If you need money urgently, we will check for the available sources with us. One of them is Fixed deposits. In this article, let’s see how to break earlier saved Fixed deposits before maturity through the HDFC Mobile Banking app and satisfy your needs.

Let’s get started..!!

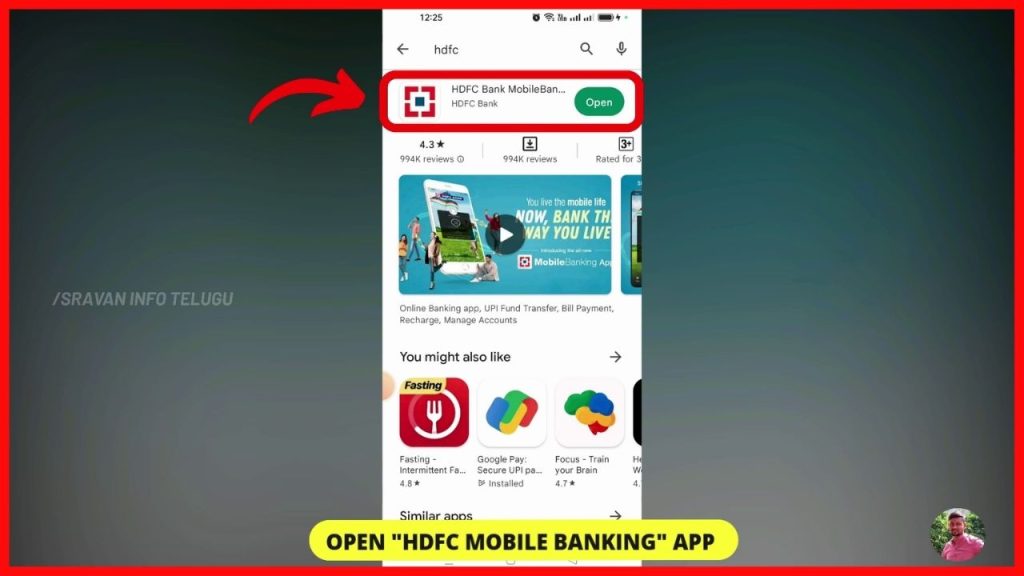

Step 1:

Firstly, open the “HDFC Mobile banking app” on your Mobile.

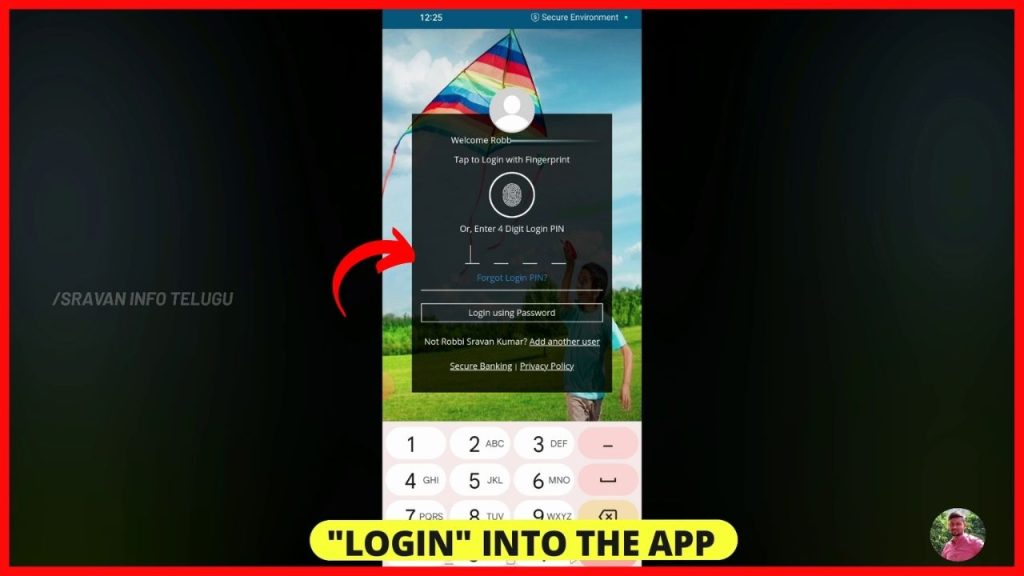

Step 2:

Now, Login into the app using the User name, Password (or) using your Fingerprint (or) using HDFC PIN number.

