SBI Account for Minors

Introduction

In this Financial world, it is quite important to have Financial literacy for children from a younger age. The India’s Largest Public sector Bank, the State Bank of India (SBI) offers a tailored solution to the Minors through their SBI Minor account.

This scheme is designed especially for individuals aged below 18 years. i.e. for Minors.

With this scheme, young minds can able to manage their finances, and also it helps them to learn Banking basics and also develop the habit of Savings and financial planning.

Till now many people may know that a Bank account is only for elders (i.e. who are 18 years of age). But nowadays, Children can also open a Bank account.

Yes, you heard it right..!!

In this article, we delve into complete details of the SBI Account for Minors, its features, benefits, deposit limits, eligibility requirements, and a lot more.

We aim to provide a comprehensive overview in helping parents and guardians in making a wise decision about the financial well-being of young brains.

Let’s get started..!!

Overview of SBI Account for Minors

| S.No. | Particulars | Description |

|---|---|---|

| 1. | Scheme Name | SBI Minor account |

| 2. | Desgined by | State Bank of India (SBI) |

| 3. | Type of Schemes | 1. Pehla Kadam 2. Pehli Udaan |

| 4. | Eligibility | 1. Pehla Kadam – Children aged below 18 years 2. Pehli Udaan – Must have above 10 years of age but below 18 years |

