Generally, we use UPI for One-time transactions. Whereas, for Regular payments say House Rent to owners whose transactions are to be maintained for record purposes, then, such payments will be done through a regular Bank account. In such a case, firstly you need to add the beneficiary bank account.

In this article, we will see How to add Beneficiary in HDFC app to transfer money through NEFT / RTGS / IMPS.

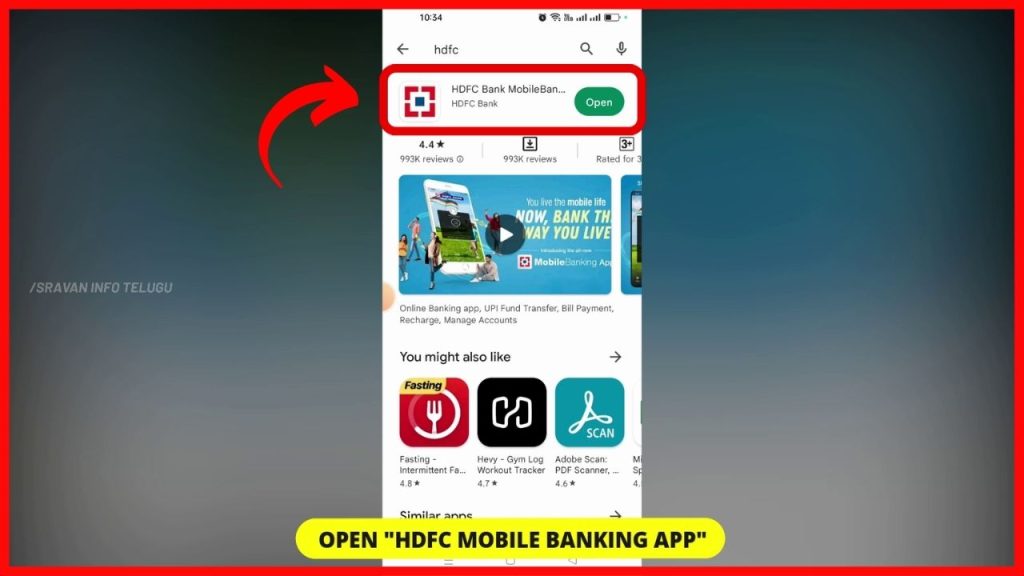

Step 1:

Firstly, open the “HDFC Mobile banking app” on your Mobile.

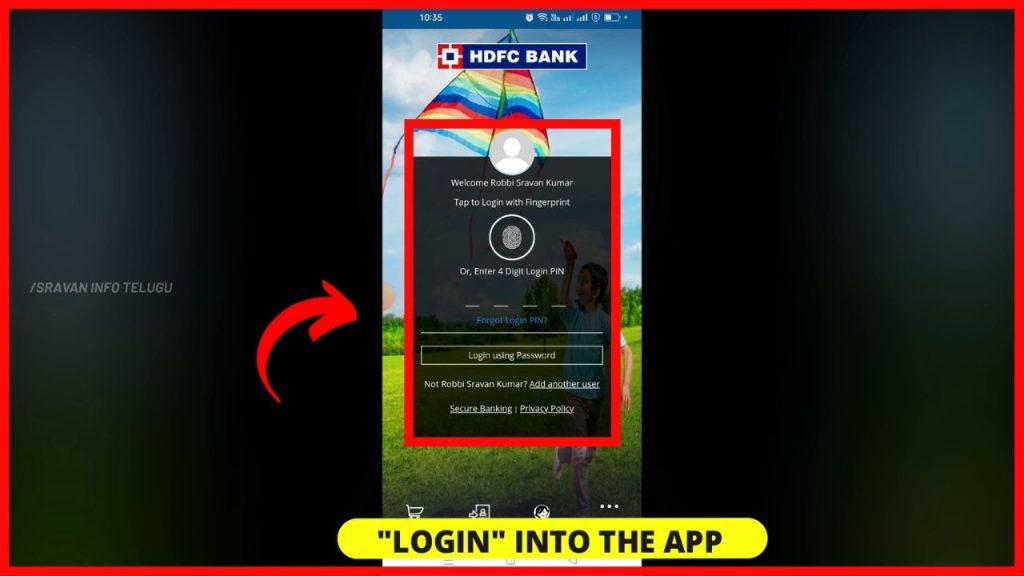

Step 2:

Now, Login into the app using the User name, Password (or) using your Fingerprint (or) using HDFC PIN number.

