Generally, you go to the Petrol bunk and get pumped either Petrol or Diesel into your vehicle. Right..!! Then, How do you pay for it?

Generally, you have 3 Options to pay

1. Pay with your Physical Cash,

2. Pay through UPI options like Phone pay, Google, Paytm etc. and Debit Cards

3. Pay through your Credit Cards.

There is no issue at all if you pay your Fuel bill with your Physical Cash or with you UPI options or with your any of your bank Debit Card. But in case if you pay it with your Credit Card, then, you should know about the “Fuel Surcharge Waiver” undoubtedly.

And also i will tell you very clearly “How you are losing money by pumping Petrol / Diesel to your Vehicle ?“

For that let me clarify in detail about What is Fuel Surcharge and Fuel Surcharge waiver? Who will provide you this Waiver benefit ? Whether it is advantageous to customer or not and also whether it is right thing to use your Credit card to pump Petrol or Diesel to your Vehicle on next time?

For all the queries, this article is a clear solution. So if read it completely to get a clear picture..!

Let’s get Started about “Fuel Surcharge Waiver Credit Card”..!

Fuel Surcharge Meaning ?

If you pump your vehicle with either Petrol or Diesel and if you have paid the same with your Credit Card, then you have to pay Additional / Extra charges for being used your Credit Card for this fuel Transaction. The additional charges apart from Petrol / Diesel charges will be called as a “Fuel surcharge“.

The Fuel Surcharge usually around 1% on the Fuel purchase you make. Some of the Petrol bunks may charge even 3-4% on your Fuel Bill. Here, such charge is to be borne by the Customer itself.

Generally, there is no Fuel Surcharge for the transaction you make your Payment through either Cash or through UPI or Debit Cards. But if you pay it through your Credit Card, then only the Petrol bunks will collect this Fuel Surcharge from their Customers.

You might be aware that few Credit Card Companies are offering the Fuel Surcharge benefit by not charging from the Credit Card holder. That benefit will be called as a “Fuel Surcharge Waiver“.

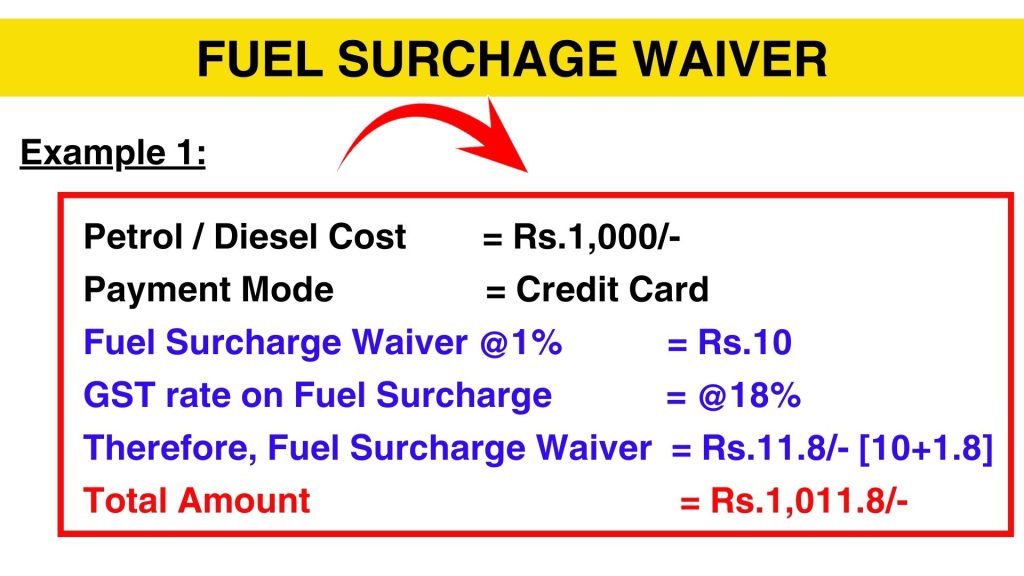

Fuel Surcharge Waiver Example

Now, let me tell you with a small example what is the benefit given by the Fuel companies and to whom it is useful either to the Customer or to the Fuel Companies?

Let’s say you pumped your vehicle with either Petrol or Diesel and spent Rs 1,000/- on it. Let’s say you have paid it using your Credit Card. So, now you will be charged with Fuel Surcharge @1% of your fuel cost.

So How much is 1% of Rs.1,000 rupees i.e. Rs.10/-

And moreover GST will be applicable on Fuel Surcharge & GST rate is 18%.

It means 18% on Rs.10/- i.e. Rs. 1.80/-.

