Are you looking for a Lifetime Free Credit Card with Zero Annual Fee..!!

If Yes, then, you must know about Millennia Credit Card from IDFC First Bank..!!

This IDFC First Bank is a Mumbai based Private Sector Bank which started its operations in October 2015. Both IDFC Bank and Capital First Bank together started the “IDFC First Bank”.

Without a further ado let’s see What are the Features or Benefits this Credit card is offering And i also share my Genuine opinion on this Credit card by discussing about its Drawbacks as well.

Let’s get Started..!!

What is IDFC First Bank Millennia Credit Card ?

As per IDFC First Bank website IDFC First Bank Millenia Credit Card is specially designed for the lifestyle of Millennials.

What Benefits you get from this Millennia Credit Card ?

IDFC First Millennia Credit Card Benefits:

Let me go through 9 Top benefits offering by this Credit Card [Incl. My Analysis]

1. Welcome Benefit

IDFC First Millennia Credit card Features:

With this IDFC First Credit card, If you spend an Amount of Rs.5,000/- or more within 30 days of Card generation, you will be provided with Rs.500/- worth of Welcome Voucher under the Welcome offer benefit.

My analysis

This feature can’t be said to be very beneficial to the Cardholder but if you spend through this credit card for any of your need, then, this voucher might be helpful for you.

But don’t be in a hurry to spend it within 30 days of receiving the card.

“It’s not wrong to spend for your need and take the benefit but never spend it for the sake of benefit without need.”

Ultimately, You will loose your money My dear Friend.

2. For Movie Lovers

Do you have the the habit of going to the Theatre to watch Movies..!

If yes, Keep on reading..!

Assume this situation.

You have booked the Tickets on the PayTm app and completed the payment for it by using this credit card. Then, you will get 25% discount on Movie Tickets that too only up to a Maximum of Rs.100/- only.

Remember that You can’t use IDFC First credit card movie ticket offer anytime as you wished. The condition is that such discount can be availed only once a month only.

3. Are you a Frequent Train Traveller ?

If you travel more on Trains, You can use this card to avail the Complimentary Railway Lounge benefits for 4 times in every 3 months period.

My analysis

Some major Railway Stations offer Free Wifi, Free Food, Free AC but your IDFC First Milleania Credit card will have to be swiped through the Point of Sale (POS) machine in that lounge. Then, an amount of Rs.2/- will be deducted from your card account as a Confirmation.

By using this Railway Lounge Facility, you can avail the stay only for up to 2 hours only. The Major drawback is that this Lounge benefit is being provided only in the 8 stations only across India.

4. If Cardholder met with Accident

IDFC First Bank also provides a Personal Accident Cover benefit to their Card holders. It’s coverage is up to Rs. 2,00,000/-.

To avail this benefit, you should meet atleast 2 Conditions.

1. You have to make at least 1 Credit card transaction compulsorily within 30 days of receiving the card.

2. You will be covered only if you do at least 1 Credit card transaction through this Credit card in the last 30 days, otherwise you will not get coverage.

In my opinion, it is much better to take Term Life Insurance directly instead of taking this card and making every month a Credit Card transaction to get covered.

5. Lost your Credit Card

In case if you lost your Millennial Credit card & suffered with any Financial loss, then, that loss will be covered to you up to Rs.25,000/- rupees under the cover of “Lost Card Liability” and this card has World wide acceptance and you can use it at any part of the world.

6. Can I Withdraw Money ?

IDFC First bank credit card Cash Withdrawal charges:

One of the major benefit of using this IDFC Millennium Credit Card as said by the IDFC First bank is that “Interest Free Cash Withdrawal“. Read this point little carefully My dear Friends.

“Interest Free Cash Withdrawal” means no interest will be charged up to 48 days if you withdraw Cash anywhere either in Domestic or in International ATM’s. But you need to pay Cash Advance Fee of Rs.199/- per transaction excluding GST.

If for any reason whatsoever you are unable to pay the withdrawn amount within 48 days, you will have to pay huge interest. That is also covered in this article, so Keep on reading till the end.

7. Can I convert any Transaction into EMI ?

By using with this Credit Card, which transactions can be converted into EMI?

If you use this credit card and do any transaction above Rs.2,500/- rupees, then, you can convert those transactions into EMI through the Mobile app itself.

After taking this card, if you do any Credit card transaction and convert it into EMI within 30 days of generating the card, then, IDFC First Bank is offers you 5% cash back, that too up to a Maximum amount of Rs.1,000/- rupees.

Even if you spend more than Rs.20,000/-, the benefit you will get is upto Rs.1,000/- only.

My analysis

if you spend more than Rs.50,000/- on this Credit card, then, you expect 5% Cash back i.e. Rs.2,500/- but the reality is that the you will the Maximum benefit of Rs.1,000/- only not Rs.2,500/-.

How to apply

IDFC First Millennia Credit card Apply :

If you want this IDFC First Credit Card card, You can apply.