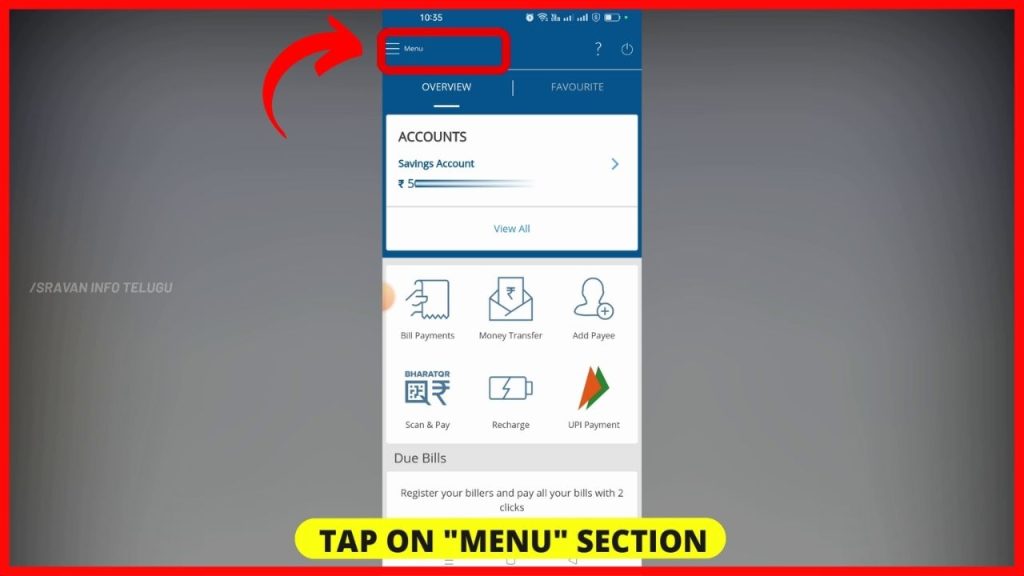

Step 3:

After logging in, your HDFC Dashboard will look like this. Now, Tap on the “Menu” section which appears on the top left.

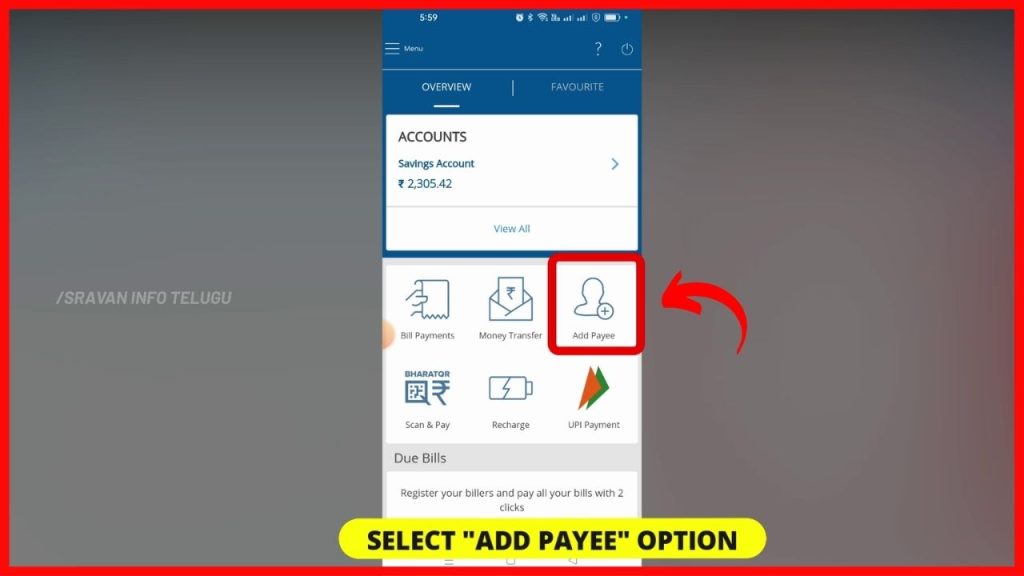

Step 4:

Now to add a new beneficiary, Tap on “Add Payee”.