So in Total, You have to pay extra Rs.10/- + Rs.1.80/- for Rs. 1,000 Fuel. It means the customer will be charged with Rs.1,011.80/-

When you pay by Credit Card, you swipe the amount of Rs.1,000/- only but this extra Fuel Surcharge will be reflected in your Credit Card statement. When you pay your Credit card bill, it will be reflected as your Total Credit Card Outstanding. So the Total Surcharge you pay additionally in this transaction is Rs.11.80/-.

This is the Fuel Surcharge Waiver that the Credit Card Companies are offering you. That Rs.11.80/- . But the bitter truth is that Credit card companies are showing this Rs.11.80/- amount only as a benefit to the Credit card holders.

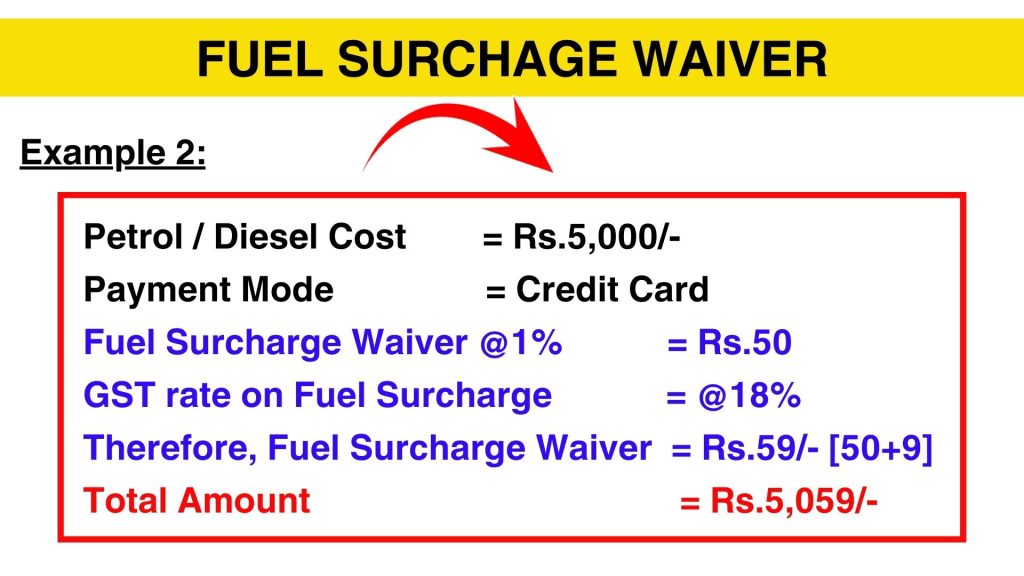

No Sir. I usually pump more fuel. So, i can save more right..

Let’s see below example as well.

Example 2

In case If you spend Rs.2,000/-, Rs. 3,000/-, Rs. 4,000/-, Rs.5,000/-then the Credit Card company will provide you a surcharge waiver up to Rs.59/- rupees only.

While offering new Credit Cards to the Customer, the Some Credit Card companies offers you to spend a Minimum of Rs.200/- rupees to a Maximum of Rs.5,000/- on Fuel in order to avail the Fuel Surcharge Waiver benefit for the customers.

If you spend anything less than Rs.200/- and anything more than Rs.5,000/- on Fuel, then you are not eligible for this Fuel Surcharge Waiver benefit. Simply, you will be ineligible for this offer.

Therefore, if you use Credit card on Fuel Purchase you will get fuel surcharge waiver benefit only between Rs.11.80/- to a Maximum Rs.59/- rupees only. That too, initially you will be charged with Fuel Surcharge along with GST and later on Credit card companies will reverse those charges on your Credit Card. Here, you just understand what extra benefit you get?

Usually the Credit Card companies are offering maximum Fuel Surcharge benefit between Rs.100/- to Rs.200/- per month only. You can check any Credit Card.

Fuel Surcharge Waiver benefit or not ?

If you don’t have physical cash (or) If you don’t have a Debit Card on your hand or else if you don’t have money in your UPI, then, there is no other option to such people to use their Credit Card to pump either Petrol / Diesel.

So they have to use their Credit Card only to fill fuel to their vehicle. Only those people might have benefited from this. Otherwise, if you have Cash or UPI balance or Debit Card, then, you don’t think that there is some Credit Card offer on Fuel. You will not get an extra one rupee of benefit at all.

So it is always suggestable to process your Fuel payments in petrol bunks through Cash or through UPI or your Debit Card only and you don’t need to pay any extra charges and avoid Credit Card payment to the extent possible.

Thanks for Reading 🙂