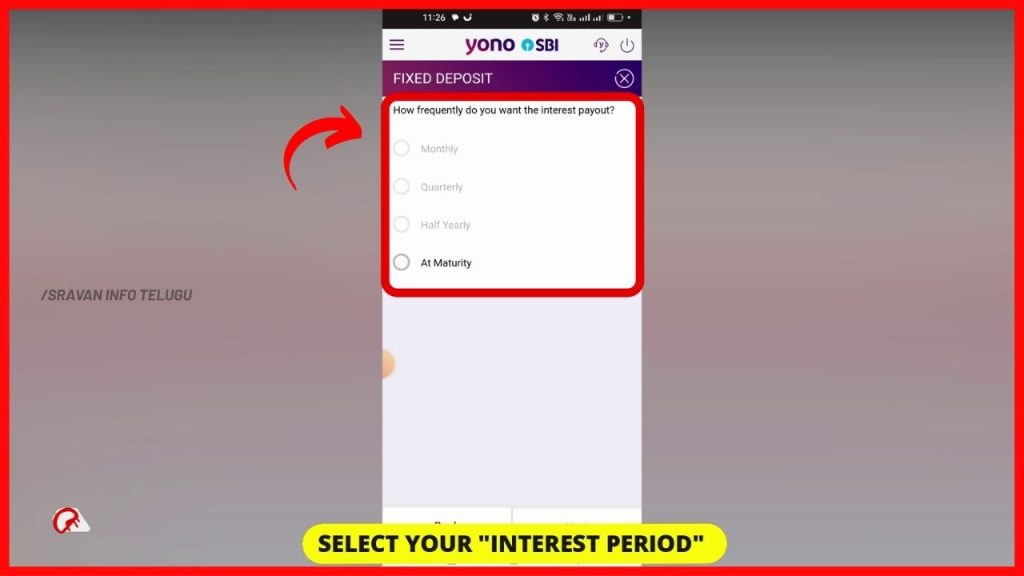

Step 8:

Now the screen displays, “How frequently do you want the Interest Payout?”. It is the period for which you have to pay the interest. i.e. either

1. Monthly,

2. Quarterly,

3. Half-Yearly, or

4. At Maturity.

Select “At Maturity” if you want to get the interest amount at the time of Maturity of your FD.

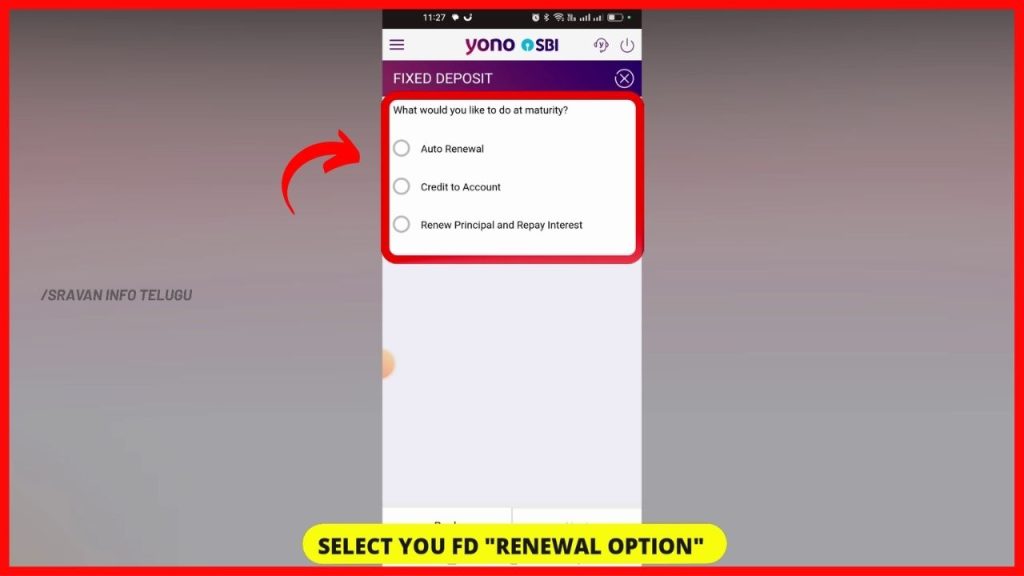

Step 9:

After that, the screen displays 3 options.

1. Auto-Renewal – If you want to renew your entire FD amount at the time of Maturity, Select it.

2. Credit to Account – If you don’t want to Renew your FD amount, Select it.

3. Renew Principal and Repay Interest – If you want to renew your principal amount and Transfer the interest amount to your bank.

Select any one of the options and tap on the “Next” button.