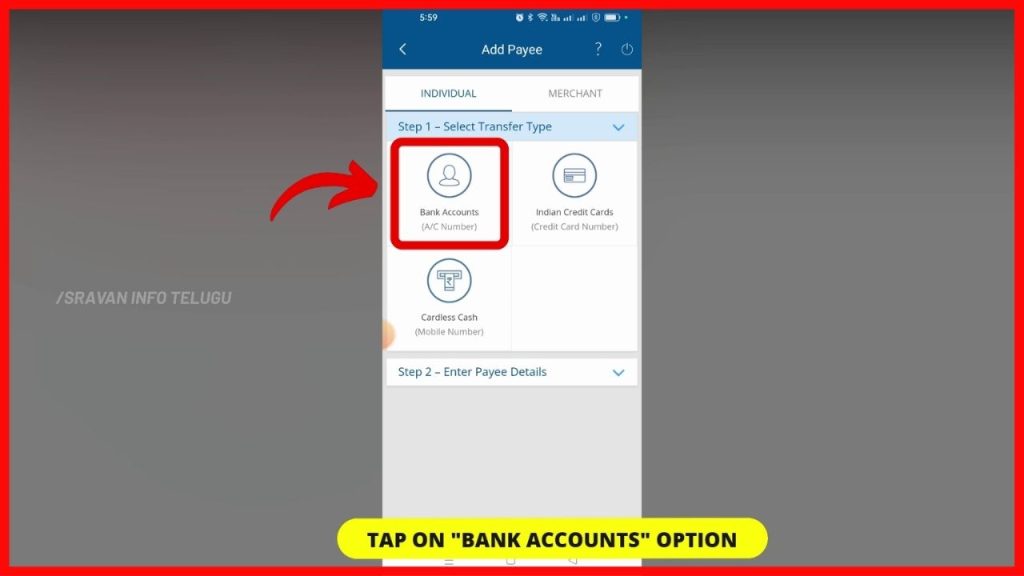

Now you have to select “Transfer Type”. You will get 3 options.

1. Bank accounts

2. Indian Credit Cards

3. Cardless Cash

Step 5:

To Transfer money by using your Bank account number, Tap on 1st option “Bank accounts”.

Step 6:

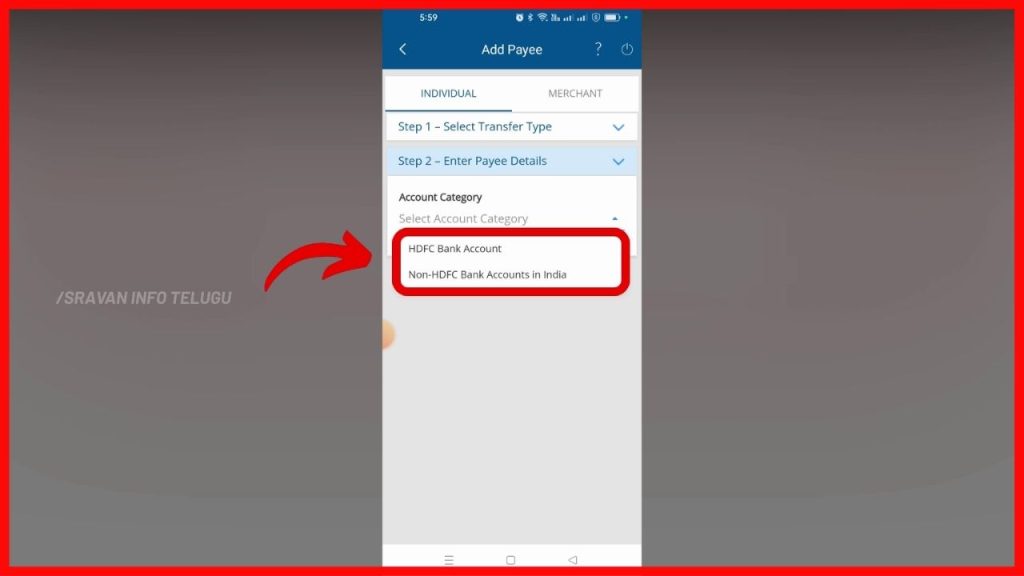

Now, you need to enter the Payee or Beneficiary details. i.e. The person to whom you need to transfer money. Here, you have to select the beneficiary “Account category”.