8. Reward Benefits

IDFC First Millennia Credit card Reward points:

When it comes to Reward Points, even if you spend Rs.20,000/- monthly on this card and if you spend on this card on your Official Birthday, then, you will get 10x reward points.

According to the IDFC First Bank website, these Reward points are Unlimited, which will never expire.

And 1 reward point is worth 0.25/- paisa. If you want to earn 1 reward point, you have to spend at least Rs.150/- using this Millenia Credit Card.

My analysis

It means if you want 10x reward points you have to spend at least Rs.20,000/- in a month. For that you will get 1,333 reward points..

No Reward Points -When ?

You will not get any reward points even if

– You have pumped your Bike / Car (or)

– Converted your Credit card transactions to EMI &

– Have used this card to Withdraw Cash.

However, you will get

– 1x reward points even if you pay Insurance Premium and pay your Utility bills.

– 6x reward points for the same Online Purchases like Amazon and

– 3x reward points for the same Offline Purchases

The condition is that to get all the above reward points. you have to spend at least Rs.20,000/- in a month..

My analysis

I recently saw a YouTube Advertisement & I don’t know what the brand it was but they have shown in that Advertisement as Reward points = Peanuts.

I think that’s True..!!

9. Petrol / Diesel Benefit

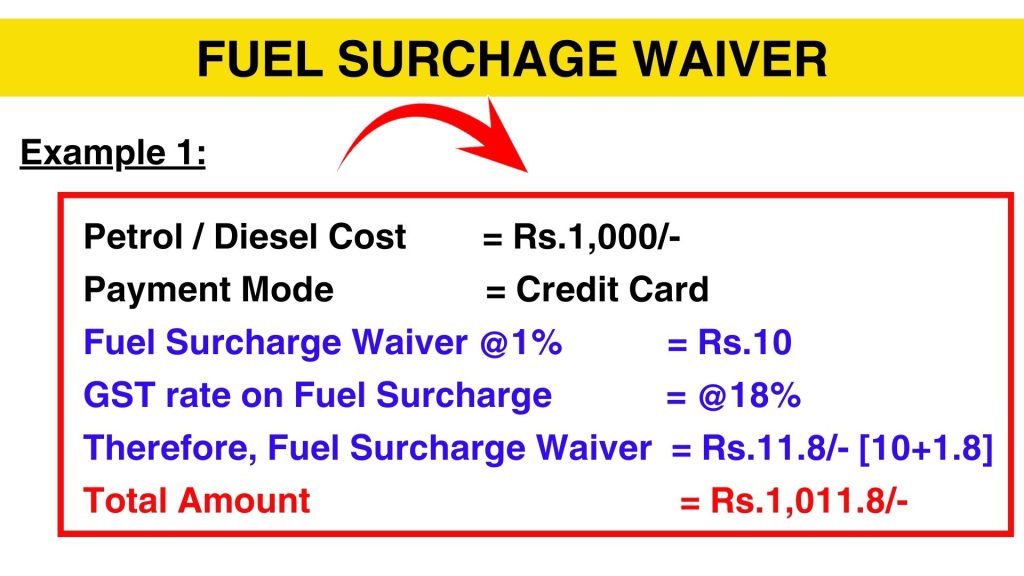

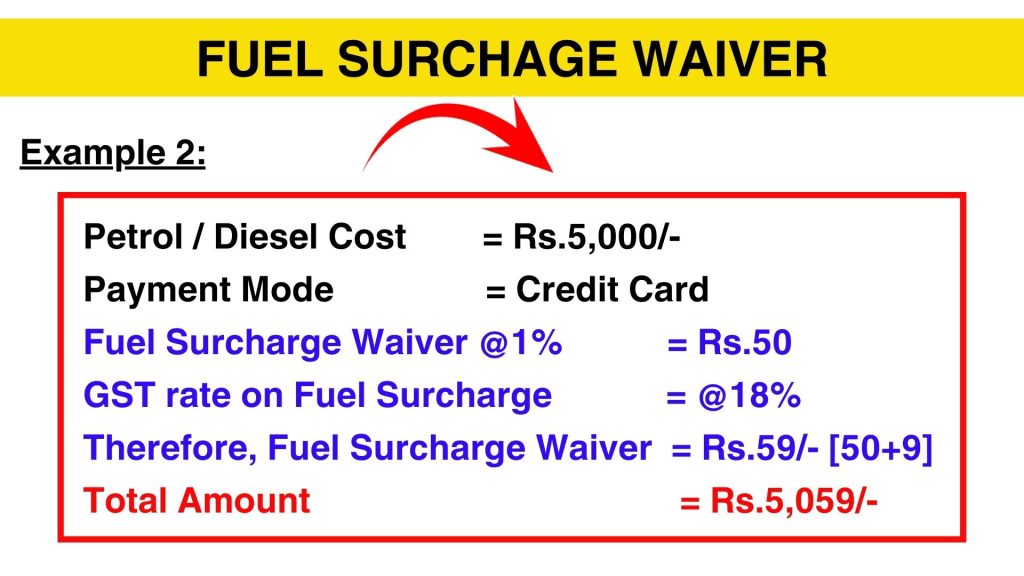

By using this Credit Card If you spend on Petrol/Diesel between Rs.200-Rs.5,000/- in any fuel stations, then, a Fuel Surcharge will be charged. It may be around 1-3% of your Fuel Cost. In case you paid it through this card, you will be eligible for “Fuel Surcharge Waiver“.