| 5. | Minimum Deposit Limit | Nil |

| 6. | Maximum Deposit Limit | Upto Rs.10,00,000/- per scheme |

| 7. | Cheque Book | Yes |

| 8. | Passbook | Yes |

| 9. | Nomination | Yes |

1. What is a SBI Account for Minors

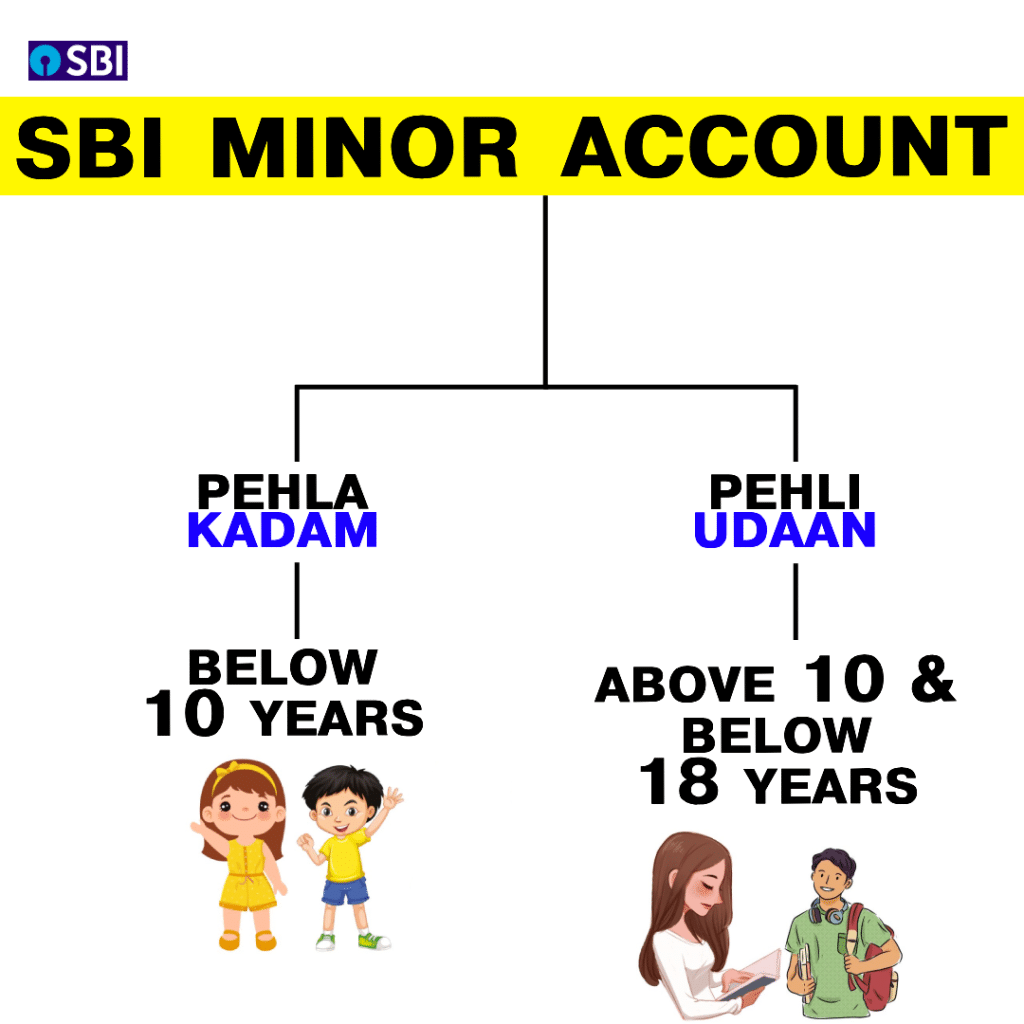

State Bank of India (SBI) offered 2 schemes for individuals aged below 18 years.

1. Pehla Kadam

2. Pehli Udaan

What are these schemes..!!

These two are Saving account schemes only.

Let me tell you in detail.

2. Eligibility

To know about these two schemes, firstly, you should know about the Eligibility criteria for these two schemes.

Pehla Kadam SBI

– Under the Pehla Kadam SBI scheme, your Children must be a Minor i.e. the age of your child must be below 18 years of age.

– Both Male and Female children are eligible to open this Savings account. It can also be opened Jointly with a parent or guardian.

Pehli Udaan SBI

SBI Pehli Udaan benefits

In the Pehli Udaan scheme also, your children must be Minors i.e. the age of your child must be below 18 years of age but must have above 10 years of age. Then only, you can directly open a Savings Bank account in your Children’s Name.

Note:

If your child is below 10 years of age, then, you select “Pehla Kadam scheme” and if they are Above 10 years of age, then, select “Pehli Udaan scheme”.

2. SBI Minor Account Transaction Limit

SBI Minor Account Minimum Balance

My dauther is below 18 years only, How much amount i can deposit..!!

Is there any Minimum and Maximum deposit limits..!

In these two schemes, you do not need to maintain any Minimum balances in your children’s accounts. i.e. No Minimum Deposit Limit

It is to be noted that there is no Monthly Minimum average balance (MAB) to be maintained under minor account in sbi bank.

Whereas, you can maintain up to a Maximum of Rs.10 Lakhs each under both schemes.

Cool..!!

But i have a doubt..!!

As a father, how could i depsot money into this sbi minor account, Will i get any Debit card..!!

Yes Sir..!

Keep on Reading..!!

3. Photo ATM-cum-Debit Card

Pehla Kadam

In the Pehla Kadam SBI scheme, you will get an ATM debit card and also your children photo will be printed on that Debit card.

This ATM Debit card will be issued in the names of both the Minor and the Guardian.

Pehli Udaan

In the Pehli Udaan scheme, an ATM Debit card will be directly issued in the name of the Minor itself.

How much amount i can withdraw under this SBI Account for Minors scheme..!!

Under both schemes, the SBI-issued ATM Debit Card allows you to withdraw or to make point-of-sale transactions from POS machines only up to a Maximum of Rs.5,000/- only.

As it is issued for Minors, don’t expect too much transaction limits my dear parents / guardians.

What about Bill payments..!

Can we make any payments from this Savings account.!

4. Mobile Banking facility

Moreover, under both these SBI schemes, one can avail Mobile Banking facility.

But you have to do bill payments, Top-up recharges, and IMPS transactions for a Maximum limit of Rs.2,000/- per day through these two accounts.

As a parent, I want to take a cheque book, Can i get one?

5. Cheque book

You can avail Cheque books under these two schemes.

To get a Cheque book, you need to apply for it separately. Once applied, you will be issued on your request with a Maximum of 10 cheque leaves.

For all the above transactions, parental control is compulsory.

I have deposited money into my Son’s Minor Savings account, but i’m getting nominal interest. Can i make a Fixed deposit from his account..!!