In case the beneficiary you are going to add is of HDFC account holder then select “HDFC Bank Account”. Whereas, if you are going to add other than HDFC bank account holders say, SBI, ICICI, or Union Bank then select “Non-HDFC bank accounts in India”.

Step 7:

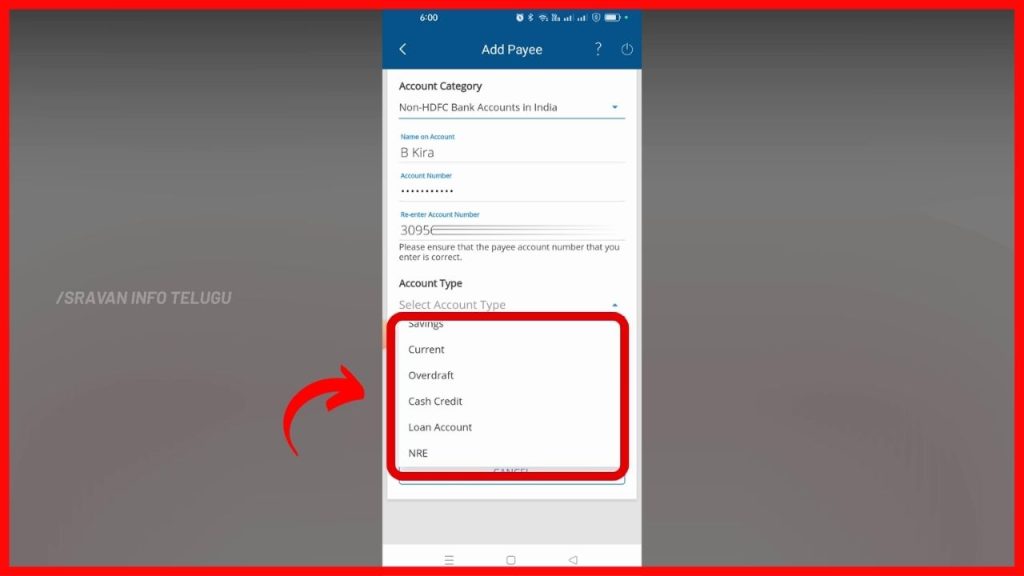

Now, You need to enter the Name of the Beneficiary in the “Name on Account” column. Then Beneficiary “Account number” and later on you need to “Re-enter the beneficiary account number”.

Step 8:

Later on, Tap on “Beneficiary Account type” and select any of the following options

1. Savings account

2. Current account

3. Overdraft

4. Cash Credit

5. Loan account

6. NRE

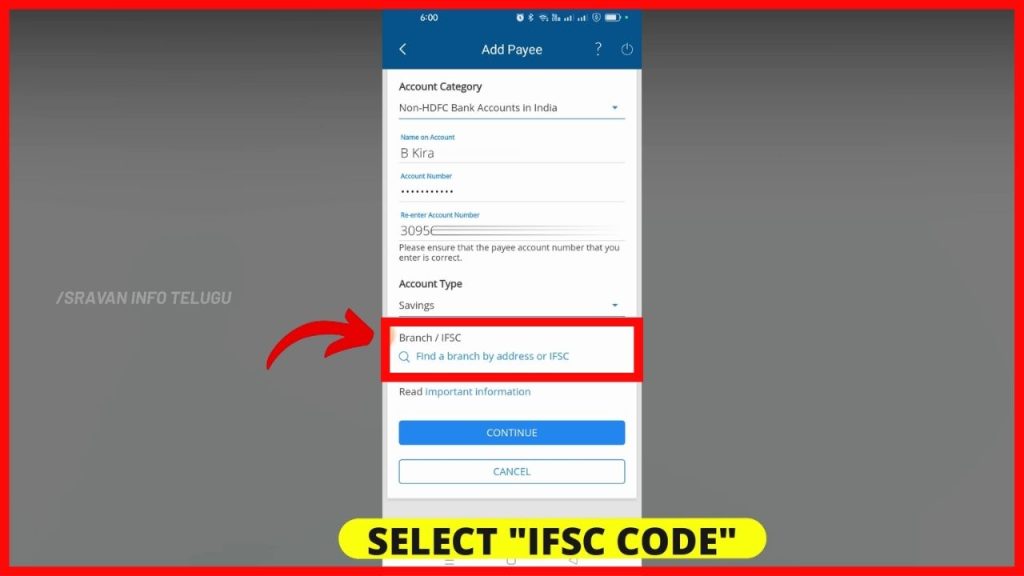

Step 9:

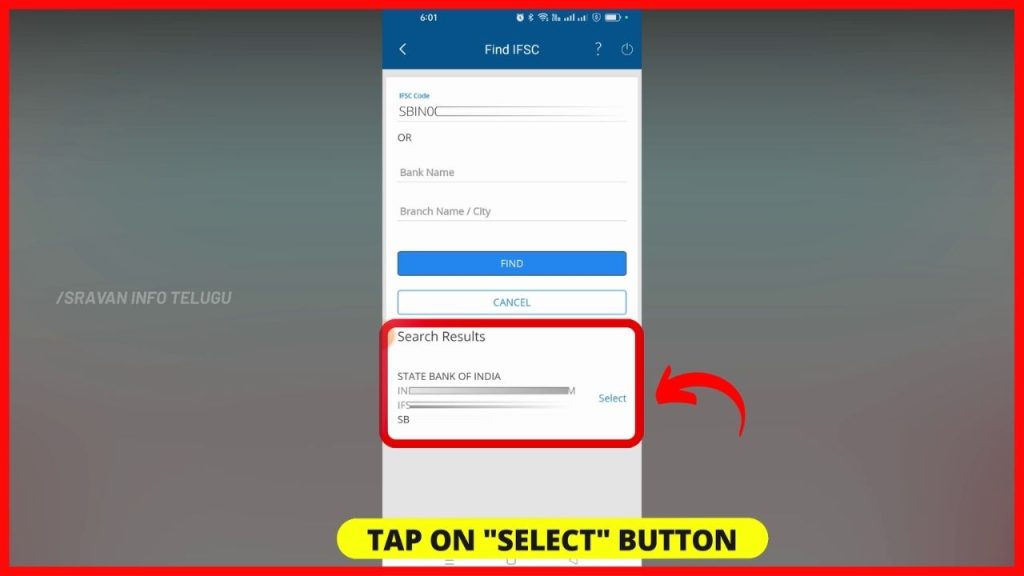

After that, you have to select your beneficiary branch / IFSC code. So, tap on the “Find a branch by Address or IFSC” option.

Step 10:

Here you need to enter the Beneficiary IFSC code under the IFSC Code column and Tap on the Find button (or)

Enter the Beneficiary Bank Name & Branch name / City and tap on the “Find” button.

If the entered IFSC details are correct, then, the Beneficiary branch details will be displayed in the search results. If the displayed details are found correct, then, tap on the “Select” button.