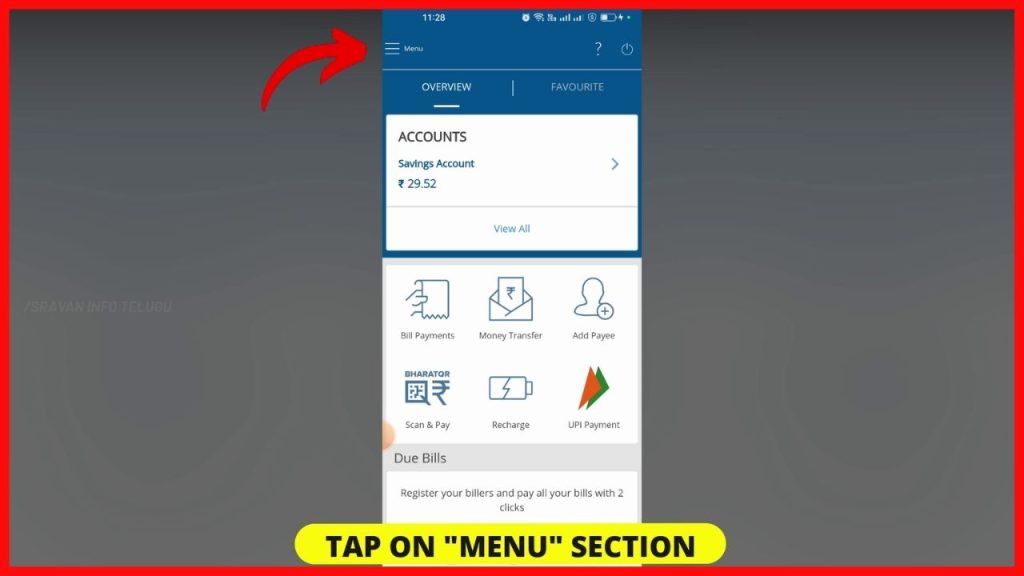

Step 3:

After logging in, your HDFC Dashboard will look like this. Now, Tap on the “Menu” section which appears on the top left.

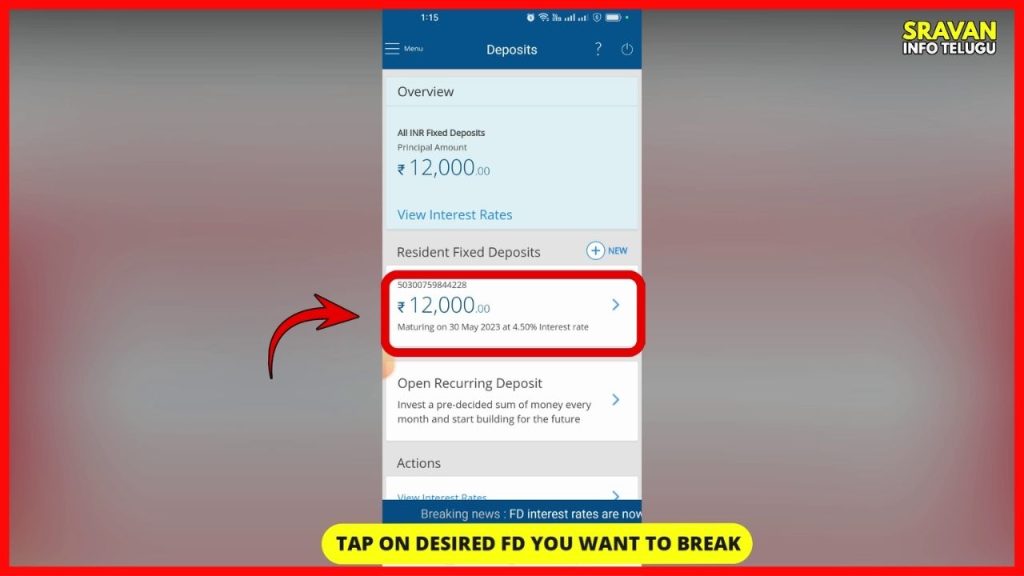

Step 4:

Later on, to break your Fixed deposit (FD) before maturity, Tap on the “Save” section and then, tap on the “Deposits” option.