Let me clarify you about Fuel Surcharge Waiver with 2 Examples

I really don’t understand why Credit card companies are highlighting Fuel Surcharge Waiver..!! This is not even a Nominal benefit to the Card user because you have to pay it only if you use this Credit card. Normally if you pay it in cash there will be No such Surcharges at all.

Also Read: How I lost Money by Paying Petrol Bills with Credit Cards

Who are Eligible for this Card?

IDFC Millennia Credit card Eligibility:

Individuals

– Aged 21 years old

– Salaried or Self Employed with Annual Income of more than Rs.3,00,000/- are eligible to apply for this card.

IDFC First Millenia Credit Card Charges [Must Read]

1. Cash Withdrawal charges

It is my sincere and humble request for all the Credit Card users that Whatever the Credit card you use, you Please don’t make any Cash Withdrawals by using your Credit Card. Consider this as my Personal request.

A Small request to all

You can Withdraw Money using this idfc first credit card but Don’t withdraw cash from any credit card. If you have urgent cash requirement / Cash crunch, then i suggest you to take a Gold Loan or a Personal Loan. Those are much better options.

Because in a Personal Loan, every month you pay Principal amount plus Interest as an EMI. The rate of interest for Personal Loan ranges from 15 to 20% p.a. on a higher note.

Do you know how much Interest you will be charged on Credit Cards ?

In the some Credit cards, the Rate of interest is 3.25% per month. It means you have to pay up to 42% per annum as a Finance / Interest charges on your Credit Card Outstanding balance.

In short, the Rate of interest you will be charged on a Credit card is more than double the interest you will be charged on a Personal Loan.

2. Interest charges / Finance Charges ?

IDFC First bank Credit card Interest rate :

You have used this idfc first credit card and bought all the stuff (Electronics, Mobile, Fashion etc) you need. But you don’t have enough money to pay the Credit Card Outstanding amount.

Then, the IDFC First bank will charge you Interest between @0.75% – @3.75% per month. It means, the Annual interest is almost 9% – 42% per annum.

3. Late payment charges

Apart from Interest charges, if you delay paying this Credit card Outstanding by 1 day, you will have to pay Penalty Charges on top of your Credit card Outstanding.

Generally, even if you delay IDFC Credit Card payment by one day, IDFC bank will charge almost 15% on the Due amount of your credit card. The Late payment charges ranges from Minimum Rs.100/- rupees to Maximum Rs. 1,250/-.

So if you use credit card you have to be very organized and should deal with Credit card timelines properly.

4. Over the limit charges

You might not have heard about these charges earlier. Let check it out.

If you spend more than available limit on this idfc first credit card. That means you have over used your Credit card. Then, you will be charged with “Over The Limit charges”.

The more you spend than your Credit card limit, the more you will be charged i.e. @2.50% on the overdrawn amount. The Minimum amount will be charged starts from Rs.500/- rupees.

Draw backs

IDFC First Millennia Credit Card Lounge Access?

This card has No Airport Lounge benefit & also this is not a “Contactless card“.

Watch : Watch about Contactless Card Video [In Telugu]

What i Liked about this Card ?

This IDFC First Millennia Credit Card comes with Zero Annual Fees i.e You does not require to pay any Annual Fees on this Credit card and it is a Lifetime Free Credit card.

My Analysis

This is a real benefit. Generally, it can be said that the absence of Annual charges for Physical credit card is a real benefit for the customers. Even the Big players in the existing Banking industry also have not offered this.

To Whom it is useful?

IDFC First Millennia Credit Card Review:

Even if it’s a Physical Credit card, the Zero Annual Charges is a true benefit to the customer. Also, Individuals who Travels more, if they want Railway lounge facility, it will be useful for them. I personally felt that the Lost Card cover is a good feature in this card. Also, if you don’t have a Life time Free credit card, you can try this card.

Frequently Asked Questions [FAQ]

1. IDFC First Millennia Credit card Airport Lounge access ?

IDFC First Millennia Credit card has no Airport Lounge access.

2. IDFC First Millennia Credit card Lounge access ?

You can use IDFC First Millennia Credit card to avail the Complimentary Railway Lounge benefits for 4 times in every 3 months period but it does not offer Airport Lounge access.

3. IDFC First Millennia Credit card Limit ?

This card does not specified any standard card limit for its customers. IDFC First Millennia Credit card limit totally depends upon Customer’s Monthly Income and CIBIL Score. In case the Customer has a Monthly Income of Rs.25,000/- with a good CIBIL Score of 750+, then, there may be better chances of getting a higher Credit limit.

Thanks for your time 🙂