6. Fixed Deposit opening facility

Under these schemes, you can also open a Fixed Deposit (FD) through your savings account. This can be opened online through Auto-sweep in facility.

Auto-sweep in facility means, whenever you need funds exceeding your Savings / Currect Bank account, then, it automatically “Swept in” from the FD to your Bank account.

What about the Interest rates and How much interest i can expect..!

7. Interest rate applicability

Don’t expect too much in the form of Interest income.

Under SBI account for minors, Interest rate offered is as applicable to Savings Bank A/c calculated on a daily balance.

The State Bank of India (SBI) offers a 2.70% rate of interest p.a. on your Minor deposits.

8. Documents required to Open a Minor Bank account in SBI

The below documents are required to open an SBI Minor account

1. Date of Birth proof of Minor i.e. Birth Certificate &

2. KYC of Parent

9. SBI Account for Minors – Other Features

– Nomination facilty is available

– Passbook will be issed for FREE. No charges are payable.

– You can change Branch without chaning your Bank account number.

10. Frequently Asked Questions

Can a minor get a SBI account?

Yes. Minor can open two types of Savings Bank account schemes in SBI. Under the first scheme of Pehla Kadam SBI, the age of your child must be below 18 years of age. Under the second scheme of Pehli Udaan scheme, the age of your child must be below 18 years but must have above 10 years of age.

Can a Male minor child can open SBI Minor Account

Yes. Male Minor child can open a Savings Bank account with SBI. The State Bank of India (SBI) offers two types of Savings account for Minors.

1. Pehla Kadam SBI- Can be opened by the Minor child aged below 18 years in the names of both the Minor and the Guardian

2. Pehli Udaan SBI – Can be opened by the Minor child aged above 10 years of age in the name of the Minor.

Is SBI Minor account only for Girl child?

No. SBI Minor account is meant for both Boy and Girl child aged below 18 years. i.e. for Minors.

Can i get a ATM Debit card in SBI Account for Minors

Under SBI Account for Minors of

1. Pehla Kadam SBI- An ATM Debit card and Children photo will be printed on that Debit card.

2. Pehli Udaan SBI – An ATM Debit card will be directly issued in the name of the Minor itself.

Is any Passbook issued under SBI Account for Minors

Under SBI Account for Minors, a Passbook will be issued for FREE. i.e. No charges are payable.

Is any Chequebook issued under SBI Account for Minors

under sbi account for minors, you can get a Cheque book. But, to get it, you need to apply for it separately. Once applied, you will be issued on your request with a Maximum of 10 cheque leaves.

Is there any Bill payment Limit in SBI Account for Minors

Through SBI minor account, you can make a Bill payments, Top-up recharges, and IMPS transactions for a Maximum limit of Rs.2,000/- per day through these two accounts .

SBI Account for Minors Interest rate

The State Bank of India (SBI) offers a 2.70% rate of interest p.a. for your Minor deposits. The maximum balance you can hold under Minor account is Rs.10,00,000/- only.

SBI Minor to Major account Application online

SBI Minor cannot convert to Major account through online. For that, Minor needs to visit SBI Bank along with the Parent / Guardian to do so. Now, the Minor needs to submit his PAN details and on completion of KYC, the bank will change your account from Minor to Major to make all your major transactions.

I hope you understood the “SBI Account for Minors” concept.

Please Comment “GOOD” if you like the article and it encourages us. Also, share this article with your Friends & family.

Thanks for reading..!!!

—————————————————————-End——————————————————

Disclaimer: The materials provided herein are solely for information purposes. No attorney-client relationship is created when you access or use the site or the materials. The information presented on this site does not constitute legal or professional advice and should not be relied upon for such purposes or used as a substitute for legal advice from an attorney licensed in your state.

Also, every effort has been made to avoid errors or omissions in this material. In spite of this, errors may creep in. Any mistake, error, or discrepancy noted may be brought to our notice which shall be taken care of in the next edition. In no event, the author or the website shall be liable for any direct, indirect, special, or incidental damage resulting from or arising out of or in connection with the use of this information.