Step 5:

Here you can see all your created Fixed Deposit details. Now Tap on the FD that you want to break.

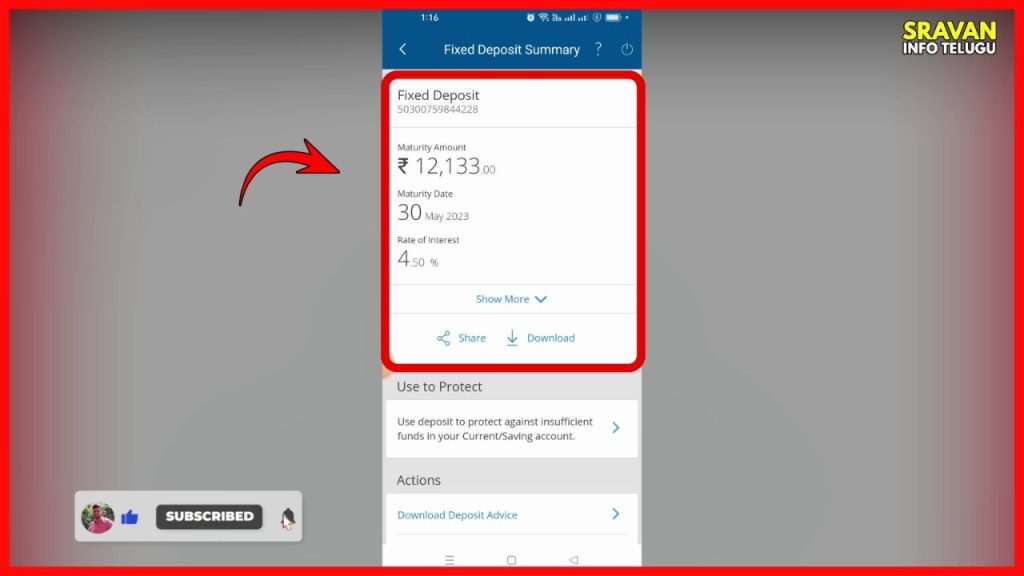

Step 6:

Now the entire Fixed Deposit (FD) Summary will be displayed like

– FD Maturity amount,

– Maturity Date, and

– Rate of interest etc.,

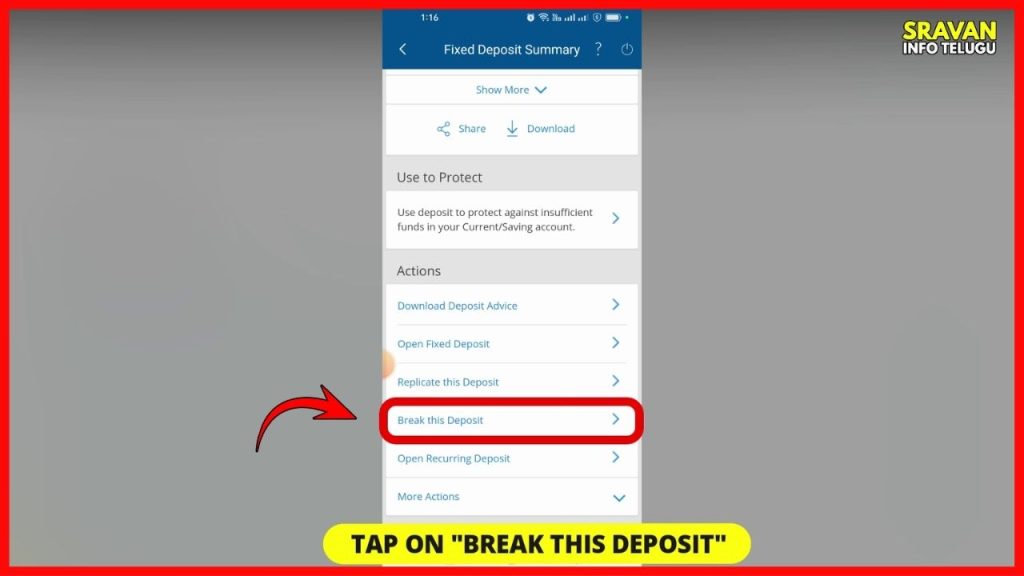

Step 7:

Now if you come to the little bottom, you can see the option of “Break this deposit”, to break your existing FD. Just tap on it.

Here, you can see all the details of

– Principal amount

– Interest earned

– Penalty charges etc

Step 8:

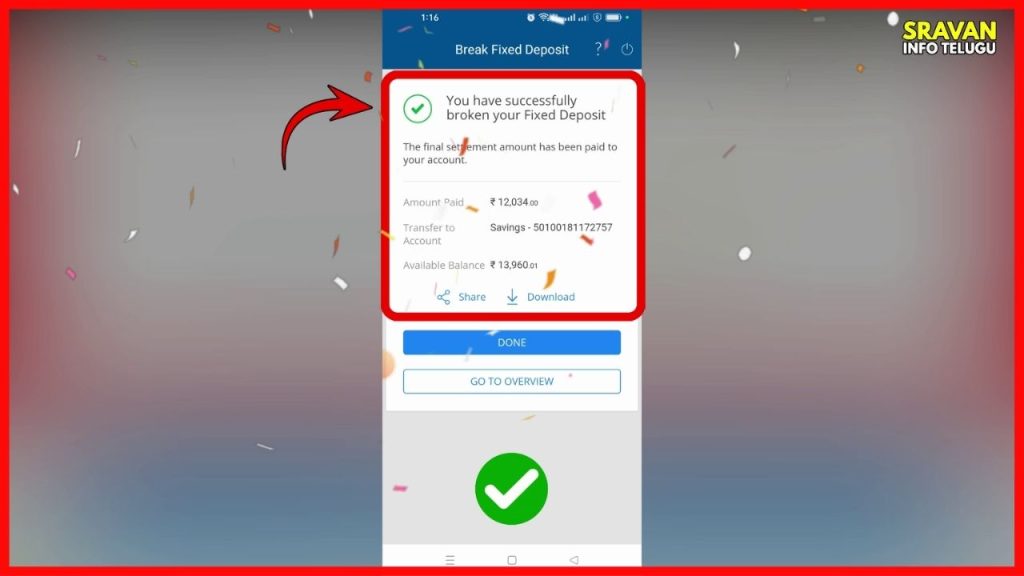

If everything is ok, then, Tick “I Accept the Terms and Conditions” and tap on the “Confirm” button.

Once you tap on that, a message will be displayed that “You have Successfully broken your Fixed Deposit” in the HDFC account.

I hope you understood the “how to break hdfc fd online” concept.

Please Comment “GOOD” if you like the article and it encourages us. Also, share this article with your Friends & Family…

Thanks for reading..!!!

—————————————————————End——————————————————

Disclaimer: The materials provided herein are solely for information purposes. No attorney-client relationship is created when you access or use the site or the materials. The information presented on this site does not constitute legal or professional advice and should not be relied upon for such purposes or used as a substitute for legal advice from an attorney licensed in your state.

Also, every effort has been made to avoid errors or omissions in this material. In spite of this, errors may creep in. Any mistake, error, or discrepancy noted may be brought to our notice which shall be taken care of in the next edition. In no event, the author or the website shall be liable for any direct, indirect, special, or incidental damage resulting from or arising out of or in connection with the use of this information.