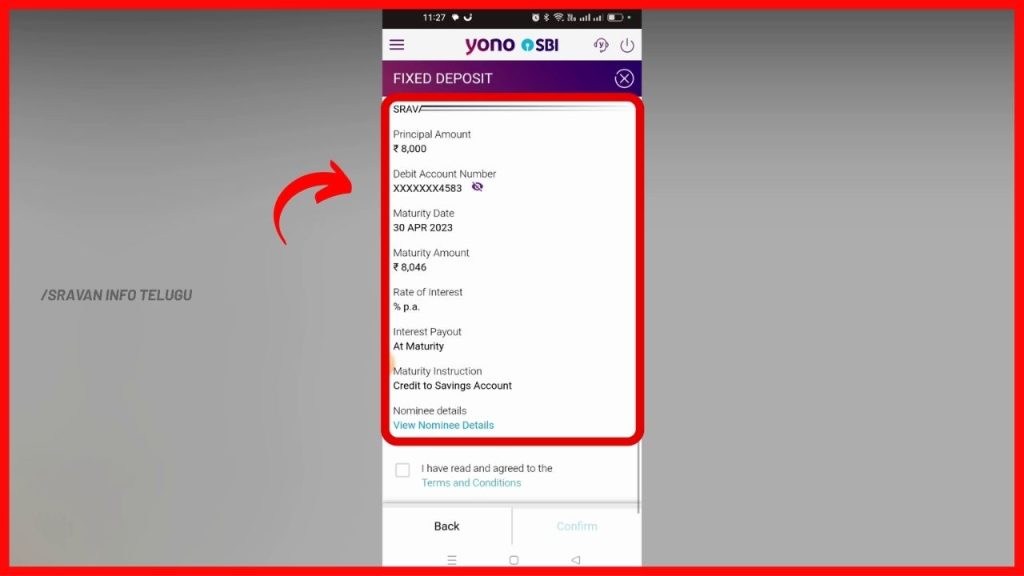

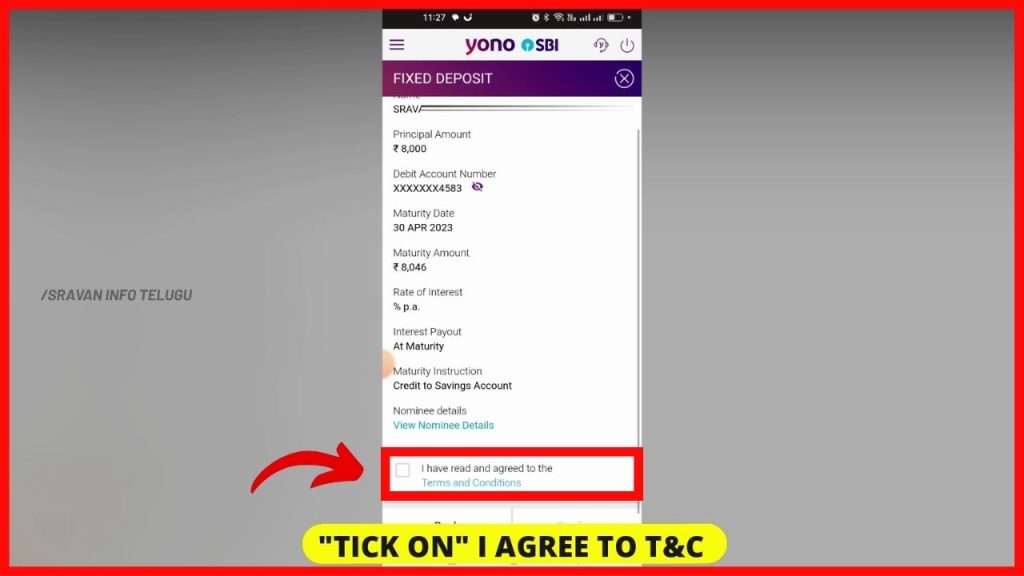

Step 10:

After that, all the FD details you have filled in will be displayed like Principal Amount, Maturity Amount, Maturity date, etc.,

Step 11:

If you think all the details are fine, then Tick “I have read to Terms and Conditions” and tap on the “Confirm” button.

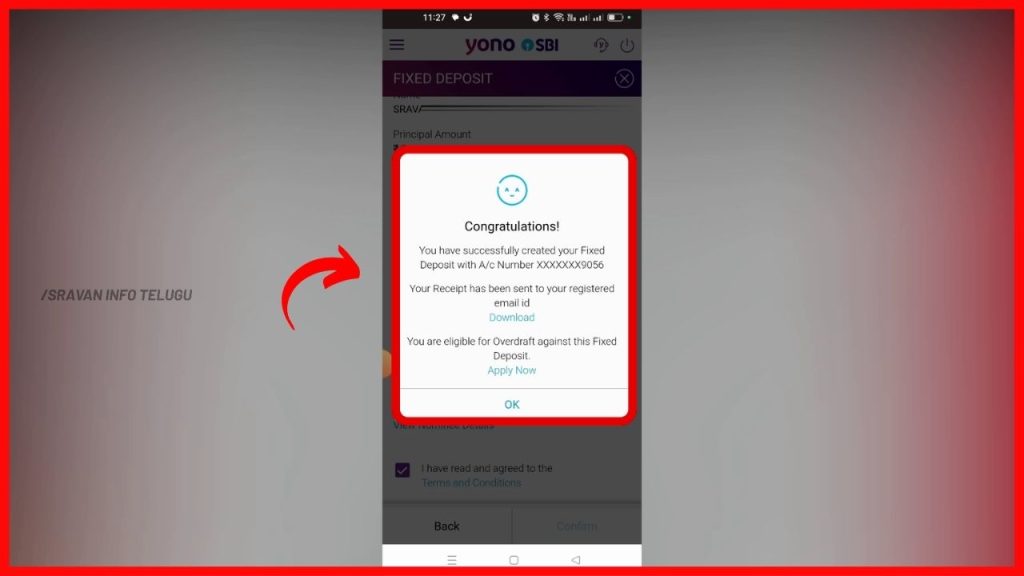

Step 12:

After that, a message will be displayed as “Congratulations you have successfully created your fixed deposit”

If you tap on the Ok button, your FD will be displayed like this in the “My Deposits” section.

Thanks for Reading 🙂