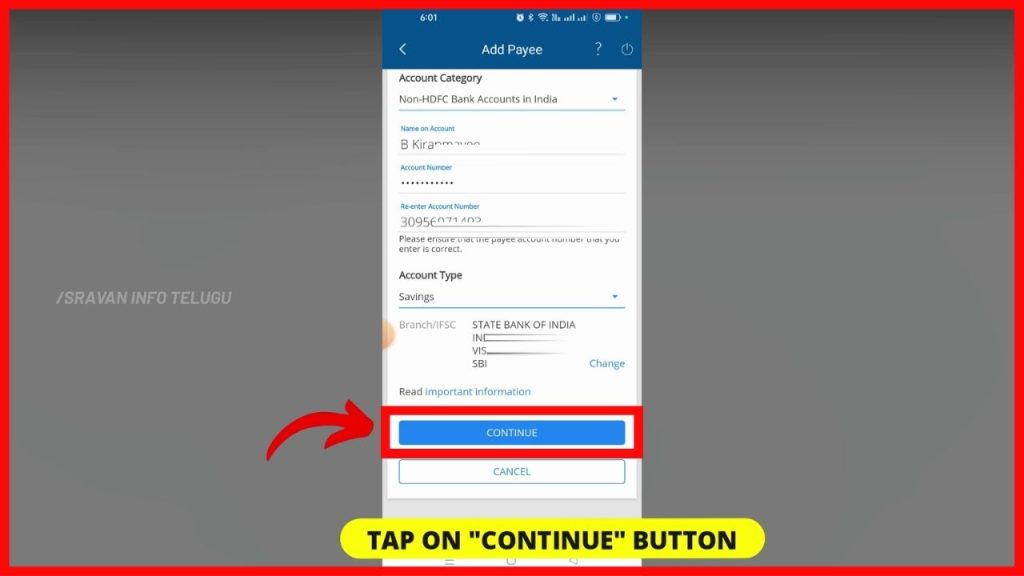

Step 11:

Now, ensure yourself that all the displayed details are correct then tap on the “Continue” button.

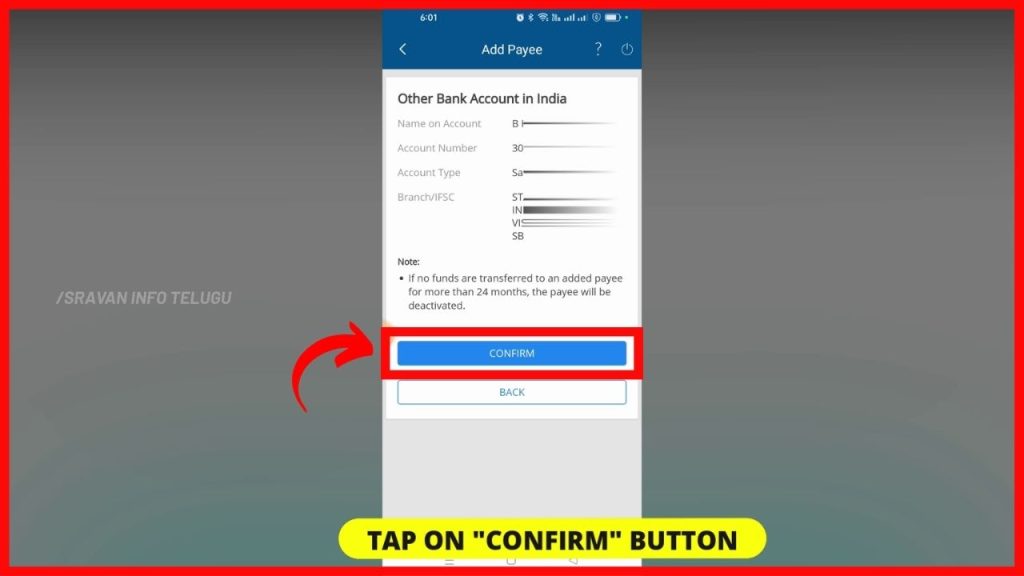

Step 12:

Here you will also see a Note mentioning if you do not transfer any funds to the beneficiary for more than 24 months, that payee will be deactivated. Now tap on the “Confirm” button.

Step 13:

Later on, you need to select your Registered Mobile number to get a One-time Password (OTP).

Step 14:

Once you receive it, Enter the OTP and Tap on the “Confirm” button.

Step 15:

Finally, it will be displayed that “You have Successfully added a Payee”.

Now tap on the “Done” option and tap on “Add/Manage Payees” and you find the added beneficiary immediately. and you can transfer money to your beneficiary instantly.

I hope you understood the “how to add beneficiary in hdfc” concept.

Please Comment “GOOD” if you like the article and it encourages us. Also, share this article with your Friends & Family…

Thanks for reading..!!!

—————————————————————End——————————————————

Disclaimer: The materials provided herein are solely for information purposes. No attorney-client relationship is created when you access or use the site or the materials. The information presented on this site does not constitute legal or professional advice and should not be relied upon for such purposes or used as a substitute for legal advice from an attorney licensed in your state.

Also, every effort has been made to avoid errors or omissions in this material. In spite of this, errors may creep in. Any mistake, error, or discrepancy noted may be brought to our notice which shall be taken care of in the next edition. In no event, the author or the website shall be liable for any direct, indirect, special, or incidental damage resulting from or arising out of or in connection with the use of this information.